Author: Nancy, PANews

A small U.S. stock company, SharpLink Gaming, which had previously attracted little attention and was hovering on the brink of delisting, suddenly became the focus of the crypto market.

On May 27, SharpLink announced the completion of approximately $425 million in private placement financing and plans to significantly purchase ETH as its main treasury reserve asset. This bold crypto gamble sparked intense discussions within the community, with many even calling it the "Ethereum version of Strategy."

Betting on ETH as a Treasury Reserve Asset, Raising $425 Million with a $2 Million Market Cap

According to the announcement from SharpLink, the company has signed a securities purchase agreement to raise approximately $425 million through a public company private investment (PIPE). Under the agreement, the company will issue about 69.1 million shares of common stock (or equivalent securities) at a price of $6.15 per share, with the management team members subscribing at a price of $6.72 per share.

This round of financing features a luxurious lineup, led by Ethereum infrastructure developer ConsenSys, with participating institutions including ParaFi Capital, Electric Capital, Pantera Capital, Galaxy Digital, Ondo, GSR, and Republic Digital. Additionally, SharpLink's CEO Rob Phythian and CFO Robert DeLucia also participated in this subscription. However, these participating institutions did not release any related news on Twitter or their official websites.

According to the company's announcement, the proceeds from the financing will primarily be used to purchase ETH, which will become SharpLink's main treasury reserve asset in the future. Some funds will be allocated for daily operations and other general corporate purposes.

The transaction is expected to be completed around May 29, 2025. A particularly significant step is the joining of Joseph Lubin, co-founder of Ethereum and CEO of ConsenSys, who will serve as the chairman of SharpLink's board and assist the company in developing its core business as a strategic advisor. ConsenSys plays an important role in the Ethereum ecosystem, being the driving force behind core tools like Infura and MetaMask. Lubin's involvement not only provides an endorsement in terms of identity but also establishes a deep strategic binding.

On the day the financing news was announced, SharpLink's stock price surged to a high of $50, setting a new record since May 2023, and the company's valuation has jumped to $2.5 billion. It's worth noting that just a week ago, it was a stock with a daily trading volume of only a few tens of thousands of dollars, with a stock price hovering around a few dollars and a market cap of less than $2 million.

Deeply Trapped in Financial Difficulties for Years, Once on the Brink of Delisting

The transformation of SharpLink into the crypto market is backed by a carefully planned deep reconstruction of its business and identity.

SharpLink is an online technology company based in Minneapolis, Minnesota, focused on providing performance-driven marketing solutions for the sports betting and iGaming (online gambling) industries. The company helps leading global sports betting and online casino operators attract, acquire, and retain players through its iGaming affiliate marketing network, PAS.net. Additionally, SharpLink operates a series of state-specific affiliate marketing websites aimed at directing local sports betting and online casino traffic to its partners.

