Original Author: BitpushNews

On Wednesday afternoon local time (June 18), the U.S. Federal Reserve (Fed) announced that it would keep the benchmark interest rate unchanged at 4.25%-4.50%, marking the fourth consecutive meeting of "holding steady," fully aligning with market expectations.

In its statement, the Fed noted that while uncertainty regarding the economic outlook has diminished, it remains at a high level. At the same time, the Fed lowered its GDP growth forecast for the U.S. in 2025 to 1.4%, while raising its inflation forecast to 3%. This indicates that the Fed still faces a dilemma between economic recovery and inflation control.

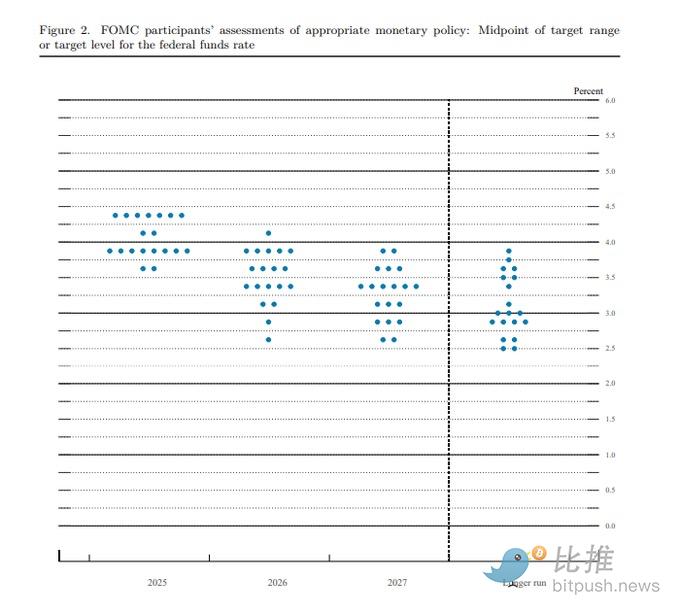

Expectations for interest rate cuts have also been adjusted: the Fed's "dot plot" shows that while two rate cuts (a total of 50 basis points) are still expected in 2025, consistent with expectations from March, the forecast for rate cuts in 2026 has been reduced from two to one (only 25 basis points). Notably, among the 19 Fed officials, 7 believe that there will be no rate cuts in 2025 at all, indicating significant internal disagreement within the Fed regarding future policy paths.

Cryptocurrency Market: Underlying Currents Beneath a Calm Surface

Despite the Fed's decisions having a significant impact on global financial markets, the response from the cryptocurrency market has been somewhat "zen." Bitcoin (BTC) has remained around $104,000, Ethereum (ETH) hovers around $2,520, and XRP and Solana are also largely flat.

According to data from CoinGlass, although the total market capitalization of the cryptocurrency market slightly decreased by 2% to $3.35 trillion that day, there was also a significant $224 million in leveraged liquidations, with Ethereum seeing the largest liquidation volume, followed by Bitcoin. This indicates that the battle between bulls and bears in the market remains intense.

It is worth mentioning that the U.S. spot Bitcoin ETF recorded a net inflow of $216 million on June 17, while the spot Ethereum ETF also saw an inflow of $11 million. This suggests that institutional funds continue to flow into the cryptocurrency market, providing support at the bottom.

Market experts believe that this "calm" response reflects investors' cautious sentiment following the Fed's decision, as everyone is waiting for clearer macroeconomic signals.

Trump Criticizes Powell Again: Political Factors Interfere with Market Judgments

Interestingly, on the same day as the Fed meeting, Trump publicly criticized Fed Chair Jerome Powell again, calling him "stupid" and predicting that the Fed would not cut rates that day. Trump has long criticized Powell, accusing his policies of "costing the country a lot of money." He noted that Europe has cut rates 10 times, while the U.S. has not done so even once, questioning Powell's political stance.

While such political remarks have drawn attention, they do not seem to have had a direct and significant impact on the cryptocurrency market, which appears to be more focused on the economic data itself.

Global Tensions Rise, Why is the Crypto Market Calm?

Ray Yossef, CEO of NoOnes, pointed out that despite escalating tensions in the Middle East and a turbulent macro environment over the past week, cryptocurrency prices have remained almost unchanged.

He explained that Bitcoin has remained stable within a narrow range around $105,000, with daily volatility below 2.1%, and there has been no large-scale panic selling.

