pump.fun plans to sell tokens at a valuation of $4 billion, with Messari's latest report estimating PUMP's valuation at $7 billion.

Written by: Sunny Shi, Messari Crypto

Translated by: Alex Liu, Foresight News

According to various media outlets citing informed sources, pump.fun is preparing to sell 25% of PUMP tokens at a valuation of $4 billion to raise $1 billion.

Is this price attractive?

Sunny Shi from Messari has built a valuation model for PUMP, which shows that its FDV (Fully Diluted Valuation) could reach $7 billion. If the prediction is correct, buying PUMP tokens would be profitable. However, there is an important premise. Here is their valuation process (from Sunny Shi's perspective, "we" refers to Messari):

Regardless of how you view memecoins, this sector continues to "print money."

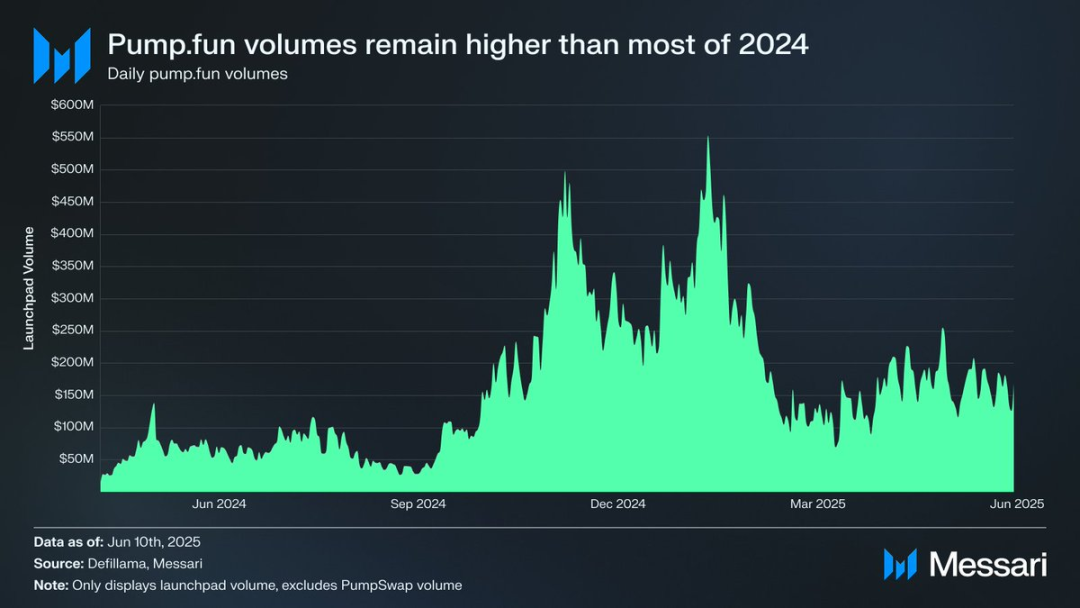

Although the trading volume on the pump.fun token platform has declined compared to the beginning of the year, it is still far above the levels for most of 2024.

