Bitget has built a more accessible path to crypto wealth.

Author: OneshotBug

Traditional investment logic is quietly losing its effectiveness.

From the stock market, real estate, to financial products and savings accounts, once reliable asset appreciation methods are losing their original appeal. Against the backdrop of declining interest rates and a slowing economy, many individual investors are beginning to rethink: what wealth opportunities are still worth exploring in the future?

Cryptocurrency assets have become an option for more and more people. But it is not easy. High volatility, complex information, and technical barriers often deter newcomers. Even if one is interested in the crypto market, it does not mean they can easily participate, let alone benefit from it.

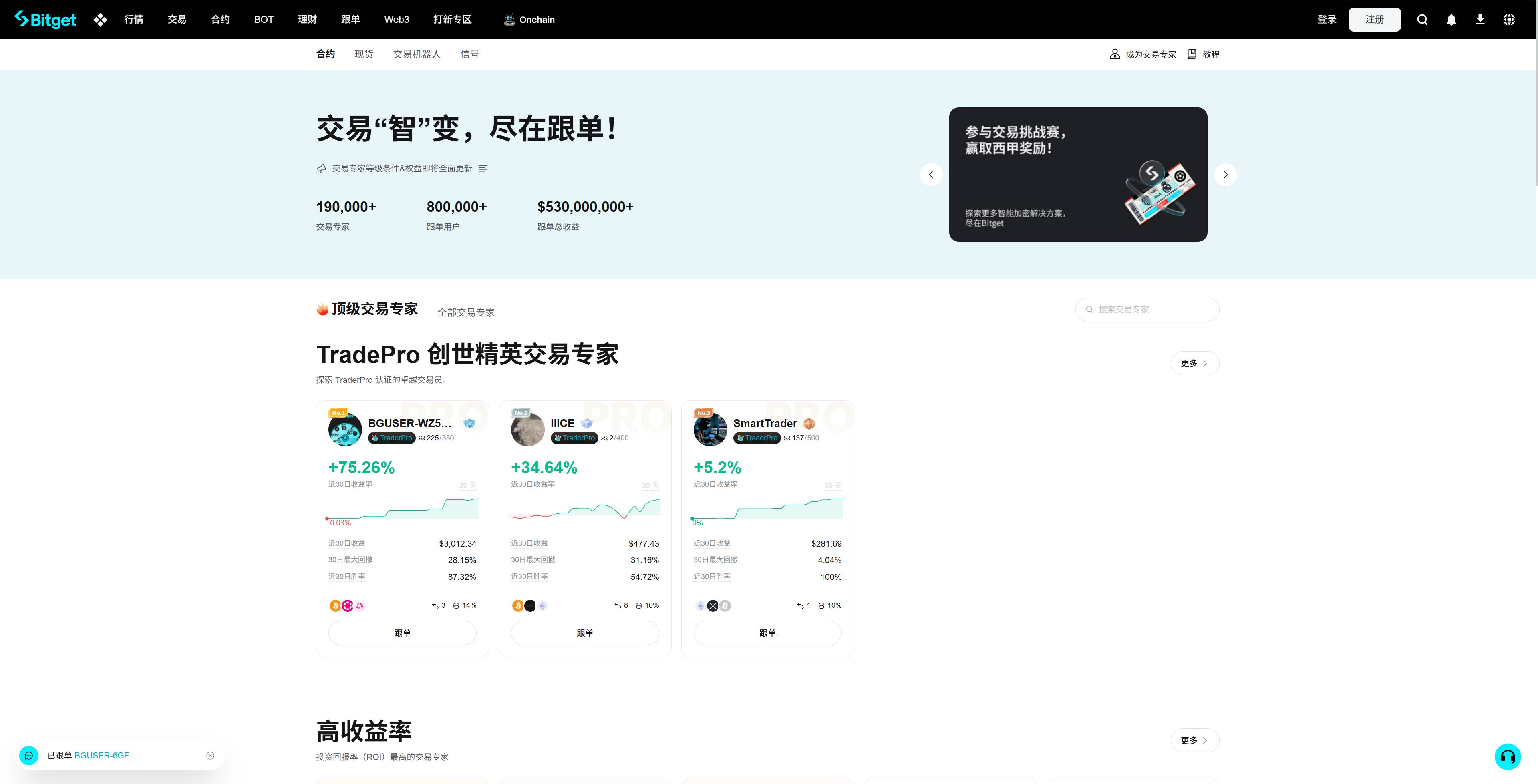

As one of the fastest-growing centralized cryptocurrency exchanges in recent years, Bitget provides a relatively easy-to-understand entry point, allowing crypto novices to participate in trading effortlessly—through a copy trading system. With this system, novice users can directly replicate the strategies of experienced traders, gaining access to the market with a low barrier to entry. This "productized trading capability" is one of the few designs in the crypto world that truly lowers the threshold for newcomers.

