Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

U.S. Bitcoin Spot ETF Net Outflow of $144 Million

Last week, the U.S. Bitcoin spot ETFs experienced a two-day net outflow, totaling $144 million, with a total net asset value of $12.615 billion.

Seven ETFs were in a net outflow state last week, with outflows primarily from ARKB, FBTC, and GBTC, which saw outflows of $281 million, $198 million, and $134 million, respectively.

Data Source: Farside Investors

U.S. Ethereum Spot ETF Net Inflow of $285 Million

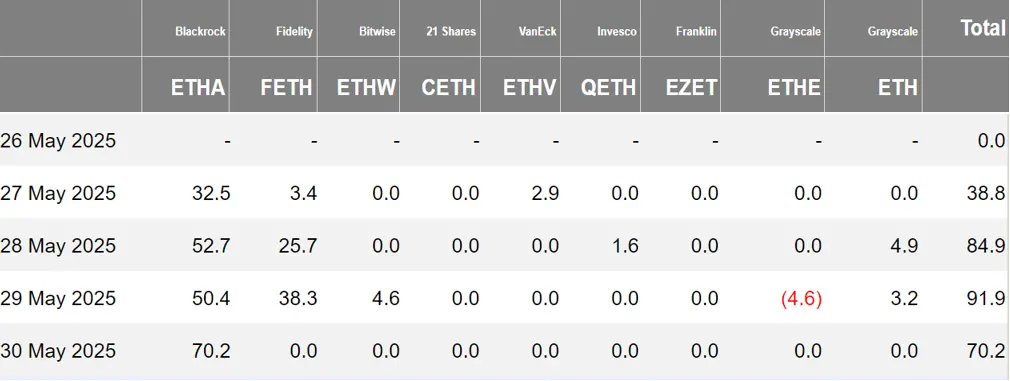

Last week, the U.S. Ethereum spot ETFs saw a continuous net inflow for four days, totaling $285 million, with a total net asset value of $9.45 billion.

The inflow last week primarily came from BlackRock's ETHA, which had a net inflow of $205 million. A total of two Ethereum spot ETFs had no fund movement.

Data Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Inflow of 430.34 Bitcoins

Last week, the Hong Kong Bitcoin spot ETFs had a net inflow of 430.34 Bitcoins, with a net asset value of $509 million. The holdings of the issuer, Harvest Bitcoin, decreased to 301.85 Bitcoins, while Huaxia increased to 2,910 Bitcoins.

The Hong Kong Ethereum spot ETFs had no fund inflow, with a net asset value of $5.864 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of May 30, the nominal total trading volume of U.S. Bitcoin spot ETF options was $1.34 billion, with a nominal total long/short ratio of 3.15.

As of May 29, the nominal total open interest of U.S. Bitcoin spot ETF options reached $16.36 billion, with a nominal total open interest long/short ratio of 1.99.

The market's short-term trading activity for Bitcoin spot ETF options has slightly decreased, with overall sentiment leaning bullish.

Additionally, the implied volatility was 48.01%.

Data Source: SoSoValue

Overview of Crypto ETF Dynamics Last Week

U.S. SEC Questions the Legality of REX's Ethereum and Solana Staking ETFs

According to Bloomberg, the U.S. SEC has expressed doubts about the Ethereum and Solana staking ETFs launched by REX Shares and Osprey Funds, suggesting they may not comply with the definitions of investment companies and ETFs under the Federal Securities Law.

The SEC stated that these funds may have "incorrectly submitted registration statements," and the disclosures regarding these funds' status as investment companies may be misleading.

Greg Collett, General Counsel of REX Financial, stated, "We believe we can satisfy the SEC on the investment company issue, and we do not intend to launch the funds until we do so."

According to The Block, REX Shares and Osprey Funds have submitted applications to the U.S. SEC to launch Ethereum and Solana staking ETFs. The new ETH and SOL funds will "invest at least 80% of their net assets in their respective reference assets," namely ETH and SOL. Each fund will also "invest at least 50% of its holdings" in these cryptocurrencies. These funds will operate as "regular C corporations" to address U.S. federal income tax, rather than as "regulated investment companies" like spot Bitcoin and Ethereum ETFs.

Canary Staked CRO ETF Submits S-1 Registration for Listing

According to official documents, the Canary Staked CRO ETF has submitted an S-1 registration statement to the U.S. SEC, planning to list on an exchange.

The ETF aims to gain exposure to the price of CRO by holding Cronos (CRO) and participating in transaction validation on the Cronos POS chain, while also earning additional CRO rewards. The ETF's net asset value (NAV) will be calculated based on the market price of CRO.

U.S. SEC Launches Further Review Process for WisdomTree XRP Spot ETF

According to official documents, the U.S. SEC announced that the "public comment" phase for the WisdomTree XRP spot ETF has ended and that it has "initiated further review procedures," without directly approving or rejecting it.

The SEC officially accepted WisdomTree's XRP ETF application on February 19, 2025, and initiated the public comment period, which has now concluded. The SEC has the authority to extend the review period for up to 240 days, with a final decision expected by the end of October 2025.

Nasdaq Submits 21Shares SUI ETF 19b-4 Form to the U.S. SEC

According to official documents, Nasdaq has submitted the 19b-4 form for the 21Shares SUI ETF to the U.S. SEC.

The ETF aims to calculate its net asset value daily based on the SUI U.S. dollar reference price compiled by CF Benchmarks, without using leverage or derivatives, and will only hold spot SUI, with custody provided by BitGo and Coinbase Custody. This trust product will allow institutions to invest in SUI through traditional brokerage accounts, providing investors with a more transparent and compliant access path.

It is reported that the 19b-4 form is a document required by the U.S. SEC for trading platforms to submit when declaring rule changes or new product listings. The ETF issuer submits a registration statement to the SEC, and the trading platform must apply to the SEC through the 19b-4 document to allow the ETF to be listed on its platform, proving its compliance with listing rules (such as liquidity, transparency, etc.). The ETF can only be listed on the trading platform after SEC approval.

Views and Analysis on Crypto ETFs

Glassnode: Ethereum ETF Investors Have an Average Unrealized Loss of About 21%

According to CoinTelegraph, crypto analytics firm Glassnode reported on May 29 that investors in BlackRock and Fidelity's spot Ethereum ETFs have an average unrealized loss of about 21%.

The current price of Ethereum is $2,601, while BlackRock's spot Ethereum ETF has a cost basis of $3,300, and Fidelity's is even higher at $3,500.

Bloomberg ETF Analyst: IBIT's Low Volatility Rise Attracts Larger Capital Inflows

Bloomberg senior ETF analyst Eric Balchunas tweeted: "IBIT's low volatility rise is attracting larger capital inflows. IBIT's 90-day rolling volatility is decreasing and has never been this low. This low volatility combined with price increases is attracting larger investors who prefer 'digital gold' over 'tech stocks.' This also explains why the capital inflows into IBIT over the past six weeks have far exceeded the average levels of other ETFs."

According to CoinDesk, Bitcoin entered a consolidation phase after reaching a historical high of $110,000 in May. Market data shows that the put/call skew for BlackRock's spot Bitcoin ETF (IBIT) has rebounded from -3.8 two weeks ago to nearly zero, indicating a weakening expectation for continued price increases.

Data from the derivatives platform Deribit shows that the premium advantage for short-term call options has disappeared, with the prices of call and put options set to expire in the next two weeks tending to equalize. As of the time of writing, Bitcoin is priced at $108,860.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。