Author: Nancy, PANews

Circle has successfully landed on the US stock market, with its stock price soaring, significantly increasing market attention on cryptocurrency concept stocks. Meanwhile, thanks to the continuous optimization of the US regulatory environment and favorable policies, the cryptocurrency industry is experiencing a wave of enthusiasm heading to Wall Street, with more and more crypto institutions actively planning to enter the US capital market.

Circle's Stock Price Soars Nearly 600%, Investment Institutions Begin Cashing Out at High Levels

Recently, Circle's performance in the capital market has become the focus of the global financial market. Fortune magazine reported that Circle is one of the seven largest IPO underpricing cases in the past 40 years, and this stablecoin giant has skyrocketed since its listing, igniting market sentiment and demonstrating strong expectations for the future of the stablecoin industry.

As of the close on June 18, Circle (CRCL) stock price closed at $199.59, with a total market capitalization reaching $44.417 billion, approaching over 70% of the circulating market value of its stablecoin USDC (approximately $61.53 billion). The single-day trading volume reached an astonishing 63 million shares, surpassing the record of 60.7 million shares set on the second day of listing, marking a historical high. From the intraday peak price of $215.7, the cumulative increase from its IPO issue price of $31 reached as high as 595%, showcasing the market's enthusiasm for participation.

In fact, since the first week of its IPO, Circle has consistently led the trading volume and increase rankings in the US stock market's cryptocurrency concept sector, driven by the premium narrative surrounding stablecoins.

As Circle's stock price continues to rise, its CEO Jeremy Allaire recently emphasized on X that stablecoins may be the most practical form of currency in history, but the entire industry has yet to reach a critical juncture similar to the "iPhone moment." Once the stablecoin industry enters this phase, developers will be able to unlock programmable digital dollars just like unlocking programmable phones, at which point digital dollars will unleash tremendous potential on the internet and bring widespread opportunities. This era may not be far off.

The capital frenzy surrounding Circle is not a coincidental market celebration but a resonance of policy turning points and ecological trends.

First, US stablecoin regulation is reaching a critical turning point, with Circle, the first stablecoin stock, becoming the most direct beneficiary and the best target for investors at this stage. On June 17, the US Senate officially passed the GENIUS Act, marking the first time the US has established a regulatory framework for dollar-backed stablecoins in legislative form. This act not only requires stablecoin issuers to have clear reserve proof and auditing mechanisms but also paves the way for the legal existence of dollars on the blockchain. The next step is for the House of Representatives to pass it and for the president to sign it, after which the act will take effect.

Trump also recently stated on his social media platform that the Senate has passed the GENIUS Act, which will promote large-scale investment and innovation in the digital asset field in the US, calling for the House to quickly pass a "clean version" and submit it to the president for signing. Meanwhile, according to former Fox Business reporter Eleanor Terrett, the US House of Representatives is considering advancing the market structure legislation CLARITY Act alongside the stablecoin legislation GENIUS Act to align with Trump's set legislative deadline in August.

At the same time, positive news surrounding Circle and USDC continues to emerge, further amplifying the market's imagination regarding its valuation. For example, recently, Coinbase's derivatives platform plans to include USDC as collateral for futures trading by 2026; financial infrastructure provider OpenPayd has partnered with Circle to utilize Circle Wallets' infrastructure to provide a unified fiat and stablecoin infrastructure layer for global enterprises; e-commerce platform Shopify is collaborating with Coinbase and Stripe to promote USDC stablecoin payments; ProShares and Bitwise have submitted ETF applications based on Circle stocks; and World Chain has launched native USDC, among others.

However, beneath the fervent market sentiment, there are signs of rational profit-taking. According to public disclosures, early partners announced they had sold all their CRCL shares after criticizing the low allocation of Circle's IPO. Ark Invest, after purchasing $373 million worth of CRCL stock on the first day of listing, has recently reduced its holdings by approximately $96.46 million over two consecutive days, selling 300,000 shares. Although some of the reductions are part of normal liquidity management, in the context of continuous high increases, these actions may be interpreted by the market as high-level cashing out, and investors need to approach FOMO sentiment rationally.