At the same time, Bitget has built a complete functional matrix and ecological incentive system around copy trading, including the platform token BGB, airdrop distribution, and wealth management returns, providing another path for users with low risk tolerance and limited time and energy to "participate in Web3."

Is this system really effective? Do users truly gain returns from it? Is Bitget's logic sustainable? This article will provide a closer observation from the perspectives of product, strategy, security, and wealth effect.

Established for six years with over 100 million users, what allows Bitget to enter the top tier?

In the past two years, the competition among cryptocurrency exchanges is no longer simply about "who lists more coins and has more aggressive promotions." As user growth slows and trading demand becomes more rational, the distinctions between platforms are being redefined. Bitget has completed its leap in this restructuring.

According to its official transparency report released in April 2025, Bitget currently has over 120 million registered users, with a daily trading volume stabilizing at over $20 billion, placing it among the top tier of global exchanges in various comprehensive metrics. This achievement is not the result of a single product or short-term explosion, but rather the outcome of its stable evolution of a "product + market + operation" multi-dimensional system.

(Data screenshot: CoinGecko May 29, 2025)

Bitget's user structure is also more representative. Unlike traditional exchanges that tend to focus on "high-frequency trading and veteran users," a significant proportion of Bitget's users come from emerging markets and novice investor groups. While pursuing returns, they hope to participate in the Web3 market in an environment that is "understandable and manageable."

The foundation of all this is its relatively unique development path:

Started with contract trading, initially focusing on highly active users;

Launched the copy trading system in 2020, truly opening up the novice market;

Expanded the product matrix starting in 2021, covering basic services such as spot trading, IPOs, and staking;

Acquired BitKeep in 2023, building an on-chain asset entry (Bitget Wallet);

The platform token BGB took off in 2024, forming an ecological incentive system.

Bitget is not the exchange with the "most actions," but its performance in user expansion, ecological layout, and strategic rhythm shows a strong sense of purpose. It has not chosen to attract new users through "hype," but rather attempts to keep new users "engaged" around trading itself. Because of this, it has gradually formed its unique character in the industry—both a "financial entry" and a "crypto tool."

Next, we will delve into how Bitget finds growth in differentiation, especially how it uses copy trading, platform tokens, security mechanisms, and ecological layout to build a visible path for new users to enter Web3.

Copy trading, strategy content, low-threshold design: How does Bitget truly "enable those who don't know to participate"?

For most people, "investing" is a complex and uncertain endeavor. Especially in the crypto market, where prices fluctuate wildly and trading logic evolves rapidly, ordinary users often need long-term accumulation to understand and engage. However, Bitget's idea is—if most people cannot become trading experts, can we use products to allow them to "indirectly possess trading capabilities"?

This is the background for the birth of Bitget's copy trading feature.

One-click copy trading: Productizing trading behavior

Bitget pioneered the copy trading system in 2020, being one of the first mainstream trading platforms to launch this feature. Its core logic is very simple and intuitive: professional traders on the platform synchronize their real trading operations, and ordinary users can "subscribe and copy" these operations like following a blogger, buying and selling in real-time.

For users without a technical background or knowledge of candlestick charts, this "productized trading" design lowers almost all barriers. Copy traders do not need to judge the market themselves; they just need to choose a trusted trader to complete their investment operations.

To enhance transparency and choice, Bitget has made numerous structural optimizations:

All traders must undergo real-name verification and platform review;

Clear trading history, profit curves, maximum drawdown, and other metrics are provided;

Customizable take-profit and stop-loss ratios are supported to control copy trading risks;

A leaderboard mechanism and strategy tagging system are introduced to help users quickly filter options.

Currently, there are over 200,000 traders available for copy trading on the Bitget platform, with active copy trading users reaching around 1 million, making it one of the largest crypto copy trading platforms globally. This ecosystem has also built a "content + trading" two-way structure: traders are incentivized to maintain stable operations, while copy trading users gain a relatively friendly market participation experience.

