Author: Token Dispatch, Thejaswini M A, Block unicorn

A company that once operated couple hotels has now positioned itself as Japan's gateway to Bitcoin, embodying a unique Japanese character.

Metaplanet's journey from the hotel industry to holding digital assets reads like a boardroom thriller—where the protagonist traded in room keys for private keys.

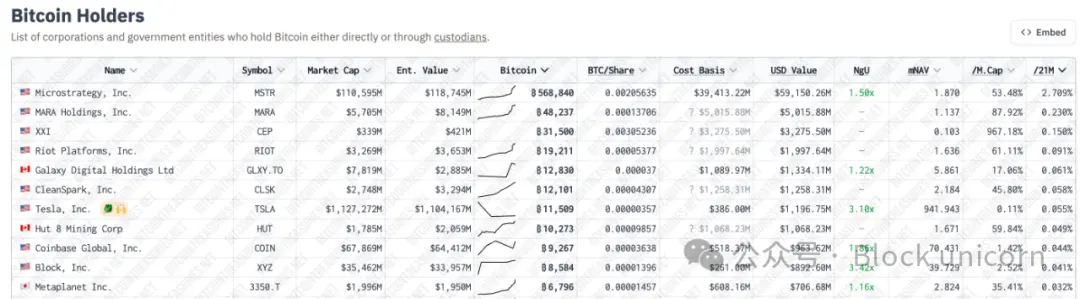

In just over a year, Metaplanet transformed from a struggling hotel company into the largest publicly traded Bitcoin holder in Asia, ranking 11th globally.

While news headlines focus on Bitcoin purchases, the real core of the story lies in how a traditional Japanese company navigated regulatory constraints, shareholder skepticism, and market volatility to execute what may be the boldest corporate strategic transformation in recent years.

Origin: A Company in Search of Purpose

The story of Metaplanet did not begin with grand ambitions but rather with ordinary realities. As a hotel company, it operated hotels across Japan.

The business model was simple: provide accommodation, generate revenue, and then repeat.

There was neither revolutionary nor groundbreaking.

Just the kind of stable, predictable business that Japanese companies have excelled at for decades.

However, the company's financial performance told a different story. Metaplanet's stock price had long been sluggish, hotel assets were underperforming, and management was searching for a new direction. By early 2024, the company was at a turning point.

Simon Gerovich, a veteran investment banker, joined Metaplanet with a vision that seemed absurd to hotel guests: to transform the company into Japan's MicroStrategy.

The Awakening of Bitcoin

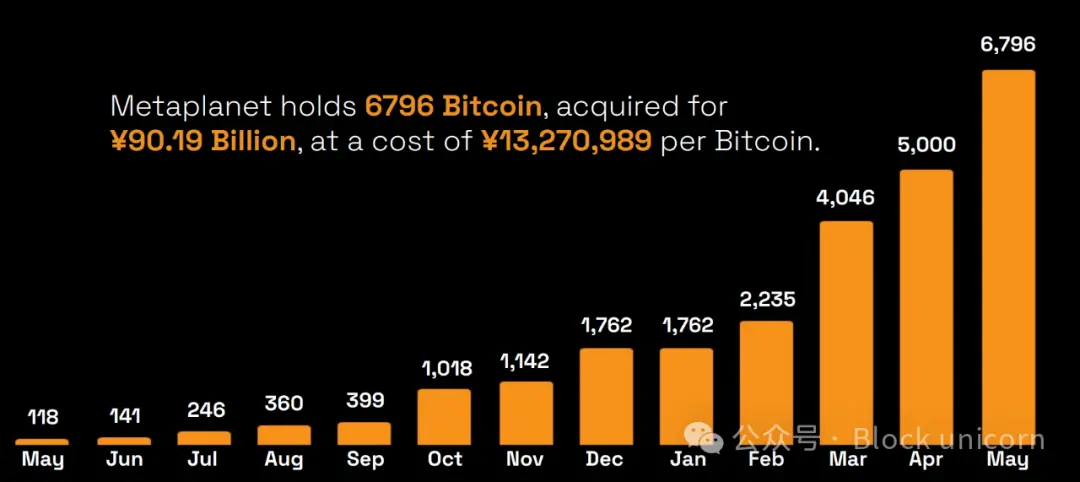

Metaplanet's Bitcoin journey began in May 2024 when the company announced its first purchase of 117.7 Bitcoins, worth approximately $7.2 million. This was a strategic transformation announced with the solemnity of a corporate declaration.

