Original | Odaily Planet Daily (@OdailyChina)

This morning, a sudden "black swan" event shattered the brief calm in the financial markets.

With news of Israel launching airstrikes against Iran, the cryptocurrency market faced a severe setback. According to the OKX market data, the price of BTC fell below $103,000, with a 24-hour decline of 3.3%; ETH, which had recently managed to rise, dropped below $2,450, with a decline of 9.2%; and SOL, which had surged due to favorable ETF news, saw its price touch around $140, with a decline of 9.5%.

The derivatives market is filled with despair. According to Coinglass data, $1.159 billion was liquidated across the network in the past 24 hours, with the vast majority being long positions, amounting to $1.084 billion. In terms of asset distribution, BTC saw liquidations of $458 million, while ETH had liquidations of $287 million.

The market switched from rebound to collapse in just one night.

Escalation of the Israel-Iran Situation: The Trigger for the Decline

This decline is not driven by technical factors but is a typical case of geopolitical events driving the market.

Israel launched airstrikes against Iran, and reports suggest that the commander of Iran's paramilitary Revolutionary Guard, Salami, may have been killed in the attack. According to Jinshi reports, several high-ranking Iranian officials have also become targets of Israeli attacks, including the Chief of Staff of the Armed Forces, Mohammad Bagheri. Israeli Defense Minister Katz stated that missile and drone attacks against Israel and its civilians are expected in the near future. Currently, Israel has conducted five rounds of airstrikes against Iran.

Iranian state media also conveyed a statement from the Chief of Staff of the Iranian Armed Forces, stating that Israel and the U.S. will "pay a very heavy price." In response, the U.S. and Israel will face "severe retaliation." According to Saudi media citing Israeli reports, the Israeli city of Tel Aviv was attacked, including ten nuclear facilities.

According to informed sources, Trump and his senior foreign policy advisors discussed how to reach an Iran nuclear agreement without escalating the situation at Camp David last Sunday and Monday. The Iran issue was one of several foreign policy topics and meetings held during the U.S. personnel withdrawal. Government officials seemed determined to reach an agreement through diplomatic means before the Israeli airstrikes.

U.S. Middle East envoy Wittekow was originally scheduled to travel to Oman for the sixth round of negotiations, but the airstrikes have cast a shadow over the prospects for talks. Trump stated on Truth Social: "We remain committed to resolving the Iran nuclear issue through diplomatic means! My entire administration has been instructed to negotiate with Iran. They can become a great nation, but they must first completely abandon their hopes of acquiring nuclear weapons."

U.S. Senator Chris Murphy stated that the attack on Iran "is clearly intended to undermine the Trump administration's negotiations with Iran" and "risks a regional war that could have catastrophic consequences for the U.S."

This geopolitical storm has not only heightened tensions in the Middle East but has also severely impacted the global risk asset market. U.S. stock index futures have widened their declines, with Nasdaq futures down 2%, and the recent rebound in the crypto market has reverted, while safe-haven assets have surged. Spot gold prices broke through $3,400 per ounce today, rising by $55, with a daily increase of over 1.65%, and gold-related assets have collectively risen.

Data Observation: Is There a Bottom-Fishing Opportunity for ETH?

Despite the turmoil in the crypto market, ETH has quietly become the focus of capital inflow against the trend. On-chain data reveals that institutions and whales are "increasing their positions to support the market."

According to on-chain analyst Yu Jin's monitoring, a whale that had accurately profited from ETH twice has spent a total of $174.1 million to purchase 65,325 ETH today, at an average price of $2,665. They are currently in a state of unrealized loss.

Lookonchain data shows that an address possibly linked to ConsenSys also bought 2,825 ETH OTC for $7.48 million four hours ago; in the past two weeks, this address has accumulated over 160,000 ETH (valued at $421 million).

Moreover, some whales have chosen to leverage their positions. According to The Data Nerd's monitoring, an address starting with 0x109 borrowed $5 million USDT from Aave to buy 1,844 ETH (approximately $4.6 million). Subsequently, this address deposited all these ETH into Aave, and currently, it holds a total of 23,786 AETHWETH.

These actions do not seem to be impulsive "bets on a rebound." Instead, they are clear signals resonating between on-chain data and the real market: ETH is being re-embraced by large funds.

Why ETH? Why Now?

Behind ETH's counter-trend accumulation, the market is not without clues.

Since the beginning of 2025, the Ethereum Foundation has initiated rare reforms to enhance operational efficiency through "self-optimization" and team restructuring. This move has been interpreted by the market as a signal that the Ethereum ecosystem is moving towards a more mature and sustainable development.

Following MicroStrategy's inclusion of BTC in its balance sheet, ETH has also begun to become a new favorite for corporate financial reserves. The U.S. publicly traded company SharpLink Gaming recently announced that it would include ETH in its asset allocation. Additionally, according to Bloomberg, at least three Nasdaq-listed companies are evaluating ETH as a long-term investment asset, attempting to replicate MicroStrategy's "growth flywheel" model. This trend indicates that traditional finance's recognition of ETH is deepening.

