These new stocks will leave short sellers with devastating losses.

Author: Arthur Hayes

Translation: Deep Tide TechFlow

(Any opinions expressed here are solely those of the author and should not be the basis for investment decisions, nor should they be interpreted as recommendations or advice for investment trading.)

Given that Circle CEO Jeremy Allaire seems to have no choice but to take his position under the "instruction" of Coinbase CEO Brian Armstrong (the author here is being sarcastic, implying a lack of independence and control by Coinbase), I hope this article can help those investors trading any assets related to "stablecoins" in the public stock market avoid incurring significant risks and losses when promoters impose worthless assets on unsuspecting retail investors. In this order, I will begin discussing the past, present, and future of the stablecoin market.

In the capital markets, professional cryptocurrency traders are somewhat unique. To survive and thrive, they need to have a deep understanding of how funds flow within the global fiat banking system. In contrast, stock investors or forex speculators do not need to understand how stocks or currencies are settled and transferred, as the brokers they must use provide this service quietly in the background.

First of all, buying your first Bitcoin is not easy; what the best and safest option is not clear. For most people, the first step (at least when I got into cryptocurrency in 2013) was to buy Bitcoin by directly sending fiat bank wire to another person or paying in cash. Then you would upgrade to trading on exchanges that provide a bilateral market, where you can trade larger amounts of Bitcoin at lower fees. However, depositing your fiat into exchanges in the past/present has not been easy or straightforward. Many exchanges lack solid banking relationships or operate in a regulatory gray area in their respective countries, meaning you cannot wire funds directly to them. Exchanges come up with workarounds, such as directing users to transfer fiat directly to local agents, who then issue cash vouchers at the exchange; or setting up a seemingly unrelated adjacent business to appear unrelated to cryptocurrency in the eyes of bank account managers, thus obtaining accounts and directing users to transfer funds there.

Fraudsters exploit this friction to steal fiat in various ways. The exchanges themselves may misreport the destination of funds, and then one day… poof— the website disappears along with your hard-earned fiat. If you use third-party intermediaries to transfer fiat in and out of the crypto capital markets, these individuals could vanish with your funds at any moment.

Due to the risks associated with transferring fiat in the cryptocurrency capital markets, traders must have a detailed understanding and trust in the cash flow operations of their trading counterparts. I learned how to handle global payments as funds flowed within the banking systems of Hong Kong, mainland China, and Taiwan (which I refer to as Greater China).

Understanding how funds flow in Greater China helped me comprehend how major Chinese and international exchanges (like Bitfinex) operate. This is important because all real innovations in cryptocurrency capital markets occur in Greater China. This is especially true for stablecoins. The reason this is important will soon become evident.

The success story of the greatest cryptocurrency exchange in the West belongs to Coinbase, which opened in 2012. However, Coinbase's innovation was in acquiring and maintaining banking relationships in one of the most hostile markets for financial innovation— the American Empire (Pax Americana). Beyond that, Coinbase is just a very expensive cryptocurrency brokerage account, which is all that was needed to make its early shareholders billionaires.

The reason I am writing another long piece about stablecoins is due to the tremendous success of Circle's IPO. It should be made clear that Circle is severely overvalued, but the price will continue to rise. This listing marks the beginning of the current stablecoin frenzy, not its end. After launching a stablecoin issuer in some public market (most likely in the U.S.), the bubble will burst, and that issuer will separate billions in capital from fools using financial engineering, leverage, and astonishing performance tricks. As usual, most of those who hand over their precious capital will not understand the history of stablecoins and cryptocurrency payments, why the ecosystem has evolved this way, and what it means for which issuers will succeed. A very reliable, charismatic guy will take the stage, spewing all sorts of nonsense, waving his (most likely male) hands back and forth, and convincing you that the leveraged nonsense he is peddling is about to monopolize a multi-trillion dollar total addressable market (TAM) for stablecoins.

If you stop reading here, then the only question you should ask yourself when evaluating an investment in a stablecoin issuer is: How will they distribute their products?