More than just copy trading, but a complete "new user-friendly" path design

Bitget's "new user friendliness" is not limited to the copy trading product. To help users without a crypto background adapt to the platform more quickly, it has made many detailed optimizations at the product and content levels:

The product interface leans towards an app-like design, simplifying the logic to lower the learning curve;

Guidance prompts, risk explanations, and video tutorials are embedded in the operation process;

The content center continuously produces copy trading tips, beginner investment courses, strategy interpretations, etc.;

The community section provides an interactive space to help users build a trust network.

These settings are not aggressive but are practical enough. For many first-time users of the crypto market, Bitget does not feel like a "high-threshold professional platform," but rather more like an "entry-level application that is half investment and half tool."

In other words, Bitget does not attempt to make users quickly become experts; instead, it allows them to "start using it" through a complete set of low-threshold designs. Establishing participation confidence under the premise of controllable risks and visible paths is the core experience the platform aims to provide.

Participatory and realizable wealth effect: Platform token BGB and diversified income channels

In the crypto world, the "get-rich-quick effect" is one of the most attractive aspects. However, for most users, the market's ups and downs are fleeting, and blindly following trends often leads to losses. Bitget does not pursue short-term stimulation in terms of "realizable wealth incentives," but rather attempts to build a relatively gentle, controllable, and gradually realizable value capture mechanism through the platform token BGB.

