Author: Lin Yingqi, Zhou Jiming, et al., CICC

A milestone in cryptocurrency regulation. Recently, the United States passed a stablecoin bill, becoming the first legislation in the U.S. to establish a regulatory framework for stablecoins, filling a regulatory gap in this area. Just two days later, Hong Kong also passed a similar stablecoin bill, which will help Hong Kong participate in the global digital financial center competition and consolidate its status as an international financial center. Stablecoins serve as a "bridge" between the traditional financial system and decentralized finance (DeFi). Following the European Union, both the U.S. and Hong Kong have introduced regulatory frameworks for stablecoins, marking an important step for cryptocurrencies to integrate into the mainstream financial system.

From "wild growth" to gradually moving towards regulated development. The recent stablecoin-related legislation primarily addresses risk points that have emerged in the industry, including the opacity of reserve assets, liquidity management risks, instability of algorithmic stablecoin values, money laundering and illegal financial activities, and insufficient consumer protection, establishing a series of regulations. The bills reference the regulatory frameworks for traditional financial institutions but impose stricter requirements on liquidity management. The statutory reserve requirement for banks in the U.S., EU, and Hong Kong is close to 0%, while stablecoin issuers are required to maintain a 100% reserve ratio. We believe this is mainly due to the existing mature and strict regulation of banks, where deposit liquidity is relatively stable; however, stablecoins do not pay interest and are traded more frequently. The overseas regulatory positioning of stablecoins is not as "on-chain deposits" but rather as "on-chain cash," thereby solidifying the foundation of the decentralized financial system.

How to understand the impact of stablecoins on the financial system? As of the end of May 2025, the total market capitalization of mainstream stablecoins is approximately $230 billion, which has grown more than 40 times compared to the scale at the beginning of 2020, showing rapid growth, but still relatively small compared to the mainstream financial system, only equivalent to 1% of U.S. onshore deposits. However, in terms of transaction volume, stablecoins play a significant role as an important payment method and infrastructure within the cryptocurrency system, with the annual transaction volume of mainstream stablecoins (USDT and USDC) reaching $28 trillion, surpassing the annual transaction volume of credit card organizations Visa and Mastercard. With stablecoins being incorporated into the financial regulatory framework, decentralized finance is also expected to welcome development opportunities and deepen its integration with the traditional financial system.

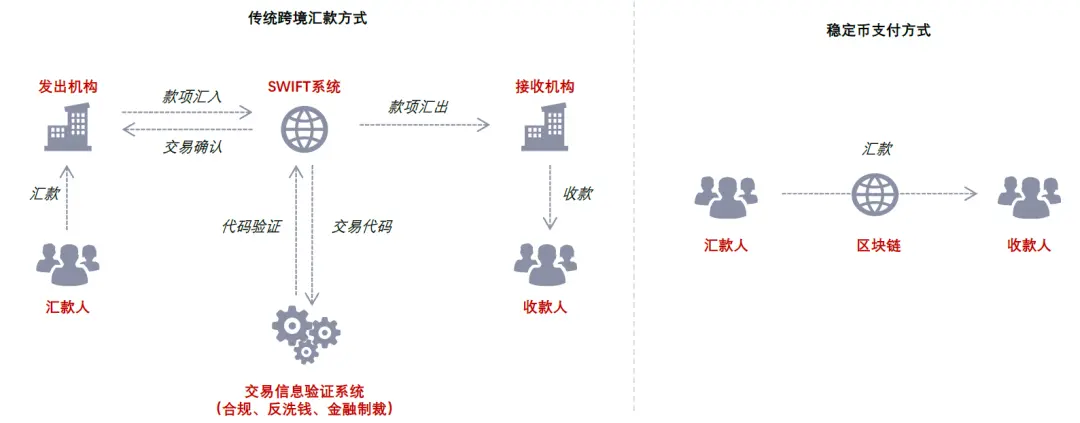

Lower cost and higher efficiency in international payment methods. According to World Bank data, as of the third quarter of 2024, the average remittance fee worldwide is 6.62%, while the United Nations' 2030 Sustainable Development Goals require this fee to be reduced to no more than 3%, with a delivery time of 1-5 business days. The efficiency of the traditional financial system is mainly affected by the need to go through multiple intermediary banks in the SWIFT network. In contrast, using stablecoins for remittances generally incurs transaction costs of less than 1%, with delivery times typically within a few minutes. However, it is worth noting that before the introduction of the bill, stablecoin payments had not been included in KYC and anti-money laundering regulations, posing challenges to cross-border capital account controls in emerging markets. Therefore, although the technical use of stablecoins for cross-border payments is highly efficient, this difference is partly due to regulatory disparities, and as regulations become standardized, the compliance costs for stablecoins may also increase. Due to potential impacts on capital accounts and monetary sovereignty in emerging markets, there are also regulatory restrictions on stablecoins in some countries and regions. In the long run, as the regulatory framework improves, we expect the market share of stablecoins in international payments to increase, although this process will still be accompanied by industry development and regulatory improvements.

