Original | Odaily Planet Daily (@OdailyChina)

First, congratulations to the Tron blockchain for reaching a new milestone. On June 16, Tron announced that it would go public through a reverse merger with SRM Entertainment, which is already listed on NASDAQ (stock code: SRM). SRM Entertainment will be renamed Tron Inc, and the company will also launch a TRX treasury strategy. (See: "Tron Merges with SRM Aiming for NASDAQ, Sun Yuchen's Move in the Atmosphere")

With Tron entering the US stock market, combined with the news on June 12 that Tron has completed the minting of its first USD1 stablecoin, this indicates that Tron is transforming into a "compliant American chain" supported by the Trump Group. With its advantages in stablecoin transfers, the future network demand for the Tron blockchain is expected to grow significantly, and it can be anticipated that the prosperity of network transfers will lead to increased costs.

To reduce transfer costs, most users will choose to engage in energy leasing, which can help users save 70% to 80% on fees for a single transfer on Tron. Although the advantages are clear, the energy leasing industry on Tron is still in a "Warring States period," with rampant industry chaos, widespread platform fraud, and significant threats to user rights. As the user base and network demand for the Tron blockchain expand, the chaotic elements in the Tron energy leasing industry are bound to face a "cleansing."

Odaily Planet Daily will detail what Tron energy is and the leasing empire behind it in this article, while also interviewing CatFee, an energy leasing self-service platform recommended by the official Tron wallet, to uncover the chaos in the Tron energy leasing industry and promote greater transparency and user-friendliness across the industry.

I. Introduction to Tron Energy and Leasing

In the TRON network, there are two types of resources: Bandwidth and Energy. Bandwidth is used to measure the storage and network resources occupied by transactions on the chain, while Energy is used to measure the computational resources required to execute smart contract instructions (such as storage read/write, logical calculations, etc.). Ordinary TRX transfers only consume bandwidth and do not consume energy; however, calling TRC-20 or TRC-721 contracts (such as transferring USDT or creating NFTs) requires both bandwidth and energy.

In simple terms, Tron energy can be understood as similar to "Gas" on Ethereum. Users mainly have the following three ways to obtain energy:

- Staking TRX

Users can stake a certain amount of TRX to receive energy for free in proportion during the staking period (daily energy obtained = staked TRX amount / total staked TRX in the network * 180,000,000,000). The staked TRX still belongs to the user, and after un-staking and waiting for 14 days, the TRX can be used normally, but no energy will be generated. Users can link their wallets to stake TRX through tronscan, and currently, staking 1 TRX can yield approximately 10.39915 energy (daily fluctuation).

- Directly Burning TRX

For users who do not frequently use the Tron network, the term energy may be somewhat unfamiliar, as some users do not seem to perceive the use of energy when transferring USDT on Tron. This is because when a user’s address does not have enough energy to pay, the wallet will automatically burn TRX in the address to exchange for the required energy. According to tronscan data, burning 1 TRX can yield 4,761.90476 energy.

It is important to note that the burned TRX is directly destroyed on the chain and is not paid to nodes or leasing platforms.

- Renting Energy through Energy Leasing Platforms

The third way is for users to rent energy in advance from third-party energy leasing platforms on Tron to cover the costs of transfers. Users can pay a certain rent for a specified address that requires energy. Taking the energy leasing platform CatFee as an example, it supports various leasing options such as in-DApp purchases, API access, and energy subleasing. Ordinary users can pay 3 TRX to obtain 65,000 energy, which is sufficient to support one USDT transfer, saving about 10 TRX (burning TRX for payment requires about 13.5 TRX).

What Problems Does Tron Energy Leasing Solve?

Undoubtedly, whether for occasional users of the Tron network, peak demanders, or project parties and developers, obtaining Tron energy through energy leasing is the optimal solution.

- Energy Leasing Reduces Transfer Costs

First, the cost of leasing is generally lower than the costs of staking and directly burning TRX to obtain energy. For example, in a USDT transfer, if the target address already has USDT, a transfer requires about 65,000 energy + 350 bandwidth, which would require burning about 13.5 TRX directly. If the target address does not have USDT, it would require about 13,000 energy (27.7 TRX).

