Compiled by: Luan Peng, RootData

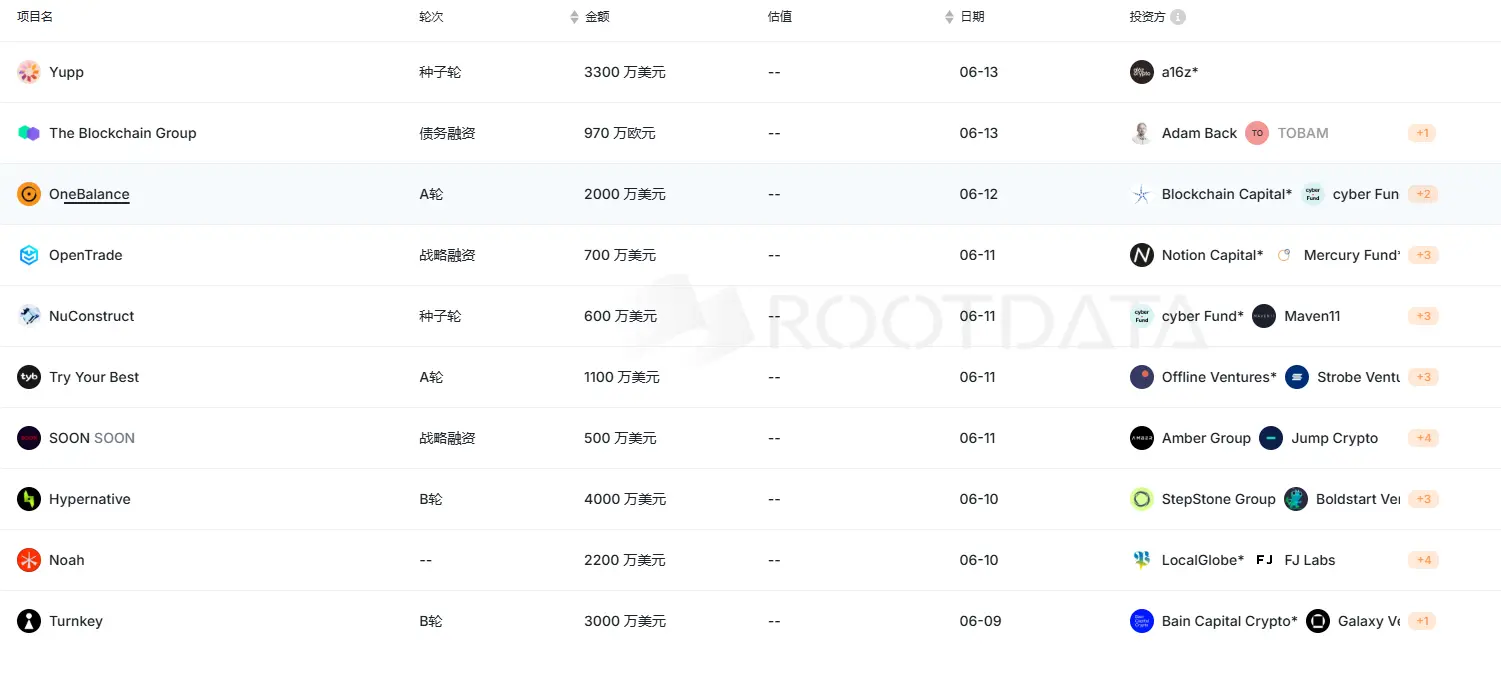

According to incomplete statistics from RootData, during the period from June 9 to June 15, 2025, there were a total of 18 public financing events in the blockchain and cryptocurrency industry, with a cumulative financing amount of approximately $195 million.

From the distribution of sectors, the projects that received financing were mainly concentrated in the infrastructure and DeFi sectors. Popular projects include the AI blockchain platform Yupp, the trusted account framework project OneBalance, the communication platform Towns Protocol, and the institutional staking platform Colossus Digital.

In addition, TOOL protocol developer nuConstruct announced the completion of a $6 million seed round financing, led by Cyber Fund, with participation from Maven11, DCG, Greenfield, Eden Block, and others.

(List of projects with financing greater than $5 million last week, data source: Rootdata)

1. Infrastructure

According to Fundz, cryptocurrency wallet provider PlutoPe has completed a Pre-Seed financing round of 5 million rupees (approximately $580,000), led by Manit Gupta. The company plans to use this funding to expand into underbanked markets and strengthen user acquisition strategies.

