Currently, the cycle is still in the "mid-term bull market pullback period," but structural opportunities are quietly emerging, and pricing anchor points are undergoing macro-level shifts.

I. Introduction

In Q2 2025, the crypto market experienced a transition from a high-heat market to a short-term adjustment. Although sectors like Meme, AI, and RWA continue to rotate and repeatedly guide sentiment, the ceiling of macroeconomic suppression has gradually become apparent. The global trade situation is turbulent, U.S. economic data is fluctuating, and the ongoing speculation around the Federal Reserve's interest rate cuts has led the market into a critical window of "waiting for the reconstruction of pricing logic." Meanwhile, marginal changes in policy dynamics are beginning to emerge: the Trump camp's positive stance on cryptocurrencies has triggered early pricing of the "Bitcoin as a national strategic reserve asset" logic. We believe that the current cycle is still in the "mid-term bull market pullback period," but structural opportunities are quietly emerging, and pricing anchor points are undergoing macro-level shifts.

II. Macro Variables: Old Logic Disintegrates, New Anchor Points Undetermined

In May 2025, the crypto market is at a critical juncture of macro logic reconstruction. The traditional pricing framework is rapidly disintegrating, while new valuation anchor points have yet to be established, placing the market in a "vague and anxious" macro environment. From macroeconomic data and central bank policy orientation to marginal changes in global geopolitics and trade relations, all are influencing the behavior patterns of the entire crypto market in a manner characterized by a "new order amidst instability."

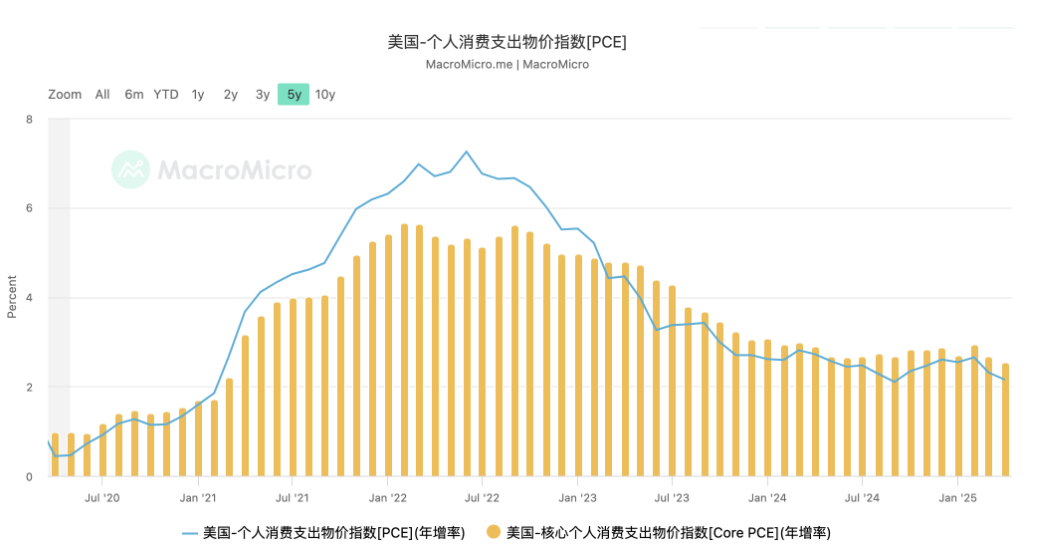

Firstly, the Federal Reserve's monetary policy is transitioning from "data dependence" to a new phase of "political and stagflationary pressure games." The CPI and PCE data released in April and May show that while U.S. inflationary pressures have eased, overall stickiness remains, especially with high rigidity in service prices, intertwined with structural labor market shortages, making it difficult for inflation to drop quickly. Although the unemployment rate has seen a marginal increase, it has not triggered the lower limit for a reversal in Federal Reserve policy, leading market expectations for interest rate cuts to be postponed from the originally anticipated June to Q4 or even further out. While Federal Reserve Chairman Powell has not ruled out the possibility of rate cuts within the year in public statements, he emphasizes "cautious observation" and "commitment to long-term inflation targets," making the vision of liquidity easing seem more distant in reality.