13 Institutions Queueing to Head to Wall Street, Exchanges Become the Main Force of the Crypto IPO Wave

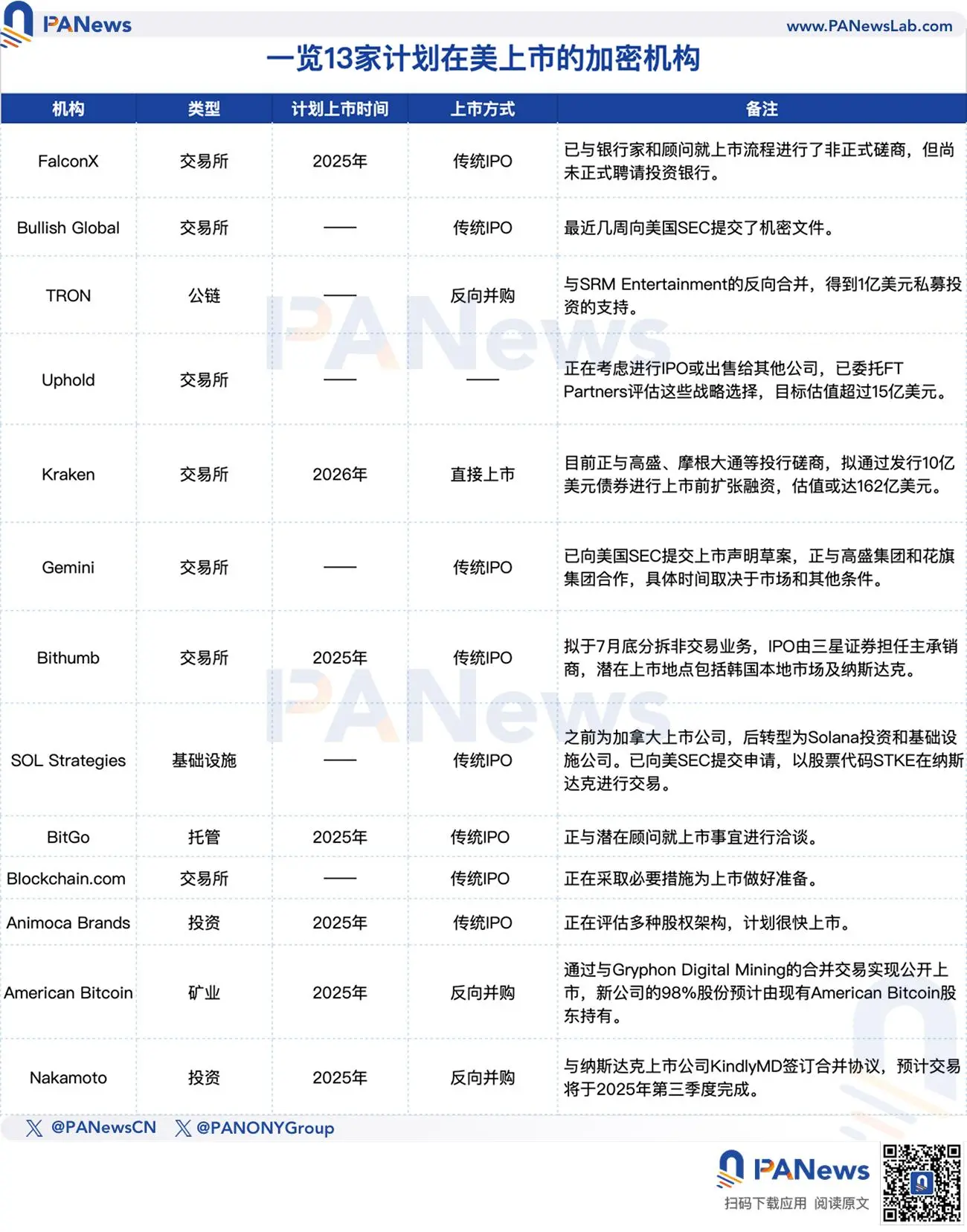

This year, the trend of cryptocurrency companies going public in the US has accelerated. PANews has compiled a list of 13 crypto-related institutions that have clear plans to list on the US stock market.