To achieve large-scale distribution— I mean being able to reach millions of users at an affordable cost— issuers must use the pipelines of cryptocurrency exchanges, Web2 social media giants, or traditional banks. If they lack distribution channels, there is no chance of success. If you cannot easily verify whether the issuer has the right to push products through one or more of these channels, then run away!

I hope my readers do not burn their capital in this way, as they can think critically about the stablecoin investment opportunities presented to them after reading this article. This article will discuss the evolution of stablecoin distribution.

First, I will talk about how and why Tether grew in Greater China, laying the foundation for their conquest of stablecoin payments in the Global South. Then I will discuss the initial coin offering (ICO) boom and how this created a true product-market fit for Tether. Next, I will discuss how Web2 social media giants first attempted to enter the stablecoin game. Finally, I will briefly mention how traditional banks will get involved.

To reiterate, because I know X (the platform) makes it difficult to read prose longer than a few hundred characters, if a stablecoin issuer or technology provider cannot distribute through cryptocurrency exchanges, Web2 social media giants, or traditional banks, they should not be in this business.

Cryptocurrency Banking in Greater China

Currently successful stablecoin issuers Tether, Circle, and Ethena have the ability to distribute their products through large cryptocurrency exchanges. I will focus on the evolution of Tether and briefly mention Circle to illustrate how nearly impossible it is for any new entrants to replicate their success.

Initially, cryptocurrency trading was overlooked. For example, from 2014 to the late 2010s, Bitfinex held the crown as the largest non-Chinese global exchange. At that time, Bitfinex was owned by an operating company in Hong Kong, which had various local bank accounts. This was great for arbitrage traders like me living in Hong Kong, as I could wire funds to the exchange almost instantly. There was a street across from my apartment in Sai Ying Pun that contained almost all local banks. I would walk between banks to transport cash to reduce fees and the time it took to receive money. This was crucial because it allowed me to rotate my capital once a day on weekdays.

Meanwhile, in China, the three major exchanges OKCoin, Huobi, and BTC China all had multiple bank accounts with large state-owned banks. A bus ride to Shenzhen only took 45 minutes, and with my passport and basic Chinese skills, I opened various local bank accounts. As a trader in mainland China and Hong Kong, having banking relationships meant you could access global liquidity. I was also confident knowing my fiat would not disappear. In contrast, every time I wired funds to certain Eastern European registered exchanges, I lived in fear because I did not trust their banking channels.

But as cryptocurrency gained notoriety, banks began closing accounts. Every day, you had to check the operational status of each bank and exchange relationship. This was very detrimental to my trading profits; the slower the flow of funds between exchanges, the less money I could make through arbitrage. But what if you could transfer electronic dollars on a crypto blockchain instead of through traditional banking channels? Then dollars— which were the lifeblood of the cryptocurrency capital markets then and now— could move between exchanges almost for free, 24/7.

The Tether team collaborated with the original founders of Bitfinex to create such a product. In 2015, Bitfinex allowed the use of Tether USD on its platform. At that time, Tether used the Omni protocol as a layer on top of the Bitcoin blockchain to send Tether USD (USDT) between addresses. This was a primitive smart contract layer built on Bitcoin.

Tether allowed certain entities to wire dollars to its bank account, and in return, Tether would mint USDT. USDT could be sent to Bitfinex and used to purchase cryptocurrencies. Wow, how exciting is it that a random exchange offers this product?

Stablecoins, like all payment systems, only become valuable when a large number of economically meaningful participants become nodes in the network. For Tether, beyond Bitfinex, cryptocurrency traders and other large exchanges needed to use USDT to solve any real problems.

Everyone in Greater China was in the same situation. Banks were closing accounts for traders and exchanges. Additionally, Asians wanted access to dollars because their local currencies were susceptible to shock devaluations, high inflation, and low domestic bank deposit rates. For most Chinese people, gaining access to dollars and the U.S. financial markets was very difficult, if not impossible. Therefore, the digital dollar version offered by Tether, accessible to anyone with internet access, was extremely attractive.

