RWA has become an important engine driving the development of the cryptocurrency market, and traditional financial institutions are actively adopting stablecoins, promoting their application in the traditional payment market.

Authors: Song Jiajie, Ren Heyi, Jishi Communication

Abstract

Stablecoins refer to cryptocurrencies that are value-pegged to various fiat currencies. As assets on the blockchain, the advantage of stablecoins is their ability to deeply integrate with cryptocurrency projects (such as DeFi) at the blockchain infrastructure level, offering excellent network scalability. With traditional financial institutions in regions like the United States and Hong Kong actively engaging in the RWA field, the exploration and deepening of stablecoin applications in the traditional payment market have been promoted.

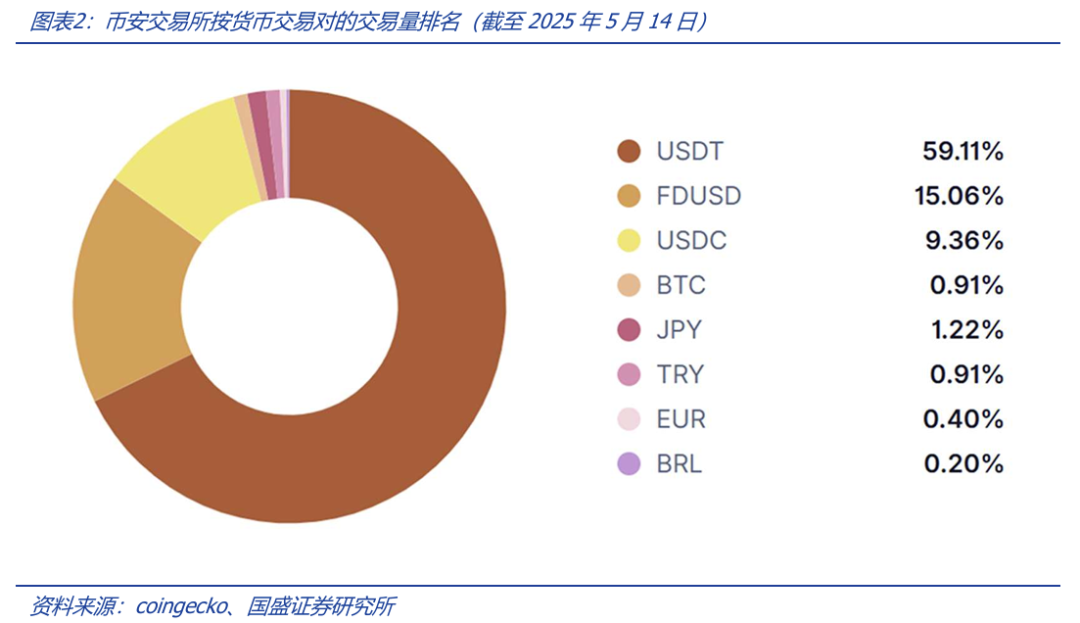

Stablecoins serve, to some extent, as a "pricing tool" for the cryptocurrency market, complementing or even replacing traditional fiat currency transactions. Shortly after their inception, the main trading pairs in the cryptocurrency market were stablecoin trading pairs, thus stablecoins play the role of "fiat currency" in terms of trading tools and value circulation. Major exchanges (including DEX decentralized exchanges) primarily use stablecoins like USDT for Bitcoin spot and futures trading pairs, especially for futures contracts with larger trading volumes, where the mainstream exchanges' contracts (futures contracts with USD stablecoins as margin) are almost all USDT trading pairs.

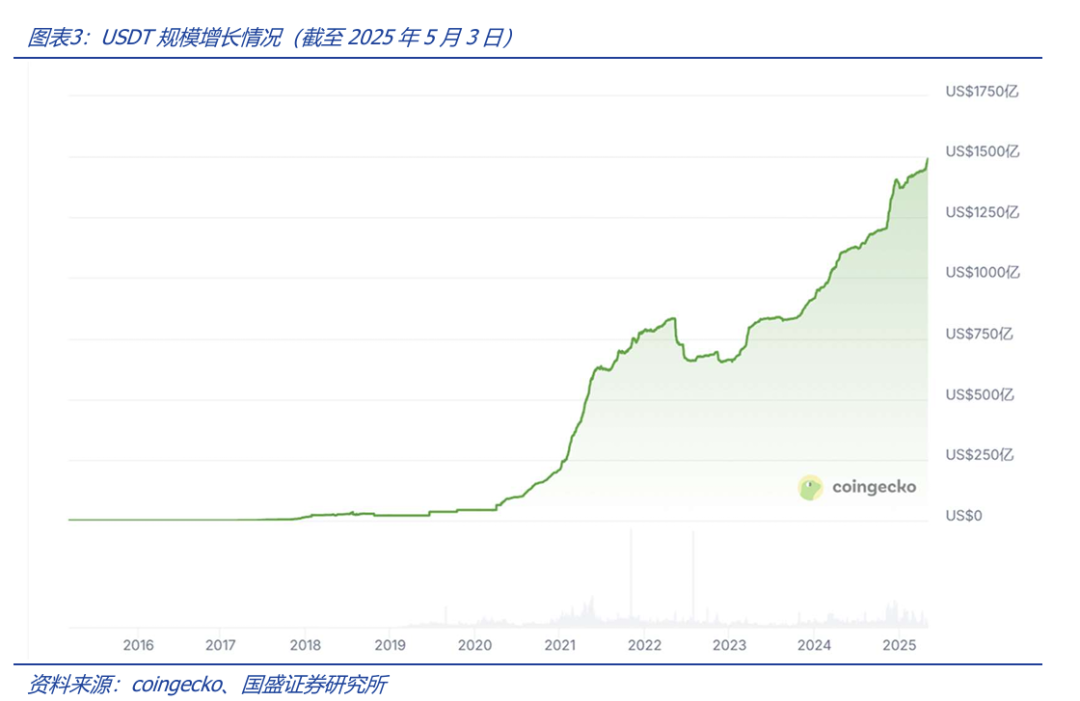

USDT is one of the earliest issued stablecoins, issued by Tether with sufficient reserves of assets pegged to the US dollar, and is currently the most widely used stablecoin. USDT was launched by Tether in 2014, with 1 USDT pegged to 1 US dollar. USDT became one of the first stablecoins listed on centralized exchanges and has gradually become the most widely used stablecoin product in the market, primarily for cryptocurrency spot and futures trading pairs. USDT is a stablecoin backed by US dollar assets, with the company claiming that each token is supported by 1 US dollar in assets. Tether provides an auditable balance sheet, primarily consisting of cash and other traditional financial assets. Since its launch, USDT has maintained a rapid growth rate, reflecting the underlying actual demand for stablecoins, making their emergence "inevitable."