However, using energy leasing can reduce transfer costs by more than 50%. Based on the current leasing price of 72 sun/Day from JustlendDAO, users can spend 7.3 TRX to rent 100,000 energy, which can complete 2 USDT transfers. If obtaining 100,000 energy through staking, at least 9,617 TRX would need to be staked.

If using the third-party energy leasing platform CatFee, users only need to spend 3 TRX to rent 65,000 energy, which is even lower in cost.

- Optimizing Capital Efficiency

In addition to being lower in cost, energy leasing can also optimize capital efficiency without excessively occupying users' TRX. For users who occasionally use Tron for transfers, staking 6,250 TRX to obtain 65,000 energy for free is clearly not cost-effective. It may seem free, but un-staking TRX requires being locked for 14 days before it can be used normally. If a significant drop occurs during this period, it poses a risk of substantial asset depreciation.

Even for users who frequently use Tron for transfers, obtaining energy through a safe and professional third-party energy leasing platform not only incurs lower costs but also enhances the flexibility of their capital.

II. The Energy Leasing Industry Still Faces Chaos

Currently, the Tron energy leasing market is showing rapid growth and has formed a multi-layered ecological structure. In the primary market, users obtain energy by staking TRX, with an annualized return rate of about 2.8%-4.1%; in the secondary market, energy leasing platforms match supply and demand, renting out idle energy, with annualized returns exceeding 20%; while in the "tertiary market," professional institutions even engage in energy futures contract trading, cross-platform arbitrage with USDD, TRX, and stUSDT, with peak annualized returns reaching 30%-50%.

However, even as the market scale expands, the Tron energy leasing industry remains in a "chaotic period," especially with rampant issues in the secondary market. We have learned that many newcomers to Tron or users unfamiliar with energy leasing have encountered phishing attacks, Ponzi schemes, and malware that steal assets, and recovering assets after such deceptive cases is extremely difficult.

Low-Cost Energy Leasing Lures Users to Transfer Incorrectly

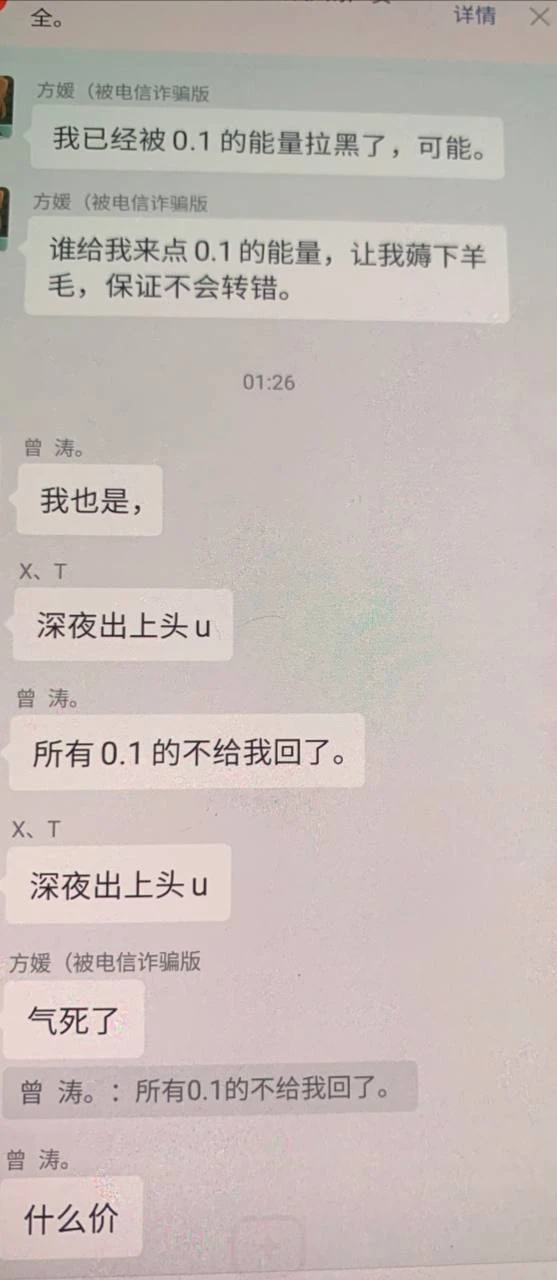

The most typical energy leasing scam model involves attracting users with low leasing prices and then misleading them into mixing up transfer addresses. Specifically, scammers intentionally lower energy prices, promoting that a USDT transfer can be made for as little as 2.5 TRX or even less (legitimate leasing requires at least 3 TRX). When users pay the scammer's address, they do indeed receive about 65,000 energy, but they are generally advised to save the address in their wallet or pin it, and are told that when they need to transfer on Tron, they can rent energy from that address.

