Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

The crypto landscape is turbulent, and the Web3 wallet battle has suddenly escalated.

Exchanges like OKX, Binance, and Bitget are each operating independently, relying on product iterations, user competition, task mechanisms, and incentive designs, engaging in rounds of offensive and defensive battles. Some have seized the high ground with their first-mover advantage, while others have broken through with strong capital and traffic.

Recently, Bybit announced a significant reduction in its Web3 wallet business, while Binance Wallet has seen its market share in trading volume exceed 90% in just two months. OKX and Bitget have also not slowed down, continuously enhancing their incentive mechanisms and functional experiences.

The outcome is still uncertain, but the smoke of battle has already risen.

Competitors: Five Major Camps with Distinct Strategies

(1) OKX Wallet

- Nickname: Tech Maniac

- Style: Steady progress, long-term cultivation, emphasizing product refinement and full-chain ecological layout.

- Representative Tactics: Function integration + inscription first-mover advantage + free offerings

- Introduction: An early entrant in the Web3 wallet space, akin to a seasoned veteran, backed by hundreds of engineers.

(2) Binance Wallet

- Nickname: Traffic Warlord

- Style: Late-stage surprise attacks, resource allocation, flexible and varied gameplay

- Representative Tactics: Strong entry binding + creative mechanisms + ecological linkage

- Introduction: Officially entered the market in 2023, starting slightly late. However, it launched innovative tactics, diversifying ecological asset flow and playing the role of a rhythm disruptor in the battle.

(3) Bitget Wallet

- Nickname: Night Walker in Armor

- Style: Quick response, closely following trends

- Representative Tactics: Breakthroughs on trending topics + rapid iteration of activities + yield-generating gameplay

- Introduction: Evolved from the established multi-chain wallet BitKeep, with flexible strategies and quick actions. Although it lacks the hardware and popularity of the leaders, it maintains a significant presence through its "lightweight" and "agile" approach.

(4) Coinbase Wallet

- Nickname: Compliant Ranger

- Style: Steady moves, safety first, focusing on the North American market

- Representative Tactics: Compliance + strong acquisitions

- Introduction: Coinbase Wallet started early. In 2018, Coinbase rebranded its self-developed wallet Toshi to Coinbase Wallet and has continuously expanded its wallet capabilities through acquisitions of projects like BRD and Astro Wallet.

(5) Bybit Wallet

- Nickname: Wind Chaser

- Style: Keen experimentation, imitative strategies, flexible maneuvers

- Representative Tactics: Gameplay following + custodial model

- Introduction: Bybit Wallet is not a major player. In its early layout, Bybit invested limited resources in wallet infrastructure, failing to establish a competitive moat.

Wallet Battlefield Record: OKX Expands for a Thousand Days, Binance Climbs to the Top via a Curve

As early as 2021, OKX initiated its Web3 wallet project, recruiting talent and investing heavily, consistently adhering to a "free functionality" model. By the end of 2023, with the sudden "inscription craze," OKX Wallet successfully capitalized on the trend by launching an inscription market in a timely manner.

In contrast, although Coinbase Wallet started earlier, its overall strategy has been more conservative, with a slower pace of functional updates and relatively limited market presence. Bitget and BitKeep were in a consolidation phase at that time, and their product rhythm and market promotion had not yet entered the right track, failing to form an effective competitive position.