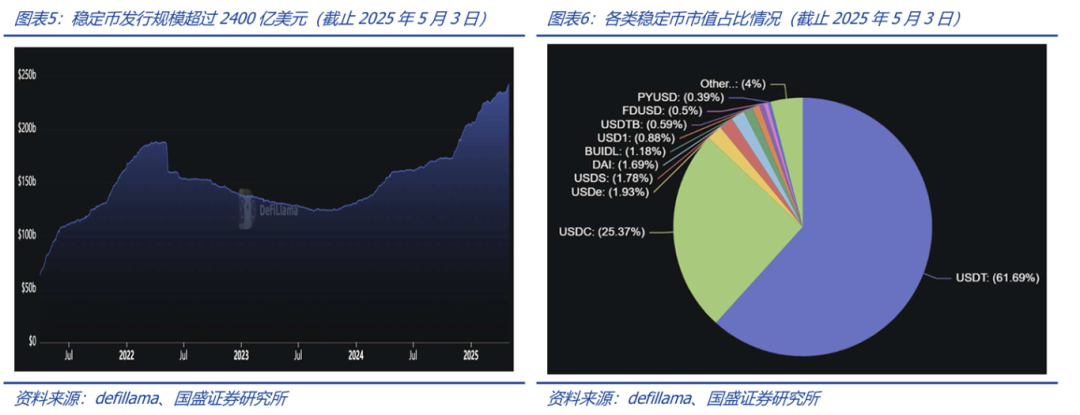

Currently, there are three ways to achieve this credit transmission: centralized institutions issuing stablecoins with sufficient asset reserves, stablecoins issued based on blockchain smart contracts collateralizing crypto assets, and algorithmic stablecoins. For stablecoins, USDT, as a centralized institution-issued stablecoin, holds a dominant position; the mechanisms of the second type (over-collateralization) and the third type (algorithmic stablecoins) are not intuitive to some extent, and users often cannot directly perceive the intrinsic value anchoring logic of their stablecoin products, especially during periods of severe cryptocurrency price fluctuations, where the effects of the liquidation mechanism cannot be intuitively anticipated. These factors limit the development of the latter two.

RWA has become an important engine driving the development of the cryptocurrency market, and traditional financial institutions are actively adopting stablecoins, promoting their application in the traditional payment market. Taking the tokenized US Treasury market as an example, the main fund BUIDL was launched in collaboration between BlackRock and Securitize, while BENJI was launched by Franklin Templeton, indicating that traditional financial institutions embracing RWA has gradually become a trend.

Stablecoin regulation is gradually advancing; currently, stablecoins are in a phase of development while simultaneously adapting to regulation. Although there have been doubts during their development, with BTC entering the mainstream capital market, the development of stablecoins is expected to accelerate.

Risk Warning: Blockchain technology research and development may not meet expectations; regulatory policy uncertainties; Web 3.0 business model implementation may not meet expectations.

1. Core Viewpoints

Stablecoins were born in the "wild" world of Web 3.0, initially serving as a fiat pricing tool for trading cryptocurrencies; as the cryptocurrency market has grown, stablecoins have become indispensable foundational tools for exchanges, DeFi, and the RWA ecosystem. A key to the success of stablecoins is their ability to gain market trust, which involves the credit transmission mechanism of stablecoins. Stablecoins are not only a necessity in the Web 3.0 world but also a bridge connecting it to the real economic world. Today, as stablecoins flourish, traditional financial institutions are also beginning to accelerate their adoption of stablecoins, embracing crypto assets. Stablecoins connect two worlds.

This article analyzes the birth, development, and current status of stablecoins, as well as their mechanisms, and looks forward to the current opportunities for stablecoins.

2. The Inevitability of Stablecoins: A Bridge Connecting Traditional Finance and Web 3.0

2.1 The Underlying Demand for Stablecoins: On-chain "Fiat" Tools

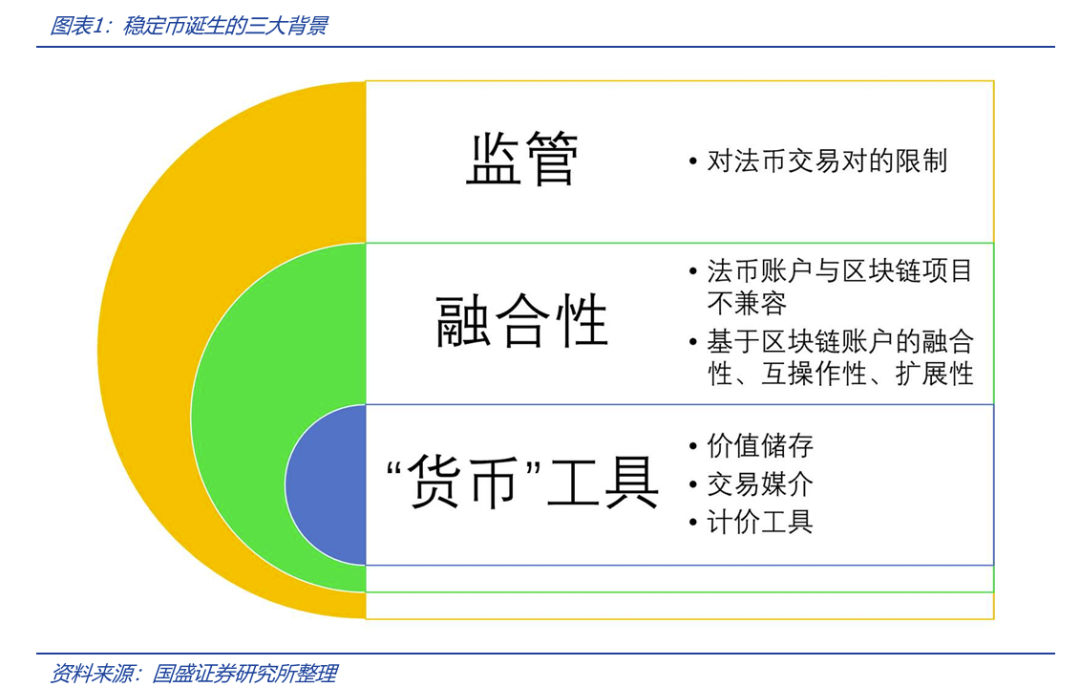

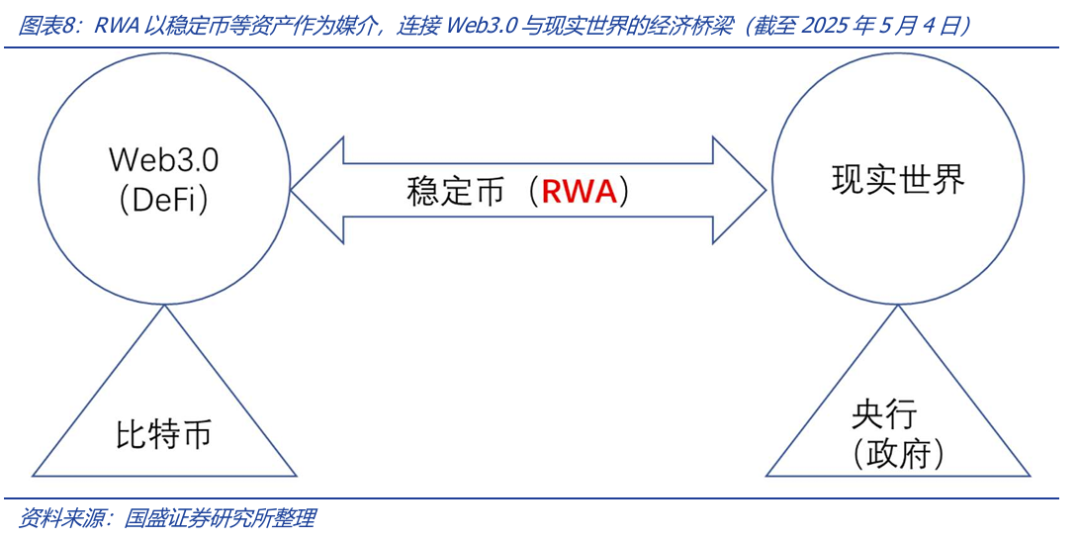

Stablecoins refer to cryptocurrencies that are value-pegged to various fiat currencies (or a basket of currencies). Intuitively, stablecoins are digital representations of fiat currency value mapped onto blockchain accounts (i.e., cryptocurrencies). In this sense, stablecoins are a typical form of RWA (Real World Assets tokenization); as assets on the blockchain, stablecoins can deeply integrate with cryptocurrency projects (such as DeFi) at the blockchain infrastructure level—such as on-chain exchanges or combinations for staking with other on-chain crypto assets. Traditional fiat currencies do not exist on the blockchain and cannot achieve on-chain scalability.