The Bitfinex/Tether team capitalized on this opportunity. Jean-Louis van der Velde, who has served as CEO of Bitfinex since 2013, had previously worked for a Chinese automaker. He understood Greater China and worked to make USDT the preferred dollar bank account for Chinese people with a cryptocurrency mindset. Although Bitfinex has never had Chinese executives, it built tremendous trust between Tether and the Chinese cryptocurrency trading community. Therefore, you can be sure that Chinese people trust Tether. In the Global South, overseas Chinese are in control, as imperial citizens have discovered in this unfortunate trade war, thus Tether provides banking services to the Global South.

Simply having a large exchange as its founding distributor does not guarantee Tether's success. The market structure has changed such that trading altcoins against the dollar can only be done through USDT. Let’s move forward to 2017, at the peak of the ICO boom, when Tether truly solidified its product-market fit.

ICO Babies

August 2015 was a very significant month, as the People's Bank of China (PBOC) made a shocking devaluation of the yuan against the dollar, and Ether (the native currency of the Ethereum network) began trading. The macro and micro stages transformed synchronously. This was legendary and ultimately drove the bull market from then until December 2017. Bitcoin skyrocketed from $135 to $20,000; Ether rose from $0.33 to $1,410.

When printing money, the macro environment is always favorable. Chinese traders were the marginal buyers of all cryptocurrencies (at that time, only Bitcoin). If they felt the yuan was unstable, Bitcoin would surge. At least that was the narrative at the time.

The PBOC's shocking devaluation exacerbated capital flight. By August 2015, Bitcoin had fallen from its historical high of $1,300 before the Mt. Gox bankruptcy in February 2014 to a low of $135 earlier that month on Bitfinex, when Zhao Dong, the largest over-the-counter Bitcoin trader in China, suffered the largest margin call in history, amounting to 6,000 Bitcoins. The narrative of capital flight from China drove the price up; from August to October 2015, BTCUSD more than doubled.

The micro is always the most fun place. The surge of altcoins truly began with the launch of the Ethereum mainnet and its native currency, Ether, on July 30, 2015. Poloniex was the first exchange to allow Ether trading, and this foresight propelled it to prominence in 2017. Interestingly, Circle nearly bought Poloniex at the peak of the ICO market and went bankrupt. Years later, they sold the exchange to the esteemed Justin Sun at a significant loss.

Poloniex and other Chinese exchanges capitalized on the new altcoin market by launching pure cryptocurrency trading platforms. Unlike Bitfinex, there was no need to interface with the fiat banking system. You could only deposit and withdraw cryptocurrencies to trade other cryptocurrencies. But this was not ideal, as traders instinctively wanted to trade altcoin/USD pairs. How could exchanges like Poloniex and Yunbi (once the largest ICO platform in China) offer these trading pairs without the ability to accept fiat deposits and withdrawals? Enter USDT!

After USDT launched on the Ethereum mainnet, it could move on that network using ERC-20 standard smart contracts. Any exchange supporting Ethereum could easily support USDT. Thus, pure cryptocurrency trading platforms could offer altcoin/USDT trading pairs to meet market demand. This also meant that digital dollars could flow seamlessly between major exchanges (like Bitfinex, OKCoin, Huobi, BTC China, etc.)—where capital entered the ecosystem—and more interesting, speculative venues (like Poloniex and Yunbi)—where gamblers played.

The ICO frenzy birthed what would later become the behemoth Binance. CZ (Changpeng Zhao) resigned as CTO of OKCoin a few years ago due to a personal dispute with CEO Star Xu. After leaving, CZ founded Binance with the goal of becoming the largest altcoin exchange in the world. Binance had no bank accounts, and to this day, I still don't know if you can deposit fiat directly to Binance without going through certain payment processors. Binance used USDT as its banking channel and quickly became the preferred venue for trading altcoins, and the rest is history.

From 2015 to 2017, Tether achieved product-market fit and built a moat against future competitors. Due to the trust of the Chinese trading community in Tether, USDT was accepted at all major trading venues. At this point, it was not used for payments, but it was the most efficient way to transfer digital dollars in and out of the cryptocurrency capital markets.