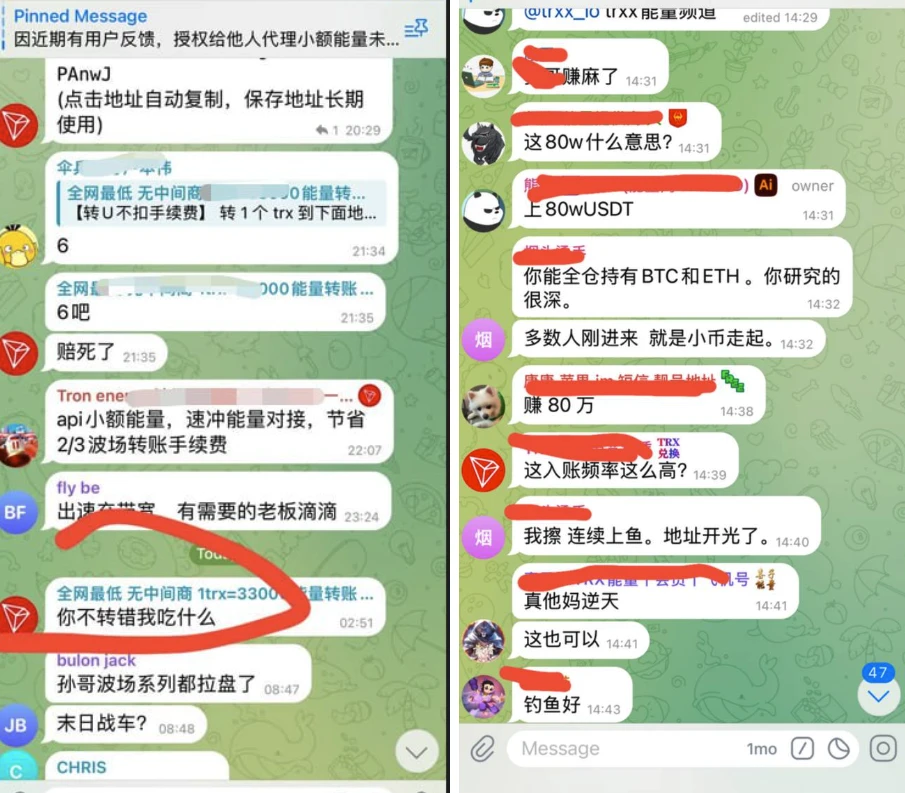

At this point, the scam begins, as the scammer's address is pinned in the address book. The scammer bets that users will mistakenly think it is the target transfer address and transfer USDT or other tokens to their address. Once users realize the mistake, the scammer will block them, completing the scam.

Scammers complete the scam when users transfer to the wrong address.

In reality, compared to Ponzi schemes and Trojan viruses, this type of scam is not sophisticated, but it is the most common. It exploits users' desire to save money and increases the "winning rate" of users transferring incorrectly through a wide net approach. You might save a few times, but the scammer only needs you to make one mistake.

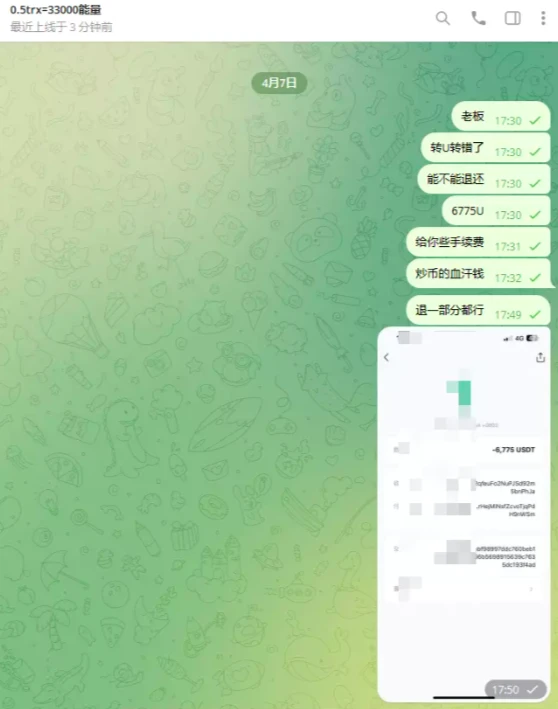

Users plead with scammers to return the incorrectly transferred USDT.