The company adopted a so-called "Bitcoin reserve strategy," positioning the cryptocurrency as its primary reserve asset. This decision was accompanied by a comprehensive restructuring of the company's operations and philosophy.

They now hold more Bitcoin than El Salvador.

Think about it: a Japanese hotel company holds more Bitcoin than a country that has made Bitcoin legal tender.

Since the initial purchase, Metaplanet has been very consistent in accumulating Bitcoin:

May 2024: Additional purchase of 23.35 Bitcoins

July 2024: Another purchase of 20.381 Bitcoins

August 2024: Increased holdings by 21.88 Bitcoins

September 2024: Multiple purchases totaling over 100 Bitcoins

December 2024: Holdings reached 1,762 Bitcoins (seriously taking it to heart)

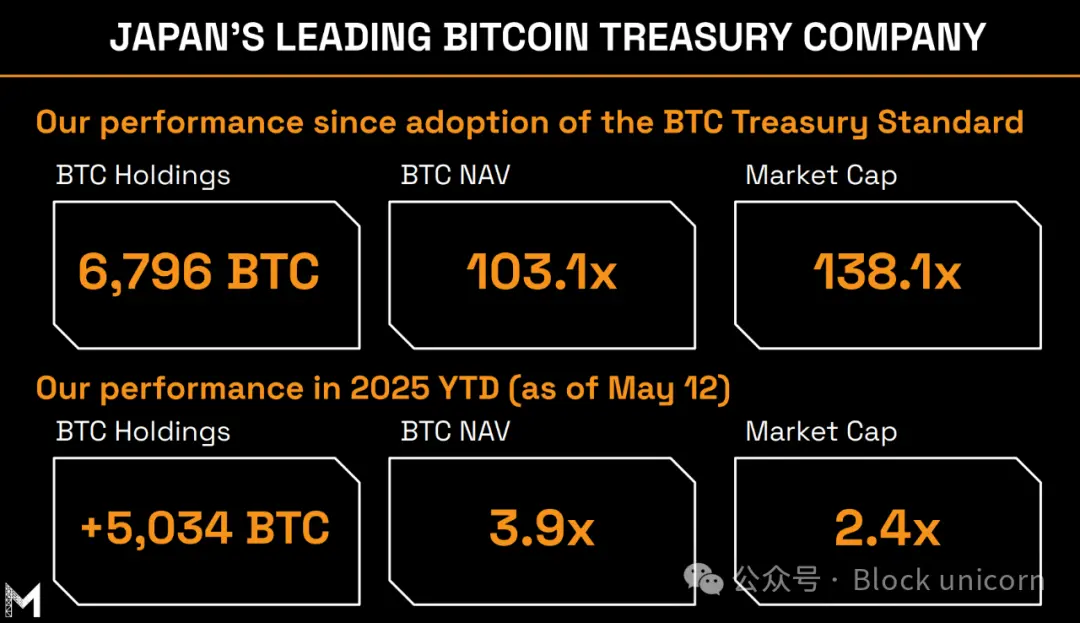

Q1 2025: Increased holdings by 5,034 Bitcoins in three months (going all out)

May 2025: After purchasing 1,241 Bitcoins, holdings reached 6,796 Bitcoins

What was their average cost? About $89,492 per Bitcoin. Considering the current price, this timing is quite favorable.

Metaplanet has now become Japan's largest corporate Bitcoin holder and one of the most significant Bitcoin holders among publicly traded companies globally.

The rise in Bitcoin prices in 2024 meant that Metaplanet's holdings significantly increased in value, with unrealized gains far exceeding its traditional hotel revenues.

