Author: Louis, ChainCatcher

Editor: Crypto Luo Xiaohei, ChainCatcher

Since its proposal, the "Bitcoin Act" has been a focal point of high interest among global crypto investors and enthusiasts. During the 2025 Bitcoin Conference held in Las Vegas, Nevada this month, Wyoming Senator Cynthia Lummis revealed that President Trump and some senior U.S. military officials have expressed clear support for the bill. At the same time, she pointed out that the Trump administration has formed a dedicated team to advance issues related to digital assets, including stablecoin legislation, market structure development, and the formulation of a Bitcoin strategic reserve.

This issue of "CC Looks at the World" will systematically outline the development context of the "Bitcoin Act" and its potential far-reaching impacts, aiming to provide readers with a clear and comprehensive analysis.

The Background and Core Points of the "Bitcoin Act"

On July 31, 2024, due to the U.S. dollar credit crisis, rising inflation, and the intensifying trend of "de-dollarization," Republican Senator Cynthia Lummis first proposed the "Bitcoin Act." She suggested establishing a strategic Bitcoin reserve and purchasing 1 million Bitcoins within five years. However, the proposal faced strong opposition from Democratic Senator Sherrod Brown.

On March 6, 2025, President Trump signed an executive order establishing the "Strategic Bitcoin Reserve" and the "U.S. Digital Asset Stockpile," incorporating nearly 200,000 Bitcoins seized by federal law enforcement into the reserve system, with a clear prohibition on their sale.

Subsequently, on March 11, 2025, Senator Cynthia Lummis and five other Republican senators reintroduced the "Bitcoin Act of 2025." Unlike the Trump executive order, which primarily aims to establish a national reserve using the nearly 200,000 Bitcoins already seized, this bill includes the following key points:

- Plans to purchase 1 million Bitcoins within five years, accounting for about 5% of the global supply

- Purchase 200,000 Bitcoins annually, with a minimum holding period of 20 years

- Prohibit sale, exchange, pledge, or disposal during the holding period

- Two years before the end of the minimum holding period, the Secretary of the Treasury must submit relevant recommendations for Congressional reference

- Excess holdings can be achieved through federal transfers, asset seizures, or donations

- Establish a nationwide distributed decentralized Bitcoin storage network

- Implement quarterly audits and publish reserve data to ensure security and transparency

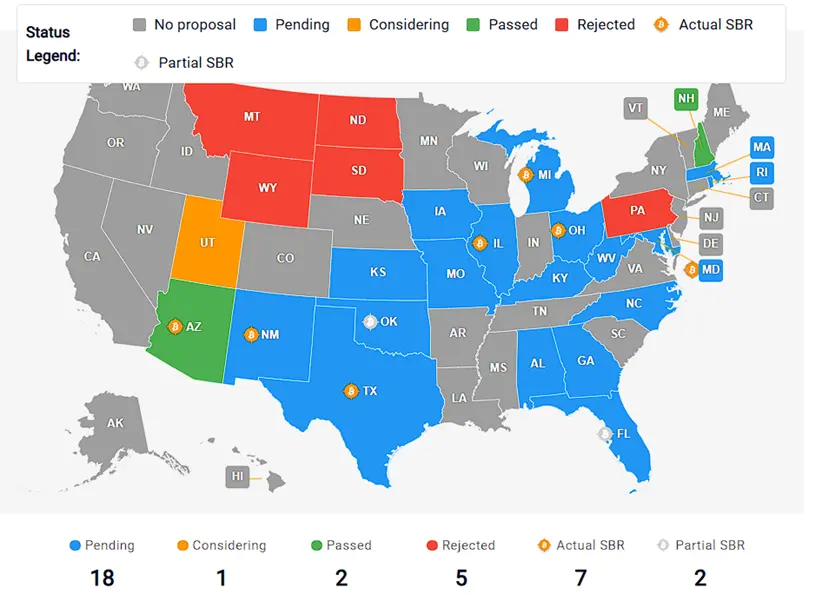

Additionally, according to Section 8 of the bill, state governments may voluntarily deposit their Bitcoin reserves into the federal system, maintaining independent accounts and ownership. As of May 28, 2025, only New Hampshire and Arizona have passed related bills (HB 302 and HB 2749), allowing for the purchase of approximately 17,139 Bitcoins, while five states have successively vetoed proposals, reflecting significant challenges in the promotion process.

In the context of rising global economic uncertainty and challenges to currency stability, the U.S. government's potential intention to establish a strategic Bitcoin reserve includes enhancing national financial resilience, promoting financial innovation, and alleviating national debt pressure by selling Bitcoins at appropriate times. Currently, the U.S. debt-to-GDP ratio is about 120%, with total debt reaching $36.2 trillion, frequently hitting the ceiling.

Choosing Bitcoin as a strategic reserve is primarily based on the following logic:

- Scarcity and durability: Bitcoin has a limited total supply, providing long-term value

- Anti-inflation characteristics: Viewed as digital gold, it has strong devaluation resistance

- Decentralized attributes: Politically neutral, conducive to building a trust foundation

- High transparency and security: Blockchain mechanisms ensure verifiability

What is the Impact on the Crypto Market?

The "Bitcoin Act" not only grants Bitcoin the status of a "national asset" from a policy perspective but also has a substantial impact on the market supply and demand structure. On one hand, government reserves and international follow-up may reduce market supply; on the other hand, legislative compliance and institutional entry significantly enhance investor confidence and demand.

Within months of the bill's proposal, driven by various positive factors, Bitcoin's price broke through $112,000, setting a new historical high. Jay Hatfield, CEO of Infrastructure Capital Advisors, stated: "The rise in Bitcoin is more based on the friendly regulatory signals released by the Trump administration rather than stock market correlations."

Although the bill currently only covers Bitcoin, President Trump has revealed on social media that he will consider including mainstream cryptocurrencies such as ETH, SOL, ADA, and XRP in the reserve. This also highlights the potential positive impact the bill may have on the entire crypto market. However, Bitcoin billionaire Tyler Winklevoss stated: "I do not oppose other cryptocurrencies, but so far, only Bitcoin truly meets the standards for a strategic reserve."

Ongoing Disagreements and Public Opinion Challenges

Despite supporters generally being optimistic about Bitcoin's reserve potential, dissenting voices cannot be ignored. A survey released by Data for Progress in March 2025 showed that only 10% of voters support increasing federal investment in the crypto and blockchain sectors, with the vast majority leaning towards budget cuts. Additionally, prominent economic commentator Matthew C. Klein pointed out that Bitcoin cannot be widely used for payments or pricing, and the market risks are far from resolved, preventing it from serving as a true safe-haven asset.

Conclusion

In summary, the "Bitcoin Act" marks a significant attempt by the U.S. government in digital asset policy and brings a demonstration effect to global financial policy. Although there are both supportive and opposing voices, its policy impact and market feedback have substantially propelled the crypto industry into a new phase dominated by compliance and institutional leadership. Whether the policy goals can be achieved in the future still relies on legislative coordination, market adaptation, and the simultaneous enhancement of public awareness.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。