In the early development of the cryptocurrency market, users primarily conducted Bitcoin and fiat currency transactions on centralized exchanges (CEX) or OTC markets—Bitcoin is an asset stored on the blockchain, while fiat currency relies on traditional bank accounts. This type of transaction actually involves two completely isolated transaction operations: between Bitcoin blockchain accounts and between bank fiat accounts, similar to the stock market where stock registration systems and bank fiat accounts are settled separately. In the early stages of cryptocurrency development, as countries tightened regulations on exchanges, bank fiat accounts were more susceptible to regulatory restrictions. Under these unique early conditions, the demand for stablecoins pegged to fiat currency value gradually emerged—forming trading pairs for cryptocurrency trading against Bitcoin (or other crypto assets) that detached from the traditional financial account system. More importantly, cryptocurrencies are assets based on blockchain accounts, and if the trading pairs they are priced against are also based on blockchain accounts, then the integration and interoperability of ledgers become possible—while traditional fiat currencies do not exist on the blockchain.

In other words, cryptocurrencies like Bitcoin do not interconnect with fiat accounts, and smart contracts cannot operate on fiat accounts, which is detrimental to network scalability. Therefore, based on the need for integration and interoperability, the market requires all assets to be expressed as digital representations of blockchain accounts. Additionally, due to the high volatility of cryptocurrencies failing to meet the three main characteristics of money: store of value, medium of exchange, and unit of account, users find it difficult to retain or exit their investments in the crypto world, which has spurred the demand for low-volatility stable currencies.

Stablecoins serve, to some extent, as a "pricing tool" for the cryptocurrency market, complementing or even replacing traditional fiat currency transactions. Shortly after their inception, the main trading pairs in the cryptocurrency market were stablecoin trading pairs, thus stablecoins play the role of "fiat currency" in terms of trading tools and value circulation. As shown in Figure 2, major exchanges like Binance primarily use various stablecoins such as USDT for Bitcoin spot and futures trading pairs, especially for futures contracts with larger trading volumes, where the mainstream exchanges' contracts (futures contracts with USD stablecoins as margin, such as perpetual contracts Futures) are almost all USDT trading pairs.

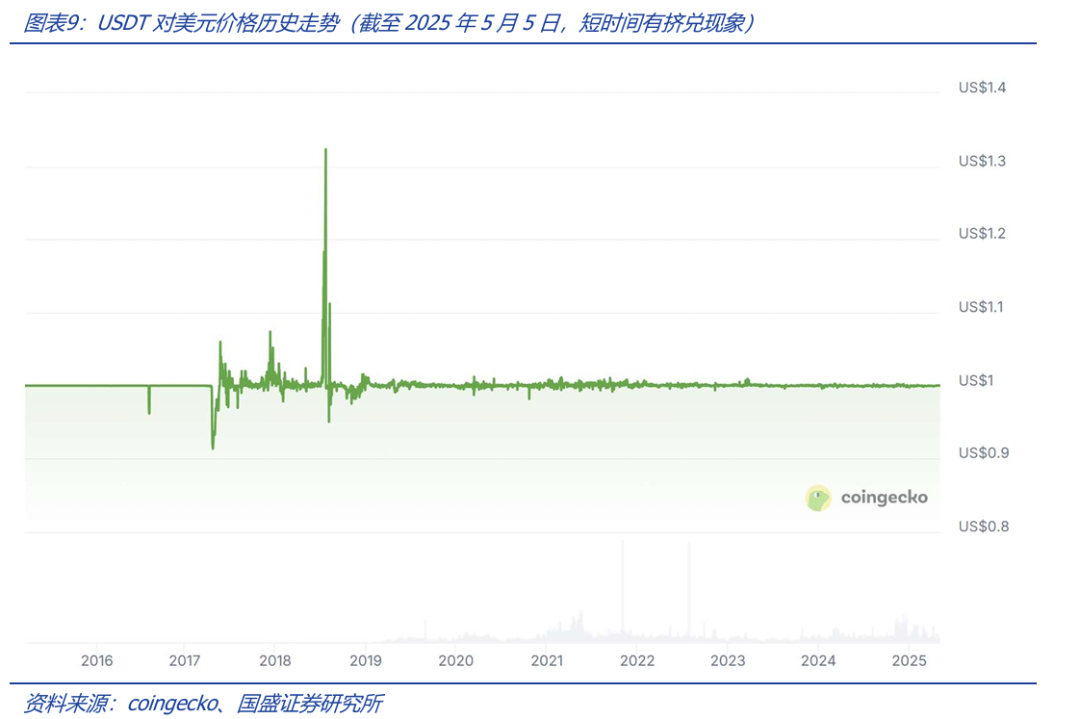

Tether USD (USDT) is one of the earliest issued stablecoins, launched by Tether in 2014, with 1 USDT pegged to 1 US dollar. USDT became one of the first stablecoins listed on centralized exchanges and has gradually become the most widely used stablecoin product in the market, primarily for cryptocurrency spot and futures trading pairs. USDT is a stablecoin backed by US dollar assets, with the company claiming that each token is supported by 1 US dollar in assets. Tether provides an auditable balance sheet, primarily consisting of cash and other traditional financial assets. Other stablecoin projects launched during the same period include BitUSD, NuBits, etc. Since its launch, USDT has maintained a rapid growth rate, reflecting the underlying actual demand for stablecoins, making their emergence "inevitable."

Due to USDT meeting the actual market demand, since 2017, as mainstream cryptocurrency trading platforms have successively launched USDT trading pairs (both spot and futures contracts), stablecoins have gained favor in the cryptocurrency market. The ability of early stablecoins to effectively peg to corresponding fiat currency values became a major concern for the market. Since early companies like Tether failed to provide convincing, compliant audited balance sheets, there has been ongoing skepticism regarding their credit. To address the issue of USDT's over-reliance on centralized institutional credit, MakerDAO issued the decentralized, multi-asset collateralized stablecoin DAI based on smart contracts in 2017, which is over-collateralized by crypto assets managed by smart contracts and relies on the smart contract system to stabilize its price against the US dollar, allowing users to mint without permission. As of May 3, 2025, the issuance scale of DAI exceeded $4.1 billion, ranking fifth among various stablecoins (not including the new stablecoin USDS issued by MakerDAO).

The emergence of DAI is a milestone event; decentralized stablecoins not only differ in credit transmission from products backed by centralized institutional credit (like USDT), but they are also native products of the DeFi system—DAI itself is an RWA product under DeFi staking. Therefore, decentralized stablecoins like DAI are not only adopted in centralized exchanges but are also an indispensable part of the RWA ecosystem—often referred to as a part of the "Lego puzzle."

As the application of stablecoins has become widespread and deepened, centralized exchanges have begun to venture into their own stablecoin products, typically exemplified by USDC led by Coinbase and BUSD led by exchange giant Binance.

Since 2019, with the development of DeFi projects, stablecoins have been widely used in DeFi systems (lending markets, decentralized exchange markets). To pursue greater decentralization and more integration with DeFi infrastructure, algorithmic stablecoins that adjust value stability based on smart contract algorithms have begun to gain traction in the market. This is based on DAI, utilizing the algorithmic mechanisms of smart contracts to achieve credit transmission between stablecoins and fiat currencies, with main products including USDe, among others.