Founded in 2022, PlutoPe offers non-custodial cryptocurrency wallet services and plans to launch cryptocurrency debit cards and merchant applications to facilitate seamless cryptocurrency payment acceptance. The company positions itself as a new bank for cryptocurrency, aiming to provide financial empowerment for everyone, regardless of geographic location or socioeconomic status.

AI blockchain platform Yupp completes $33 million seed round financing, led by a16z founders

According to an official announcement, AI blockchain platform Yupp has completed a $33 million seed round financing, led by a16z founder Chris Dixon and a16z investment partner Elizabeth Harkavy. The Yupp platform allows users to compare various AI models for free, where users can input prompts and view responses generated by multiple AIs side by side, selecting the best result to form a "preference data package," which is used for post-training and evaluation of AI models.

The platform combines blockchain technology to achieve transparency in the evaluation process, where users can provide feedback and receive corresponding rewards, while AI developers obtain verifiable training data. The platform design makes human judgment a cyclical resource: an increase in users brings more evaluation data, which improves model quality, and high-quality models attract more user participation.

The Blockchain Group completes €9.7 million financing for Bitcoin reserve strategy

According to Bitcoin Magazine, the European listed company The Blockchain Group (ALTBG) announced the completion of €9.7 million financing to advance its Bitcoin reserve strategy. The funds were raised through a combination of equity and convertible bonds, with major investors including Adam Back, TOBAM, and Ludovic Chechin-Laurans.

TOBAM subscribed to €6 million in convertible bonds with a conversion premium of 30%; Ludovic Chechin-Laurans invested €2.4 million in Bitcoin; Adam Back converted all of his first-phase bonds into 14.9 million shares of ALTBG stock and additionally subscribed for 2.1 million shares. This financing is expected to allow the company to increase its Bitcoin holdings by approximately 80, bringing the total reserve to 1,611 Bitcoins.

According to The Block, the trusted account framework project OneBalance announced the completion of $20 million in Series A financing, led by Cyber Fund and Blockchain Capital, with participation from Mirana Ventures and L2IV, bringing its total financing to $25 million.

OneBalance is a new framework for trusted accounts, combining chain abstraction, gas abstraction, and permission management to address the fragmented Web3 user experience.

Payment company Stripe to acquire cryptocurrency wallet provider Privy

According to Bloomberg, American payment giant Stripe announced it will acquire cryptocurrency wallet infrastructure provider Privy, with the specific transaction amount undisclosed.

This follows its acquisition of stablecoin infrastructure company Bridge. Privy's embeddable wallet service has been adopted by platforms like OpenSea, simplifying the NFT purchasing process.

Stripe's CEO stated that integrating Privy with Bridge is expected to drive the development of global crypto-native financial services. The transaction is expected to be completed within weeks.

SVM Network SOON completes $5 million strategic financing, with participation from Jump Crypto

According to The Block, SVM Network Solana Optimistic Network (SOON) announced the completion of $5 million in strategic financing, with participation from Jump Crypto, Amber Group, zkSync's Nana Murugesan, Kamino Finance co-founder Mark Hull, Switchboard founder Chris Hermida, and Wormhole's Tori Cohen.

SOON plans to use these funds to provide high-performance chains and trading tools, further expand into the RWA sector, and enhance its copy trading products.

According to official news, communication platform Towns Protocol has completed an additional $3.3 million financing, led by Coinbase Ventures and echo, which was completed in April this year.

In April, Towns Protocol announced the completion of $10 million in Series B financing, led by a16z crypto, with participation from Coinbase Ventures, Benchmark, and others.

Towns Protocol is built on the Base network and aims to promote the development of Web3 social and collaboration tools. Towns hopes to create a digital town square through decentralization and Web3, where members can define boundaries, set rules, and build the world they want, with users becoming the owners of the digital town square.

Cryptocurrency wallet infrastructure company Turnkey announced the completion of $30 million in Series B financing, led by Bain Capital Crypto, with participation from Lightspeed Faction and Galaxy Ventures.

Turnkey was co-founded by former Coinbase employees Bryce Ferguson and Jack Kearney, aiming to help developers build user-friendly wallets using APIs, currently employing 35 people.