This uncertain macro environment directly affects the funding pricing basis of crypto assets. Over the past three years, crypto assets enjoyed valuation premiums under the backdrop of "zero interest rates + broad liquidity easing," but now, in the latter half of a cycle with high interest rates dulling, traditional valuation models face systemic failure. Bitcoin, while maintaining a trend of upward oscillation driven by structural funds, has failed to generate the momentum needed to cross the next significant threshold, reflecting that its "alignment path" with traditional macro assets is disintegrating. The market is beginning to move away from the old linkage logic of "Nasdaq up = BTC up" and is gradually realizing that crypto assets require independent policy anchors and role anchors.

At the same time, the geopolitical variables affecting the market have undergone significant changes since the beginning of the year. The previously heated topic of the U.S.-China trade war has significantly cooled. Recent shifts in the Trump team's focus on "manufacturing return" indicate that U.S.-China tensions are unlikely to escalate further in the short term. This has temporarily dampened the logic of "geopolitical hedging + Bitcoin as a risk-averse asset," leading the market to no longer assign premiums to the "hedging anchor" of crypto assets, but rather to seek new policy support and narrative momentum. This is also an important backdrop for the shift from structural rebounds to high-level oscillations in the crypto market since mid-May, with some on-chain assets experiencing continuous outflows.

On a deeper level, the entire global financial system is undergoing a systemic process of "anchor point reconstruction." The U.S. dollar index is consolidating at high levels, the interconnections between gold, government bonds, and U.S. stocks have been disrupted, and crypto assets are caught in between, lacking the central bank endorsement typical of traditional safe-haven assets and not being fully integrated into the risk control frameworks of mainstream financial institutions. This "neither risk nor safe haven" intermediate state places the market's pricing of main assets like BTC and ETH in a "relatively vague zone." This vague macro anchor further transmits downstream, leading to the explosive narratives of Meme, RWA, and AI branches, but they struggle to sustain. Without the support of macro incremental funds, localized prosperity on-chain is prone to fall into the "rapid ignition—quick extinguishment" rotation trap.

We are entering a "de-financialization" turning window dominated by macro variables. In this phase, market liquidity and trends are no longer driven by simple correlations between assets but depend on the redistribution of policy pricing power and institutional roles. If the crypto market wants to welcome the next round of systemic revaluation, it must wait for a new macro anchor—this could be the official establishment of "Bitcoin as a national strategic reserve asset," the "clear initiation of the Federal Reserve's interest rate cut cycle," or the "acceptance of on-chain financial infrastructure by multiple governments worldwide." Only when these macro-level anchor points are truly established will there be a comprehensive return of risk appetite and a resonant upward movement in asset prices.

Currently, what the crypto market needs to do is not to cling to the continuation of old logic but to calmly identify the signs of new anchor points emerging. Those funds and projects that can first understand the changes in macro structure and lay out ahead of new anchor points will gain the initiative in the next true wave of upward movement.

III. Policy Variables: The Approval of the GENIUS Act, State-Level Bitcoin Strategic Reserves, Triggering Structural Expectations

In May 2025, the U.S. Senate officially passed the GENIUS Act (Guaranteed Electronic Network for Uniform and Interoperable Stablecoins Act), becoming one of the most institutionally influential stablecoin legislative proposals globally since MiCA. The passage of this act not only marks the establishment of a regulatory framework for U.S. dollar stablecoins but also sends a clear signal: stablecoins are no longer a technical experiment or a gray financial tool but have become an integral part of the sovereign financial system, serving as an organic extension of the influence of the digital dollar.

The core content of the GENIUS Act mainly focuses on three aspects: first, it establishes the Federal Reserve and financial regulatory agencies' licensing authority over stablecoin issuers and sets capital, reserve, and transparency requirements equivalent to those of banks; second, it provides a legal basis and standard interfaces for the interoperability of stablecoins with commercial banks and payment institutions, promoting their widespread application in retail payments, cross-border settlements, and financial interoperability; third, it establishes a "regulatory sandbox" exemption mechanism for decentralized stablecoins (such as DAI, crvUSD, etc.), preserving the innovative space of open finance within a compliant and controllable framework.