Although the cryptocurrency industry pursues sufficient decentralization, the stablecoin market (mainly USD stablecoins) is still dominated by USDT and USDC, which are issued based on centralized institutional collateral/reserve assets, occupying an absolute monopoly status. As shown in Figure 4, as of May 3, 2025, the scale of the leading USDT exceeded $149 billion, while the second-ranked USDC exceeded $61 billion, and the third-ranked USDe was less than $5 billion. The two centralized stablecoins, USDT and USDC, hold an absolute advantage. The blockchain smart contract algorithmic stablecoin USDe ranks third, with a scale of approximately $4.7 billion. Stablecoins issued based on blockchain smart contract collateralized assets, represented by USDS and DAI, rank fourth and fifth, with scales of approximately $4.3 billion and $4.1 billion, respectively.

Currently, the main use of stablecoins is in the cryptocurrency market, as the mainstream pricing method in the cryptocurrency market is based on stablecoins. With the bull market in the cryptocurrency market over the past year, the issuance scale of stablecoins (mainly USD stablecoins) has seen rapid growth, as shown in Figures 5 and 6, exceeding $240 billion as of May 3, 2025; currently, the scales of USDT and USDC account for 61.69% and 25.37%, respectively. It is noteworthy that decentralized stablecoins have not demonstrated sufficient advantages; from a practical application perspective, stablecoins like USDT and USDC, which are based on traditional financial asset reserves, have become the absolute leaders. There are many influencing factors, and the rapid development of RWA is somewhat related to the adoption of USDT and USDC, which will be further analyzed later.

2.2 Not Just a Pricing Tool, But a Bridge Connecting Web 3.0 and Traditional Financial Markets

In the DeFi lending market, stablecoin assets like USDT are commonly used as collateral/lending assets, serving not only as a deposit savings tool but also existing as a type of crypto asset—stablecoins can be used to borrow against collateralized crypto assets like Bitcoin/ETH, and they can also be used as collateral to borrow other crypto assets. For example, in the AAVE project, which ranks first in DeFi locked assets, three of the top six projects by market size are USD stablecoin loans, with USDT, USDC, and DAI ranking second, third, and sixth, respectively.

Whether in trading markets or DeFi lending markets, stablecoins are somewhat similar to currencies or notes issued by private institutions. Due to the characteristics of blockchain infrastructure, stablecoins have different potentials in terms of settlement speed, integration, and scalability compared to traditional financial markets. For example, stablecoins can be quickly and seamlessly switched between various DeFi projects (such as exchanges, lending markets, leveraged products, etc.) with just a few clicks on a mobile device, while fiat currencies cannot circulate as quickly in traditional financial markets.

The integration of the Web 3.0 world, represented by cryptocurrencies, with the real economic world is an inevitable trend, and RWA is an important driving force in this integration process—because RWA more directly maps real-world assets onto the blockchain. From a broad perspective, stablecoins are one of the most fundamental RWA products, anchoring fiat currencies like the US dollar to the blockchain. For users in traditional financial markets, stablecoins and RWA serve as a bridge for entering the cryptocurrency market. For traditional financial institutions looking to enter the Web 3.0 world, stablecoins represent an important position; possessing stablecoins allows them to navigate the Web 3.0 world for asset allocation conversion. Conversely, investors holding cryptocurrency assets can convert them into traditional financial assets or purchase goods through stablecoins, returning to the traditional financial market. On April 28, 2025, payment giant Mastercard announced that it would allow customers to spend using stablecoins and enable merchants to settle in stablecoins. The use of stablecoins has begun to reverse diffuse into the traditional economic society.

2.3 Three Models of Stablecoin Credit Transmission

The digital representation of a bank account reflects the user's fiat currency deposits, which are guaranteed by the rules of traditional economic society. Stablecoins attempt to transmit fiat currency value to on-chain account numbers, and the credit transmission involved requires a different approach than banks, which is a very critical core issue of stablecoin credit. Overall, there are currently three ways to achieve this credit transmission: centralized institutions issuing stablecoins with sufficient asset reserves, stablecoins issued based on blockchain smart contracts collateralizing crypto assets, and algorithmic stablecoins.

For stablecoins, USDT, as a centralized institution-issued stablecoin, holds a dominant position; this type of product model has a simple logic, leveraging the credit transmission model of the traditional economic market, making it easier for users to understand and operate. In the early development stage of stablecoins, this was the most rational choice. The mechanisms of the second type (over-collateralization) and the third type (algorithmic stablecoins) are not intuitive to some extent, and users often cannot directly perceive the intrinsic value anchoring logic of their stablecoin products (i.e., novice users may not accept the logic well), especially during periods of severe cryptocurrency price fluctuations, where the effects of the liquidation mechanism cannot be intuitively anticipated—during periods of severe price volatility, the liquidation mechanism can lead to some irrational market outcomes, which limits the development of the latter two.

2.3.1. Relying on Traditional Economic Market for Credit Transmission: USDT

Centralized institutions issue stablecoins with sufficient asset reserves, and credit transmission completely relies on the traditional economic market. As the simplest stablecoin model, it involves a centralized institution issuing a corresponding number of stablecoins on the blockchain with sufficient reserve assets (the issuing institution assumes responsibility for the issuance and redemption of stablecoins), anchoring the stablecoin to fiat currency at a 1:1 ratio, with the centralized institution serving as the credit endorsement entity. Effective audits of the issuer's balance sheet are necessary, and these assets are typically traditional market government bonds, cash, etc., with a small portion possibly being cryptocurrencies like Bitcoin. Through a 1:1 collateral custody, this model ensures that users can redeem equivalent collateral from the issuer, ensuring the price stability of the stablecoin. However, this model also heavily relies on the secure custody of collateral, which involves multiple details such as the compliance of the project party, the compliance of the custodian, and the liquidity of the collateral. Typically, whether the issuing institution can provide compliant and effective audit reports is of utmost concern.

The early establishment of USDT also provided the project with a significant first-mover advantage, and it is currently the stablecoin product with over 60% of the circulating supply. To ensure widespread application, USDT is issued on multiple blockchains, including Omni, Ethereum, Tron, and Solana. In the early stages of its growth, factors such as liquidity and market skepticism regarding its balance sheet, combined with market volatility, occasionally led to USDT experiencing de-pegging (sometimes trading at a premium). However, these special situations are temporary, and overall, USDT's peg to the US dollar has been relatively successful. We believe that this is largely due to strong market demand, as USDT is a necessity for the cryptocurrency market.