Pump.fun's trading volume is higher than most of 2024, data: Messari

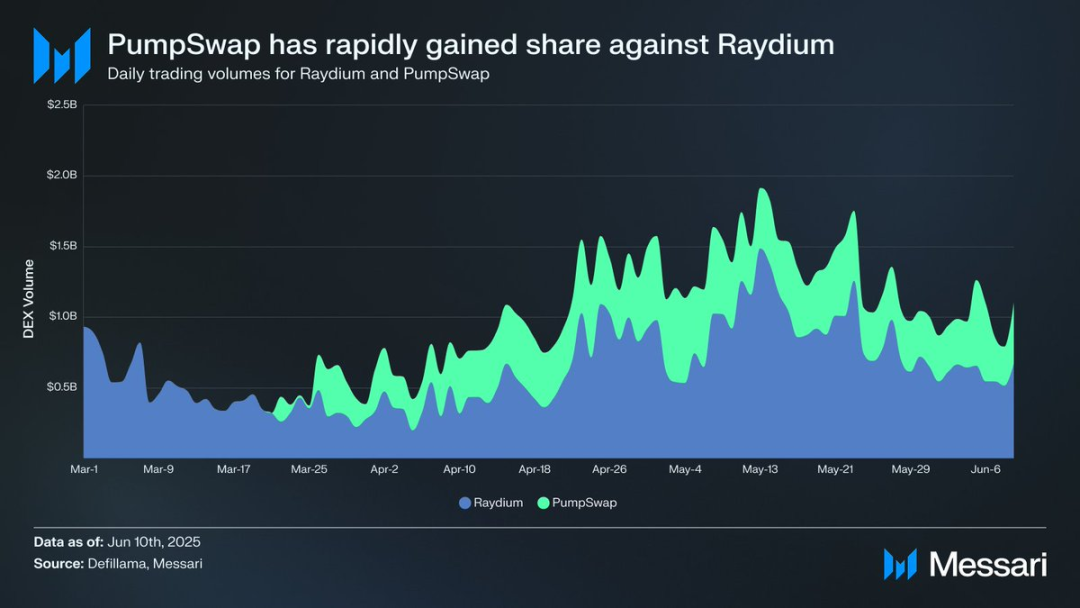

People may also be underestimating the success of PumpSwap. This DEX launched about three months ago but has already significantly captured market share from Raydium on Solana.

Comparison of market share between PumpSwap and Raydium, data: Messari

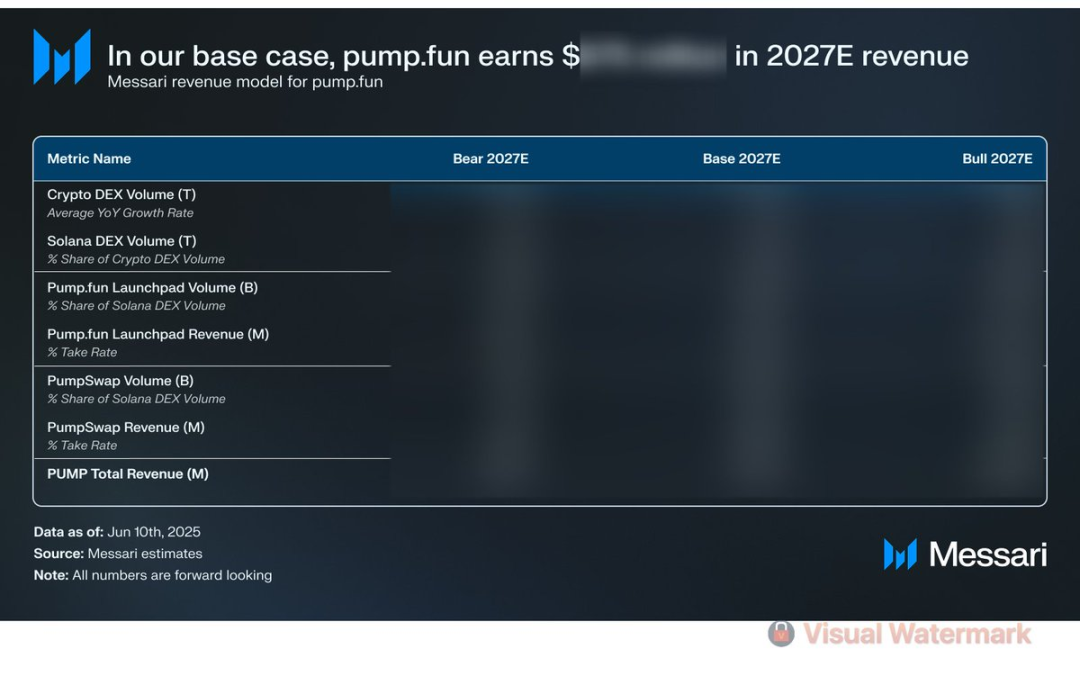

Our valuation method uses a top-down model, assuming overall trading volume in the crypto market, Solana's market share, launch platform share, and PumpSwap's market share. These assumptions and models are only available to enterprise clients, but I will share the main conclusions.

In our base case, we believe memecoins will occupy a niche in the broader crypto economy, as they are more suitable for speculative purposes than NFTs.

Of course, as the Solana ecosystem matures, it will undoubtedly diversify into new asset pairs, but this is also likely to hold true.

We believe that even if pump.fun's share within the Solana ecosystem slightly declines, the continued growth of PumpSwap means the pump project is still expected to generate about $675 million in revenue over the next two years.

Calculating with a 10x valuation multiple, the corresponding FDV is approximately $7 billion.

However, the key premise is: if the project chooses an opaque token/equity structure that allocates most of the revenue to insiders rather than token holders, we believe the current market has become quite cautious and will not overlook such poor value accumulation methods.

In our full report, we provide a valuation table to assess PUMP's potential value based on the percentage of revenue that token holders can access.

Regardless of how the market ultimately judges, this is an excellent opportunity to participate in the most profitable crypto application in history. It now depends on whether the project team provides token holders with sufficient buy-in value to make it a worthwhile investment.

Editor's Note:

At this moment, the price of PUMP on Aevo's pre-market perpetual trading platform is $6, corresponding to an FDV of $6 billion.

PUMP's pre-market price on Aevo

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。