Do not underestimate this "simple" method; we learned from CatFee that since its leasing business opened 2 years ago, it has refunded over $600,000 in incorrectly transferred funds to users. The profits of leasing platforms that deliberately fish for users and do not return funds can be imagined.

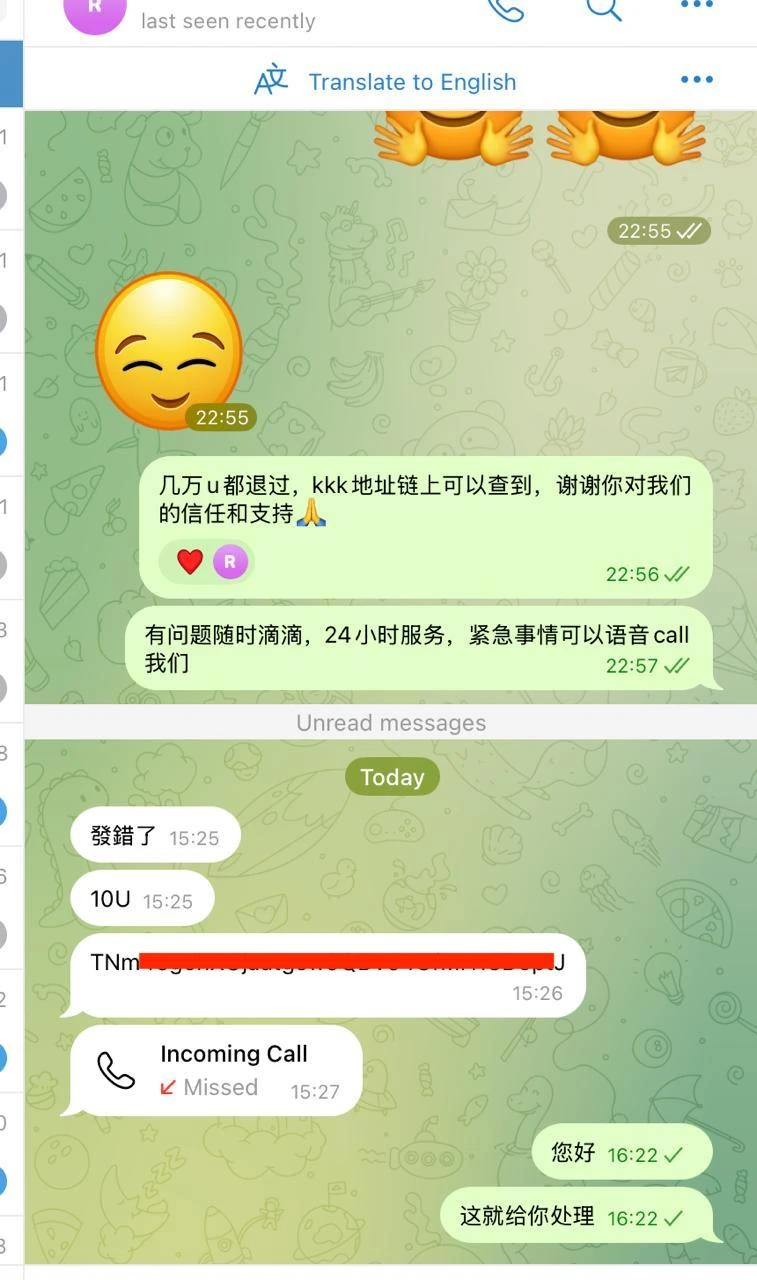

Legitimate energy leasing platforms will refund users for incorrectly transferred funds.

