Wall Street giant Jamie Dimon, who once called Bitcoin a "fraud," may not have anticipated that he would now personally open the door to cryptocurrency.

Written by: BitpushNews

Wall Street giant Jamie Dimon, who once called Bitcoin a "fraud," may not have anticipated that he would now personally open the door to cryptocurrency.

According to Bloomberg on June 4, citing informed sources, JPMorgan Chase will begin offering financing services backed by BlackRock's iShares Bitcoin Trust (IBIT) shares in the coming weeks. This policy will be available to all customer groups globally, treating individual retail investors and institutional investors equally.

This milestone move not only marks a significant shift in traditional finance's attitude towards crypto assets but also signals the accelerating deep integration of digital assets with the mainstream financial system.

New Loan Collateral Regulations: Bitcoin ETFs on Par with Traditional Securities

It is noteworthy that, in addition to loan collateral, JPMorgan will also begin to consider cryptocurrency holdings when assessing the net worth and liquid assets of certain clients, placing them on equal footing with traditional securities such as stocks, cars, or artworks in evaluating loan eligibility.

This is not merely a simple business adjustment but a significant turning point. Just at the investor day event in May, Dimon publicly stated that he was "not optimistic about Bitcoin," only begrudgingly acknowledging that "clients have the right to buy it."

This move marks JPMorgan's transition from a previously limited, case-by-case approval of crypto asset collateral to a more formal and structured financing framework. Previously, other major financial institutions like Morgan Stanley have also been exploring broader integration of crypto products, such as Morgan Stanley's plan to launch cryptocurrency trading on its E*Trade platform, reported by Bloomberg last month.

Shift in Executive Attitudes and Institutional Demand

Dimon has long been critical of cryptocurrencies, particularly wary of their use in illegal activities such as money laundering. However, his recent softening of attitude, especially his statement "I am not a fan of Bitcoin, but I defend your right to buy Bitcoin," clearly reflects the bank's pragmatic choices in the face of market and regulatory pressures.

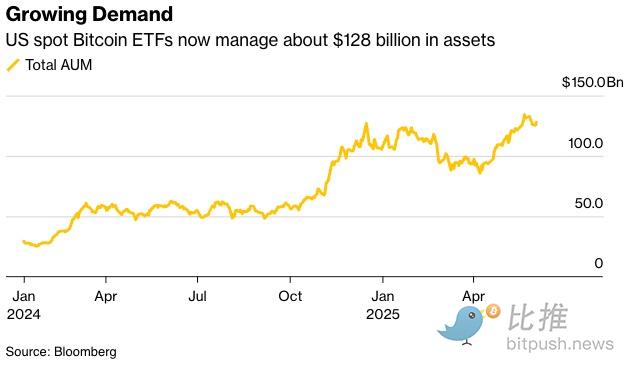

Wealth management firms are facing significant demand from clients for exposure to digital assets. Data shows that the total size of the U.S. spot Bitcoin ETF has surpassed $128 billion since its launch, with daily trading volumes outpacing those of gold ETFs.

The public listings of crypto companies like Circle on U.S. stock exchanges, combined with investors' growing interest in cryptocurrencies before seeking regulatory clarity, make it increasingly difficult for banks to ignore this sector. Earlier, a private banking advisor at JPMorgan mentioned in a CNBC interview, "Every day, high-net-worth clients ask: Why can't we allocate Bitcoin?"

Trump Administration's "Pro-Crypto" Policies Boost the Trend

JPMorgan launched JPM Coin in 2019 to test the waters of blockchain but has always kept a safe distance from Bitcoin. The backdrop of this shift is the increasingly favorable regulatory environment in the U.S. Since President Trump took office again in January 2025, his administration has adopted a distinctly "pro-crypto" stance.

- Executive Orders and Working Groups: On January 23, 2025, Trump signed an executive order aimed at promoting the responsible growth of digital assets and blockchain technology, emphasizing the U.S. role as a global leader in innovation.

- Crypto-Friendly Appointments: His administration also appointed crypto-friendly individuals like David Sacks to lead a crypto working group responsible for creating a legal framework that supports industry growth and provides clarity for businesses.

- Treasury Secretary's Position: Trump's Treasury Secretary Scott Bessent has been a strong advocate for blockchain innovation, contrasting sharply with the stringent measures of the Biden era. During former Treasury Secretary Janet Yellen's tenure, banks like JPMorgan received multiple regulatory warning letters for servicing crypto companies.

From a broader perspective, this "compromise" reflects the opening of a new era: as asset management giants like BlackRock and Fidelity launch Bitcoin ETFs, and as the Trump administration elevates crypto innovation to a national strategy, the resistance of traditional financial institutions has become increasingly outdated.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。