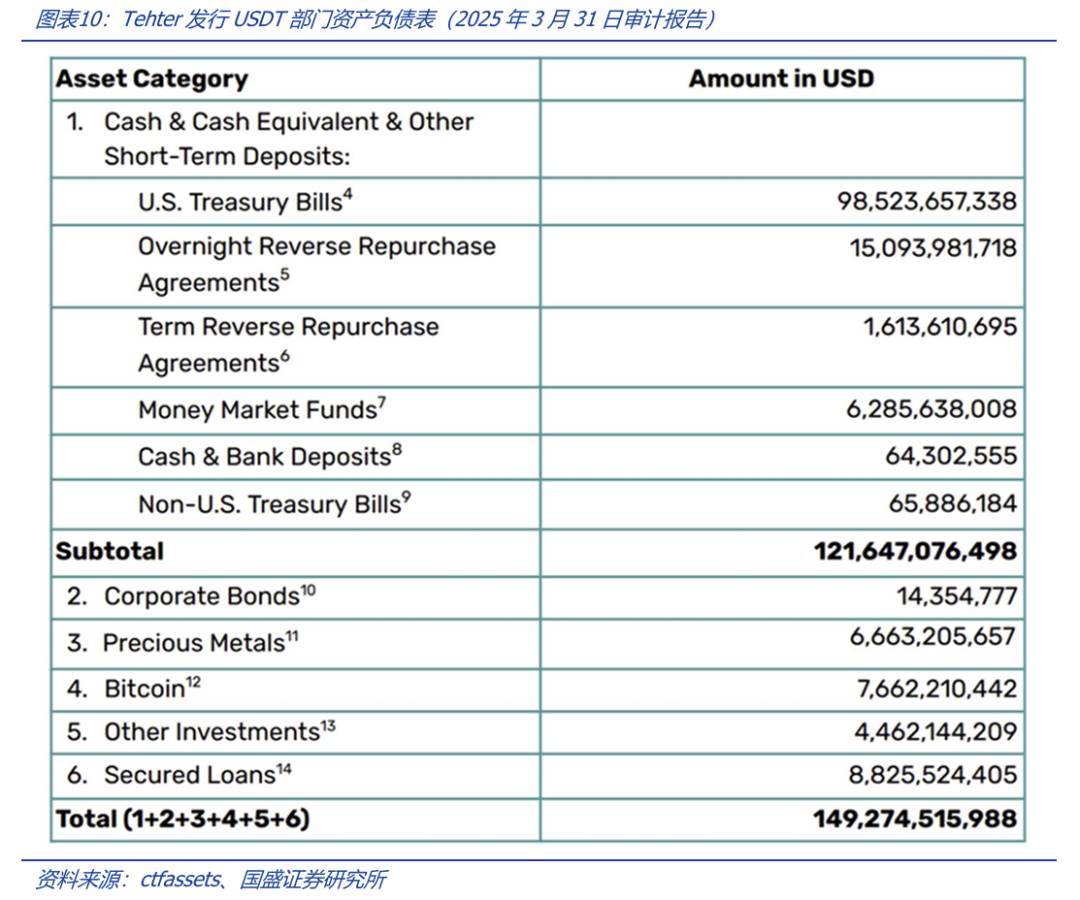

In response to market concerns about its reserve assets and redemption capabilities, Tether has now publicly released a complete and effective audit report. According to the audit report from an independent agency, as of March 31, 2025, Tether's total assets in the USDT issuance department were approximately $149.3 billion, which is consistent with the scale of USDT issued. A close examination of the balance sheet reveals that 81.49% of the reserve assets are cash, cash equivalents, and other short-term deposit items, primarily consisting of US government bonds, ensuring the robustness of its assets and liabilities while fully considering liquidity measures to address redemptions. Interestingly, there is also a reserve of $7.66 million in Bitcoin, which, although not substantial, underscores the fact that Bitcoin (and by extension, other cryptocurrencies) can serve as a reserve asset for issuing stablecoins. In summary, the composition of USDT's reserves is diverse, considering both liquidity and the diversity of allocations.

As the issuer of USDT, Tether achieved over $13 billion in total profits in 2024, with only about 150 employees. During the Federal Reserve's interest rate hike cycle, US government bonds contributed to Tether's core profits. Of course, there are also fees associated with redeeming USDT. As a compliant company responsible for issuing and redeeming stablecoins, Tether's model is currently the most sought after in the market. We believe that USDT's early entry into the market, along with its strong first-mover advantage in both centralized exchanges (CEX) and the DeFi era, as well as its reliance on publicly audited companies for credit endorsement, are important reasons for its acceptance in both traditional financial markets and the Web 3.0 market.

2.3.2. Decentralized Collateralized Asset Issued Stablecoins Can Also Gain Market Trust

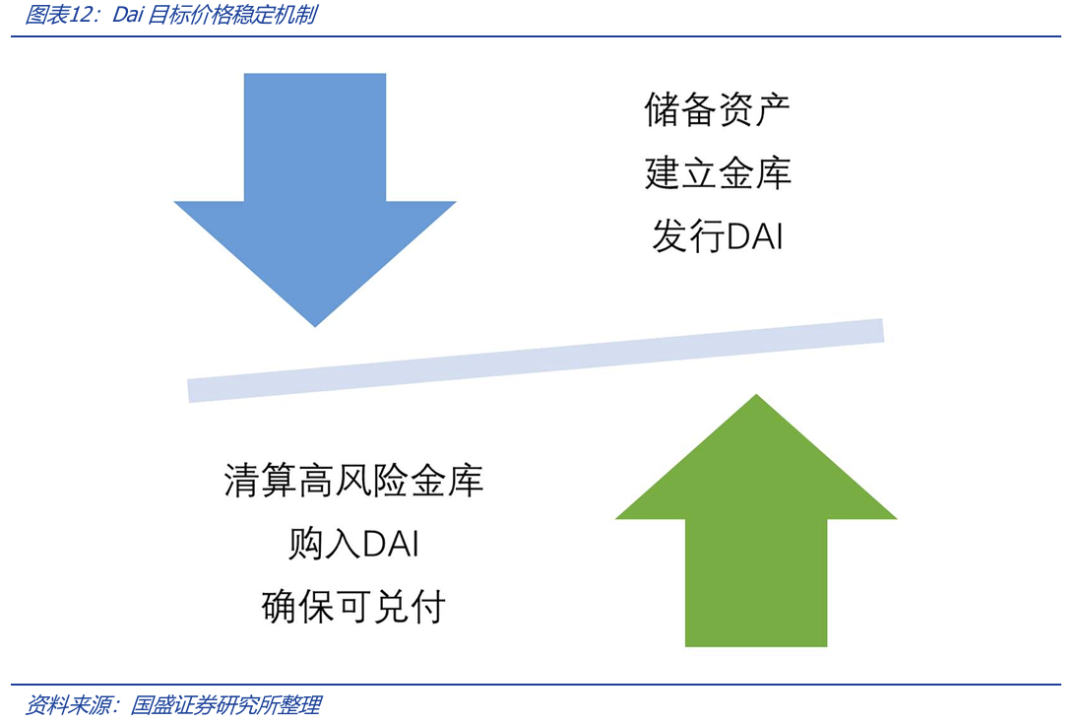

Stablecoins issued based on blockchain smart contracts collateralizing crypto assets can also gain market trust through over-collateralization. By collateralizing cryptocurrency assets to a smart contract, the smart contract locks on-chain crypto assets and issues a certain number of stablecoins. Since the on-chain crypto assets do not inherently maintain price stability against the US dollar, there is a risk of price volatility for the collateralized assets. To achieve price stability and redeemability for stablecoins, this type of stablecoin implements credit transmission through an over-collateralization model—meaning that the value of the collateralized crypto assets exceeds the amount of stablecoins issued. In the event of market fluctuations (especially when the price of collateralized assets declines), the blockchain smart contract liquidates the collateralized assets (while purchasing stablecoins) to ensure the redeemability of the stablecoins. The distinction of this model from the first type is that it does not rely on the credit of centralized institutions. The largest and most typical examples of this model are USDe and DAI—USDe is based on DAI and issued under the new Sky protocol, which can be considered an upgraded version of DAI (the two can be freely exchanged at a 1:1 ratio without restrictions). In 2024, MakerDAO rebranded as Sky Ecosystem and launched a stablecoin product called USDS, where all acceptable collateralized crypto assets can be generated as DAI through a smart contract called Maker Vault under the control of the Sky protocol. A decline in the price of collateral can lead to the risk of insufficient collateral value, and the protocol will sell off the collateral (i.e., buy DAI) according to the set parameters to support the value of DAI pegged to the US dollar at a 1:1 ratio.