BGB: From platform tool to user reward engine

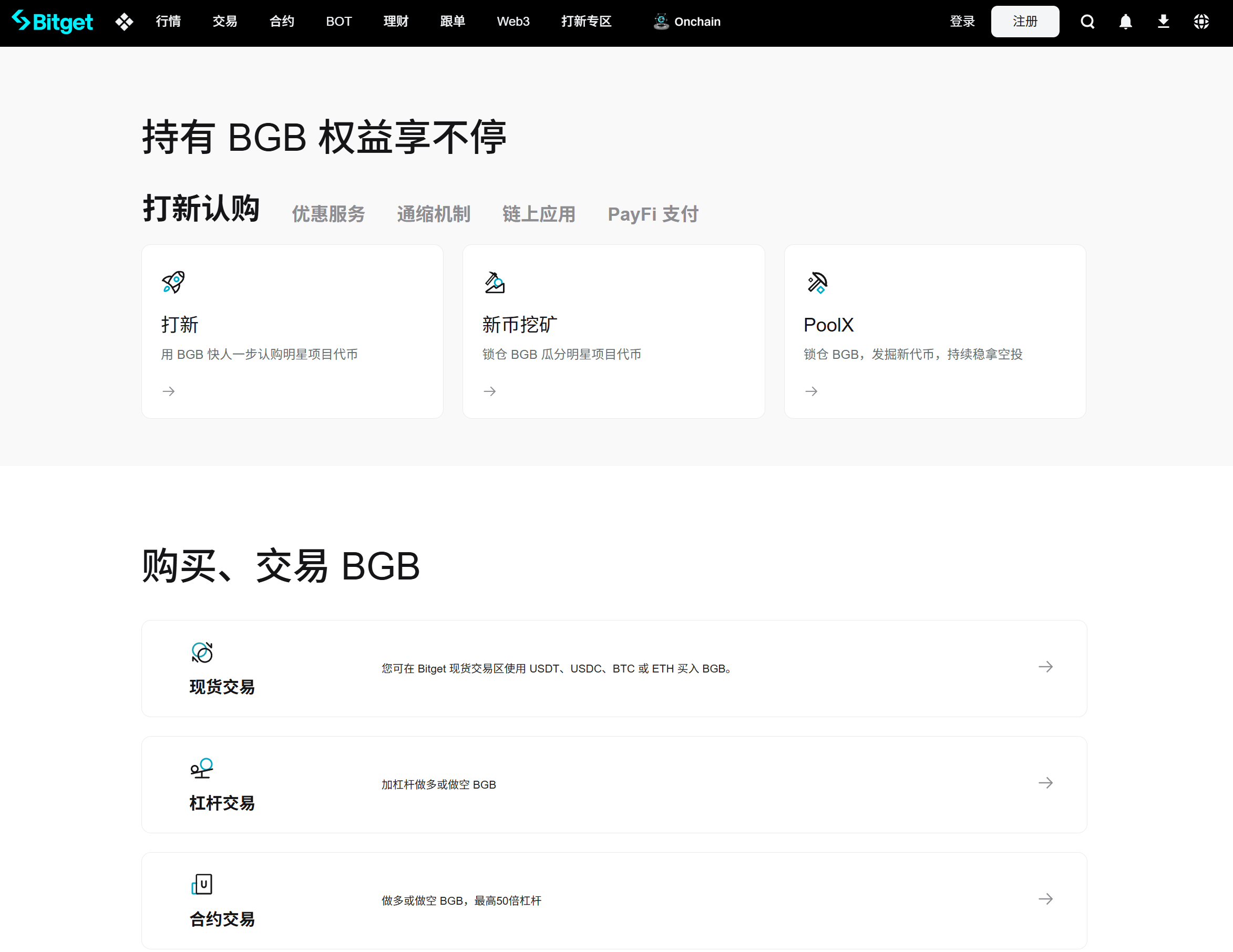

BGB is the platform token issued by Bitget, originally designed for internal platform rights, such as fee discounts and membership level incentives. However, as the platform's products have diversified, BGB has been integrated into more and more practical use cases: participating in IPOs on the Launchpad, staking, winning airdrops, unlocking VIP rights, fee discounts, and participating in wealth management and staking activities.

More importantly, in recent years, Bitget has begun to return a portion of its platform revenue to BGB through buyback and burn mechanisms, forming a value return mechanism similar to "platform revenue sharing."

According to CoinGecko data, BGB's price peaked at $8.45 in 2024, with an annual increase exceeding 1,000% at one point, far surpassing the growth of most mainstream platform tokens during the same period. Even after experiencing a short-term correction, as of the end of May 2025, BGB's 365-day increase still exceeded 300%.

While such trends cannot be generalized, they have indeed allowed many users to achieve asset appreciation in the crypto market through "holding rather than trading."

A diversified, stable, non-speculative logic of "Web3 income model"

In terms of other applications and benefits of BGB, compared to some platforms that hype their tokens, pump prices, and distribute airdrops, Bitget is more inclined to build a logic of "participation equals income," including:

New users can receive BGB airdrops after registering and binding to an inviter;

Users can earn BGB incentives by participating in trading, staking, and activities;

Specific activities will use BGB as tickets or participation conditions.

This makes BGB no longer a "speculative tool" in the hands of traders, but rather a part of the "daily operations" of platform users—you do not need to specifically "invest in BGB," but can earn its benefits simply by participating in Bitget.

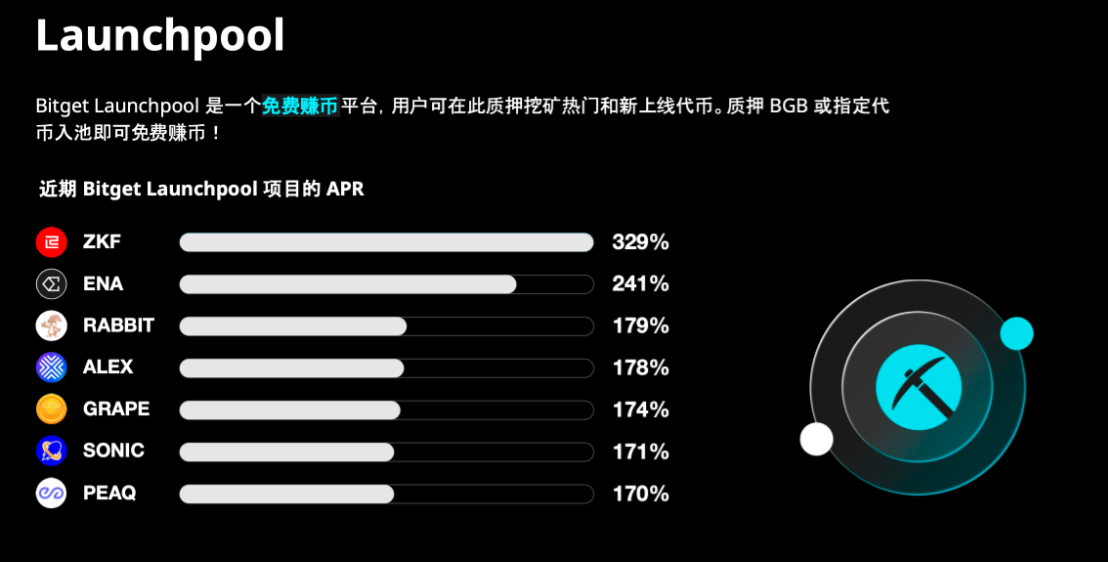

(The image shows recent yield APR from Bitget Launchpool projects)