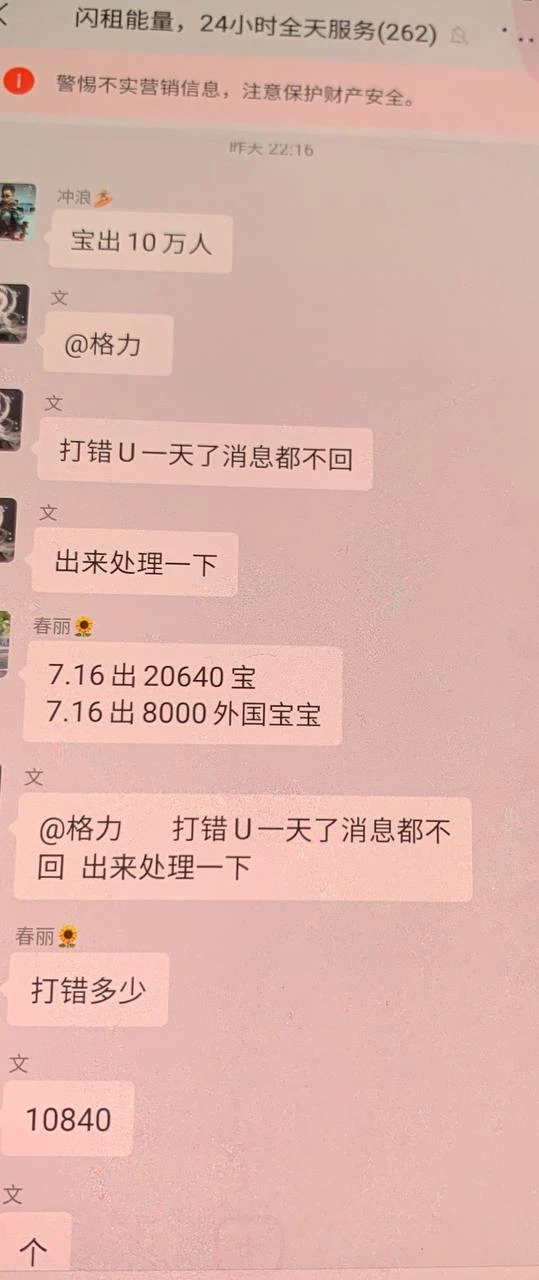

At the same time, CatFee revealed to Odaily reporters that phishing leasing platforms do not care about leasing costs; they mainly aim to cultivate user habits. You may not transfer incorrectly for 1-10 days, but over a month, about 10% of users will make careless mistakes, which is called "raising fish fry." There are even people currently teaching phishing and recruiting agents, streamlining this phishing method.

Users lose contact with scammers after transferring to the wrong address.

So how can we distinguish whether an energy leasing platform is legitimate? CatFee states that the most important factor is to check if there are records of returning incorrectly transferred funds to the original source. Users can also observe whether the platform's website is professional, the domain registration time, whether the development documentation is complete and legitimate, the activation time of the business address, and the activity level of transaction records. If there is not even a business website and operations are solely conducted through a simple Telegram bot, it could disappear at any time.

Interestingly, there are also users who believe they will never make a mistake and are dedicated to taking advantage of scammers.

III. Overview of Mainstream Energy Leasing Platforms

From the phishing cases above, it is clear that for ordinary users, choosing a low-cost and reliable Tron energy leasing platform is extremely important. Currently, there are four mainstream energy leasing platforms available for users: the official Tron JustLend energy leasing platform, the CatFee energy leasing self-service platform, the 100CAT C2C energy trading platform, and the Mefree energy leasing platform, which will be introduced below.

JustLend

JustLend is the first official lending platform on Tron, where users can also check energy prices and lease energy. JustLend's energy prices are calculated daily, fluctuating between 70 to 75 sun per day (1 TRX = 1,000,000 sun). For example, users can rent 100,000 energy for 7.365 TRX (equivalent to the energy obtained by staking 9,617 TRX), which is enough to cover two transactions.

CatFee

CatFee is a third-party energy leasing platform recommended by the official Tron wallet. The company was established in Los Angeles, USA, at the end of 2023, and with rapid business development, it has successively set up branches in Melbourne, Australia, and Malaysia in 2024. In the Tron energy leasing business, CatFee aims to help downstream TRC20 transfer users save on gas fees while providing energy leasing services to upstream "whale" users holding large amounts of TRX to generate additional income.