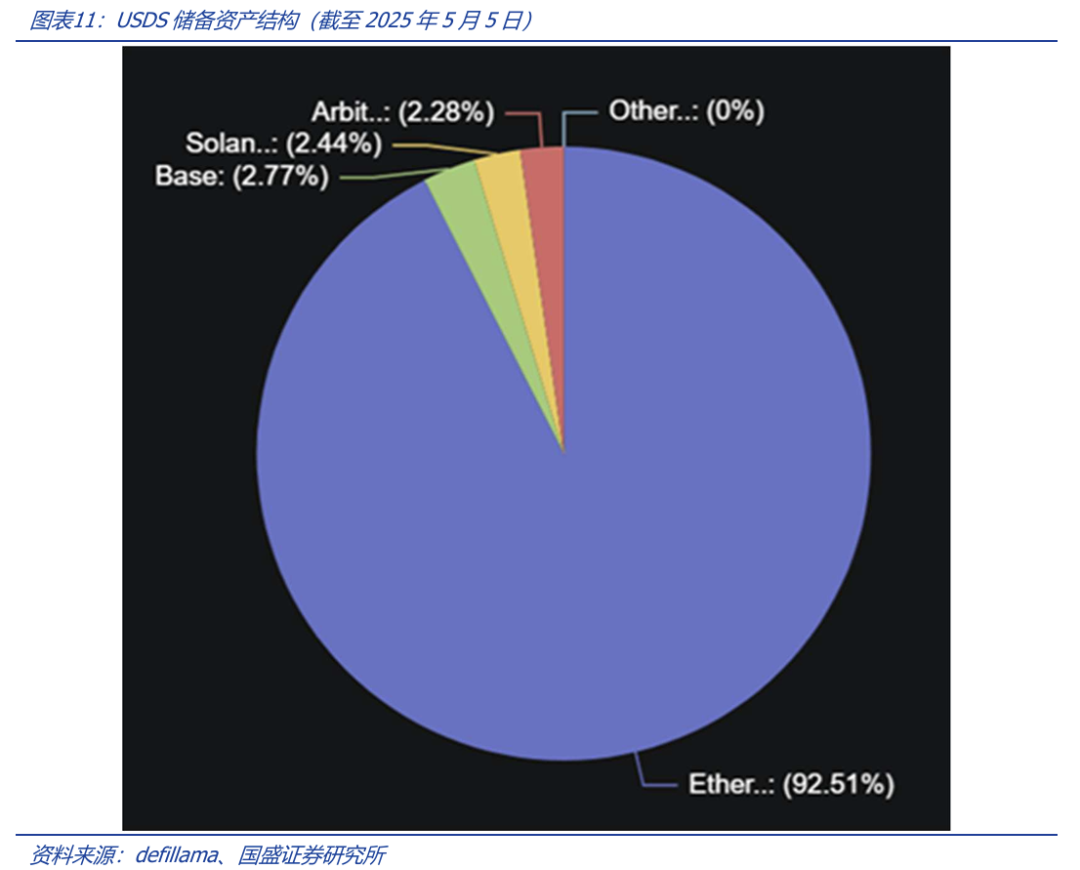

From the composition of collateral assets, as of May 5, 2025, the main collateral for USDS is ETH tokens, accounting for over 92%.

How is DAI stability ensured? In other words, ensuring that DAI holders can redeem it is the core of DAI's stable anchoring. The issuer of DAI interacts with the Sky Protocol Vault contract on-chain, depositing sufficient collateralized crypto assets into the vault (the asset value exceeds the amount of DAI issued, ensuring DAI can be redeemed). During market fluctuations, if the price of the collateralized crypto assets declines, there is a risk that the collateral may not be sufficient to redeem the issued DAI. The vault liquidates the collateral according to the contract's protocol, and the liquidation is conducted by redeeming DAI. This mechanism is similar to the margin mechanism in futures contracts, where positions are liquidated in advance when the margin is insufficient. The Sky protocol has designed a corresponding auction price mechanism to ensure that the value of the vault's collateral is redeemable for DAI circulating in the market, thereby ensuring the "stability" of DAI's price.

2.3.3. Algorithmic Stablecoins: Fully Trusting Blockchain Algorithms, Currently Small in Scale

The above two stablecoin models are both collateralized asset-based stablecoins. USDT is backed by a company with sufficient auditable reserves, while USDS/DAI achieve collateralization and redeemability through blockchain smart contracts. The pricing and governance of the liquidation mechanism for the latter are not entirely decentralized. Under the demand from native users of decentralized finance for fully decentralized stablecoins, mechanisms that rely entirely on algorithmic mechanisms to achieve stablecoin value anchoring have emerged, resulting in products that maintain stablecoin price stability in the trading market through algorithms. The price stability mechanism of these algorithmic stablecoins is generally similar to market arbitrage/hedging mechanisms controlled by algorithms, theoretically ensuring that stablecoins remain pegged. However, this practice is still in its early stages, and instances of detaching from the pegged price level are not uncommon. The scale of algorithmic stablecoins remains relatively small. Compared to the second type, algorithmic stablecoins rely entirely on decentralized smart contract algorithms, requiring virtually no human intervention. As an innovative track, several different arbitrage/hedging mechanisms have historically emerged for algorithmic stablecoins, but overall, there are not many projects that have successfully operated in the long term.

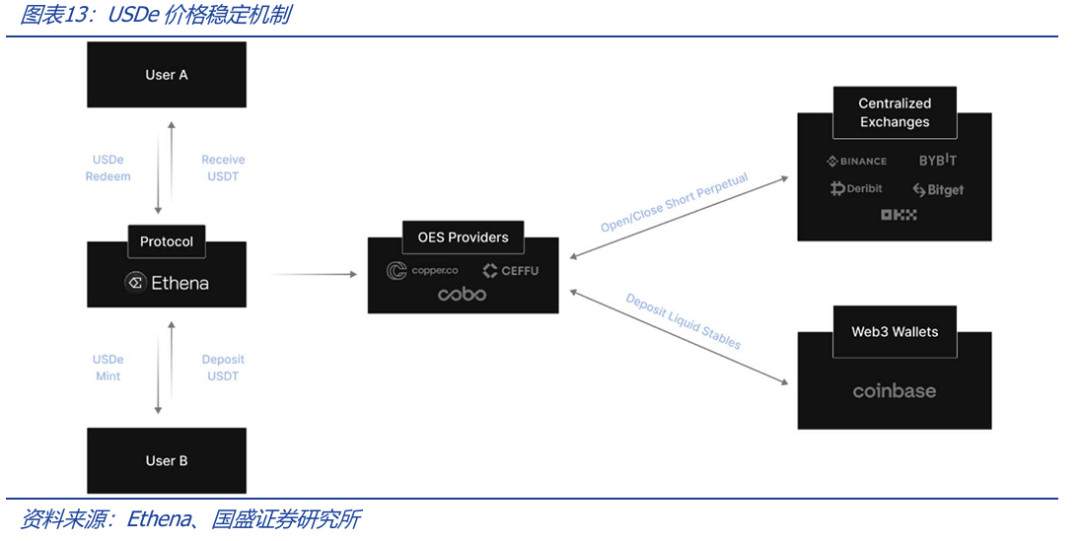

Currently, the representative of algorithmic stablecoins is USDe, which ranks third in scale and is issued by the Ethena protocol. Generally, whitelisted users deposit crypto assets such as BTC, ETH, USDT, or USDC into the Ethena protocol to mint an equivalent amount of stablecoin USDe. The protocol establishes short positions on CEX exchanges to hedge against price fluctuations of its reserve assets, maintaining the value stability of the issued stablecoins. This method is similar to the hedging mechanism in commodity futures, which is an automated neutral hedging strategy entirely controlled by algorithms.