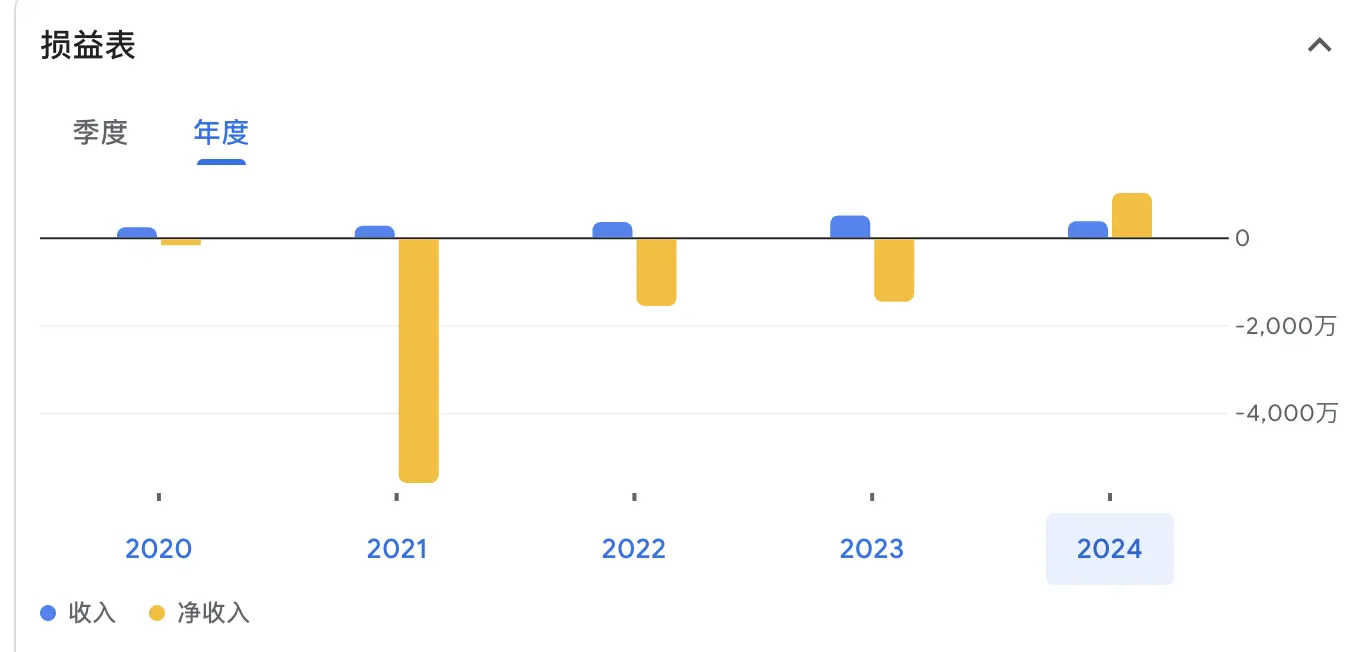

In recent years, SharpLink has faced dual pressures of declining revenue and deteriorating finances, only achieving a turnaround to net income last year. According to SharpLink's disclosed financial data for the full year 2024, annual revenue fell by 26.1% year-on-year, with only $3.662 million in revenue for the year. Although tax benefits from business termination brought about $10.09 million in net profit, this did not mask the fatigue of its main business. Moreover, by the end of 2024, SharpLink's cash reserves were approximately $1.436 million, down 42.2% from $2.487 million at the end of 2023. Faced with tight funds, SharpLink raised about $1.83 million in 2024 through "at-the-market" (ATM) offerings.

To stem the bleeding, SharpLink sold its core assets in fantasy sports and game development at the beginning of 2024, bringing in $22.5 million in cash, repaying about $19.4 million in debt, and relocating its registration from Israel to Delaware to lay the groundwork for future compliance and capital operations. Rob Phythian stated at the time, "The sale of fantasy sports and SHGN business and the repayment of debt mark a turning point in SharpLink's history. The company has now completed its focus and slimming down, allowing it to concentrate on its core affiliate marketing business and emerging growth directions."

Additionally, to boost the trading price per share and avoid mandatory delisting from Nasdaq, SharpLink implemented a 1-for-12 reverse stock split in May 2025.

This series of strategic adjustments laid the foundation for SharpLink's transformation into an Ethereum reserve company. In February 2025, SharpLink took its first step into the crypto world by acquiring a 10% stake in the UK-based Armchair Enterprises Limited (parent company of CryptoCasino.com) for $500,000 in cash, securing a future priority right to acquire a controlling stake. CryptoCasino.com is a blockchain-based online gambling platform that supports deposits and bets in over 20 mainstream cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, offering over 6,000 gambling games, and has launched its native token $CASINO. Although this move did not immediately boost the company's stock price, it sent a signal of transformation to the outside world.

However, given that SharpLink's revenue scale is still small, its main business is in the early stages of transformation, and its financial structure remains under pressure, why did heavyweight crypto institutions like ConsenSys still choose to invest heavily? The reason lies in the fact that building an on-chain treasury through a Nasdaq-listed company is not only highly persuasive in the market compared to crypto-native enterprises but can also trigger a broader capital market linkage, potentially changing the capital market's perception of Ethereum. Similar to how Strategy incorporated Bitcoin into a listed company and leveraged the capital market to amplify value, achieving a stock price premium far exceeding the coin price itself, this model has been widely recognized by the market and attracted many followers.

Joseph Lubin also expressed his thoughts on this investment, stating, "After the transaction is completed, ConsenSys looks forward to collaborating with SharpLink to explore and formulate an Ethereum treasury strategy and serve as a strategic advisor on its core business. This is an exciting moment for the Ethereum community, and I am very pleased to work with Rob and his team to bring the potential of Ethereum into the public capital market."

However, whether SharpLink can withstand the market cycle test brought by the financial leverage effect of relying on ETH reserves and replicate the capital miracle of Strategy remains to be seen over time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。