Ray Yossef also warned that the escalating macro risks cannot be ignored. He emphasized, "If geopolitical tensions escalate or begin to affect the financial system through sanctions, infrastructure disruptions, or capital controls, the crypto market will not be spared." He noted that Bitcoin's market dominance is approaching 66%, indicating that investors' risk appetite for altcoins is decreasing in the current environment.

On-Chain Data Reveals: Bitcoin Scarcity is Strengthening

In addition to price and macroeconomic factors, on-chain data also provides an interesting perspective.

According to data from the institutional DeFi solution provider Sentora (formerly IntoTheBlock), the market value to realized value ratio (MVRV Ratio) of Bitcoin is currently still below historical market peaks.

The MVRV Ratio is an indicator that measures the ratio of Bitcoin's total market capitalization to the total value of all Bitcoins at their last on-chain movement (i.e., "realized value"). It reflects whether investors across the network are overall in profit or loss.

Data shows that extreme peaks in Bitcoin's MVRV Ratio have historically coincided with asset price tops, as when the MVRV value is high, average investors hold substantial profits and are more inclined to take profits. However, Bitcoin's current MVRV Ratio is 2.25, which, while more than double the realized value, is significantly lower compared to past cyclical tops. This indicates that the market has not overheated like before, and Bitcoin still has potential upside.

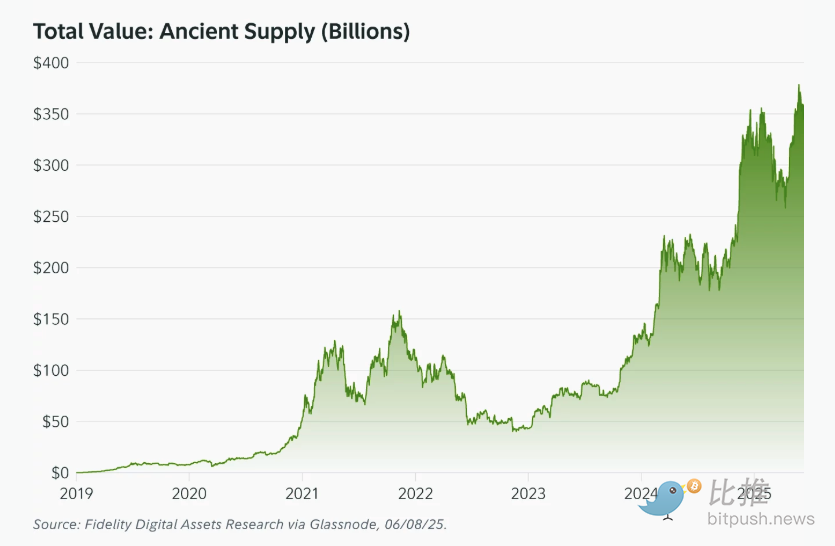

Fidelity Digital Assets' research report on June 18 pointed out that Bitcoin's "Ancient Supply" is growing faster than the daily issuance of new Bitcoins.

"Ancient Supply" refers to Bitcoins that have not been moved for at least ten years. Since April 2024, an average of 566 Bitcoins have entered the "not moved for over ten years" category daily, exceeding the 450 Bitcoins that miners add to circulation each day. This occurs less than a year after the 2024 halving, which directly cut the issuance in half and fundamentally changed Bitcoin's supply dynamics.

"Ancient Supply" currently accounts for over 17% of all mined Bitcoins, valued at approximately $360 billion. Although Satoshi holds 33% of this share and some Bitcoins may be permanently lost, analysts point out that any of these coins could potentially be reactivated.

Fidelity's report also mentioned the "HODL Rate" (i.e., the inflow of ancient supply minus new issuance). This metric turned positive in April 2024, with an average daily increase of 116 Bitcoins, further confirming that core holders are absorbing circulating Bitcoins at a faster rate than miners produce them.

Fidelity expects that based on current trends, by 2035, the "Ancient Supply" will exceed 30% of the circulating Bitcoin supply. While this scarcity does not directly guarantee price increases (as demand support is also needed), the continuous increase in Bitcoins controlled by long-term holders will tighten the number of Bitcoins available for traders, making price discovery increasingly reliant on marginal flows.

The report concludes that Bitcoin has now differentiated itself from commodities with elastic supply. Its scarcity, combined with long-term holding and lost tokens, is expected to strengthen over time. If demand grows in tandem in the future, this characteristic may reshape its value discovery logic, becoming a core advantage that distinguishes it from other assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。