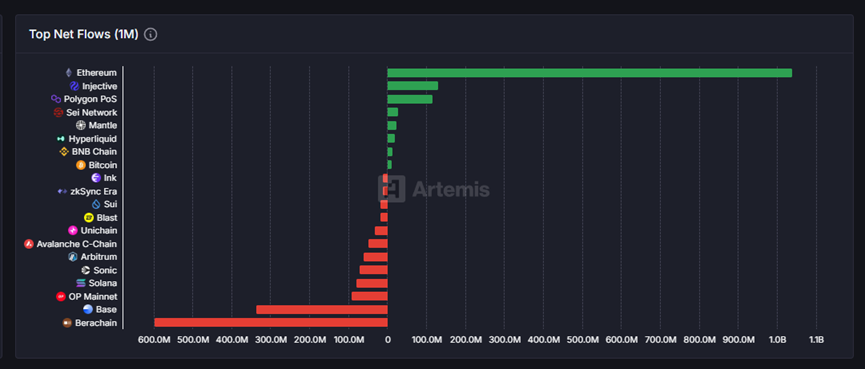

According to data from Artemis, Injective has seen a net inflow of approximately $142 million in the past 30 days, second only to Ethereum.

Author: Frank, PANews

In the past month, the well-established public chain Injective has returned to the public eye with a second-place ranking in net inflow of funds. According to data from Artemis, Injective has achieved a net inflow of approximately $142 million in the past 30 days, only behind Ethereum.

PANews has also observed other data aspects of Injective and found that this phenomenon of net fund inflow is not an isolated case. There have been significant increases in on-chain fees, active users, and token trading volume. After a long period of silence, will this former public chain star Injective usher in an ecological explosion again? Or is it just a fleeting moment?

$142 million monthly inflow: Is high yield "honey" or a "flare"?

As of June 4, data shows that Injective has achieved a net inflow of $142 million in the past month. Although the amount is not particularly high, it still ranks second among all public chains in recent data. A closer look at the data reveals that the reason for this net inflow is that Injective has indeed experienced a wave of rapid large-scale fund inflows, while the net outflow of funds is very minimal, only $11 million. Therefore, if we delve into the reasons, Injective's high ranking in net fund inflow is not due to overall fund movement being exceptionally active (i.e., having large-scale inflows and outflows simultaneously). In fact, its pure inflow volume ranks only around tenth when compared horizontally with other public chains. The key to its outstanding performance in the 'net inflow' metric lies in the negligible outflow of funds during the same period.

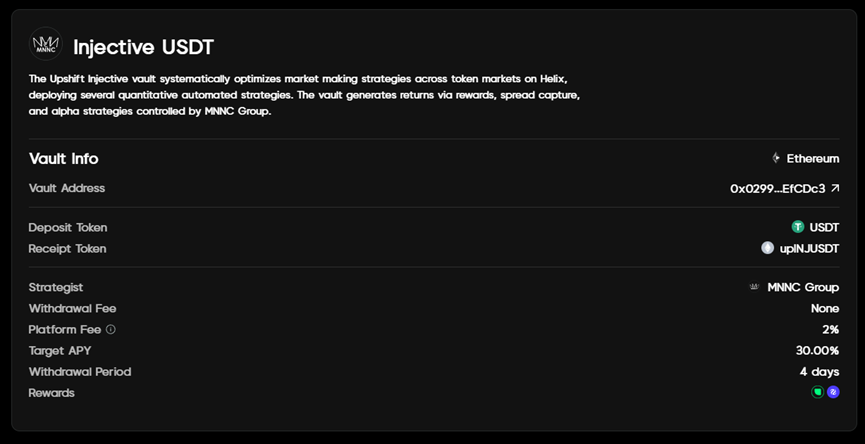

However, such unusual on-chain fund movements are also rare for the Injective network. Of the $142 million inflow, $140 million was completed through the Peggy cross-chain bridge, accounting for 98.5% of the total. Market analysis firm Keyrock pointed out in its report "Key Insights, Bond Appetit" released on May 26 that this large-scale fund inflow is mainly attributed to the launch of the institutional-grade yield platform Upshift on Injective. It is understood that Upshift's treasury on Injective has an APY of 30%, and this high yield could indeed be a significant reason for attracting funds to transfer assets to Injective.

However, PANews found through investigation that the hard cap for Upshift's treasury on Injective is $5 million, which cannot fully accommodate this portion of fund inflow. Those funds that were unable to participate in this treasury investment may potentially flow out again in the short term.

From derivatives setbacks to RWA hopes, can Injective open up new avenues?

In addition to the inflow of funds, Injective has indeed welcomed some important changes in its ecosystem recently. On April 22, the Lyora mainnet was officially launched, marking an important milestone in Injective's development. This mainnet upgrade introduced dynamic fee structures and smart memory pool optimizations. According to official information, after the upgrade, Injective is described as "faster," claiming to have lower latency and higher throughput.

Additionally, Injective has launched a dedicated oracle framework for RWA called iAssets, and Upshift's treasury is an RWA DeFi treasury. On May 29, Injective officially announced the launch of an on-chain foreign exchange market for euros and pounds, utilizing the iAsset framework. From this perspective, Injective's new narrative seems closely tied to RWA.

As an established public chain, Injective's original core narrative was a decentralized derivatives exchange. The initial Injective evolved from a decentralized derivatives exchange into a public chain, a path that seems similar to the currently popular Hyperliquid.

However, Injective's current derivatives trading does not seem to have achieved the expected goals. Data from June 4 shows that the highest trading volume for the BTC contract trading pair on Injective within 24 hours was approximately $39.75 million, with the total derivatives trading volume across the chain around $90 million. In comparison, Hyperliquid's data for the same day was about $7 billion, a difference of approximately 77 times.