By the late 2010s, exchanges struggled to maintain bank accounts. Taiwan became the de facto cryptocurrency banking center for all the largest non-Western exchanges, controlling a significant portion of global cryptocurrency trading liquidity. This was because several Taiwanese banks allowed exchanges to open dollar accounts and somehow maintained agency relationships with large U.S. money center banks like Wells Fargo. However, as the agency banks demanded that these Taiwanese banks expel all cryptocurrency clients or risk losing access to the global dollar market, this arrangement began to unravel. As a result, by the late 2010s, USDT became the only way to transfer dollars on a large scale in the cryptocurrency capital markets, solidifying its position as the dominant stablecoin.

Western participants, many of whom raised funds with the narrative of cryptocurrency payments, rushed to create competitors to Tether. The only one to survive on a large scale was Circle's USDC. However, Circle was at a clear disadvantage as it was a U.S.-based company headquartered in Boston, disconnected from the core of cryptocurrency trading and usage—Greater China. The unspoken message from Circle was/and still is: China = scary; U.S. = safe. This message is amusing because Tether has never had Chinese executives, yet it has always been associated with the Northeast Asian market, which today is the Global South.

Social Media Wants In

The stablecoin frenzy is not new. In 2019, Facebook (now Meta) decided it was time to launch its own stablecoin, Libra. Its appeal lay in the fact that Facebook could provide dollar bank accounts to the entire world outside of China through Instagram and WhatsApp. Here’s what I wrote about Libra in June 2019:

The event horizon has passed. With Libra, Facebook began to enter the digital asset space. Before I start analyzing, let me clarify one thing: Libra is neither decentralized nor censorship-resistant. Libra is not cryptocurrency. Libra will destroy all stablecoins, but who the hell cares. I won’t shed a single tear for all the projects that somehow are deemed valuable by a nameless sponsor running on a blockchain.

Libra could lead to the decline of commercial banks and central banks. It could reduce their utility to a stupidly regulated digital fiat currency warehouse. And these institutions should be just that in the digital age.

Stablecoins offered by Libra and other Web2 social media companies could have stolen the spotlight. They have the largest customer bases and almost completely control their preferences and behavioral data.

Ultimately, U.S. political institutions acted to protect traditional banks from real competition in payments and foreign exchange. I said at the time:

I have no sympathy for the foolish remarks and actions of U.S. Congresswoman Maxine Waters in the House Financial Services Committee. But the outburst of concern from her and other government officials does not stem from altruistic feelings for their constituents but from a fear of disrupting the financial services industry—an industry that has lined their pockets and maintained their positions. The speed at which government officials rushed to condemn Libra tells you that there is something potentially positive for human society embedded in this project.

That was then, but now the Trump administration will allow competition in financial markets. Trump 2.0 has no sympathy for the banks that canceled his entire family’s platform during President Biden’s administration. Therefore, social media companies are reviving plans to natively embed stablecoin technology into their platforms.

This is good news for shareholders of social media companies. These companies could completely swallow the revenue streams of traditional banking systems, payments, and foreign exchange. However, this is bad news for any entrepreneur creating new stablecoins, as social media companies will build everything internally to support their stablecoin businesses. Investors in new stablecoin issuers must be wary of promoters boasting partnerships with any social media company or distribution through them.

Other tech companies are also joining the stablecoin trend. Social media platform X, Airbnb, and Google are all in early discussions about integrating stablecoins into their business operations. In May, Fortune magazine reported that Mark Zuckerberg's Meta—having previously failed in attempts with blockchain technology—has been in discussions with cryptocurrency companies about introducing stablecoins for payments.

– Source: Fortune Magazine

My article “Libra: Zuck Me Gently”

Extinction-Level Event for Traditional Banks

Whether banks like it or not, they will not be able to continue earning billions of dollars each year to hold and transfer digital fiat currencies, nor will they be able to charge the same fees for foreign exchange transactions. I recently spoke with a board member of a large bank about stablecoins, and they said, "We're screwed." They believe stablecoins are unstoppable and cited the situation in Nigeria as proof. I was previously unaware of the extent to which USDT had penetrated that country, but they told me that one-third of Nigeria's GDP is conducted in USDT, even though the central bank is very serious about trying to ban cryptocurrencies.

They went on to point out that because adoption is bottom-up rather than top-down, regulators are powerless to stop it. By the time regulators notice and try to do something, it’s too late because adoption has already become widespread among the populace.