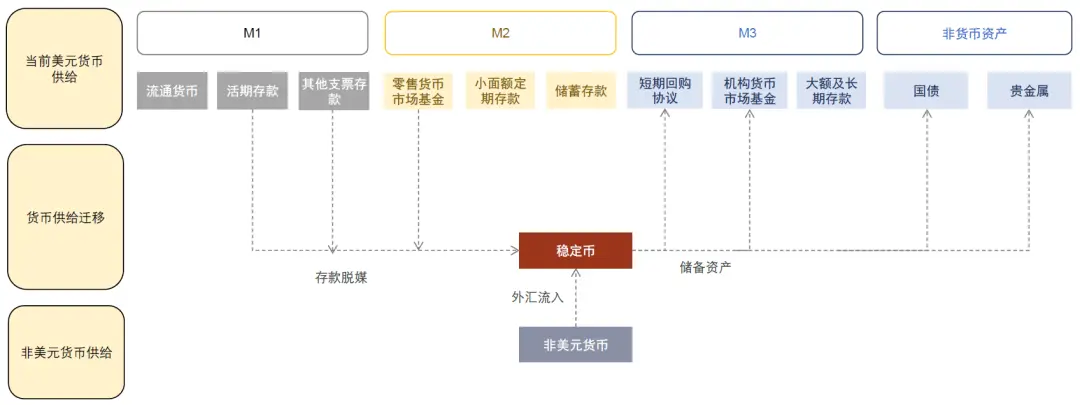

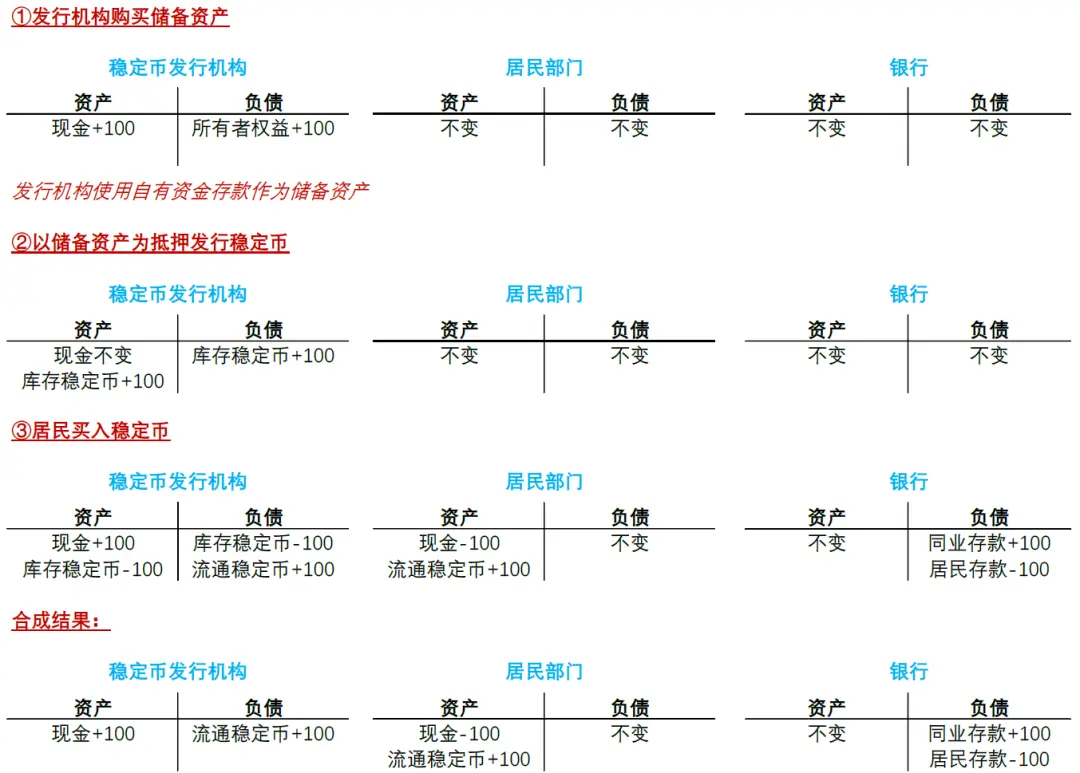

Full reserve requirements limit the money creation function: The theoretical requirement for 100% reserve assets restricts the ability of stablecoin issuers to expand credit. The process of converting deposits into stablecoins is essentially a transfer of bank deposits rather than their creation; therefore, the issuance of stablecoins theoretically does not affect the supply of U.S. dollars. However, when funds continuously flow out of deposits, it may lead to banks shrinking their balance sheets and a decrease in money supply. The process of converting other currencies into U.S. dollar stablecoins effectively results in currency exchange, but this manifests as the flow of dollars across borders or accounts, without affecting the total supply of U.S. dollars. Additionally, lending platforms that use cryptocurrencies as collateral effectively perform a credit creation function similar to banks, increasing the scale of "quasi-money" (i.e., stablecoins) within the decentralized financial system, but not affecting the supply of traditional currency. Since the application scenarios involving the cryptocurrency financial system are mainly concentrated in payment and investment, and lending is primarily based on speculative demand, the scale of cryptocurrency lending platforms is approximately $37 billion by the end of 2024, which is relatively small.

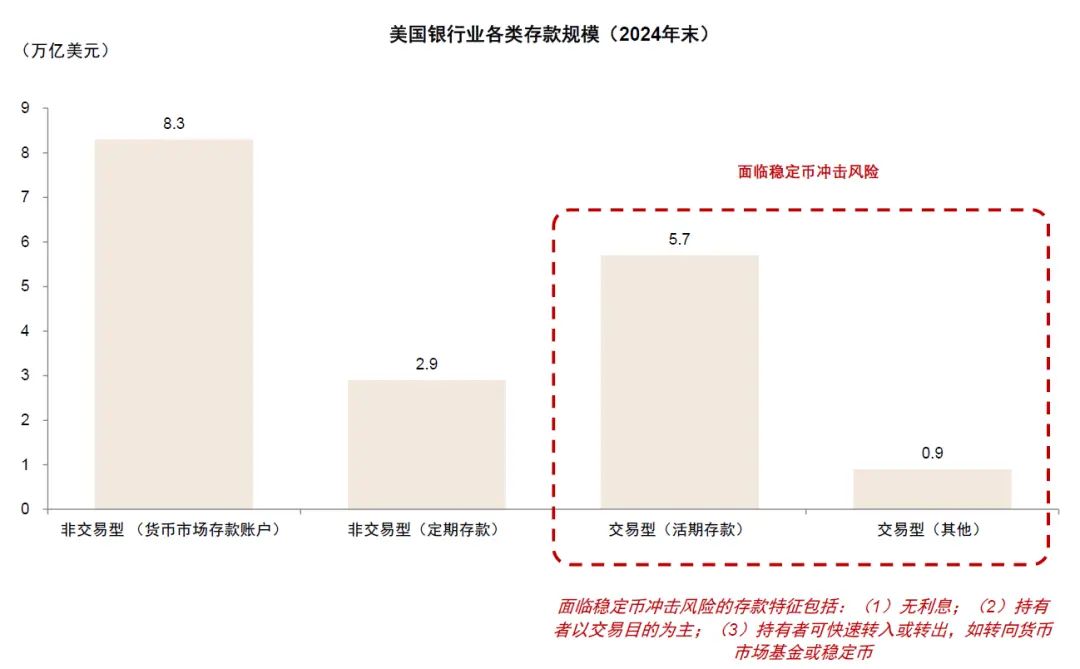

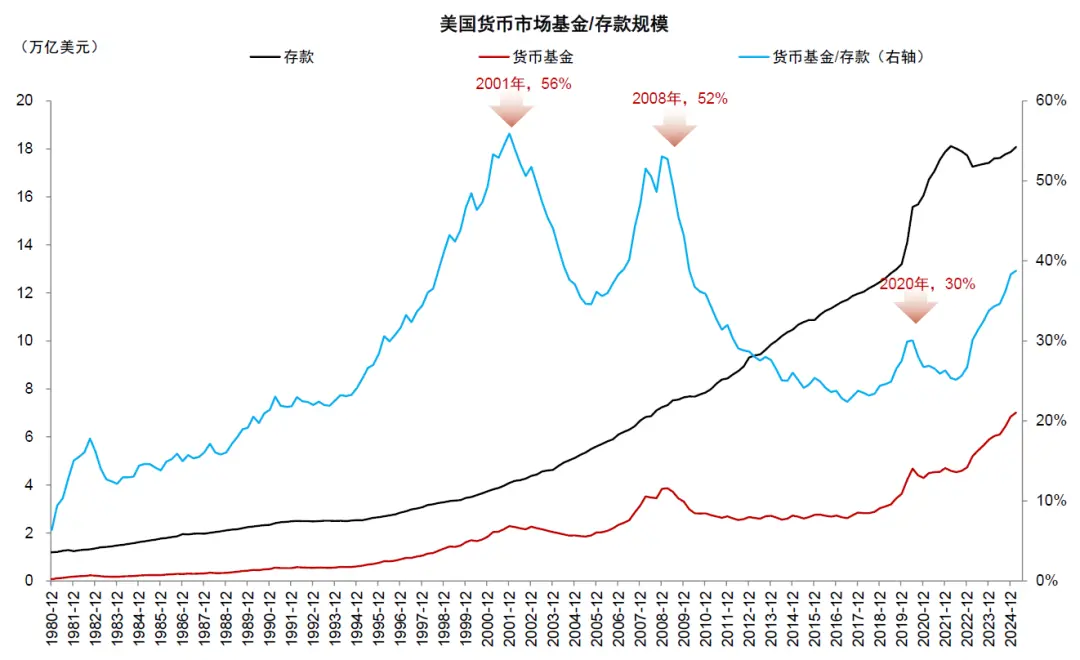

The impact of deposit disintermediation on banks. The impact of stablecoins on the banking system is primarily reflected in the financial disintermediation effect (i.e., de-intermediation). The conversion of deposits into stablecoins may lead to deposit outflows, a phenomenon similar to the impact of money market funds and high-yield bond markets on the banking system. For example, since 2022, in the high-interest-rate environment in the U.S., deposits flowing into money market funds have reached approximately $2.3 trillion, becoming one of the triggers for the Silicon Valley Bank risk event. According to statistics from the U.S. Federal Deposit Insurance Corporation, as of the end of 2024, approximately $6 trillion of the $18 trillion in deposits held by U.S. banks are classified as transaction deposits, which the U.S. Treasury considers to be at theoretical risk of outflow. However, considering that the development of stablecoins has been incorporated into the government regulatory framework, the impact on the financial system is relatively controllable. At the same time, traditional banks are also exploring ways to adapt to the trend of stablecoin development and address the challenge of deposit diversion, such as JPMorgan Chase, Société Générale, and Standard Chartered.