Q1 2025 Data

Record Operating Profit: Revenue of 877 million yen generated a profit of 592 million yen

Bitcoin Revenue: Earned 770 million yen through options premiums (88% of total revenue)

Hotel Operating Revenue: Only 104 million yen (12% of revenue)

Bitcoin Holdings: 6,796 Bitcoins (1,762 at the end of 2024)

Unrealized Bitcoin Losses: 7.4 billion yen in Q1, but reversed to a gain of 13.5 billion yen by May 12

What is Bitcoin revenue? Simply put, they sell cash-secured Bitcoin put options, collecting premiums while buying more Bitcoin at lower prices when the options are exercised.

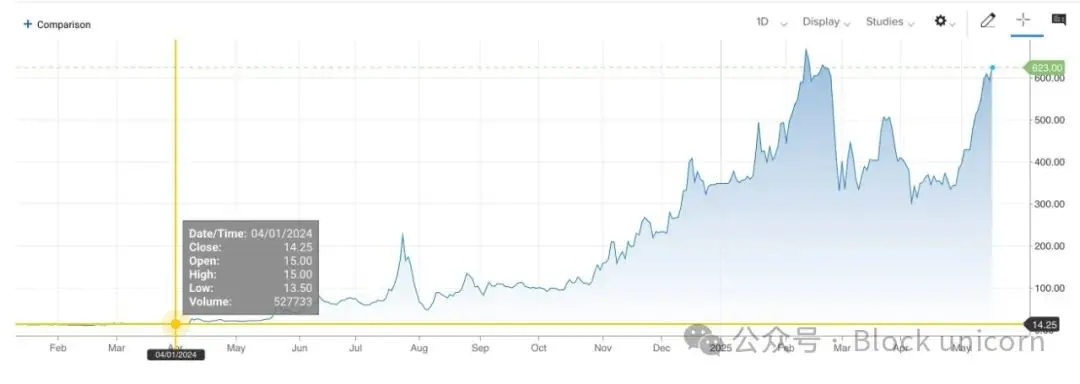

What about their stock price? It has risen 3000% since embarking on the Bitcoin journey. Meanwhile, traditional hotel stocks may still be struggling to recover from the lows of 2020.

While Bitcoin itself performed well during this period, Metaplanet's over 3000% increase far outpaced Bitcoin's returns, indicating that investors are willing to pay a premium for:

Their innovative financing mechanism

The execution of the "BTC yield" strategy

The opportunity to gain Bitcoin exposure within Japan's regulatory framework

The company's ability to amplify Bitcoin exposure

Where Does the Money Come From?

Let’s break it down simply.

1. Dynamic Exercise Price Warrants (The Clever Part)

They sold 210 million "warrants" to investors

These warrants only convert to shares when Metaplanet's stock price rises

Result: Shareholders are only diluted when everyone is making money

They raised 76.6 billion yen this way without issuing shares below market price

2. Zero-Interest Bonds (Free Money)

They borrow money and pay 0% interest

Why would anyone lend money for free? Because if Bitcoin skyrockets, they have potential upside

Latest news: Borrowed 3.6 billion yen at 0% interest

3. Bitcoin Revenue (Let Bitcoin Earn for Itself)

They sell "insurance" on Bitcoin (cash-secured put options).

If Bitcoin crashes, they are forced to buy more (which is exactly what they want).

If Bitcoin does not crash, they keep the options premium.

In Q1 2025, 88% of revenue came from this strategy.

4. Hotel Business Cash Flow

They still own some hotels, generating 104 million yen in revenue each quarter.

All this cash is directly used to purchase Bitcoin.

Positive Feedback Loop

Use raised funds to buy Bitcoin.

Bitcoin price rises → stock price rises.

Stock price rises → can sell more warrants.

Use warrant funds to buy more Bitcoin.

Repeat the above process.

Why Does This Work?

They only issue new shares (warrants) when the stock price rises.

They borrow money at zero interest (zero-interest bonds).

They profit from Bitcoin's volatility (options trading).

Everything feeds back into the cycle of buying more Bitcoin.

If Bitcoin crashes and the stock price falls, the entire mechanism will cease to function. No one will buy warrants, bonds become hard to sell, and they cannot fund purchases for more Bitcoin.