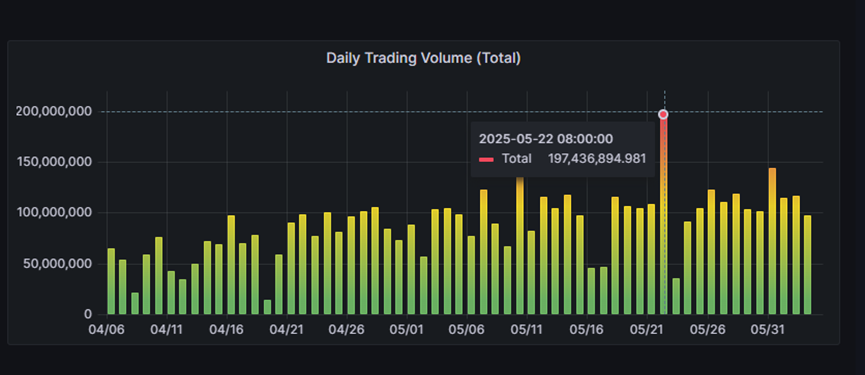

Perhaps due to difficulties in opening up the crypto derivatives market, Injective has chosen to pivot towards the RWA integration direction. From the perspective of its own ecological development, this transformation seems to have had some effect. On May 22, Injective's derivatives trading volume peaked at $1.97 billion, significantly higher than at other times, and has shown an overall upward trend recently.

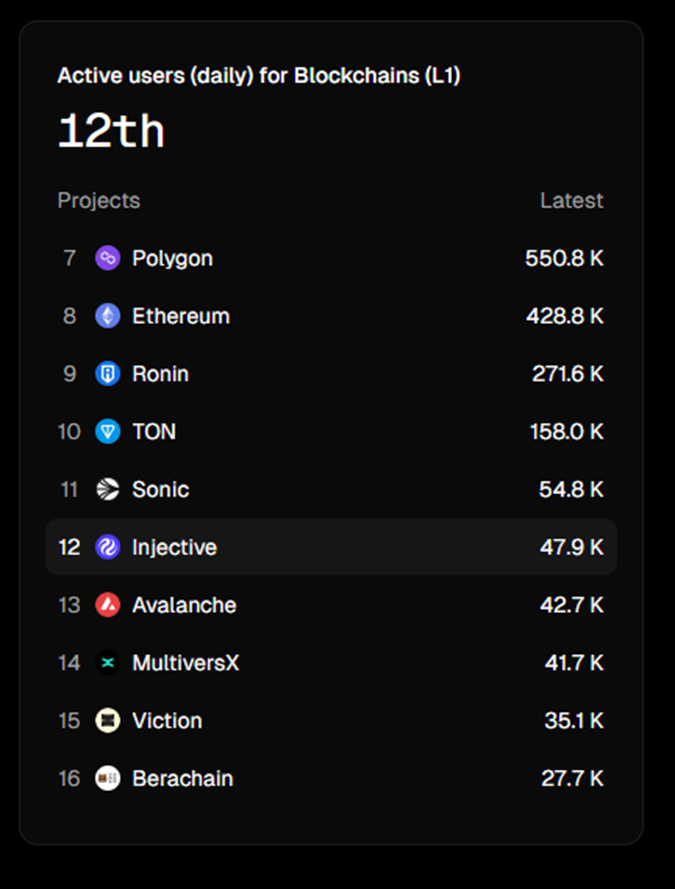

Moreover, in terms of daily active users, the number has surged from a low of 6,300 addresses in February to 47,900 recently, an increase of about 7.6 times. Although this data ranks only 12th among all public chains, considering the rapid growth in a short period and surpassing public chains like Avalanche and Berachain, it can be seen as a notable breakthrough.

However, even with a significant increase in daily active users, Injective's TVL has not shown notable changes, having been on a downward trend since March 2024, with the current TVL at only $26.33 million. At least for now, the DeFi projects on Injective still do not have a strong attraction for funds.

Token performance shows a short-term rebound, but still has a fourfold gap from historical highs

In terms of economics, its governance token INJ currently has a market capitalization of approximately $1.26 billion, ranking 82nd. Compared to its highest market cap of $5.3 billion, it has dropped by 76%. However, from a low of $6.34 in April, it rebounded to a high of $15.48, an increase of 144%, which is quite impressive among established public chains. The question remains how long this performance can be sustained.

Of course, Injective's recent actions are not limited to the above. For instance, it has recently attracted several well-known institutions such as Republic, Google Cloud, and Deutsche Telekom MMS to join the validator ranks, as well as launched some AI-related products and initiatives. Overall, Injective has been actively seizing new narratives such as AI and RWA for transformation over the past year. As of June data, it has indeed seen some growth in recent months. However, in terms of scale, it still has a significant gap compared to current mainstream public chains.

And this race to catch up is not unique to Injective; several previous star public chains are now facing similar predicaments. Many have returned to the public eye through rebranding and upgrades. However, whether this new bottle for old wine model can truly offer the market a new taste or merely refresh the packaging remains to be seen.

Currently, Injective's ecological transformation and revival path is still in its early stages. The fund inflow triggered by Upshift seems more like an important market sentiment test and a demonstration of ecological potential, rather than a fundamental shift in the landscape. Whether its strategic tilt towards RWA can truly create differentiated competitive advantages and translate into sustained ecological prosperity and value capture still needs to overcome many challenges and undergo long-term market testing.

Whether the short-term data rebound is a fleeting moment or a positive signal in a long recovery journey, only time will provide the final answer. For Injective, the real test has just begun.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。