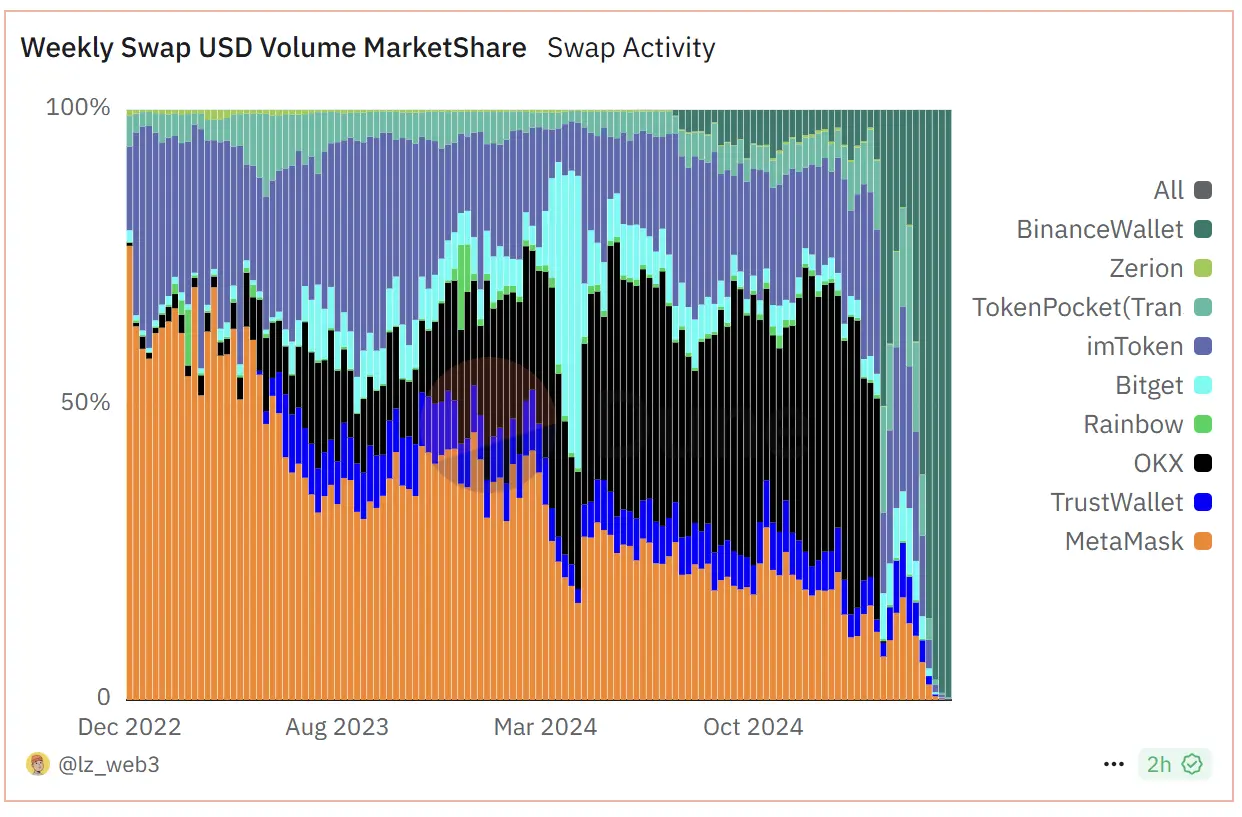

The final results were quite clear: OKX Wallet widened the gap in early confrontations and somewhat squeezed the survival space of small and medium independent wallets. According to public data, OKX Web3 Wallet's user growth approached tenfold in 2024, and by early 2025, its market share exceeded 50%, reaching a historical high.

However, after three years of building a kingdom, it was intercepted in March.

In March 2025, the battle took a critical turn. Bybit experienced a $1.5 billion security incident, suffering heavy losses, which also indirectly pulled OKX into the vortex. On March 17, OKX suspended its DEX aggregator service, leading to a sharp decline in its wallet market share. Meanwhile, Bybit Wallet, due to long-term poor performance and weak revenue, announced the closure of most of its functions.

Amidst the turbulent market winds, Binance Wallet seized the window of opportunity to break through rapidly. Although it started late, Binance created a "detour overtaking" path: directly entering through "operational strategy + wealth incentives," building a new paradigm via the Binance Alpha program. By focusing on traffic and asset distribution, it quickly gathered users and ecological developers within a few months. Since May 17, Binance Wallet's market share has consistently remained above 90%, achieving a remarkable turnaround.

The "weekly dollar trading volume market share" chart on Dune clearly illustrates the dynamic trajectory of the aforementioned confrontations.

Crypto KOL Crypto Fearless commented on this war with a vivid metaphor: "OKX Wallet is like a finely crafted, years-in-the-making artwork, costing a fortune and killing off a batch of small projects, yet it has yet to turn a profit; while Binance used industrial machines to replicate it in two months, not only recreating the functionality but achieving trading volumes a hundred times that of OKX, with profitability that is crushing."

Will the Strong Remain Strong, or Will the Weak Break Through?

In reality, in the face of Binance's aggressive assault, OKX's counterattacks are also continuously advancing. In response to Binance Wallet's TGE activities, OKX Wallet launched the Cryptopedia TGE express and introduced a "liquidity pool area," suitable for hedging players looking to earn Alpha points. On the surface, it appears to be a "higher-dimensional strike," but most user feedback indicates a lack of interest. Despite boasting thousands of percent APY, this yield can only be reached within a very narrow range, and the APY itself fluctuates dramatically with trading volume.

Community opinions on the ultimate winner of this war are gradually diverging. Some believe that the "strong will remain strong" pattern has become a foregone conclusion. User @0xNathanWalk pointed out: "OKX's product strength is too strong, while Binance has financial strength and global influence; other wallets are likely to find it hard to break through." Others argue that differentiation and a solid user base remain the survival path for non-leading wallets.

Another perspective reexamines the wallet battlefield from a strategic dimension. Community user @Zhouqi_2013 stated that, in his view, under the current market structure, Binance quickly attracts users through subsidies, OKX wins user reputation through product strength, and Bitget focuses on auxiliary functions, compressing the survival space of small wallets through "downward pressure." However, the profitability of these platforms in the wallet business has yet to show significant improvement.

Binance executed an extreme turnaround with speed and strategy, while OKX still firmly holds its product base. Every step taken by the giants is a battle of offense and defense; first movers are not necessarily guaranteed victory, and latecomers can also launch lightning strikes.

If we refer to every chaotic battle among internet tech giants, we believe that ultimately, the one who wins the hearts of users will conquer the world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。