From a macro perspective, the passage of this act has triggered a threefold structural expectation shift for the crypto market. Firstly, a new paradigm of "on-chain anchoring" has emerged for the international extension path of the U.S. dollar system. As the "federal check" of the digital age, the on-chain circulation capability of stablecoins not only serves internal payments within Web3 but may also become part of the U.S. dollar policy transmission mechanism, enhancing its competitive advantage in emerging markets. This also means that the U.S. is no longer simply suppressing crypto assets but is choosing to incorporate part of the "channel rights" into the national fiscal system, legitimizing stablecoins while positioning the dollar in the upcoming digital financial war.

Secondly, the legalization of stablecoins is driving a revaluation of on-chain financial structures. The ecosystems of compliant stablecoins like USDC and PYUSD are set to experience a liquidity explosion, and the logic of on-chain payments, on-chain credit, and on-chain ledger reconstruction will further activate the demand for bridging DeFi and RWAs. Especially in the context of high interest rates, high inflation, and regional currency fluctuations in the traditional financial environment, the attributes of stablecoins as "cross-institutional arbitrage tools" will further attract users from emerging markets and on-chain asset management institutions. Less than two weeks after the passage of the GENIUS Act, the daily trading volume of stablecoins on platforms like Coinbase reached a new high for 2023, with the circulating market value of on-chain USDC increasing by nearly 12% month-on-month, and the liquidity focus beginning to shift from Tether to compliant assets.

More structurally significant is that multiple state governments have followed up with Bitcoin strategic reserve plans after the passage of the act. By late May, New Hampshire had already passed a Bitcoin strategic reserve bill, while Texas, Florida, Wyoming, and others announced that they would allocate part of their fiscal surpluses as Bitcoin reserve assets, citing reasons such as inflation hedging, diversification of fiscal structures, and support for local blockchain industries. In a sense, this behavior marks the transition of Bitcoin from a "grassroots consensus asset" to being included in "local fiscal asset tables," representing a digital reconstruction of the logic of reserve assets in the golden age. Although the scale remains small and the mechanisms are still unstable, the political signals released behind it are far more important than the asset volume: Bitcoin is beginning to become a "government-level choice."

These policy dynamics collectively contribute to a new structural landscape: stablecoins become "on-chain dollars," Bitcoin becomes "local gold," with each serving distinct roles, coexisting and hedging against the traditional currency system from the perspectives of payment and reserve. This situation provides another safe anchoring logic in the geopolitical financial fragmentation and declining institutional trust of 2025. This also explains why the crypto market maintained high-level oscillations in mid-May despite poor macro data (persistent high interest rates, CPI rebound)—because the structural turning point at the policy level has established long-term certainty support for the market.

After the passage of the GENIUS Act, the market's reassessment of the "U.S. Treasury yield-stablecoin yield" model will also accelerate the alignment of stablecoin products with "on-chain T-Bills" and "on-chain money market funds." In a sense, the future digital debt structure of the U.S. Treasury may be partially managed by stablecoins. The expectation of on-chain U.S. Treasuries is gradually becoming clearer through the institutionalization of stablecoins.

IV. Market Structure: Intense Sector Rotation, Main Line Still to be Confirmed

The crypto market in Q2 2025 presents a highly tense structural contradiction: on the macro level, policy expectations are warming, and stablecoins and Bitcoin are moving towards "institutional embedding"; yet on the micro structural level, there is still a lack of a truly market-consensus "main line sector." This has led to the overall market exhibiting characteristics of frequent rotation, weak sustainability, and temporarily "idling" liquidity. In other words, while funds are still circulating on-chain, the sense of direction and certainty has yet to be reconstructed, contrasting sharply with certain "single-sector main wave" cycles in 2021 or 2023 (such as DeFi Summer, AI narrative explosion, Meme Season).

Firstly, from the performance of sectors, the crypto market in May 2025 showed an extremely polarized structure. Solana Meme, AI+Crypto, RWA, DeFi, and others took turns "passing the baton," with each sub-sector experiencing explosive cycles lasting less than two weeks, followed by rapid dissipation of subsequent follow-up funds. For example, Solana Meme once triggered a new wave of FOMO frenzy, but due to weak community consensus and overextended market sentiment, the market quickly corrected from high levels; the AI sector, represented by projects like $FET, $RNDR, and $TAO, exhibited "high beta and high volatility" characteristics, heavily influenced by the sentiment of AI-weighted stocks in the U.S. stock market, lacking the continuity of spontaneous narratives within the chain; while the RWA sector, represented by ONDO, although certain, has entered a "price-value divergence" consolidation period as a portion of airdrop expectations have already been realized.

