Canadian listed company Sol Strategies plans to list on Nasdaq under the code "STKE," marking a strategic evolution of corporate treasuries from Bitcoin as "digital gold" to Ethereum as "productive assets," and now to Solana as a "financial operating system."

Written by: Luke, Mars Finance

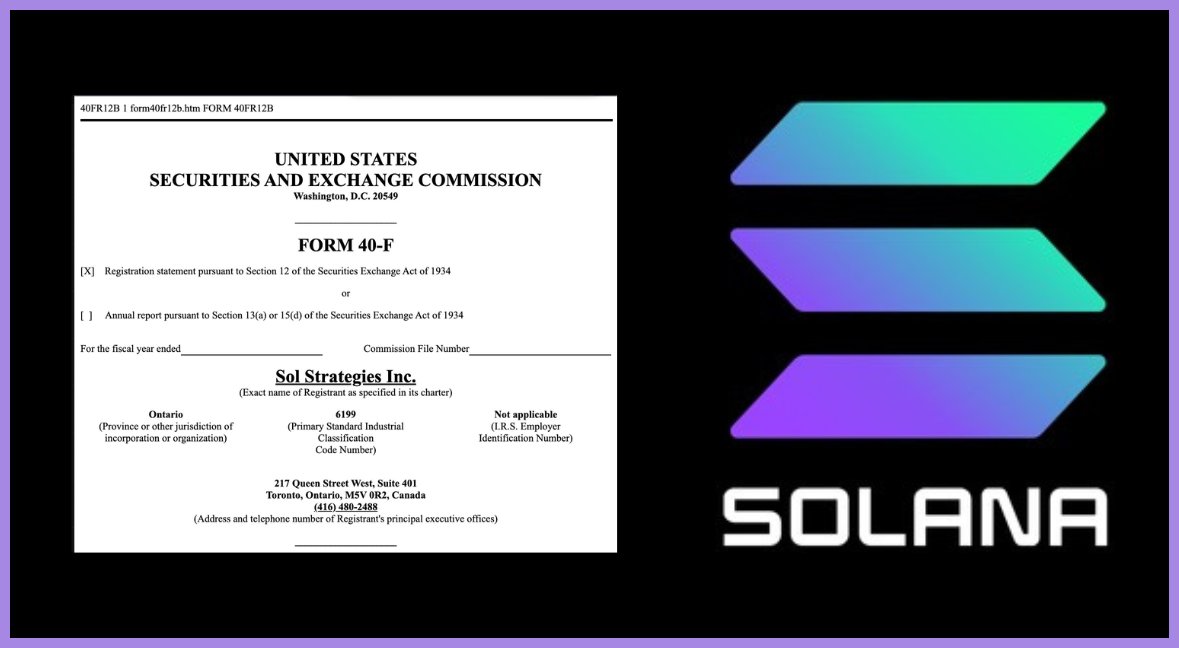

A seemingly ordinary announcement has cast a significant stone in the landscape where cryptocurrency intersects with traditional finance. On June 19, Canadian listed company SOL Strategies Inc. (CSE: HODL) submitted a Form 40-F registration statement to the U.S. Securities and Exchange Commission (SEC), planning to list on the Nasdaq capital market under the code "STKE." This is not just a capital operation of a single company but a microcosm of an emerging trend.

In recent years, the strategy of listed companies incorporating cryptocurrency into their balance sheets has undergone a clear evolution. From initially treating Bitcoin (BTC) as "digital gold" to later embracing Ethereum (ETH) as "productive assets," each iteration reflects a change in the market's depth of understanding of digital assets. Now, we are witnessing the rise of a third wave, with Solana at its center.

With SOL Strategies Inc.'s plan to list on Nasdaq as a landmark event, more and more corporate treasuries are beginning to turn their attention to Solana. This raises a core question: In a context where Bitcoin and Ethereum have already occupied mainstream views, why are these companies choosing to bet on Solana? Is this merely a speculative game waiting for asset appreciation, or is there a deeper strategic consideration behind it? The answer is far more complex than simple price expectations; it reveals a profound wager on the future of financial infrastructure.

The Evolution of Corporate Treasuries: From "Digital Gold" to "Financial Operating System"

To understand why companies are choosing Solana, we first need to review the three-part evolution of corporate crypto asset strategies. This journey has progressed from passive preservation to active yield generation, ultimately leading to strategic integration.

The First Wave: Bitcoin as the "Digital Gold" story began with companies like MicroStrategy. They pioneered the use of Bitcoin as a primary reserve asset, with the core logic being to view Bitcoin as a value storage tool and a hedge against macroeconomic uncertainty—"digital gold." This strategy is relatively passive, essentially "HODLing," betting on Bitcoin's long-term scarcity and value consensus. Many companies, including Tesla and Block Inc., have followed suit, using Bitcoin as a strategic reserve to guard against fiat currency inflation.

The Second Wave: Ethereum as a "Productive Asset" With Ethereum's shift to a Proof-of-Stake mechanism, the story entered its second chapter. Companies began to realize that ETH could not only serve as a value store but also as a "productive asset" that generates returns. By staking ETH, companies can achieve stable income streams and realize endogenous growth of their assets. Recently, Nasdaq-listed sports betting platform SharpLink Gaming announced the acquisition of 176,271 ETH worth $463 million, planning to stake over 95% of its holdings, aiming to become the "Ethereum version of MicroStrategy." This shift in strategy marks the evolution of corporate treasuries from "passive holding" to "active yield generation."