Undertaking government debt and influencing monetary policy transmission. As of the first quarter of 2025, issuers of USDT and USDC hold approximately $120 billion in U.S. Treasury reserves. If combined as a single "economy," they rank 19th among foreign holders of U.S. Treasury securities, between South Korea and Germany. As the market capitalization of stablecoins rises, we expect the demand for U.S. Treasuries as reserve assets to increase. However, stablecoins can primarily undertake short-term U.S. Treasuries with maturities of less than three months, and we expect their capacity to absorb long-term Treasuries to be limited. The interest rates on short-term Treasuries are influenced by central bank monetary policy, depending on factors such as inflation and employment in the real economy. For monetary policy, the purchase of Treasuries by stablecoin issuers lowers short-term interest rates, necessitating the central bank to withdraw money to hedge; in the long run, the attraction of stablecoins to deposits may lead to a trend of financial disintermediation, resulting in a shift of financing from the traditional financial system to the decentralized financial system, which may also weaken the effectiveness of central bank monetary policy.

The transmission of cryptocurrency price volatility to financial markets. From the perspective of money creation, lending activities within the decentralized financial system achieve a "quasi-money" creation function, especially through stablecoins to purchase tokenized stock assets, which directly causes funds to flow into or out of the stock market. From the perspective of market sentiment, cryptocurrency prices are highly volatile, affecting stock market expectations. Historically, there has been a certain correlation between the Nasdaq index and Bitcoin prices; in the stock market, assets related to cryptocurrencies and stablecoins, such as cryptocurrency exchanges and financial institutions, influence stock prices through changes in fundamentals.

The potential restructuring force of the international monetary order. For the U.S. dollar, the impact of stablecoins is somewhat "contradictory": on one hand, since 99% of fiat stablecoin market capitalization is pegged to the dollar, the development of stablecoins seems to reinforce the dollar's dominant position in the global financial system; on the other hand, the international context of stablecoins and cryptocurrency development is actually based on the rising risks of de-globalization trends, financial geopolitical restrictions, and weakened fiscal discipline, leading to a demand for de-dollarization in some economies. Therefore, the high correlation of stablecoins with the dollar not only reflects the dollar's dominance in the global financial landscape but also serves as a "bridge" towards a more diversified new order in the global financial system. This may explain why the recent rise and popularity of cryptocurrency prices have coincided with the intensification of de-globalization trends. Furthermore, the recent actions by the EU and Hong Kong have opened up space for the issuance of non-dollar stablecoins, competing with the dollar's dominant position in the stablecoin sector. In the long run, whether the dollar's status continues to be reinforced under the guidance of the new regulatory framework for stablecoins or faces challenges from other currencies and cryptocurrencies remains to be observed as the industry develops. For emerging economies, since stablecoins are competitive with local currencies, if local residents and enterprises use stablecoins for settlement, it will lead to the local currency effectively being exchanged for dollars, resulting in currency depreciation and inflation. Therefore, for financial security reasons, several economies have implemented restrictions on the use of stablecoins.

Implications for currency internationalization. For the Hong Kong dollar, regulating the issuance of stablecoins, especially Hong Kong dollar stablecoins, will help enhance the influence of the Hong Kong dollar in cross-border payments and cryptocurrency sectors, strengthening the international competitiveness of Hong Kong's financial industry and the Hong Kong dollar, thereby consolidating Hong Kong's status as an international financial center. At the same time, Hong Kong can leverage its financial market advantages and the institutional innovations brought by the stablecoin bill to provide a "testing ground" for the internationalization of other currencies. The bill allows for the issuance of non-dollar stablecoins, which can expand the use of non-dollar currencies in international payments, settlements, and investment scenarios, accelerating the process of internationalization. In summary, the Hong Kong stablecoin bill has far-reaching implications for currency internationalization, but this process still requires continuous attention to financial stability risks and timely optimization and adjustment of relevant policies.

Risks

Risks in the development of the cryptocurrency industry, the impact of stablecoins on the traditional financial system exceeding expectations, and regulatory policies advancing slower than expected.

Main Text

Stablecoin Bill: A Milestone in Cryptocurrency Regulation

The EU, U.S., and Hong Kong have successively established regulatory frameworks for stablecoins

Stablecoins are a type of cryptocurrency that is pegged to specific assets (usually fiat currencies), serving as a bridge between decentralized financial systems (DeFi) and traditional financial systems, and are also an important infrastructure for decentralized finance (DeFi). Recently, the United States passed a stablecoin bill, becoming the first legislation in the U.S. to establish a regulatory framework for stablecoins, filling a regulatory gap in this area. Just two days later, Hong Kong also passed a similar stablecoin bill, which will help Hong Kong participate in the global digital financial center competition and consolidate its status as an international financial center. Stablecoins serve as a "bridge" between the traditional financial system and decentralized finance (DeFi). Following the European Union, both the U.S. and Hong Kong have introduced regulatory frameworks for stablecoins, marking an important step for cryptocurrencies to integrate into the mainstream financial system.

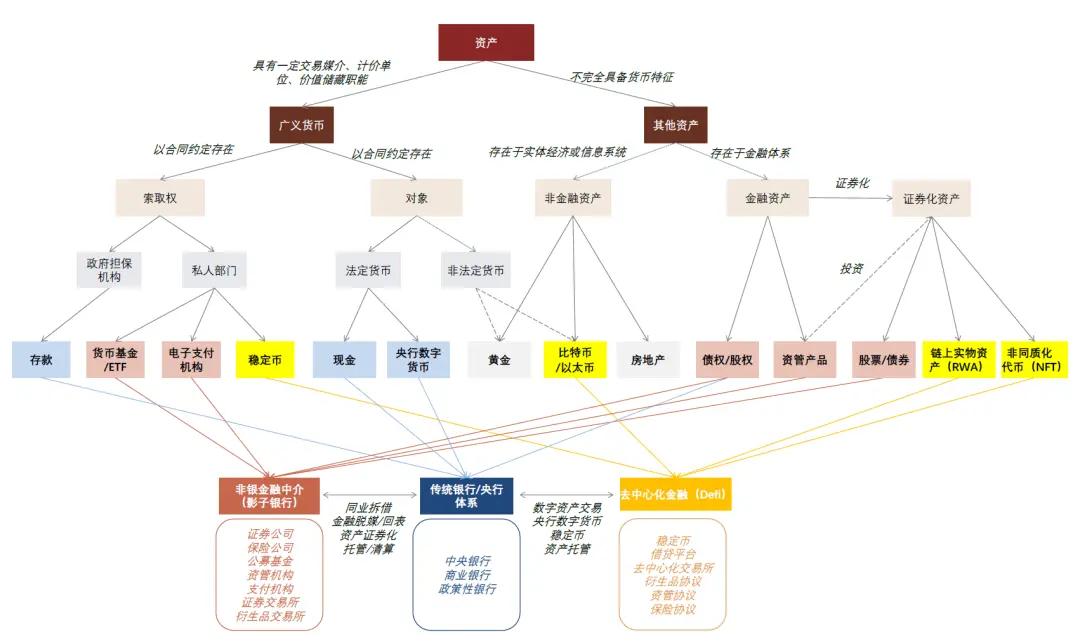

Chart 1: Cryptocurrency Assets Begin to Exhibit Characteristics of Currency and Financial Systems