The flow of funds indicates that this rotation phenomenon essentially reflects a structural liquidity flood rather than the initiation of a structural bull market. Since mid-May, the market capitalization of USDT has stagnated, while USDC and DAI have seen slight recoveries. The daily trading volume on on-chain DEXs has maintained a fluctuation range of $2.5 to $3 billion, shrinking nearly 40% compared to the peak in March. There has been no significant influx of new funds; rather, existing funds are seeking short-term trading opportunities characterized by "local high volatility + high sentiment." In this context, even frequent sector switches are unlikely to form a strong mainline trend, further amplifying the "pass-the-parcel" speculative rhythm, leading to a decrease in retail participation willingness and a growing disconnection between trading enthusiasm and social engagement.

On the other hand, the phenomenon of valuation stratification has intensified. First-tier blue-chip projects exhibit significant valuation premiums, with leading assets like ETH, SOL, and TON continuing to attract large funds, while long-tail projects find themselves in an awkward position of "fundamentals unable to be priced, expectations unable to be fulfilled." Data shows that in May 2025, the top 20 cryptocurrencies accounted for nearly 71% of the total market capitalization, the highest since 2022, reflecting characteristics similar to the "concentration rebound" seen in traditional capital markets. In the absence of a "broad market," liquidity and attention are concentrated on a few core assets, further compressing the survival space for new projects and narratives.

At the same time, on-chain behavior is also changing. The number of active addresses on Ethereum has stabilized around 400,000 over the months, but the overall TVL of DeFi protocols has not seen a corresponding increase, reflecting a rising trend of "fragmentation" and "de-financialization" in on-chain interactions. Non-financial interactions such as meme trading, airdrop farming, domain registration, and social networking are gradually becoming mainstream, indicating a shift in user structure towards "light interaction + heavy sentiment." While these behaviors drive short-term enthusiasm, they increasingly pressure protocol builders regarding monetization and retention, limiting their willingness to innovate.

From an industry perspective, the market is currently at a critical point where multiple mainlines coexist but lack a strong upward wave: RWA still has long-term logic but needs to wait for regulatory compliance to take root and for the ecosystem to grow spontaneously; Meme can stimulate sentiment but lacks leading assets with "cultural symbols + community mobilization" capabilities like DOGE and PEPE; the AI + Crypto space has immense imaginative potential, but the technical implementation and token incentive mechanisms have yet to reach consensus standards; the Bitcoin ecosystem is beginning to take shape, but the infrastructure is still incomplete, remaining in an early "trial and error + positioning" phase.

In summary, the current market structure can be summarized with four keywords: rotation, differentiation, concentration, and exploration. Rotation has increased trading difficulty; differentiation has compressed the medium- to long-term layout space; concentration means that valuations are flowing back to the top, leaving long-tail assets muddied; and the essence of all hotspots is still the market's exploration of whether new paradigms and mainlines can gain "consensus + funding" dual recognition.

Whether a mainline can take shape in the future largely depends on the resonance of three factors: first, whether there will be innovative mechanisms for on-chain native blockbuster products similar to DeFi in 2020 or Meme in 2021; second, whether the implementation of policy regulations continues to release institutional benefits conducive to the long-term pricing logic of crypto assets (such as tokenized government bonds, federal-level BTC reserves, etc.); third, whether the secondary market will replenish mainstream funds, re-energizing primary sector financing and ecosystem building.

This current phase resembles a "pressure test" in deep waters: sentiment is not bad, institutional warmth is slight, but the mainline is absent. The market needs a new core narrative to gather people, funds, and computing power. This may become a decisive variable in the evolution of the market in the second half of 2025.

V. Future Outlook and Strategic Recommendations

Looking back from the midpoint of 2025, we have gradually emerged from the "halving + election + interest rate cut" dividend period, but the market has yet to establish a long-term anchor point that can truly stabilize participant confidence. Historically, if a strong mainline consensus has not formed by Q3, the overall market is likely to enter a medium-intensity structural consolidation period, during which hotspots will become even more fragmented, trading difficulty will continue to rise, and risk appetite will significantly stratify, forming a "low volatility window during the policy upturn."