From the types of institutions, exchanges are the absolute main force in going public in the US, with a total of six, including Gemini, Kraken, Bullish Global, FalconX, and Bithumb. These institutions generally have strong cash flow, a broad customer base, and a stable business structure, making them potential top performers in the capital market under a clearer regulatory backdrop. Meanwhile, the other seven cover investment institutions, custody, and mining, all seeking valuation reassessment and capital support in the US stock market.

It is noteworthy that among these 13 institutions, those from Asian or European backgrounds account for a significant proportion, with representative projects including TRON, Bithumb, and Animoca. These institutions choose the US as their primary listing location, reflecting not only considerations of liquidity and valuation systems but also the fact that the US remains the most attractive capital hub for global crypto enterprises in terms of regulatory framework, capital depth, and institutional participation.

From a timing perspective, 2025 has become the target window for most crypto companies to go public, including FalconX, Bithumb, BitGo, Animoca Brands, and American Bitcoin. Many of these projects had previously attempted IPOs but were forced to delay due to market conditions or regulatory obstacles; now, they are accelerating again in light of clearer regulations and a recovering market.

In terms of progress, some institutions have entered the substantive preparation stage for listing, including submitting prospectuses to the SEC, hiring underwriting teams, and restructuring equity, being at a critical "last step" period, ready to officially enter the market once the capital window opens.

In terms of listing paths, traditional IPOs remain mainstream, especially favored by institutions with strong compliance capabilities and mature customer structures, such as Gemini, Bullish Global, BitGo, and FalconX. However, traditional IPO processes are complex and lengthy, making them more suitable for medium to large platforms with clear business models and robust profit models.

In contrast, reverse mergers have become a shortcut for many small and medium-sized crypto institutions due to their simplified processes and faster speed. For example, TRON and Nakamoto quickly entered the US capital market through shell listings, effectively avoiding the cumbersome IPO process while enhancing flexibility.

Another noteworthy path is direct listing. Kraken, valued at up to $16.2 billion, has chosen the direct listing method, foregoing new financing to focus on establishing liquidity and shareholder exit channels. This model is suitable for highly profitable, well-recognized brands that are less reliant on financing.

The US Regulatory Environment Supports Crypto Listings, While Hayes Predicts a Similar Outcome to EOS

From this perspective, crypto capitalization is entering the fast lane. Behind this wave of listings is a significant improvement in the US regulatory environment. In fact, as early as last year, The Information cited industry insiders stating that after Trump's victory, investment bankers from top Wall Street institutions like JPMorgan, Goldman Sachs, and Morgan Stanley had been meeting with executives from cryptocurrency companies, hoping to gain opportunities for potential IPOs post-election.

David Bailey, CEO of Bitcoin Magazine, bluntly stated that now is a golden opportunity for crypto companies to go public, primarily for two key reasons: first, crypto stocks are performing strongly on Wall Street, and second, the regulatory environment is improving with the shift in policy stance.

JPMorgan also pointed out in a recent report that the advancement of the GENIUS Act is expected to continue improving the US crypto regulatory environment, prompting more crypto companies to seek IPOs. So far this year, the number of crypto company IPOs has matched the levels seen during the 2021 bull market. This wave coincides with the SEC's withdrawal of lawsuits against some of the industry's largest companies, including Kraken, Binance, Ripple, and Coinbase.

Andrei Grachev, a partner at DWF Labs, believes that crypto projects should establish trading tools by listing on Nasdaq to attract traditional investors and convert them into long-term token holders through share sales, thereby aiding the development of the crypto market.

Meanwhile, Arthur Hayes, co-founder of BitMEX, recently revealed in an interview that his family office Maelstrom plans to raise investor funds to acquire specific crypto companies, particularly those with very stable cash flow and strong profitability. The management structure of these companies may be restructured, with a focus on increasing new revenue sources. In the future, Maelstrom also plans to go public in the US through a SPAC (Special Purpose Acquisition Company).

However, he also warned that the crypto industry is transitioning from the ICO boom of 2017 to an IPO frenzy from 2025 to 2027. This wave will likely end with a large IPO similar to EOS, which will attract a significant amount of fiat capital but perform poorly after opening. He believes that for new stablecoin issuers lacking channel support, even if they successfully go public, it will be difficult to maintain high valuations, and they may ultimately go to zero.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。