Data Source: CICC Research Department

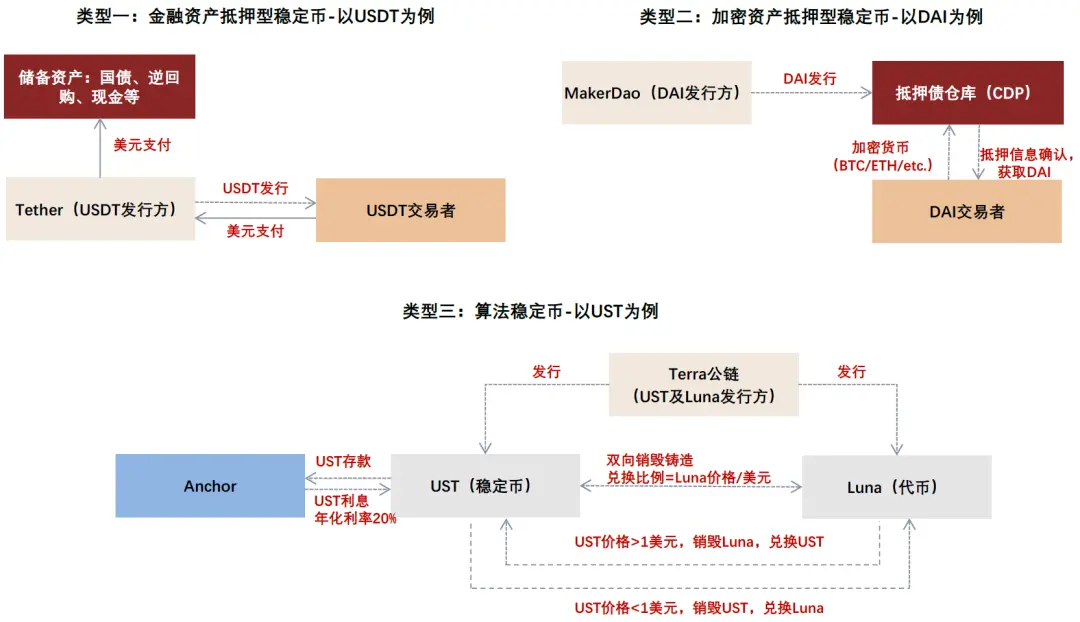

Chart 2: Principles of Mainstream Stablecoins

Data Source: Tether, MakerDao, CICC Research Department

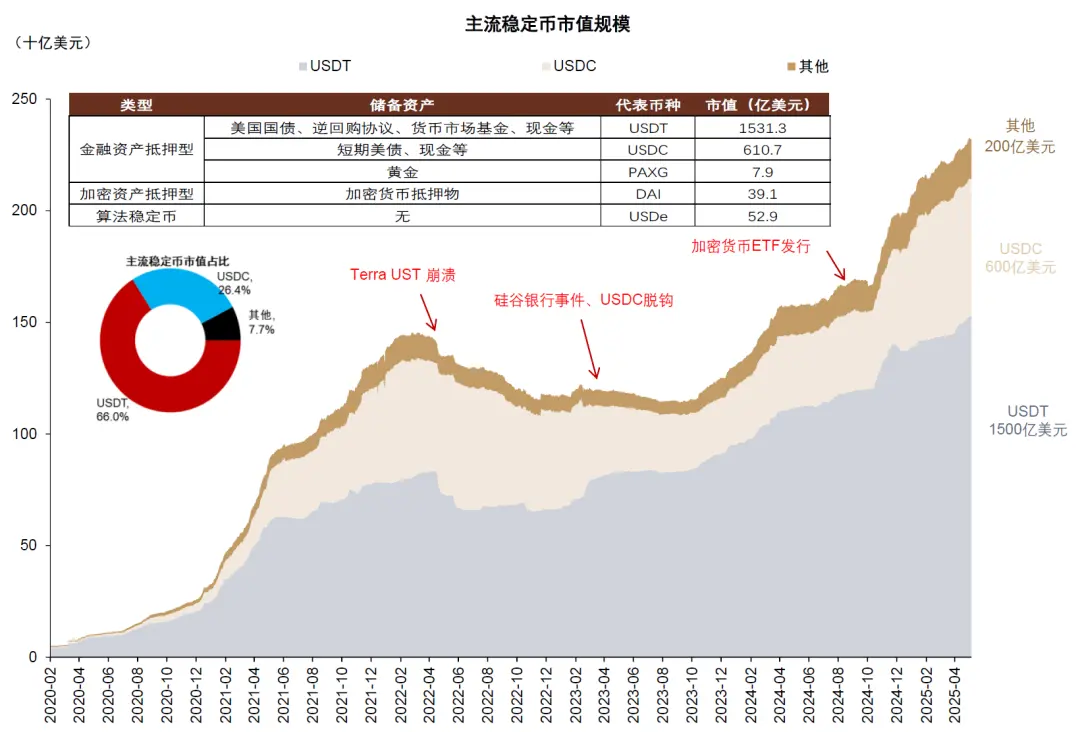

Chart 3: Dollar Stablecoins Based on Highly Liquid Asset Collateral Dominate

Note: Data as of May 31, 2025

Data Source: CoinGecko, CICC Research Department

From "Wild Growth" to Gradually Moving Towards Regulated Development

Previously, the stablecoin sector experienced several significant risks and regulatory events, including the collapse of TerraUSD (UST) in 2022, regulatory restrictions on Tether (USDT) in the EU due to unclear underlying assets in 2024, and the New York financial regulator's requirement for Binance USD (BUSD) to stop minting in 2023. The recent stablecoin-related legislation in the United States and Hong Kong primarily addresses the risk points that have emerged in the industry, including the opacity of reserve assets, liquidity management risks, instability of algorithmic stablecoin values, money laundering and illegal financial activities, and insufficient consumer protection. A series of regulations have been established, including:

Liquidity: Stablecoin reserve assets must be 100% pegged to fiat currencies or highly liquid assets, including cash, demand deposits, and short-term U.S. Treasury bills. Reserve assets need to be isolated from operating funds to prevent misappropriation.

Entry Qualifications: Issuing institutions must obtain regulatory licenses and establish minimum capital entry thresholds.

Anti-Money Laundering: Stablecoins must be incorporated into existing anti-money laundering regulatory frameworks, with customer identity verification requirements set.

Consumer Protection: It must be ensured that users can redeem at face value, and in the event of bankruptcy, customer funds enjoy priority repayment rights.

Interest Prohibition: It is explicitly prohibited for stablecoins to pay interest, to reduce the impact on the traditional financial system.

In fact, the above stablecoin legislation has referenced the regulatory frameworks for traditional financial institutions, setting similar requirements regarding licenses, capital, liquidity management, anti-money laundering, and consumer protection, but with stricter liquidity management. The statutory reserve requirement for banks in the U.S., EU, and Hong Kong is close to 0%, while stablecoin issuers are required to maintain a 100% reserve ratio. We believe this is mainly due to the existing mature and strict regulation of banks, where customer deposits generally arise from the savings and operational needs of residents and enterprises, and banks also pay interest on deposits, resulting in relatively stable deposit liquidity. However, stablecoins are required not to pay interest, and their trading is more frequent, leading to unstable liquidity conditions. Additionally, as stablecoins serve as important infrastructure for decentralized finance (DeFi) pegged to fiat currencies like the U.S. dollar, they require stronger reserve assets as underlying support. In summary, overseas regulators position stablecoins not as "on-chain deposits" but as "on-chain cash" (despite the issuers being commercial entities, which distinguishes them from central bank digital currencies), thereby solidifying the foundation of the decentralized financial system.