From a medium-term perspective, the variables determining the trend in the second half of the year have gradually shifted from "macro interest rates" to "institutional implementation processes + structural narratives." The U.S. PCE and CPI continue to decline, and there is a preliminary consensus within the Federal Reserve for two interest rate cuts this year, with bearish factors marginally easing. However, the crypto market has not seen a large influx of funds, indicating that the current market is more concerned with long-term institutional support rather than short-term monetary stimulus. We believe this represents a transition of crypto assets from "high-elasticity risk assets" to "institutional game equity assets," resulting in a fundamental shift in the market pricing system.

The implementation of the GENIUS Act and state-level Bitcoin strategic reserve pilots may be the starting point for this institutional support. Once more states begin to incorporate BTC into their fiscal strategic reserves, crypto assets will truly enter an era of "quasi-sovereign endorsement." Coupled with the expected restructuring of federal policies after the November elections, this will constitute a structural catalyst more penetrating than the halving. However, it is important to note that such processes are not instantaneous; if the policy rhythm lags or election trends reverse, crypto assets may also experience severe adjustments due to corrections in institutional expectations.

In terms of strategy, the current environment is not suitable for a "full-scale offensive," but rather for a "patient defensive, waiting for opportunities to strike quickly." We recommend adopting a "three-layer structural strategy":

Core Positioning in Sovereign Anchor Assets: Assets like BTC and ETH, representing "emerging institutional assets," will continue to attract large funds. It is advisable to prioritize these as core positions, focusing on assets with low supply elasticity, low institutional risk, and clear valuation models.

Participate in Structural Hotspots During High Volatility Windows: For sectors like RWA, AI, and Meme, tactical allocation strategies can be employed, controlling risk through time dimensions and judging entry and exit rhythms based on liquidity intensity, especially paying attention to any breakthroughs in on-chain behavior or signals of capital injection.

Watch for Native Innovations in the Primary Market: All genuine waves capable of changing the crypto structure stem from the dual drive of "on-chain mechanism innovation + community consensus." It is recommended to gradually shift the focus to the primary market to capture potential new paradigms (such as chain abstraction, MCP protocol groups, native user layer protocols, etc.), forming a long-term holding advantage in the early stages of the ecosystem.

Additionally, we remind the community to pay attention to the following three potential turning points, which may dominate the structural market in the second half of the year:

- Whether the Trump administration will release systemic policy benefits such as BTC strategic reserves, tokenized government bonds, ETF expansions, and regulatory exemptions.

- Whether the Ethereum ecosystem can bring real user growth after the Petra upgrade, whether the L2/LRT mechanism can complete a paradigm leap, and whether publicly listed companies will continue to finance and buy ETH as they do with BTC.

In summary, the second half of 2025 will be a transitional window from "policy vacuum to policy game." Although the market lacks a mainline, it has not lost momentum and is overall in a state of "squatting and gathering strength before an upward breakthrough." Assets with true cyclical penetration capabilities will not peak in superficial enthusiasm but will bottom out in chaos, welcoming a certain rise when policies and structures resonate.

In this process, we advise community members to abandon the illusion of "hitting it big in one shot" and instead establish a coherent investment and research system capable of traversing multiple cycles, seeking true "penetration points" from project logic, on-chain behavior, liquidity distribution, and policy context. Because the real bull market in the future will not be the rise of a particular sector, but a paradigm shift where crypto is widely accepted as an institutional asset, supported by sovereignty, and where users genuinely migrate.

VI. Conclusion: The Winners Awaiting the "Turning Point"

The current crypto market is in a state of ambiguity: macro logic is undetermined, policy variables are in contention, market hotspots are rapidly rotating, and liquidity has not fully shifted towards risk assets. However, a valuation anchoring under institutional re-evaluation and sovereign state contention is forming. We judge that the true market uptrend will no longer be driven solely by the bull-bear cycle but will be triggered by the "establishment of the political role of crypto assets," leading to a comprehensive re-evaluation. The turning point is approaching, and the winners will ultimately belong to those who understand the macro landscape and patiently lay out their strategies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。