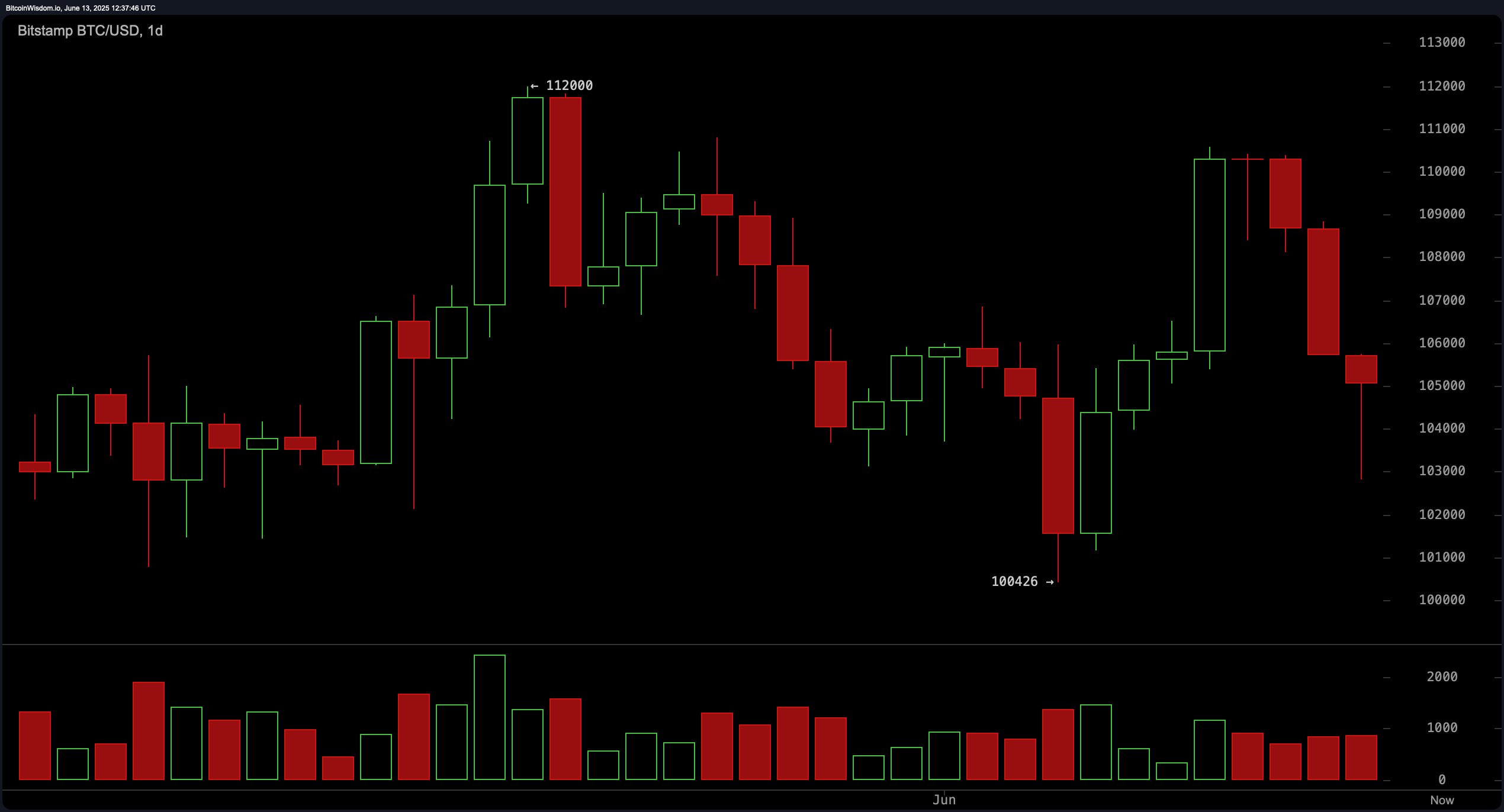

From a broader technical perspective, the daily chart reveals that bitcoin is experiencing a pronounced bearish divergence following a local high of $112,000 and a subsequent drop to $100,426. The price now appears to be setting lower highs and lower lows, a classical sign of a downward trend forming. Bearish volume increased during the recent downturn, suggesting firm selling pressure. Entry opportunities for short positions may emerge if the price retests the $108,000–$109,000 resistance zone without bullish conviction. For bullish sentiment to regain footing, a decisive move above $110,000 on increased volume would be required.

BTC/USD 1-day chart via Bitstamp on June 13, 2025.