In "wealth management" products such as Launchpool, PoolX, Wealth Management Treasure, and Shark Fin, BGB plays a role in "mitigating risks and locking in returns," constructing a relatively "stable" asset return logic.

This provides a "participatory, perceivable, and predictable" way for users from traditional financial environments, with low risk tolerance but dissatisfied with the low interest rate environment, to engage in Web3.

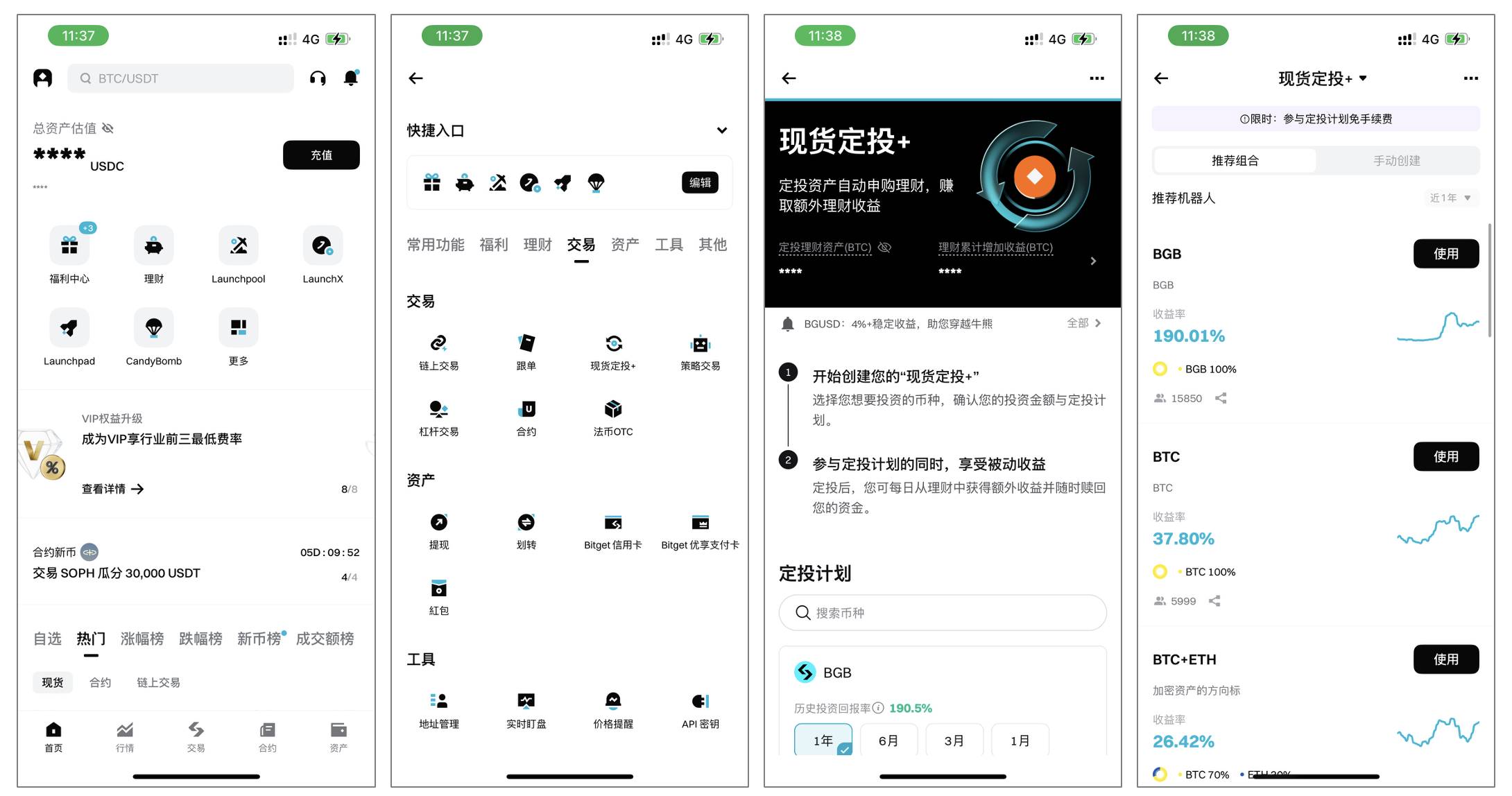

Innovative Automated Investment Tools: Opening New Paths for Novice Crypto Investors