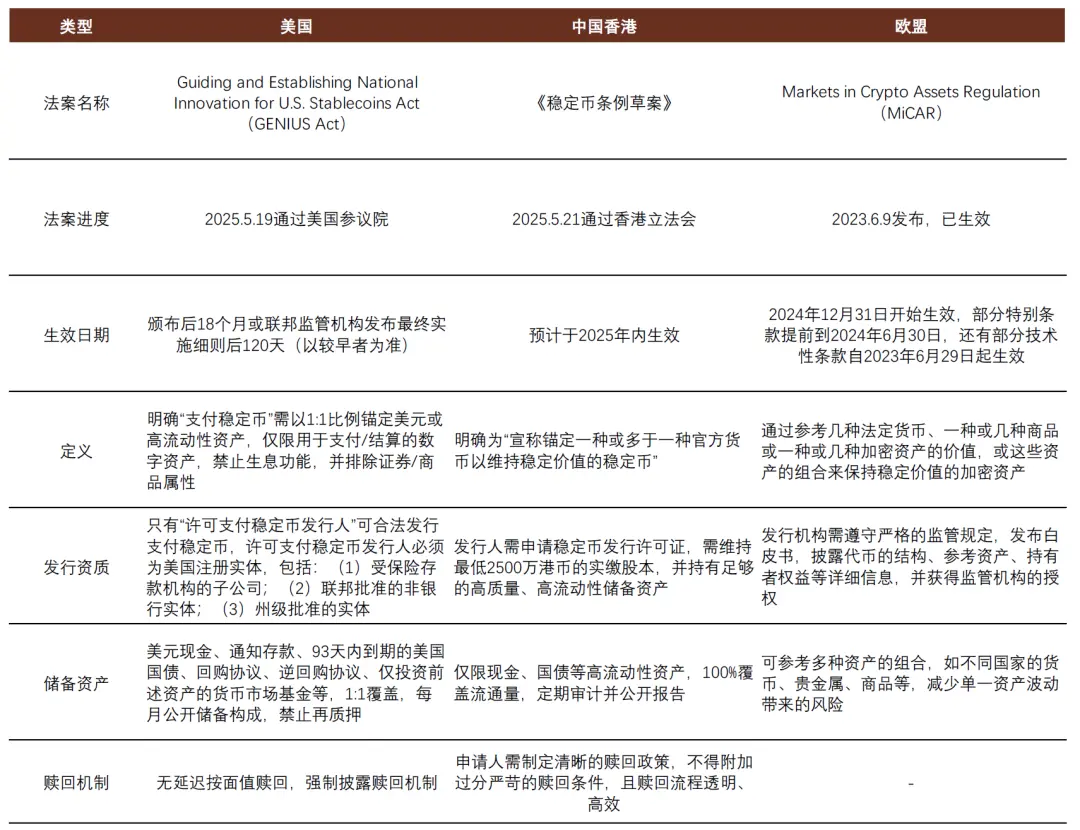

Chart 4: The Regulatory Framework for Stablecoins is Becoming More Complete

Data Source: U.S. Senate, Hong Kong Monetary Authority, European Parliament, CICC Research Department

How to Understand the Impact of Stablecoins on the Financial System?

In terms of scale, as of the end of May 2025, the total market capitalization of mainstream stablecoins is approximately $230 billion, which has grown more than 40 times compared to the scale at the beginning of 2020, showing rapid growth. However, it remains relatively small compared to the mainstream financial system, such as U.S. dollar deposits (approximately $19 trillion in onshore deposits) and U.S. Treasuries (approximately $37 trillion), and is also smaller than mainstream cryptocurrencies (Bitcoin's market capitalization is approximately $2 trillion). However, in terms of transaction volume, stablecoins play a significant role as an important payment method and infrastructure within the cryptocurrency system. According to institutional estimates, the annual transaction volume of mainstream stablecoins (USDT and USDC) reaches $28 trillion, surpassing the annual transaction volume of credit card organizations Visa and Mastercard (approximately $26 trillion, although the high-frequency trading of stablecoins may make this data not entirely comparable); this figure also exceeds the transaction volume of Bitcoin in 2024 (approximately $19 trillion). As stablecoins are incorporated into the financial regulatory framework, decentralized finance is expected to welcome development opportunities and deepen its integration with the traditional financial system, also bringing new challenges and risks to the global financial system.

1. Lower Cost and Higher Efficiency in International Payment Methods

According to World Bank data, as of the third quarter of 2024, the average remittance fee worldwide is 6.62%, while the United Nations' 2030 Sustainable Development Goals require this fee to be reduced to no more than 3%, with a delivery time of 1-5 business days. The efficiency of the traditional financial system is mainly affected by the need to go through multiple intermediary banks in the SWIFT network. In contrast, using stablecoins for remittances generally incurs transaction costs of less than 1%, with delivery times typically within a few minutes. However, it is worth noting that before the introduction of the bill, stablecoin payments had not been included in KYC and anti-money laundering regulations, posing challenges to cross-border capital account controls in emerging markets. Therefore, although the technical use of stablecoins for cross-border payments is highly efficient, this difference is partly due to regulatory disparities, and as regulations become standardized, the compliance costs for stablecoins may also increase. Due to potential impacts on capital accounts and monetary sovereignty in emerging markets, there are also regulatory restrictions on stablecoins in some countries and regions. In the long run, as the regulatory framework improves, we expect the market share of stablecoins in international payments to increase, although this process will still be accompanied by industry development and regulatory improvements.

Chart 5: Comparison of Traditional Cross-Border Payment and Stablecoin Payment Models

Data Source: SWIFT, CICC Research Department

2. Full Reserve Requirements Limit Money Creation Function

The theoretical requirement for 100% reserve assets restricts the ability of stablecoin issuers to expand credit. The process of converting deposits into stablecoins is essentially a transfer of bank deposits rather than their creation; therefore, the issuance of stablecoins theoretically does not affect the supply of U.S. dollars, specifically:

If reserve assets are used for deposits, the money supply remains unchanged, as resident deposits are converted into an equivalent amount of stablecoins and interbank deposits. If reserve assets are used to purchase U.S. Treasuries held by residents, enterprises, and non-bank institutions, the money supply remains unchanged, as market-circulating Treasuries are converted into stablecoins. However, when funds continuously flow out of deposits, it may lead to banks shrinking their balance sheets and a decrease in money supply.

U.S. dollar stablecoins have an attractive effect on other currencies; the process of converting other currencies into U.S. dollar stablecoins effectively results in currency exchange, but this manifests as the flow of dollars across borders or accounts, without affecting the total supply of U.S. dollars.

Lending platforms that use cryptocurrencies as collateral effectively perform a credit creation function similar to banks, increasing the scale of "quasi-money" (i.e., stablecoins) within the decentralized financial system, but not affecting the supply of traditional currency. Since the application scenarios involving the cryptocurrency financial system are mainly concentrated in payment and investment, and lending scenarios are relatively few, the scale of cryptocurrency lending platforms is approximately $37 billion by the end of 2024, which is relatively small.

Chart 6: The Mechanism of Stablecoins' Impact on Traditional Money Supply

Data Source: U.S. Department of the Treasury, CICC Research Department

Chart 7: The Impact of Stablecoin Issuance on Money Supply

Data Source: CICC Research Department

3. The Impact of Deposit Disintermediation on Banks

The impact of stablecoins on the banking system is primarily reflected in the financial disintermediation effect (i.e., de-intermediation). The conversion of deposits into stablecoins may lead to deposit outflows. Although stablecoin issuers purchasing Treasuries, reverse repos, and other assets may cause deposits to flow back to banks, in the long run, this will lead to banks' liabilities being replaced from savings deposits to interbank liabilities, or cause banks to reduce their bond holdings, resulting in pressure on bank interest margins and erosion of profits. This effect is similar to the impact of money market funds and high-yield bond markets on the banking system. For example, since 2022, in the high-interest-rate environment in the U.S., deposits flowing into money market funds have reached approximately $2.3 trillion, becoming one of the triggers for the Silicon Valley Bank risk event.