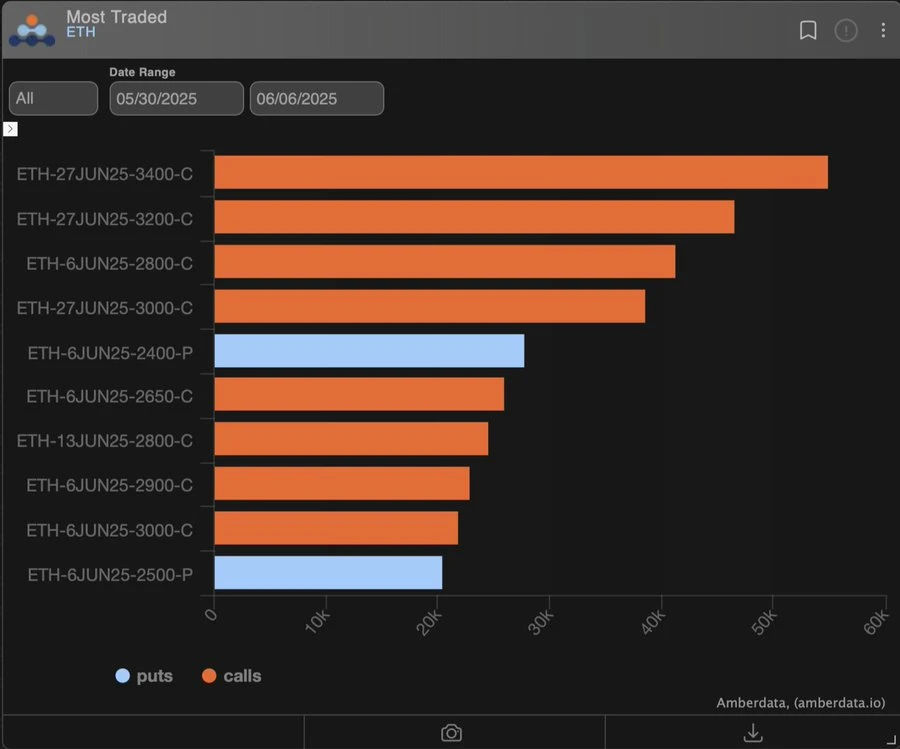

According to Deribit data, the trading volume of ETH call options has continued to rise since June, indicating an increasing market expectation for a short-term rebound in ETH.

Image source: @Amberdataio

Who is Gathering the "ETH Bull Army"?

On June 11, a wallet suspected to be associated with Cumberland withdrew 10,200 ETH (approximately $28.54 million) from Binance. This address had deposited $30 million USDC into Binance 20 hours earlier to build a position, when ETH was priced in the $2,790 range.

The loudest voice for ETH bulls in this round (especially in the Chinese-speaking community) belongs to Trend Research. This organization has been continuously bullish on ETH since it was at $1,400, currently holding 142,000 ETH. Founder Jack Yi is holding 100,000 ETH call options.

More dramatically, ETH has become a "target for hackers": in April 2023, it stole various tokens worth $23 million from the Bitrue exchange and then converted these assets into ETH, selling 4,207 ETH at a price of $3,885 for 16.345 million DAI.

On June 12, the hacker transferred 5,111.5 ETH and 16.345 million DAI to a new address, then bought 5,917.8 ETH with the 16.345 million DAI at a price of $2,762. They then laundered all 11,029.3 ETH (worth $30.46 million) through Tornado.

In other words, the $23 million worth of assets stolen by the hacker from Bitrue was ultimately converted into 12,079 ETH and laundered through Tornado, which at that time was valued at $32.36 million, an increase of $9.36 million from the initial value.

Market Focus: Where Will BTC Stop Falling? Can ETH Break Through?

Caroline Morin, co-founder of crypto derivatives liquidity provider Orbit Markets, analyzed: "The cryptocurrency market's negative reaction to Israel's attack on Iran is consistent with the performance of major risk assets. We expect BTC to find technical support around $101,000, but in the short term, geopolitical news will remain the dominant factor influencing price movements."

The situation in the Middle East remains highly uncertain, and it is difficult for risk assets to recover in the short term. However, ETH's counter-trend accumulation undoubtedly sends a signal: the market is still searching for certainty assets, and ETH may be emerging from the "altcoin resonance."

In contrast, the situation for altcoins is not optimistic. HashKey Capital investment manager Rui stated that the liquidity of altcoins has reached a freezing point. There are no buy or sell orders on the order book, and no one is taking up favorable news; new coins drop within thirty seconds of listing, and everything has turned into a slow decline.

However, there is some good news. Recently, SEC Chairman Paul Atkins stated that the SEC is developing an "innovation exemption" policy for DeFi platforms. Atkins mentioned that he has asked staff to study rule modifications to provide regulatory exemptions for on-chain financial systems, allowing entities under SEC jurisdiction to quickly launch on-chain products. If this policy is implemented, it would mean a relaxation of DeFi regulation and would directly benefit the expansion of the Ethereum ecosystem, enhancing ETH's intrinsic value.

However, this also raises a key question: Does ETH's rise signify the return of the "altcoin season"? The answer may not be optimistic. Currently, ETH's ability to attract capital relies more on large institutional support. So, if even ETH needs institutional backing, what can other altcoins rely on?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。