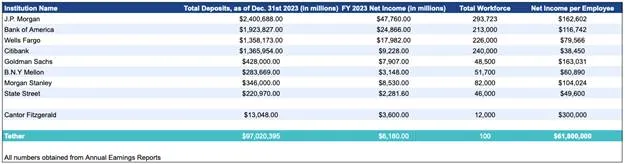

Despite having people like them in senior positions at every large traditional bank, the organism that is the bank does not want to change, as that would mean the death of many of its cells—its employees. Tether has fewer than 100 employees but can leverage blockchain technology to perform key functions of the entire global banking system. In contrast, consider that JPMorgan, the best-operating commercial bank in the world, employs just over 300,000 people.

Banks are facing a critical moment—adapt or die. But complicating their efforts to streamline their bloated workforce and provide the products needed for the global economy are regulatory requirements about how many people must be hired to perform certain functions. For example, I experienced this when trying to open a Tokyo office and obtain a cryptocurrency trading license at BitMEX. The management team considered whether to open a local office and obtain a license to conduct some limited types of cryptocurrency trading beyond our core derivatives business. The cost of compliance was the issue because you cannot leverage technology to meet the requirements. Regulators stipulate that for every compliance and operational function listed, you must hire a person with the appropriate level of experience. I don’t remember the exact number, but I believe it required about 60 people per year, each earning at least $80,000, totaling $4.8 million annually to perform all the mandated functions. All of this work could have been automated for less than $100,000 a year in SaaS vendor fees. And I would add that the mistakes made in doing so would be less than those made by hiring error-prone individuals. Oh… and you can't fire anyone in Japan unless you close the entire office. Oops!

Bank regulation is designing employment creation plans for an over-educated population, which is a global issue. They are over-educated in nonsense rather than in what truly matters. They are just high-paid checkbox tickers. Although bank executives would love to cut their workforce by 99% and thereby increase productivity, as regulated entities, they cannot do so.

Stablecoins will eventually be adopted by traditional banks in a limited form. They will operate two parallel systems: the old, slow, and expensive system, and the new, fast, and cheap system. The extent to which they are allowed to truly embrace stablecoins will be determined by prudent regulators in each office. Remember, JPMorgan is not an organism; each instance of JPMorgan in different countries is subject to different regulations. Data and personnel often cannot be shared between instances, hindering company-wide technology-driven rationalization. Good luck, you bastard bankers; regulation protects you from the impact of Web2, but it will seal your fate in Web3.

These banks will certainly not collaborate with third parties on technology development or stablecoin distribution. They will do all of this internally. In fact, regulators may explicitly prohibit collaboration. Therefore, the distribution channel is closed for entrepreneurs looking to build their own stablecoin technology. I don’t care how many proofs of concept a specific issuer claims to be conducting for traditional banks. They will never lead to adoption across the banking sector. So, if you are an investor and stablecoin issuer promoters claim they will partner with traditional banks to bring their products to market, run away quickly.

Now that you understand the difficulties new entrants face in achieving large-scale distribution for their stablecoins, let’s discuss why they will attempt this impossible task anyway. Because stablecoin issuers are extremely profitable.

Dollar Interest Rate Game

The profitability of stablecoin issuers depends on the amount of net interest income (NIM) available. The issuer's cost base is the fees paid to holders, while income comes from cash invested in government debt (like Tether and Circle) or returns from some form of cryptocurrency market arbitrage (like spot holding arbitrage basis trading, such as Ethena). The most profitable issuer, Tether, does not pay any fees to USDT holders or depositors and earns all NIM based on the yield levels of short-term Treasury bills (T-bills).

Tether is able to retain all of its NIM because it has the strongest network effects, and its customers have no other options for dollar bank accounts. Potential customers do not choose other dollar stablecoins because USDT is accepted throughout the Global South. A personal example is how I make payments during the ski season in Argentina. I ski in the Argentine countryside for a few weeks each year. When I first went to Argentina in 2018, it was a hassle to pay if the vendor did not accept foreign credit cards. But by 2023, USDT took over, and my guides, drivers, and chefs all accepted USDT as payment. This is great because even if I wanted to, I couldn't pay in pesos; bank ATMs only dispense a maximum of $30 worth of pesos per transaction and charge a 30% fee. It’s a damn crime—long live Tether. It’s fantastic for my staff to receive digital dollars stored in cryptocurrency exchanges or their mobile wallets, which can be easily used to purchase domestic and international goods and services.