From the perspective of the stablecoin bill, U.S. regulatory legislation explicitly requires stablecoins not to pay interest, which can somewhat reduce the attraction of stablecoins to deposits; the vast majority of deposits are used for daily fund clearing, which has a degree of stickiness. Although the scale of stablecoins is growing rapidly, it is still only about 1% of the scale of bank deposits in the U.S. Assuming the scale of stablecoins maintains an annual growth rate of 15% over the next three years, by 2030, the attraction to deposits would be approximately $200-300 billion, accounting for about 1% of deposits, which would have a limited impact. However, in the long run, there are two risks:

The development speed of stablecoins exceeds expectations. For example, U.S. Treasury Secretary Yellen cited market predictions that the scale of stablecoins will rise from the current $200-300 billion to $2 trillion by 2028, implying an eightfold growth rate within three years, significantly higher than the recent annual growth rate of 15%.

Stablecoins may become more convenient to obtain investment returns indirectly, such as investing in tokenized money market funds (Tokenized MMF), real-world assets (RWA) that can generate returns, staking derivatives, etc., making non-interest-paying stablecoins yield returns, thus increasing their attractiveness to deposits.

According to statistics from the U.S. Federal Deposit Insurance Corporation, as of the end of 2024, approximately $6 trillion of the $18 trillion in deposits held by U.S. banks are classified as transaction deposits, which the U.S. Treasury considers to be theoretically at risk of outflow. However, we believe that considering the development of stablecoins has been incorporated into the government regulatory framework, the impact on the financial system is also included in the policy decision-making considerations, making the impact relatively controllable.

At the same time, traditional banks are also exploring ways to adapt to the trend of stablecoin development and address the challenge of deposit diversion. For example, JPMorgan Chase has launched JPM Coin to achieve the tokenization of the U.S. dollar, serving institutional clients for cross-border payments and securities trading; Société Générale has launched USD CoinVertible and EUR CoinVertible stablecoins for institutions and investors; Standard Chartered has established a joint venture to issue a Hong Kong dollar stablecoin and applied for a license from the Hong Kong Monetary Authority, among others.

Chart 8: Deposits at Risk of Outflow are Mainly Non-Interest-Bearing Transaction Deposits

Data Source: FDIC, CICC Research Department

Chart 9: The Phenomenon of Deposit Disintermediation in the U.S. Intensified in a High-Interest Rate Environment

Data Source: Federal Reserve, FDIC, CICC Research Department

4. Absorbing Government Debt and Influencing Monetary Policy Transmission

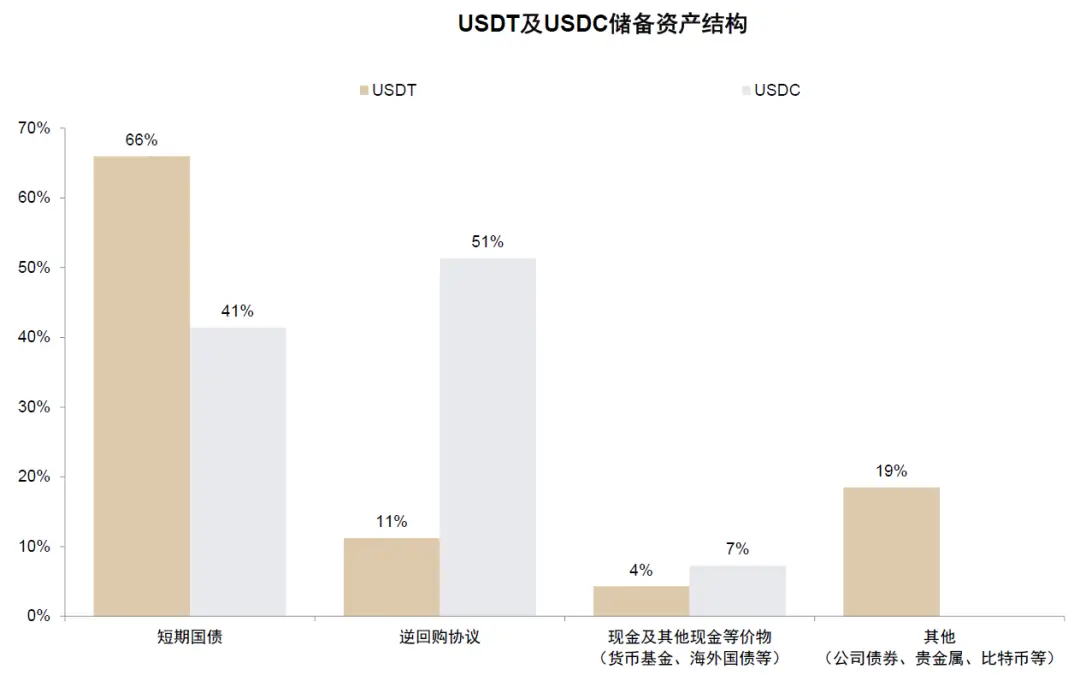

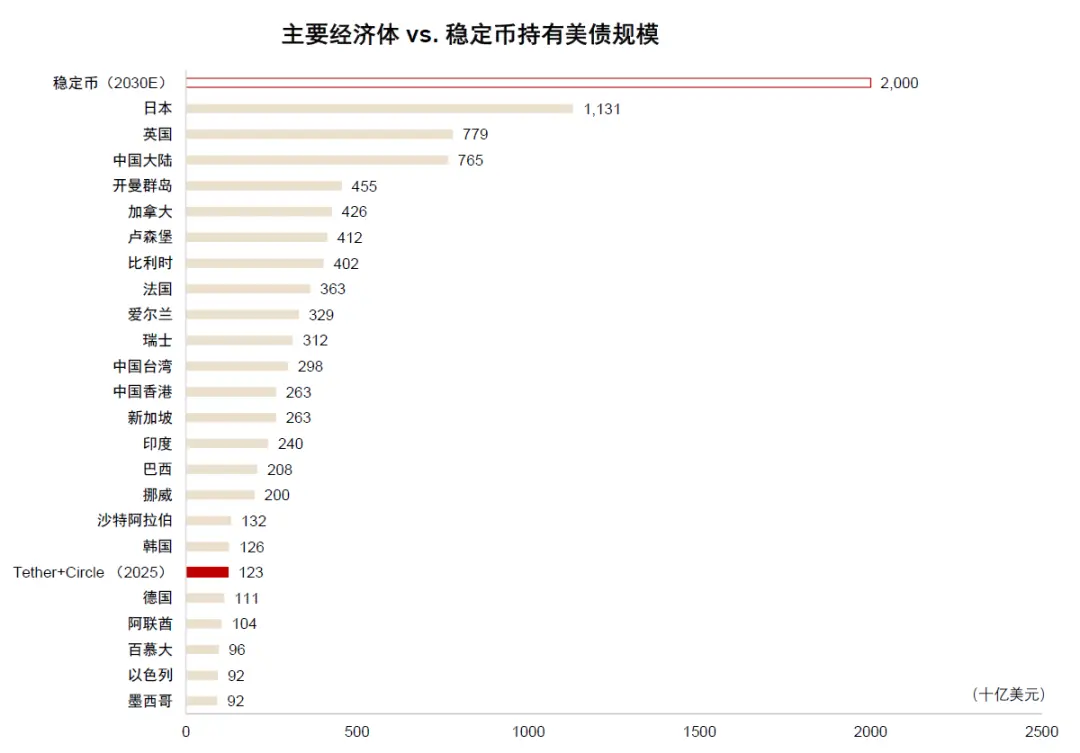

Stablecoin issuers have become buyers of U.S. Treasuries. The reserve assets of USDT and USDC are primarily composed of short-term U.S. Treasuries and reverse repurchase agreements, with short-term U.S. Treasuries accounting for 66% and 41% of the reserve assets of USDT and USDC, respectively. As of the first quarter of 2025, the issuers of USDT and USDC held a total of approximately $120 billion in U.S. Treasury reserves. If combined as a single "economy," they would rank 19th among foreign holders of U.S. Treasuries, positioned between South Korea and Germany.

