Stablecoins process trillions annually on chains that aren't designed for them.

@PlasmaFDN is the first chain built to be the global settlement layer for digital dollars.

How is Plasma different from general-purpose blockchains?

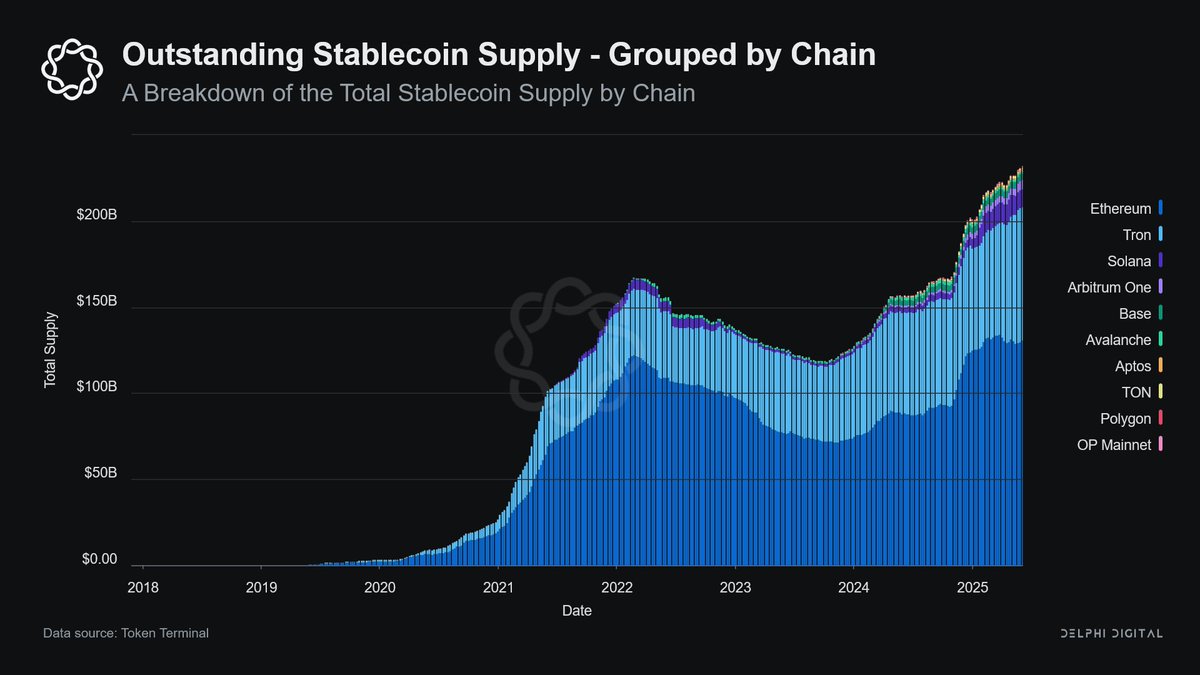

First it's liquidity. Roughly $155B USDT is scattered across a dozen networks, increasing fragmentation & bridge risks.

Plasma plans to unify this under one settlement layer where stablecoins can be swapped & redeemed. No need for bridges and wrappers.

Is a Stablecoin Chain Necessary?

Performant chains like Solana solve throughput but not liquidity coordination. They treat stablecoins as just another token, not the foundation.

Plasma treats stablecoins as the primary use case, enabling potential optimizations like zero fee transfers.

With Plasma, Tether is not only the issuer, but also the monetary and infrastructural substrate.

This lets Tether:

• Build vertical integration between issuance, transfer, and redemption

• Set protocol-level guarantees around things like redemption timing and compliance requirements

• Provide native tools and SDKs without needing to support different chains and environments

Think of it like Visa launching a global card network that also controls the payment rails, identity layer, and the merchant backend.

Plasma isn't competing to be another L1 but to be the settlement layer for the digital dollar economy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。