Tether's profitability is the best advertisement for social media companies and banks to create their own stablecoins. Both categories do not need to pay for deposits because they already have rock-solid distribution networks, which means they capture all NIM. Therefore, this could become a massive profit center for them.

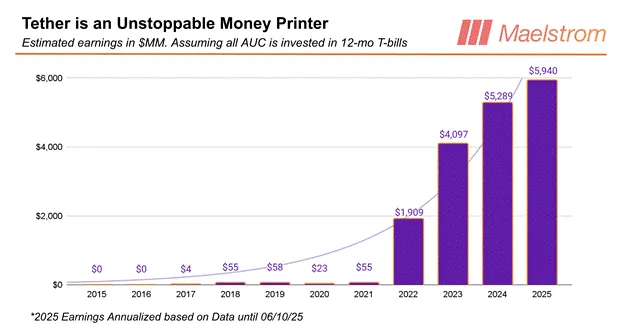

Tether makes more money each year than this chart estimates. The chart assumes that all AUC (Assets Under Custody) are invested in twelve-month short-term Treasury bills. The point is to show that Tether's earnings are highly correlated with U.S. interest rates. You can see the huge leap in earnings from 2021 to 2022, which was due to the Federal Reserve raising interest rates at the fastest pace since the early 1980s.

This is a table I published in the article “Dust on Crust Part Deux” that clearly shows with 2023 data that Tether is the highest profit-per-capita bank in the world.

Distributing stablecoins can be very expensive unless you are affiliated with a proprietary exchange, social media company, or traditional bank. The founders of Bitfinex and Tether are the same group of people. Bitfinex has millions of customers, so it’s plug-and-play, and Tether has millions of customers as a result. Tether does not have to pay for distribution because it is partially owned by Bitfinex, and all altcoins trade against USDT.

Circle and any other stablecoins that emerged afterward must pay some form of distribution fee to exchanges. Social media companies and banks will never collaborate with third parties to build and operate their stablecoins; therefore, cryptocurrency exchanges are the only option.

Cryptocurrency exchanges can build their own stablecoins, as Binance attempted with BUSD, but ultimately many exchanges find building a payment network too difficult and distracting from their core business. Exchanges need equity from the issuer or a portion of the issuer's NIM to allow trading of their stablecoins.

Even so, all cryptocurrency/USD trading pairs are likely still paired with USDT, meaning Tether will continue to dominate the market. This is why Circle has to appease Coinbase. Coinbase is the only major exchange not on the Tether track because its customers are primarily Americans and Western Europeans.

Before U.S. Commerce Secretary Howard Lutnik favored Tether and provided banking services through his company Cantor Fitzgerald, Tether had been criticized by Western media as some sort of foreign-made scam. Coinbase's existence relies on the favor of U.S. political institutions, and it must find an alternative. Thus, Jeremy Allaire positioned himself to accept Brian Armstrong's request.

The deal is this: Circle pays 50% of its net interest income to Coinbase in exchange for distribution across the entire Coinbase network. Yachtzee!!

The situation for new stablecoin issuers is dire. There are no open distribution channels. All major cryptocurrency exchanges either own issuers or collaborate with existing issuers Tether, Circle, and Ethena. Social media companies and banks will build their own solutions.

Therefore, a new issuer must transfer a significant portion of its NIM to depositors in an attempt to pry them away from other stablecoins with higher adoption rates. Ultimately, this is why, at the end of this cycle, investors will almost certainly lose their shirts on every publicly listed stablecoin issuer or technology provider. But this will not stop the party; let’s delve into why investors' judgment will be clouded by the enormous profit potential of stablecoins.