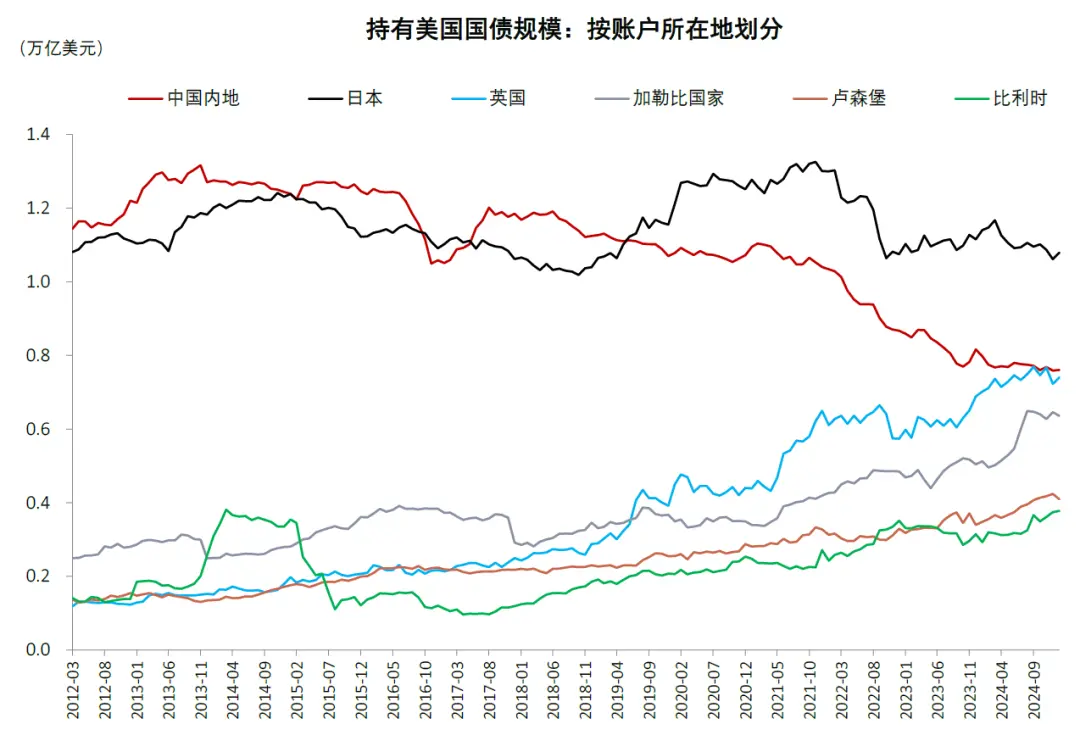

How to understand the role of stablecoins in absorbing government debt? As the market capitalization of stablecoins rises, we expect the demand for U.S. Treasuries as reserve assets to increase. If we follow the market forecast cited by U.S. Treasury Secretary Yellen, which predicts that the scale of stablecoins will rise from the current $200-300 billion to $2 trillion by 2028, this would surpass Japan, the current largest holder of U.S. Treasuries. However, it is important to note that stablecoins can primarily absorb short-term U.S. Treasuries with maturities of less than three months. We expect their capacity to absorb long-term U.S. Treasuries to be limited, as short-term Treasury rates are influenced by central bank monetary policy, which depends on real economic factors such as inflation and employment. The central bank can hedge by reducing or increasing the supply of base money.

Impact on monetary policy transmission. As mentioned earlier, when stablecoin issuers buy U.S. Treasuries, they lower short-term interest rates, prompting the central bank to withdraw money to hedge; in the long run, the attraction of stablecoins to deposits may lead to financial disintermediation, resulting in a shift of financing from the traditional financial system to the decentralized financial system, which may also weaken the effectiveness of central bank monetary policy.

Chart 10: USDT and USDC Reserve Assets are Primarily Composed of Short-Term Treasuries and Reverse Repos

Note: As of the first quarter of 2025

Data Source: Tether, Circle, CICC Research Department

Chart 11: In the Long Term, Stablecoins May Absorb Some Demand for U.S. Treasuries

Note: The scale of U.S. Treasuries held by stablecoins in 2030 is based on market forecasts cited by U.S. Treasury Secretary Yellen

Data Source: U.S. Department of the Treasury, Tether, Circle, CICC Research Department

Chart 12: In Recent Years, Mainland China's Holdings of U.S. Treasuries Have Decreased

Data Source: U.S. Department of the Treasury, CICC Research Department

5. The Impact of Cryptocurrency Price Volatility on Financial Markets

The impact of stablecoins on financial markets mainly manifests in three aspects:

From the perspective of money creation, as mentioned earlier, lending activities within the decentralized financial system achieve a "quasi-money" creation function, especially through stablecoins purchasing tokenized equity assets, which directly channels funds into or out of the stock market;

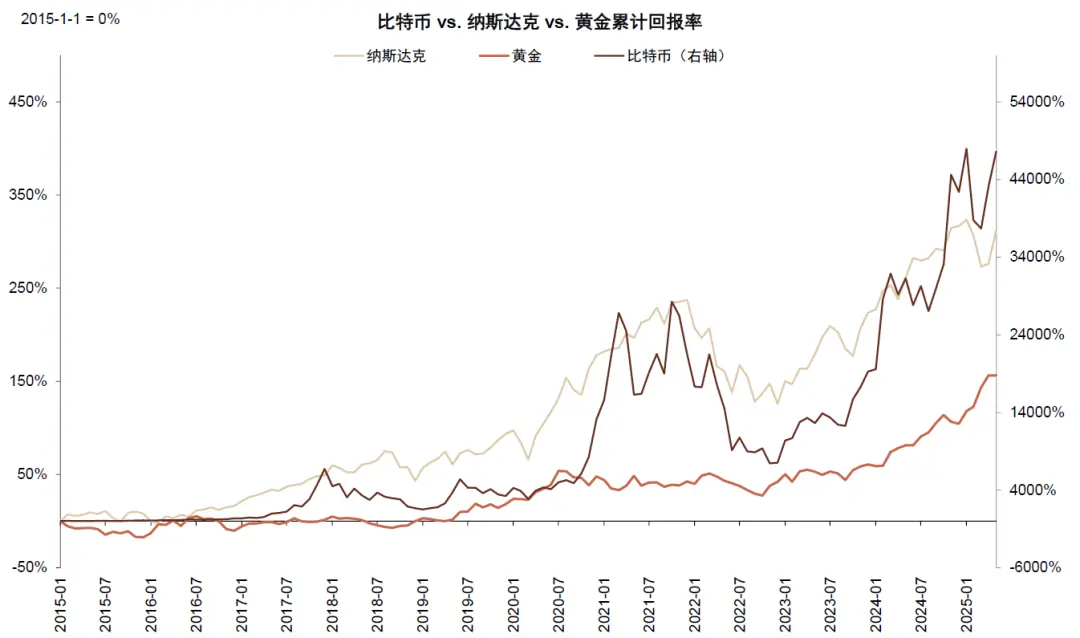

From the perspective of market sentiment, cryptocurrency prices are highly volatile, affecting stock market expectations. Historically, there has been a certain correlation between the Nasdaq index and Bitcoin prices;

In the stock market, assets related to cryptocurrencies and stablecoins, such as cryptocurrency exchanges and financial institutions, influence stock prices through changes in fundamentals.

