Will BlackRock ETH sell impact Ethereum price prediction June 2025?

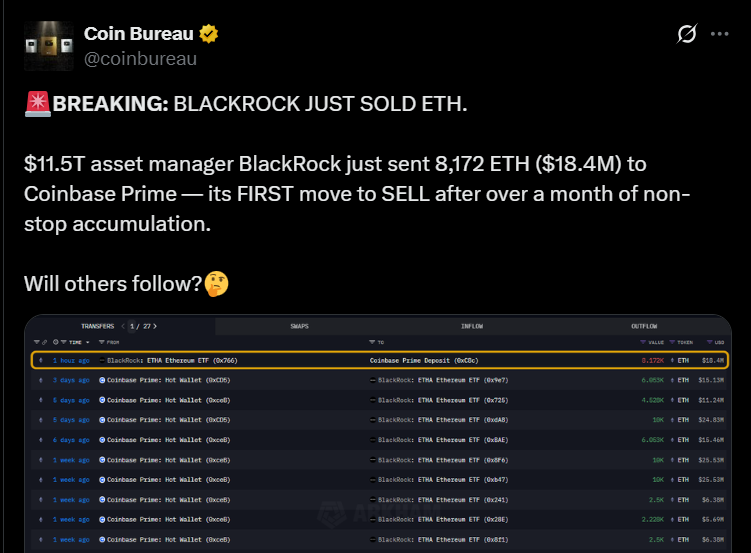

The market was shaken after BlackRock, the world’s largest asset manager, reportedly sold a portion of its Ethereum holdings for the first time in over a month.

According to Coin Bureau, BlackRock sent 8,172 ETH (worth $18.4M) to Coinbase Prime, marking a shift after accumulating over $750M worth of coins in June alone.

Source: Coin Bureau X Account

Source: Coin Bureau X Account

The sudden BlackRock sell ETH move has reignited debate over its mid-term outlook. However, Ethereum price prediction June 2025 remains bullish among analysts and traders, especially as institutional holding via BlackRock’s iShares ETF still stands at 1.66M tokens (approx. $3.83B), per Lookonchain data.

Why Ethereum is Going Up Today? 2 Major Reasons

As of writing, The price today is trading just below $2,272.53 with a 3% daily increase, but the 24-hour trading volume is down 28.84%, now $20.09B, according to CoinMarketCap.

Here are the 2 green signals behind why ETH is pumping:

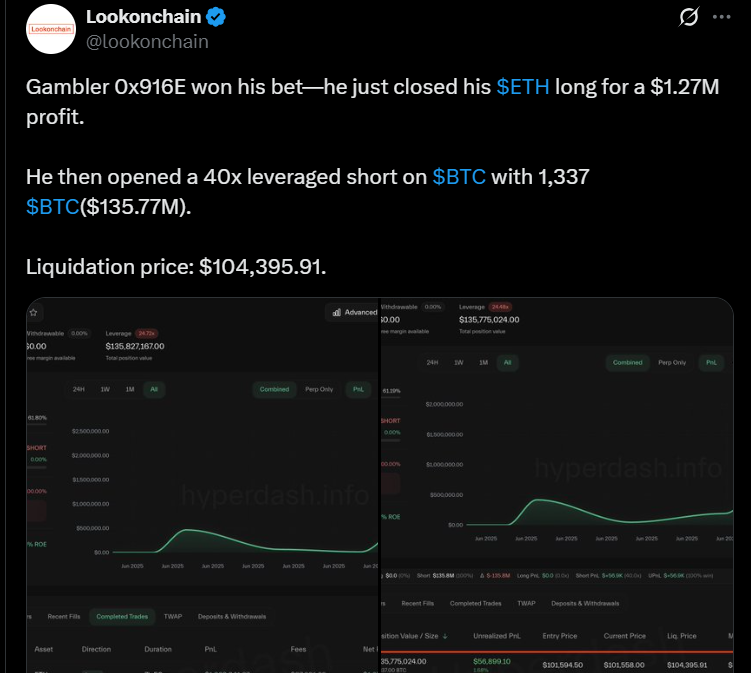

1. The price bump appears to be supported by both on-chain bullish trades and macro stability. As per the latest reports, newcomer wallet 0x916E deposited $4.28M USDC into Hyperliquid and opened a 25x ETH long, injecting sudden demand.

Source: Lookonchain

2. Good Entry Point: After observing the technical indicators flashing signals of a potential bounce, the RSI had just dipped near oversold territory (35.84) which also tells you there is a chance of reversal in the short term, and pricing was still above major support zones which were around $2,100, and with traders establishing a good entry point the price could have the chance to bounce.

Given these signals, the price prediction for June 2025 has started gaining fresh momentum despite the ETF outflows.

Top Analyst Cipher X Predicts $4K ETH in Q3 — But With Conditions

As per Cipher X ETH analysis , the price increase is following a Wyckoff accumulation pattern, suggesting that value could be gearing up for a rally. After retesting support successfully, the token avoided a breakdown and held its bullish structure.

Source: Cipher X

However, he clearly warns: a daily close below $2,100 would invalidate the pattern. If price action stays strong, the short term target is $2.9K–$3K, with long-term potential to reach $3.5K–$4K in Q3 2025. These predictions strongly align with growing interest around the next Ethereum price target .

Daily Chart Breakdown: Is This a Shakeout or Setup?

Technical Indicators:

-

RSI: 35.84 → near oversold territory, suggesting a bounce is likely

-

MACD: Bearish but flattening, showing potential for reversal

-

Volume: Average – no whale reentry yet, but also no panic

Source: TradingView

Price Prediction: Will Ethereum Hit $3K Target?

-

Short-Term (3–7 Days): Consolidation in $2,200–$2,300

-

Mid-Term (2–3 Weeks): Rise toward $2,400–$2,550 with volume breakout

-

Long-Term (1–2 Months): Rally to $2,800–$3,000 possible with ETF inflows

What This BlackRock Ethereum News Really Means For Investors?

While the market reacted to the BlackRock sell, being a crypto analyst, I believe the transaction may be a portfolio rebalance or liquidity test for the company.

Traders are watching for daily closes, ETF activity, and global market news to confirm whether this was a short-term action or something bigger.

Conclusion: Ethereum Price Prediction June 2025 Still Bullish

Despite the short-term noise, the bigger picture for Ethereum price prediction June 2025 remains optimistic. If it remains above $2,100 and ETF outflows slow down, a run toward price target $3K+ could play out within weeks.

For now, this move looks more like a setup than a selloff—especially with whales still placing leveraged bets, so keep an eye on the latest market updates to see where the price goes next.

Also read: CEX.IO Power Tap Daily Quiz Answer Today 24 June 2025: Win Big!免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。