When asked about concerns regarding the stock price, Gerovich's response was, "We are just getting started." Given their current holdings exceed those of an entire country, their confidence is undoubtedly strong.

Metaplanet also announced plans to issue another $21 million bond to EVO FUND. This is their 14th bond issuance to date. These bonds? Naturally zero-interest, because who needs that kind of yield when you have Bitcoin?

The company is establishing a wholly-owned subsidiary, Metaplanet Treasury Corp, in Florida, planning to raise $250 million to expand its Bitcoin purchasing capacity outside Japan. Clearly, one country is no longer enough to satisfy their appetite for purchases.

Comparison with MicroStrategy

Metaplanet is not engaging in hedging operations. They are not pursuing a 50% Bitcoin, 50% hotel strategy, but are fully betting on the orange currency (Bitcoin) strategy. Their entire business model now is:

Raise funds

Buy Bitcoin

Generate revenue from Bitcoin volatility

Repeat the above process

Metaplanet's strategy is clearly inspired by MicroStrategy's transformation under Michael Saylor. However, this Japanese company operates in a different regulatory and cultural environment, which brings both opportunities and constraints.

Metaplanet has introduced its own key performance indicator (KPI) called "BTC yield"—measuring the growth of Bitcoin holdings per share over time. Q1 2025 showed a 170% BTC yield. This means that despite the company issuing more shares, the amount of Bitcoin held per shareholder increased by 170%.

In contrast, the achievements Metaplanet accomplished in three months took MicroStrategy 19 months to complete. Their market net asset value growth rate is 3.8 times faster than that of MicroStrategy.

Unlike MicroStrategy, which benefits from a mature U.S. capital market and a complex convertible bond market, Metaplanet must navigate Japan's more conservative financial environment. Japan's corporate bond market is underdeveloped, and retail investors may have limited interest in leveraged Bitcoin investments.

Metaplanet also benefits from being a pioneer in the Japanese market. As a major Bitcoin proxy among publicly traded companies in Japan, it attracts capital from both domestic and international investors seeking Bitcoin exposure in Japan.

The company's hotel business background also provides a narrative buffer. Unlike pure Bitcoin companies, Metaplanet retains operational business, theoretically able to support the company if the Bitcoin strategy fails. This may offer some comfort to more conservative investors.

Our Perspective

Metaplanet's transformation represents a profound significance in the evolution of businesses in the digital age. It is a company that recognizes the impending obsolescence of traditional business models and boldly places a radical bet on an emerging asset class.

Metaplanet essentially picked up MicroStrategy's playbook and optimized it for the Japanese market. While MicroStrategy issues convertible bonds, Metaplanet pioneered dynamic exercise price warrants that only dilute shareholders when the stock price rises. What’s the result? A more efficient Bitcoin accumulation engine favored by Japan's regulatory advantages.

This boldness is striking. Most corporate transformations involve incremental changes—retailers shifting online, media companies embracing streaming. In contrast, Metaplanet has completely abandoned its core competency, betting the company on an asset that did not exist at its inception.

The success or failure of this strategy largely depends on Bitcoin's long-term trajectory. If Bitcoin continues to be adopted by institutions and governments, Metaplanet's early positioning may prove to be visionary. The company essentially transforms into a leveraged firm capitalizing on Bitcoin's popularity.

If Bitcoin stagnates or faces regulatory crackdowns, Metaplanet's strategy could lead to disastrous consequences. The company would be left with a shrinking hotel business, and its cryptocurrency holdings would face significant unrealized losses.

One thing is certain: Metaplanet has created a template for corporate adoption of Bitcoin that other companies will study—whether as inspiration or caution. In a world where traditional business models are continually being disrupted, perhaps the most rational strategy is to fully embrace that disruption.

Sometimes, survival requires not just adaptation but a complete metamorphosis. Metaplanet's management bets that Bitcoin represents the future of value storage. Time will tell whether they are visionary or reckless.

But in an era where stagnation often means regression, a company daring to take all risks to uphold its beliefs exhibits a commendable courage. Whether this transformation leads to prosperity or peril remains one of Japan's most captivating corporate stories today.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。