Another example is Bitget's "Spot Dollar-Cost Averaging+" feature, which is also an automated investment tool that helps novices operate and invest for returns. This feature can be found in the Bitget App under "Trading - Spot Dollar-Cost Averaging+." By setting a dollar-cost averaging strategy with fixed time intervals and amounts, the bot automatically purchases specified cryptocurrencies at regular intervals. This automated investment strategy helps users avoid constantly monitoring the market and achieve steady asset growth through low-risk, phased purchases.

Safety Nets and Compliance Exploration: How Does Bitget Build a "Trustworthy Platform"?

Regardless of how the crypto industry changes, safety remains the fundamental concern for users. Especially after experiencing multiple incidents of trading platforms shutting down, asset freezes, and hacking attacks, "where the funds are held" and "whether the platform is trustworthy" have become key factors in determining whether users stay.

Bitget does not shy away from this issue; instead, it attempts to build a sense of "trustworthiness" through a structured and normalized risk management mechanism.

PoR and Protection Fund: Not Just Concepts, But Concrete Measures

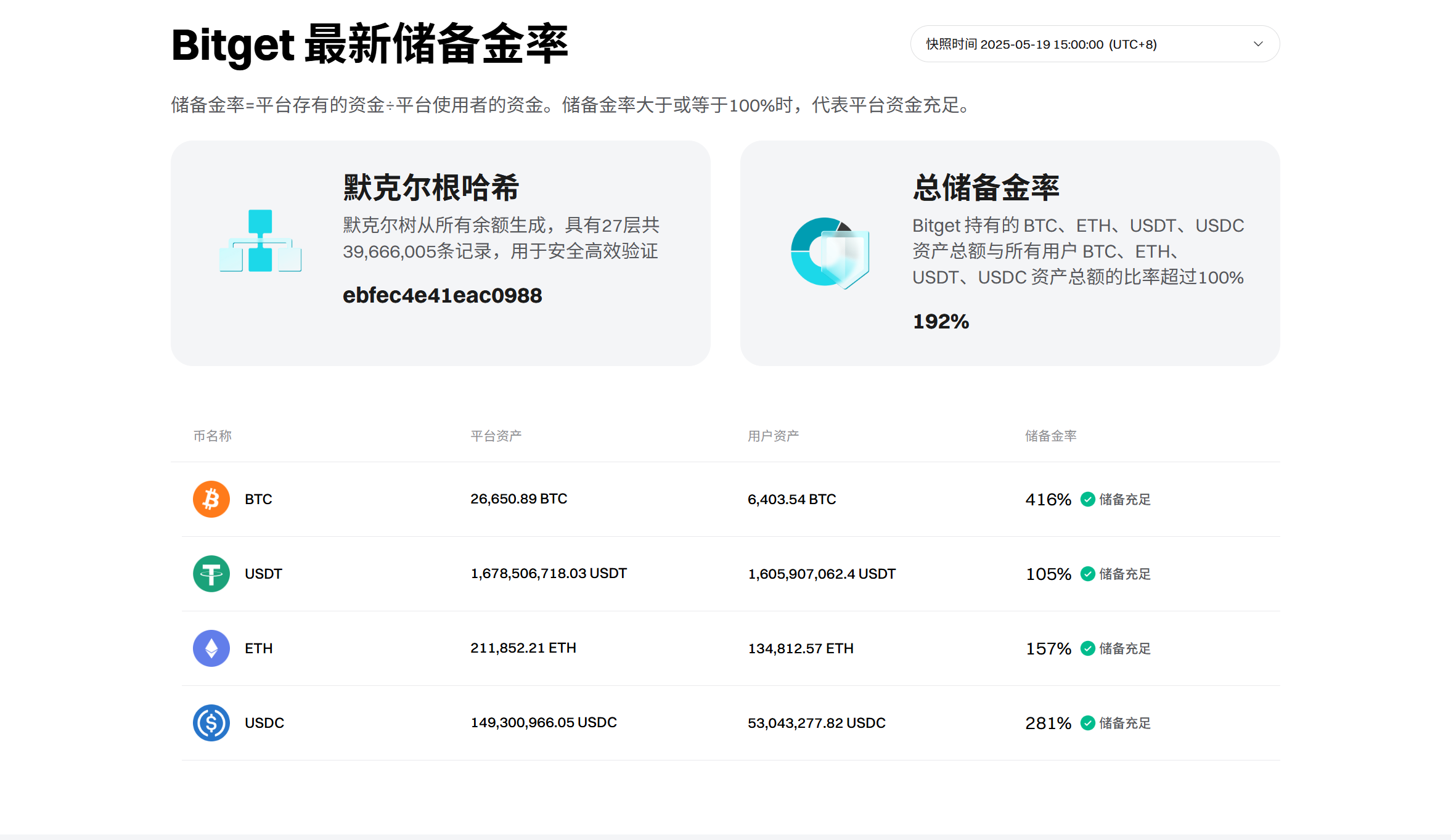

As early as after the FTX collapse, Bitget quickly launched the "Proof of Reserves" (PoR) system, using Merkle Tree technology to allow users to verify whether the platform's asset reserves are sufficient to cover the total assets of users. This proof is updated monthly and can be checked at any time. (https://www.bitget.com/zh-TC/proof-of-reserves).

According to the latest data from April 2025, Bitget's reserve ratio is 213%, far exceeding the industry standard baseline of 100%. In other words, even in the event of extreme concentrated withdrawals, the platform still has sufficient assets to fulfill its obligations. This data can be viewed in real-time on the Bitget reserve page, and users can manually compare on-chain addresses with their account balances to verify fund consistency.

To address potential black swan events, Bitget has also established a "User Protection Fund" with a total scale exceeding $600 million, promising that in the event of platform-related security incidents, this fund will prioritize compensating user losses. The fund consists of mainstream assets such as BTC, USDT, and USDC, stored in publicly transparent addresses to ensure clear traceability of fund sources and destinations.

These two mechanisms are not short-term public relations tactics but are integrated into the platform's daily operational logic, becoming core components of its "trust system."