2. AI

Netcapital subsidiary Zelgor acquires crypto-native protocol Mixie

According to globenewswire, Nasdaq-listed fintech company Netcapital announced the acquisition of the crypto-native protocol Mixie, with the specific amount undisclosed.

Netcapital's portfolio company Zelgor completed this acquisition, stating that this is the first time a publicly listed company has acquired a crypto-native protocol to expand its blockchain business. Netcapital is headquartered in Boston and operates a digital capital market platform, with a stock code of NCPL and a market value of approximately $6.8 million.

3. DeFi

According to Techfundingnews, London-based fintech infrastructure platform OpenTrade has completed a strategic financing round of $7 million, led by Notion Capital and Mercury Fund, with follow-on investments from AlbionVC, a16z crypto, and CMCC Global.

OpenTrade enables fintech companies to directly embed real-world asset (RWA)-backed stablecoin yield products into existing applications, transforming stablecoins from passive payment tools into active savings tools with annual interest rates of up to 3-9%. Since its launch in early 2024, OpenTrade has processed over $175 million in transaction volume, managing client assets totaling $47 million, and achieving an average month-over-month growth of 20% over the past six months.

According to official news, the privacy execution layer Silhouette based on Hyperliquid has officially announced the completion of a $3 million Pre-Seed round financing led by RockawayX, with participation from Amber Group, HiveMind, Protagonist, No Limit Holdings, NGC Ventures, and Echo.

Silhouette is a "Shield Exchange" built on TEE, aiming to achieve privacy-protected order matching and settlement functions on Hyperliquid, supporting HyperCore and HyperEVM, and providing a new DeFi experience with various advanced strategy operations including TWAP, VWAP, and RFQ. It aims to address the issue of "excessive transparency" in on-chain trading, allowing users to trade freely without exposing their strategies.

4. CEX

Institutional staking platform Colossus Digital receives €1 million investment from SBI Ven Capital

According to Crowdfundinsider, institutional staking platform Colossus Digital has received a €1 million (approximately $1.15 million) investment from SBI Ven Capital. This investment was made through a joint fund supported by SBI Ven Capital, Sygnum Bank, and Azimut Group, and the funds will be used to launch Colossus Digital's institutional crypto platform, which will connect regulated custodians with validators for staking and governance.

Stablecoin startup Noah completes $22 million financing, led by LocalGlobe

According to Fortune, stablecoin startup Noah has completed $22 million in financing, led by European venture capital firm LocalGlobe, with other participants including Felix Capital, FJ Labs, and angel investors such as Palantir co-founder Joe Lonsdale and former Adyen CTO Alexander Matthey. Former Adyen executive Thijn Lamers has joined as co-founder and president.

5. Others

TOOL protocol developer nuConstruct completes $6 million seed round financing, led by Cyber Fund

TOOL protocol developer nuConstruct announced the completion of a $6 million seed round financing, led by Cyber Fund, with participation from Maven11, DCG, Greenfield, Eden Block, and others.

It is reported that TOOL builds a trusted execution environment through Intel TDX TEE, aiming to replace Flashbots MEV-boost and improve the user experience of on-chain transactions.

According to Fortune, the blockchain-based loyalty platform Try Your Best (TYB) has completed $11 million in Series A financing, co-led by Offline Ventures and Strobe Ventures, with participation from Coinbase Ventures, Castle Island Ventures, and Unusual Ventures.

Consumers on TYB can participate in gamified challenges to earn digital collectibles and have blockchain-based loyalty profiles that track their interactions across different brands.

Digital identity project Humanity Protocol acquires attention asset protocol Moongate

Digital identity project Humanity Protocol announced the acquisition of the attention asset protocol Moongate, with the specific acquisition amount undisclosed. This acquisition will allow Moongate to continue operating under its own brand. HumanID will integrate with Moongate's infrastructure, transforming ticketing, festivals, and conferences into PoH checkpoints.

Moongate is building an attention asset protocol for real-world activation. Moongate converts consumers' real-world assets and experiences into on-chain achievements to earn exclusive rewards, access, and community. Moongate was previously an NFT ticketing and membership platform.

Axios reported that Web3 security company Hypernative has completed $40 million in Series B financing, led by Ten Eleven Ventures and Ballistic Ventures, with participation from StepStone Group, Boldstart Ventures, and IBI Tech Fund.

Previously, Hypernative completed $16 million in Series A financing, led by Quantstamp.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。