Narrative

There are three business models responsible for creating cryptocurrency wealth beyond merely holding Bitcoin and other altcoins. They are mining, operating exchanges, and issuing stablecoins. For my part, my wealth comes from my ownership of BitMEX (a derivatives exchange), while Maelstrom (my family office) has its largest position and generates the most absolute returns from Ethena, the issuer of the USDE stablecoin. Ethena has grown from zero to the third-largest stablecoin in less than a year in 2024.

The uniqueness of the stablecoin narrative lies in its vast and obvious total addressable market (TAM) for traditional finance (TradFi) fools.

Tether has proven that a chain-based bank that merely holds people's funds and allows them to transfer back and forth can become the highest profit-per-capita financial institution in history. Tether has succeeded in the face of legal warfare initiated by various levels of government in the U.S.

What would happen if U.S. authorities at least did not hold a hostile attitude toward stablecoins and allowed them some operational freedom to compete with traditional banks for deposits? The profit potential is insane.

Now consider the current setup: U.S. Treasury staff believe that stablecoin AUC (Assets Under Custody) could grow to $2 trillion. They also believe that dollar stablecoins could be the spearhead in advancing/maintaining dollar hegemony while also being buyers insensitive to Treasury debt prices.

Wow, that’s a significant macro tailwind. As a delicious bonus, remember that Trump harbors resentment toward large banks because they canceled his and his family's platform after his first presidential term. He has no intention of stopping the free market from providing better, faster, and safer ways to hold and transfer digital dollars. Even his sons have jumped into the stablecoin game.

This is why investors are drooling over investable stablecoin projects. Before we continue discussing my predictions on how this narrative will translate into money-burning opportunities, let me define the criteria for investable projects.

The issuers discussed must be able to go public in some form on the U.S. stock market. Secondly, the issuers must provide products for moving digital dollars; none of that foreign nonsense, this is “Murica.” That’s it; as you can see, there’s plenty of blank space here for creativity.

The Road to Ruin

The most obvious issuer to IPO and kick off the party is Circle. They are a U.S. company and the second-largest stablecoin issuer by AUC.

Circle is severely overvalued at this stage. Remember, Circle gives 50% of its interest income to Coinbase. However, Circle's market cap is 39% of Coinbase's. Coinbase is a one-stop cryptocurrency financial shop with multiple profitable business lines and tens of millions of customers worldwide. Circle excels at fellatio; while this is a very valuable skill, they still need to up their game and take care of their step-children.

Should you short Circle? Absolutely not! Maybe if you think the Circle/Coinbase ratio is unreasonable, you should buy Coinbase. Although Circle is overvalued, when we look back at the stablecoin frenzy in a few years, many investors will wish they had just held Circle. At least they might still have some capital left.

The next wave of IPOs will be imitators of Circle. Relatively speaking, these stocks will be more overvalued in terms of price/AUC ratio than Circle. Absolutely, they will never surpass Circle in revenue generation.

Promoters will boast meaningless traditional finance credentials, trying to convince investors that they have the connections and capabilities to disrupt traditional banks' positions in the global dollar payment space by partnering with them or leveraging their distribution channels. The scam will succeed; issuers will raise a hell of a lot of money. For those of us who have spent some time in the trenches, it will be quite comical to watch those suited clowns deceive the public into investing in their bullshit companies.

After this first wave, the scale of the scam entirely depends on the stablecoin regulatory framework enacted in the U.S. The more freedom issuers have regarding the assets backing the stablecoins and whether they can pay returns to holders, the more they can use to cover up the bullshit financial engineering and leverage. If you assume a lightly or non-intrusive stablecoin regulatory regime, you might see a replay of Terra/Luna, where some issuer creates a deceptive algorithmic stablecoin Ponzi scheme. Issuers can pay high returns to holders, with the returns coming from leveraging certain asset holdings.

As you can see, I don't have much good to say about the future. There is no real future because the distribution channels for new entrants are closed off. Forget about that idea.

But don’t short. These new stocks will rip the faces off of shorts. The macro and micro are synchronized. As former Citigroup CEO Chuck Prince said when asked if his company was involved in subprime mortgages: “When the music stops, things get complicated in terms of liquidity. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing.”

I’m not sure how Maelstrom will dance, but if there’s money to be made, we will go make it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。