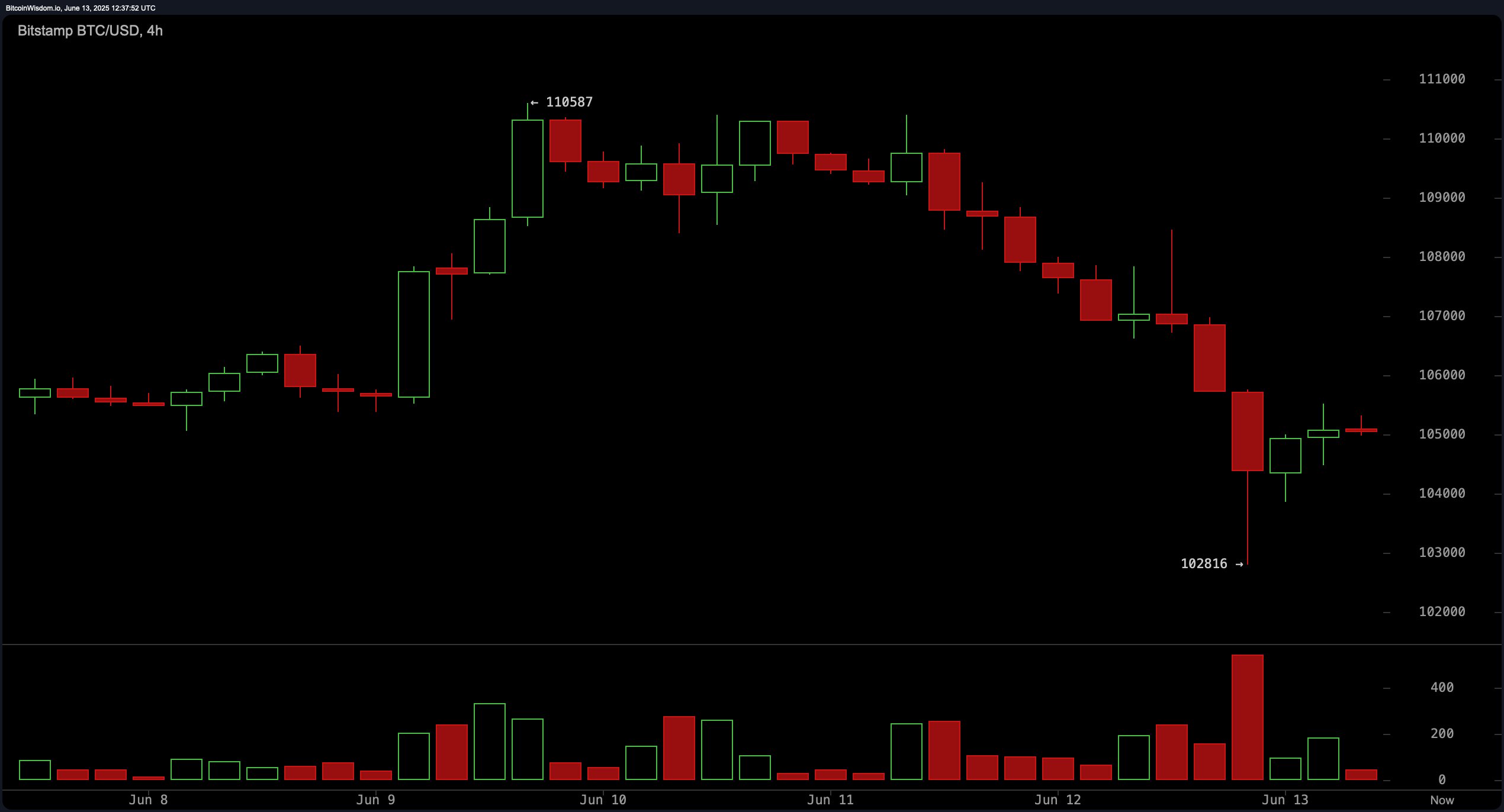

Examining the 4-hour chart, bitcoin recently broke down from $110,587 to a local low of $102,816 and is now consolidating slightly above $105,000. The breakdown was accompanied by a surge in bearish volume, hinting at a possible capitulation event. At present, bitcoin needs to reclaim $106,000 with conviction to neutralize bearish short-term pressures. Failure to do so may invite further selling, targeting $102,500. A rejection at $106,000 on low volume would signal an opportunity to short with tight risk control.

BTC/USD 4-hour chart via Bitstamp on June 13, 2025.

The 1-hour chart supports the cautionary tone, as bitcoin remains in a clear downtrend despite a modest bounce off $102,816. The muted buy-side volume on the recovery suggests weak bullish interest. A bullish scenario could emerge if the price sustains above $105,500 and forms higher lows, potentially targeting $107,000. However, a drop below $104,500 would invalidate short-term bullish setups and reopen downside risk.

BTC/USD 1-hour chart via Bitstamp on June 13, 2025.

Looking at oscillator indicators, most are flashing neutral signals, reflecting the indecisive nature of the market. The relative strength index (RSI) is at 49, Stochastic stands at 60, and the commodity channel index (CCI) reads -66—all indicating a lack of clear directional momentum. The average directional index (ADX) at 17 suggests a weak trend, while the awesome oscillator at 1,671 also shows neutrality. However, the momentum oscillator at -329 and the moving average convergence divergence (MACD) level at 995 both lean bearish, signaling that downside risk remains present.

The moving averages (MAs) offer a mixed picture. On the shorter-term horizon, both the 10-day exponential moving average (EMA) at 106,613 and the 10-day simple moving average (SMA) at 106,225 suggest a negative outlook. This bearish bias extends through the 20-day and 30-day EMAs and SMAs, except for the 30-day EMA at 105,091, which offers a lone bullish signal. In contrast, the 50-, 100-, and 200-day EMAs and SMAs are firmly bullish, reflecting a long-term upward trend that has yet to be broken. This divergence highlights the tactical tension between short-term corrections and a resilient macro uptrend.

Bull Verdict:

Despite recent corrective pressure, bitcoin retains its long-term bullish structure, underpinned by strong moving average support across the 50-, 100-, and 200-day intervals. A sustained break above $106,000 with volume would strengthen the case for a recovery toward $110,000 and beyond, particularly if momentum and MACD indicators begin to reverse their bearish bias.

Bear Verdict:

With momentum indicators turning negative and short-term moving averages aligning bearishly, bitcoin faces a heightened risk of continued downside. The inability to reclaim $106,000 resistance could lead to renewed selling pressure, pushing the price toward the $102,500–$100,000 support range, especially if volume continues to favor the bears.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。