Currently, CatFee's daily energy leasing scale stabilizes between 4 to 5 billion, providing TRC20 transfer support to an average of 30,000 to 40,000 users daily, with the platform's daily energy sending service orders exceeding 30,000, cumulatively saving users over 300,000 TRX in gas fees daily. The lower transaction fees not only reduce the usage threshold for users but also encourage more people to choose TRC20 transfers through the Tron network, thus promoting the development of the Tron ecosystem while providing actual convenience and cost advantages to end users.

Compared to other energy leasing platforms, CatFee has the following advantages:

- Large Energy Pool with High Concurrency Capability

CatFee has an enormous Tron energy pool of over 4 billion, ensuring energy supply during peak times with stable delivery. Additionally, CatFee has redundant data centers in Los Angeles, Melbourne, and Singapore, and its substantial hardware investment enables high concurrency capabilities, processing up to 300 orders per second, providing energy for 500,000 TRC20 transfers daily.

- Leasing Costs Lower than Official Leasing Prices

A USDT transfer on Tron requires about 65,000 energy (13.5 TRX). Compared to JustLend's energy leasing costs, using CatFee to lease 65,000 energy only requires 3 TRX, which is cheaper than the official price. CatFee states that if a leasing platform lacks its own funds and energy pool, the operational cost of energy can reach up to 4.6 TRX. Only with these two elements can energy leasing platforms reduce sales costs. "Even so, the platform only has a 5% profit margin, and last year it was even operating at a slight loss until the business gradually entered a small profit stage between March and May 2025," CatFee told Odaily reporters.

This indirectly proves that energy leasing services priced below 2 TRX in the market, especially in the range of 0.1–2 TRX, are 99% likely to be operating at a loss or are phishing platforms.

- Reliable Team with Full Refunds for Incorrect Transfers

The CatFee team consists of a strong professional development team made up of blockchain engineers from various countries, with rapid updates and iterations of product services. Additionally, in the energy leasing industry, CatFee is one of the few platforms operating as a professional company, supporting 24/7 global multilingual customer service to assist users with inquiries.

Furthermore, CatFee promises that if energy is purchased through a transfer, even if assets are mistakenly transferred to the platform, CatFee will not charge fees and will return the assets 100% to the original source.

100CAT C2C Energy Trading Platform

100CAT is a C2C energy trading platform officially recommended by Tron, where users can sell idle energy (suitable for stakers), and users in need of energy can also purchase it on the platform. The energy prices on the 100CAT platform are also cheaper than the official pricing. For example, purchasing 65,000 energy for a 3-day rental can have a unit price as low as 45 sun per day. Energy sellers can also manually fulfill orders to sell energy to buyers. If they do not want to sell manually, they can register as a 100CAT VIP, and the platform will help customers automatically sell energy to achieve maximum profits.

Mefree

Mefree is also an energy leasing platform officially recommended by Tron, with its own energy pool of about 1.2 billion. However, due to the increase in USDT transfer fees on the Tron blockchain, Mefree has also raised its energy leasing prices, requiring 5 TRX (10 TRX if the target address does not have USDT) to purchase 65,000 energy. They also state that if users mistakenly transfer 3 TRX and do not receive energy, they will provide a full refund.

IV. Final Thoughts

Undoubtedly, with the prosperity of the Tron blockchain itself, the energy leasing industry will also benefit in the future, and user demand for energy leasing will increase. However, the entire industry is still in a stage of sifting through the chaos, coexisting with disorder and order, with middlemen competing alongside legitimate operating companies.

"The legitimate energy leasing industry is a highly technical and capital-intensive competitive field. Once it cannot maintain basic profits, the question of whether to turn to illegal methods such as phishing becomes a test of the humanity of teams engaged in energy leasing," CatFee stated when asked about the current state of the energy leasing industry.

Indeed, in such circumstances, many teams may turn to phishing, scams, or evolve into Ponzi schemes relying on customer funds for operation. However, we believe that the energy leasing industry on Tron will also evolve from "wilderness" to civilization and order, and in the future, only platforms that truly provide quality services to users will survive.

Related Articles

Why Can't You Use Centralized Exchange Wallets to Purchase Energy?

Why Did the Transfer Fail Even After Renting Energy?

Why Are Some Energy Rentals Particularly Cheap?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。