Compliance Rhythm: Not Aggressive, But Clear Pathways

On the regulatory front, Bitget has not adopted an aggressive strategy of "rushing for licenses," but has chosen a model of "regional advancement + gradual integration." It has currently obtained relevant licenses in El Salvador, Australia, Italy, Poland, and Lithuania, and has launched compliant services in the UK.

This rhythm may mean that it does not have the same breadth of compliance as traditional crypto institutions like Coinbase and Kraken, but it also leaves more room for adjustment in regions where policies are still unclear, avoiding regulatory conflicts caused by aggressive expansion.

For users, the direct significance of compliance actions is that the platform will not "disappear overnight." Bitget's approach is to fully embrace and achieve compliance without sacrificing operational efficiency.

This dual mechanism of "compliance + safety," while it cannot completely eliminate user anxiety, has already formed a relatively rare foundational guarantee in the frequently turbulent crypto world.

Summary: Bitget Has Built a More Accessible Path to Crypto Wealth

In the complex and diverse reality of the crypto industry, with numerous projects and high technical barriers, Bitget's strategy is particularly clear: to build a platform path that is "understandable, usable, and manageable" for those lacking professional knowledge but eager for asset growth opportunities.

It does not rely on technical showmanship or compete on the number of coins, but rather transforms trading capabilities into a productized service through the "copy trading" mechanism—this is more appealing to many users who are first encountering crypto assets than any white paper.

Around this mechanism, Bitget has created a complete collaborative system of platform token incentives, airdrop participation, wealth management products, and asset management, which not only lowers the participation threshold but also increases the likelihood of user retention. In this process, BGB, as an important token connecting user behavior and platform value, has gradually established its functional position within the ecosystem.

Overall, Bitget may be the platform that understands "how ordinary people can enter the crypto world" the best. For those who want to participate but do not want to take on extremely high risks, it offers a more friendly, extensible, and sustainable path to wealth.

For novice users looking for the next investment entry point and hoping to understand a relatively low barrier to entry in Web3, Bitget is the "most suitable start."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。