3. RWA: An Important Application Area for Stablecoins Today

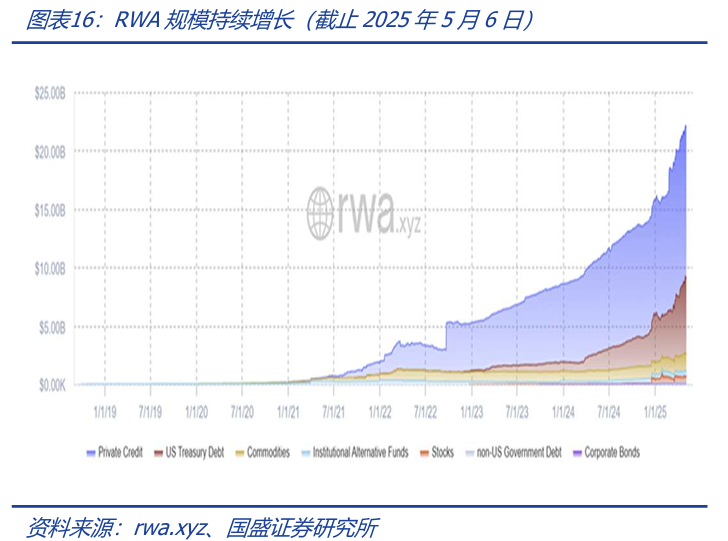

Since the beginning of this year, Bitcoin prices have experienced a certain decline, leading to a downturn in the cryptocurrency market, while the RWA market has maintained a good upward trend. According to data from rwa.xyz, as of May 6, the RWA scale has exceeded $22 billion, showing a continuous growth trend this year, seemingly unaffected by the decline in Bitcoin prices. In terms of RWA composition, private credit and tokenized U.S. Treasury bonds have contributed significantly to the scale and growth.

RWA has become an important engine driving the development of the cryptocurrency market, thanks to the active participation of traditional financial institutions. Taking the tokenized U.S. Treasury bond market as an example, the leading fund BUIDL was launched in collaboration between BlackRock and Securitize, while BENJI was launched by Franklin Templeton, indicating that traditional financial institutions embracing RWA has gradually become a trend.

As a track with certain growth potential, the demand for stablecoins in RWA is also evident, as RWA brings real-world assets on-chain, and USDT serves as a bridge connecting the real world with the Web 3.0 world.

3.1 The Importance of Stability Under the Institutional Trend of RWA

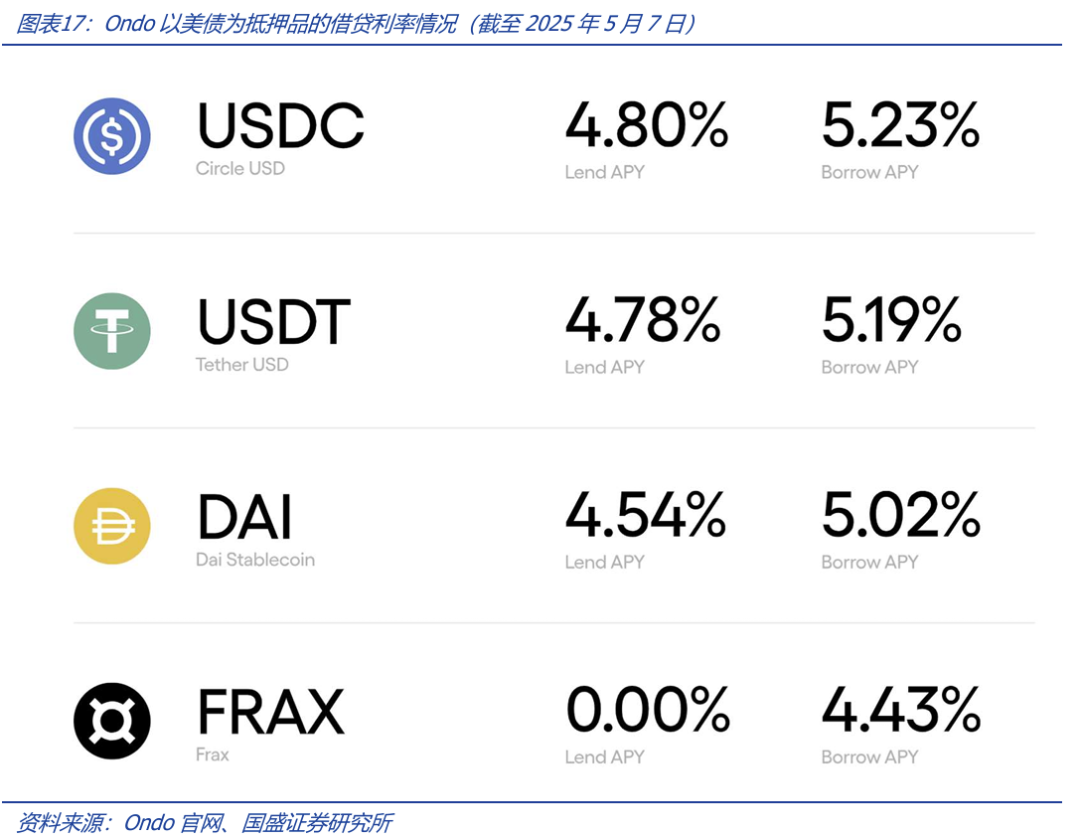

Although RWA was born in the wild world of Web 3.0, it has now shown a certain trend of "institutionalization"—especially as Bitcoin ETFs have strengthened the recognition of traditional financial institutions and markets towards Web 3.0, this trend is a natural progression. Taking Ondo as an example, this is a U.S. blockchain technology company whose mission is to accelerate the Web 3.0 process of the traditional wealth world by building platforms, assets, and infrastructure that bring financial markets on-chain. Recently, the company announced a new technology initiative—Ondo Nexus, aimed at providing real-time liquidity for third-party issuers of tokenized U.S. Treasury bonds. In other words, Ondo Nexus provides redemption and exchange services for tokenized Treasury bonds, enhancing the liquidity and practicality of tokenized Treasury bonds while building infrastructure for a broader range of RWA asset classes. Its clients include Franklin Templeton, WisdomTree, Wellington Management, and Fundbridge Capital, while leveraging existing relationships with companies like BlackRock and PayPal to provide 24/7 liquidity. Additionally, on February 12, the company announced a strategic partnership with World Liberty Financial (WLFI), supported by Donald Trump Jr. (son of former U.S. President Trump), to bring traditional finance on-chain by promoting the development of RWA. RWA has accelerated its entry into the "institutional" era.

With Ondo Nexus, investors in tokenized Treasury bonds from partner issuers will be able to seamlessly redeem their RWA assets using various stablecoins, thereby enhancing the liquidity and practicality of the entire ecosystem, increasing the investability of the RWA field, and boosting confidence in the liquidity of on-chain assets. By 2024, the total locked value (TVL) of RWA assets in the tokenized Treasury bond category of the company exceeded $3 billion, achieving good results.

With the support of traditional financial institutions, Ondo has received good liquidity support, which is crucial for attracting clients from the traditional financial market, as many of these clients' assets are not on-chain.

4. Traditional Payment Market Emphasizing Stablecoins: Payments and Interest

As a bridge connecting Web 3.0 with the real world, the role of stablecoins is twofold; not only do real-world assets go on-chain through stablecoins, but the application of stablecoins is also penetrating the real-world market. What we can expect is that the application of stablecoins in cross-border payments will be promising, and as a type of asset similar to a shadow "fiat currency," if users can earn interest on stablecoins, it will be another significant breakthrough.

The support for stablecoin usage by traditional payment institutions like Mastercard is no longer a novelty; this is a proactive effort by traditional financial institutions to capture Web 3.0 financial traffic. Since DeFi systems provide ways for crypto assets to earn interest, this is an advantage for on-chain assets, and traditional financial institutions are also seeking higher attractiveness in terms of interest generation. Payment giant PayPal is ramping up its development of the PYUSD stablecoin market, and recently the company plans to start offering a 3.7% interest on balances to U.S. users holding PYUSD, with the plan set to launch this summer. Users will earn interest while storing PYUSD in their PayPal and Venmo wallets. PYUSD can be used through PayPal Checkout, transferred to other users, or exchanged for traditional dollars.