The Third Wave: Solana as "Strategic Infrastructure" Now, companies like SOL Strategies, DeFi Development Corp, and Upexi are leading the third wave. Their choice of Solana goes beyond mere expectations of asset appreciation and passive yield generation. It represents a deeper strategic layout, viewing Solana as a "high-performance financial operating system," and attempting to deeply participate in and build the future on-chain economy by holding SOL.

Why Solana? Three Core Driving Forces

The reason corporate treasuries are betting on Solana is not a whim but a comprehensive consideration based on three core driving forces. These three driving forces collectively answer the question of "why Solana," and the answer goes far beyond "waiting for appreciation."

1. Not just yield generation, but also "productive materials"

Like Ethereum, Solana can also generate substantial returns through staking. However, for companies like SOL Strategies, the significance of SOL goes far beyond that. They are not simply delegating SOL to third parties for staking; instead, they view SOL as "productive materials" for their core business.

SOL Strategies' business model involves operating its own validator nodes. The substantial SOL they hold serves as the capital base for operating these nodes, providing the company with dual or even multiple revenue streams: first, staking rewards from their own SOL assets; second, earning commissions and block rewards by attracting third-party institutions (such as the Australian listed company DigitalX) to delegate their SOL to their validators. This model transforms the company from a mere asset holder into a provider and operator of ecological infrastructure. As its CEO Leah Wald emphasized, SOL Strategies is a "technology company," not a fund. In this model, SOL is no longer just a number on the balance sheet but the core fuel driving the company's business flywheel.

2. Firm belief in superior technological performance

All strategic layouts stem from confidence in underlying technological strength. Wall Street investment bank Cantor Fitzgerald, in a widely discussed report, bluntly stated that they believe "Solana's technology is clearly superior to Ethereum on every metric." This judgment is not unfounded.

The Solana network is renowned for its unparalleled performance, capable of continuously processing over 2,000 transactions per second (TPS), with average transaction fees below $0.001. This high throughput and low-cost characteristic make many applications that are difficult to implement on other blockchains due to high costs (such as high-frequency trading, micro-payments, and consumer applications) possible on Solana. Its highly anticipated new validator client, Firedancer, aims to increase network throughput to the million TPS level, and Solana co-founder Anatoly Yakovenko stated that this is more of a hardware optimization issue rather than a fundamental change to the protocol.

For companies, choosing Solana means opting for a platform believed to be technologically superior and more capable of supporting future large-scale applications. This is a bet on the technological route, trusting that its outstanding performance will ultimately translate into a more prosperous ecosystem and higher network value.

3. Deeply binding to the grand vision of "the next Wall Street"

This may be the most fundamental and exciting reason for companies to bet on Solana. Holding SOL means being deeply tied to a grand vision—the "decentralized Nasdaq" originally envisioned by Solana co-founder Anatoly Yakovenko. The core of this vision is that all financial assets in the future, whether stocks, bonds, or real estate, will be issued, traded, and settled on the blockchain in tokenized form (RWA).

Companies holding Solana are not just investing in a token; they are investing in the "underlying track" of future financial markets. By holding core network assets, they gain a ticket to participate in and shape this future ecosystem. As Autonomys Labs CEO Todd Ruoff stated, companies holding SOL "are not just for value storage but to actively integrate into a growing ecosystem." SOL Strategies has even begun collaborating with Superstate to explore tokenizing its company equity on the Solana chain, attempting to become part of this future.

This strategy is far more forward-looking than simply waiting for asset appreciation. It represents a deep strategic alliance, closely linking the company's future with the success or failure of the Solana ecosystem. This is a transformation from a bystander to a participant, and even to a builder.

Risks and Horizons: A Clear-eyed Examination

Despite the broad prospects, this path is not without risks. First, the price volatility of the SOL token itself is a significant challenge that all participants must face. Second, the ongoing uncertainty in the global cryptocurrency regulatory environment, especially regarding asset classification (such as whether it is considered a security), hangs like the sword of Damocles over all projects.

Additionally, there is a more subtle structural financial risk. The stock prices of these "treasury companies" often trade at prices significantly above their net asset value (NAV) of held crypto assets, creating a notable premium. Some analysts have compared this phenomenon to the former GBTC premium, suggesting that it effectively injects leverage into the system. Once market sentiment reverses, and the premium turns into a discount, it could trigger a chain reaction, forcing these companies to liquidate assets to repay debts, thereby exerting downward pressure on the market. Finally, even Solana's founder remains clear-headed, with Yakovenko reminding that converting high user participation into high retention rates and pushing the ecosystem beyond the frenzy of meme coins towards maturity is a current challenge that needs to be addressed.

Conclusion: A Strategic Gamble Beyond Price

In summary, the motivation for corporate treasuries to start betting on Solana is multi-layered and strategically visionary.

- From a strategic perspective, this is an evolution from passive holding (Bitcoin as "digital gold") and active yield generation (Ethereum as "productive assets") to deep strategic integration (Solana as "financial operating system").

- From a business perspective, SOL can not only bring staking rewards but also serve as productive materials driving the company's core business (such as validator nodes), creating diversified revenue streams.

- From a technological perspective, this is a firm belief that Solana's high-performance, low-cost architecture can win future competition.

- From a visionary perspective, this is the ultimate bet on the grand narrative of "tokenization of everything" and "decentralized Nasdaq," aiming to seize the strategic high ground in the future on-chain financial world.

Therefore, simply interpreting these companies' actions as "waiting for appreciation" clearly underestimates the ambition behind them. They are not buying a lottery ticket; they are purchasing a cornerstone of a future new continent and attempting to personally participate in the construction of this new land. This is precisely the true allure of Solana as the new darling of Wall Street, attracting more and more corporate treasuries to join the fray.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。