Chart 13: There is a Correlation Between Cryptocurrency Prices and the Nasdaq Index

Data Source: Bloomberg, CICC Research Department

6. Potential Reconstructive Force for International Monetary Order

For the U.S. dollar, the impact of stablecoins is somewhat "contradictory":

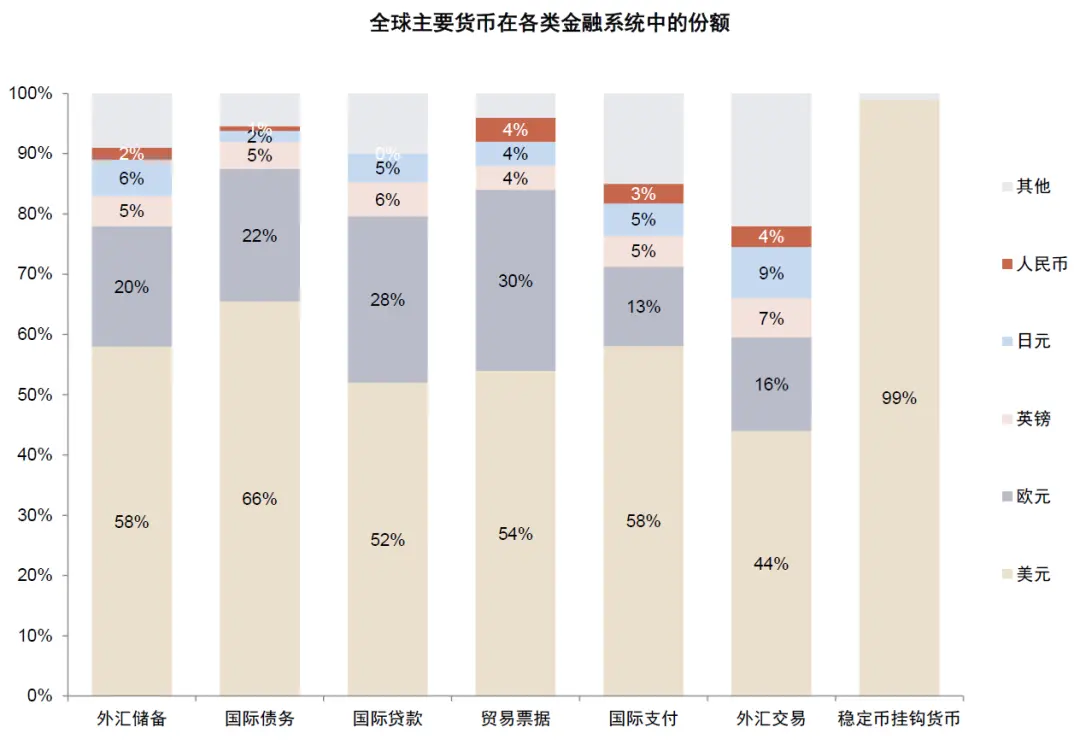

On one hand, since 99% of fiat stablecoin market capitalizations are pegged to the U.S. dollar, the development of stablecoins seems to reinforce the dollar's dominant position in the global financial system;

On the other hand, the international context of stablecoins and cryptocurrency development is actually based on the rising risks of geopolitical restrictions and weakened fiscal discipline under the trend of de-globalization, along with the demand for de-dollarization in some economies.

Therefore, the high correlation of stablecoins with the U.S. dollar not only reflects the dollar's dominance in the global financial landscape but also serves as a "bridge" towards a more diversified new order in the global financial system. This may explain why the recent rise and popularity of cryptocurrency prices have coincided with the intensification of de-globalization trends. Additionally, the recent EU and Hong Kong regulations have opened up space for the issuance of non-U.S. dollar stablecoins, competing with the dollar's dominant position in the stablecoin sector. In the long run, whether the dollar's status continues to be reinforced under the new regulatory framework for stablecoins or faces challenges from other currencies and cryptocurrencies remains to be observed as the industry develops.

For emerging economies, stablecoins pose a competitive threat to local currencies. If local residents and enterprises use stablecoins for settlement, it would effectively convert local currencies into U.S. dollars, leading to currency depreciation and inflation. Therefore, for financial security reasons, several economies have implemented restrictions on the use of stablecoins.

Chart 14: The U.S. Dollar Dominates Major Financial Systems

Note: Data as of the end of 2024

Data Source: Brookings, U.S. Department of the Treasury, CICC Research Department

7. Implications for Currency Internationalization

For the Hong Kong dollar, regulating the issuance of stablecoins, particularly Hong Kong dollar stablecoins, can help enhance the influence of the Hong Kong dollar in cross-border payments and cryptocurrency sectors, strengthening the international competitiveness of Hong Kong's financial industry and the Hong Kong dollar, thereby solidifying Hong Kong's status as an international financial center. At the same time, Hong Kong can leverage its financial market advantages and the institutional innovations brought by the stablecoin bill to provide a "testing ground" for the internationalization of other currencies. The bill allows for the issuance of non-U.S. dollar stablecoins, which can expand the use of non-U.S. dollar currencies in international payments, settlements, and investment scenarios, accelerating the process of internationalization. In summary, the Hong Kong stablecoin bill has profound implications for currency internationalization, but this process still requires continuous attention to financial stability risks and timely optimization of related policies.

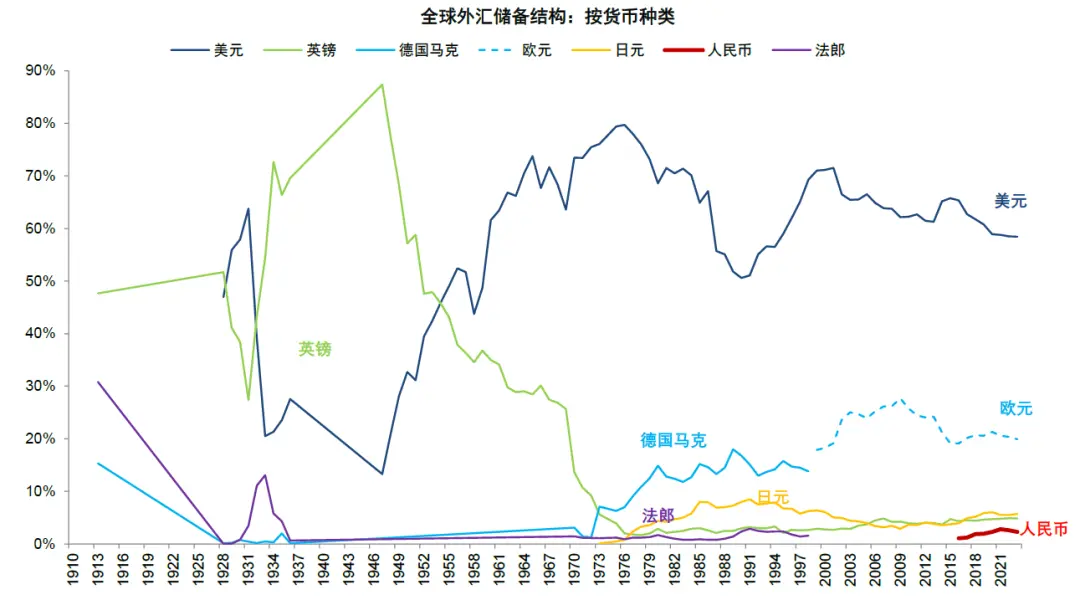

Chart 15: The Renminbi Has Room for Improvement in Global Foreign Exchange Reserves

Data Source: IMF, Barry Eichengreen, CICC Research Department

Risk Warning

Development Risks in the Cryptocurrency Industry: The regulation of the cryptocurrency industry is still in its infancy, and there remains significant uncertainty in industry development. Potential risks include the opacity of reserve assets, liquidity management risks, instability of algorithmic stablecoin values, money laundering and illegal financial activities, and insufficient consumer protection.

Impact of Stablecoins on the Traditional Financial System Exceeding Expectations: The rapid development of the cryptocurrency industry may lead to stablecoins having an unexpected impact on the traditional financial system, affecting the business development of traditional financial institutions.

Regulatory Policy Advancement Not Meeting Expectations: The current regulatory framework for stablecoins still needs improvement, and there is a time lag between the introduction and implementation of regulatory policies, which poses a risk of policy advancement not meeting expectations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。