As early as September 2024, PayPal announced that it would allow payment partners to settle cross-border remittances made through Xoom using PayPal USD (PYUSD), enabling them to fully leverage the cost and speed advantages of blockchain technology; in April of that year, the company allowed its U.S. Xoom users to transfer money to overseas friends and family using PYUSD without incurring transaction fees. Xoom is a service under PayPal, a pioneer in the digital remittance field, providing fast and convenient remittance, bill payment, and mobile recharge services to friends and family in approximately 160 countries.

In other words, stablecoins are beginning to be adopted by the traditional payment market, and generating interest is a potential means to attract customers.

On May 7, 2025, Futu International Securities announced the official launch of crypto asset deposit services for BTC, ETH, USDT, and others, providing users with Crypto + TradFi (traditional finance) asset allocation services. Recently, Meta, three years after abandoning the Libra/Diem project, is in talks with several crypto companies regarding stablecoin applications, exploring cross-border payments for creators through stablecoins to reduce costs. Traditional financial/internet institutions are beginning to layout crypto asset services, sharing Web 3.0 financial traffic, which is an inevitable trend.

Of course, cryptocurrency projects are also actively expanding into the traditional financial market. On April 1, U.S. time, Circle, the issuer of the USDC stablecoin, submitted an S-1 form to the U.S. Securities and Exchange Commission, applying for a listing on the New York Stock Exchange under the ticker symbol CRCL. Circle reported that by the end of 2024, its stablecoin-related business generated $1.7 billion, accounting for 99.1% of total revenue. Circle is expected to become the first publicly listed stablecoin issuer in the U.S. If Circle successfully goes public, it will further promote the development of the U.S. stablecoin market and accelerate the acceptance process of traditional financial users, especially institutional users, towards stablecoins—after all, the current traditional users of stablecoins still come from the cryptocurrency market.

5. How Should Stablecoins Be Regulated?

Cryptocurrencies were born in the wild, and as a completely new entity, their development has always been accompanied by a tug-of-war with regulation. Taking the U.S. market as an example, multiple regulatory bodies, including the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the Financial Crimes Enforcement Network (FinCEN) responsible for anti-money laundering (AML) and counter-terrorism financing (CFT), and the Office of the Comptroller of the Currency (OCC) (responsible for regulations related to national banking), have shown regulatory intent and cases regarding cryptocurrencies. In fact, as a new entity, cryptocurrencies largely touch upon the regulatory scope of the aforementioned departments, and each regulatory body is striving to strengthen its dominance over cryptocurrency regulation. However, there are currently no mature regulatory laws, and each department is implementing regulations according to existing laws or their own interpretations. During their development, cryptocurrency projects often face regulatory interventions and legal lawsuits from regulatory agencies. A typical example is Tether, the issuer of USDT, which faced accusations from the New York Attorney General's Office in its early days—alleging issues such as operational opacity and deceiving investors. After a lengthy 22-month investigation, the New York Attorney General's Office announced in February 2021 that it had reached a settlement agreement with Tether, which included a $18.5 million fine and a prohibition on providing related products and services to residents of New York. Similar accusations from regulatory agencies against cryptocurrency projects or platforms are not uncommon, reflecting the current reality of cryptocurrency regulation—lacking a sufficiently comprehensive legal framework, which allows cryptocurrencies to operate in a gray area.

Since the approval of Bitcoin spot ETFs in the U.S., the cryptocurrency market has not only seen significant growth in market size but has also received a more positive regulatory attitude. Represented by the U.S., the overall regulatory stance towards cryptocurrencies is positive. On March 7, the White House held its first cryptocurrency summit, inviting numerous industry figures, including the CEO of Coinbase and the founder of MicroStrategy (MSTR). President Trump stated at the summit that the federal government would support the development of cryptocurrencies represented by Bitcoin and the digital asset market, and he urged Congress to pass legislation to provide regulatory certainty for the cryptocurrency and digital asset market.

For stablecoin regulation in the U.S., the most important legislation currently is the GENIUS Act, which requires stablecoins to be backed by liquid assets such as U.S. dollars and short-term Treasury bonds, establishing a legal framework for issuing stablecoins in the U.S. On May 8, the U.S. Senate held a key vote on the GENIUS stablecoin bill, but unfortunately, the bill did not pass. Looking at the most popular stablecoin, USDT, its reserve assets are primarily U.S. dollars and Treasury bonds, which is relatively close to the requirements of the bill. However, for stablecoins like DAI and USDe, there is still a significant gap from the GENIUS Act's requirements. Correspondingly, prior to this, the SEC released a guidance announcement on April 4, indicating that stablecoins meeting specific conditions would be classified as "non-securities" under the new guidelines and exempt from trading reporting requirements. The SEC defines these "compliant stablecoins" as tokens fully backed by fiat currency reserves or short-term, low-risk, high-liquidity instruments that can be redeemed for U.S. dollars on a 1:1 basis. This definition explicitly excludes algorithmic stablecoins that maintain a dollar peg through algorithms or automated trading strategies, leaving the regulatory status of algorithmic stablecoins, synthetic dollar assets (RWA), and interest-bearing fiat tokens uncertain.

Currently, although stablecoins are making inroads in the market, there is still no complete and clear legal framework to support them. This reflects the current state of cryptocurrency regulation—cryptocurrencies, as a financial or technological innovation different from any before, face unprecedented regulatory challenges.

From a practical perspective, stablecoins are the "simplest" form of cryptocurrency. Considering their relationship with fiat currency, stablecoins can penetrate the payment sector and are the most closely monitored cryptocurrencies by regulators. Not only is the U.S. regulatory focus on stablecoins, but other regions, such as Hong Kong, are also accelerating their regulatory efforts regarding stablecoins. On February 27 of this year, the relevant bill committee of the Hong Kong Legislative Council was reviewing the "Stablecoin Regulation Bill." The Hong Kong Monetary Authority's (HKMA) head of digital finance, He Hongzhe, expressed hope that the Legislative Council would pass the bill this year, after which the HKMA would issue regulatory guidelines explaining how to interpret the law, including details on regulatory oversight of issuers' operations, and would implement a system to allow interested participants to apply for licenses in due course. On April 22, Shen Jiangguang, Vice President and Chief Economist of JD Group, stated that JD has already entered the "sandbox" testing phase for stablecoin issuance in Hong Kong. This is a positive response from enterprises in Hong Kong to regulation, indicating that there is a certain demand expectation for stability in the Hong Kong market.

In summary, the current state of stablecoins is that they are in a phase of initial application while simultaneously negotiating with regulators. Regardless, the demand for stablecoin applications and business logic has basically matured, and the regulatory policies of authorities in the U.S. and Hong Kong will only serve to standardize the development of stablecoins, providing traditional financial institutions with a clearer business logic for operations.

6. Risk Warning

Underdevelopment of blockchain technology: The underlying blockchain technologies and projects related to Bitcoin are in the early stages of development, posing a risk of technological development falling short of expectations.

Uncertainty of regulatory policies: The actual operation of blockchain and Web 3.0 projects involves multiple financial, internet, and other regulatory policies. Currently, regulatory policies in various countries are still in the research and exploration stage, and there is no mature regulatory model, so the industry faces risks from regulatory policy uncertainty.

Underperformance of Web 3.0 business models: The infrastructure and projects related to Web 3.0 are in the early stages of development, posing a risk of business models not materializing as expected.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。