OKX and Binance are like two philosophers, interpreting Heraclitus's "everything flows" and Plato's "rational order"; one fights in chaos, while the other strategizes within a framework.

Author: danny

If you often wonder why your positions on OKX get liquidated before those on Binance? Or why you earn less on Binance compared to OKX? Or why OKX has been slow to introduce new contract trading pairs, as if they don't want to continue? This long article will address your confusion.

Revealing: Why hasn't OKX introduced many new perpetual contract trades? Meanwhile, Binance's new contract trades are soaring? — Is it a business decision? Compliance? No, this is actually a battle of underlying algorithms.

Introduction

I wonder if anyone has noticed that for the same perpetual contract trading pair,

Why can Binance offer leverage up to 75x (assuming you can open at 75x, with a maximum of 5000 USDT), while OKX only allows up to 20x?

Why are the prices for the same trading pair at the same time different between the two platforms? And why are the funding rates charged differently?

Is it because you are so strong that capital is specifically targeting you? Is OKX specifically monitoring your account to strike at it? Is Binance skimming your profits?

Don't be silly, kid. You're overthinking it… This is all due to the differences in underlying algorithms.

1. What is perpetual contract trading?

First, we need to understand the key factors that determine perpetual contract trading:

Index Price

Mark Price

Funding Rate algorithm

In short, the relationship between these three key elements is:

Mark Price + Index Price = the core algorithm mechanism that determines "contract price," and the funding rate algorithm = the mechanism that decides whether you should pay someone money and how much.

As for the differences in the algorithms for these three elements between Binance and OKX, let me elaborate.

What?! You say you don't want to know the details? Just passing by to see the conclusion.

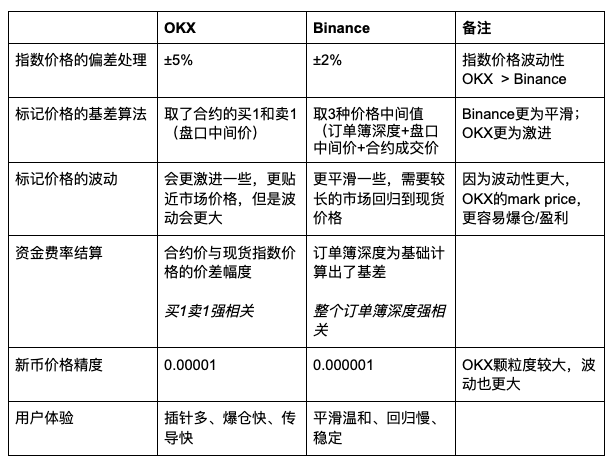

Alright then, take a look at this simple comparison table.

Summary:

From an algorithmic perspective, OKX (Mark Price + Buy 1 Sell 1) inherently has higher volatility in its contract trading compared to Binance, and with a coarser granularity, this further exacerbates its volatility.

2. The devil is in the details

Below is a detailed explanation without (hard) talk; if you find it boring, feel free to skip to the next chapter:

Index Price

The index price refers to the weighted average price of the current market's circulating spot, usually derived from the spot prices of multiple mainstream exchanges, weighted accordingly.

To prevent a particular exchange from causing excessive price deviation due to technical or liquidity issues, the system performs "smoothing":

Binance: ±2%

OKX: ±5%

Thus, in extreme market conditions, the index price volatility of OKX > Binance, resulting in higher risk/reward and faster market response.

Mark Price

This is the most critical price in futures trading — it directly determines whether you get liquidated.

The design concept of the mark price is: based on the spot index price, it incorporates some reference factors of the contract price to form a more "reasonable" midpoint price for calculating profits and losses and liquidation.

The formula is:

Mark Price = Index Price + Basis

The so-called "basis" is the price difference between spot and futures, smoothed using a moving average to prevent interference from "spike" market conditions.

In other words, the volatility of the spot price is the biggest culprit for your liquidation, not some mysterious "exchange secretly changing prices."

Differences in Mark Price algorithms between OKX and Binance

OKX's algorithm:

It only takes the "Buy 1" and "Sell 1" of the contract, which is the midpoint price (Taker price). It does not consider order book depth, resulting in greater volatility (easier to spike), but the price is closer to the market. This means that when there is a price difference between spot and futures, the return to equilibrium is faster, but you are also more likely to get liquidated or make a huge profit.

Under OKX's scheme, the Mark Price is more closely aligned with the spot price, and when there is a price difference, it will return to equilibrium more quickly.

Binance's algorithm:

More cautious. It calculates three prices:

A weighted price strongly correlated with the spot index and funding rate (considering order book depth)

The Buy 1/Sell 1 midpoint price like OKX

The actual transaction price of the contract

Then it takes the average of the three as the mark price. This results in smaller volatility and greater stability, but a slower return to equilibrium between spot and futures.

Why can the spot and contract transaction prices be different?

This is the norm in contract trading. The algorithm does not force the two to converge. Therefore, the platform introduces a mechanism to "compensate" for this price difference: the funding rate.

How is the funding rate settled?

The positive and negative values of the funding rate are merely the result of market behavior. Its role is to gradually bring the contract price back to the spot price by transferring costs.

Your held position will incur funding fees at certain intervals. For example:

You opened a 10x long position with 100 USDT (nominal position 1000 USDT)

The current funding rate is 0.1%

This period you will pay: 1000 * 0.1% = 1 USDT

Positive rate: Long position → pays to short position

Negative rate: Short position → pays to long position

OKX's funding rate algorithm:

The formula essentially is:

(Contract market price - Spot index price) / Spot index price, then take a moving average and limit the upper and lower bounds (±1.5%).

Moreover, OKX sets the borrowing rate to 0. This means the market almost does not consider the real cost of borrowing coins.

Binance's funding rate algorithm:

In contrast, Binance's is more complex. Based on OKX's algorithm (with upper and lower limits of ±2%), it also considers two key factors:

- Borrowing rate ≠ 0

Binance's default borrowing rate is 0.01%, so even if the spot and futures prices are the same, there will still be a minimum funding fee of 0.01%.

- Premium index + Impact Bid/Ask

This part is the highlight. Binance does not settle for the "surface price" of Buy 1/Sell 1 but refers to the depth of the entire order book. However, it has renamed this concept to "Impact Bid/Ask."

For example:

"Impact Ask": When someone places a market buy order of 1 million USDT, where will the price be pushed to?

"Impact Bid": Conversely, when selling, where will the price be pressed to?

These deep considerations make Binance's funding rate more reflective of real supply and demand, rather than just focusing on the surface price.

Precision design

OKX Precision: 0.0001 → Larger minimum order unit → Plus OKX is Buy 1/Sell 1, price changes quickly

Binance Precision: 0.000001 → Looks at order book depth, price changes are more nuanced

Combining OKX's mechanism of only referencing Buy 1/Sell 1 leads to: fast volatility, severe liquidations, and rapid pace, suitable for short-term scalpers; while Binance is stable like a hen, suitable for large funds and stable operations.

An example of a bug where the funding rate is "useless":

When the contract price is below the spot price (negative funding rate), theoretically, arbitrageurs should:

Short the spot + Long the contract → Raise the contract price

But the problem arises: If the spot token is controlled by a whale and cannot be borrowed, arbitrageurs cannot complete this set of operations. Even if they are willing to borrow, the borrowing rate may be higher than the funding rate, rendering the arbitrage opportunity ineffective.

Thus, the contract price remains low compared to the spot, while the funding rate continues to settle, allowing "longs to get free money," but the price does not return.

This is also why "meme coins" like Alpaca/TRB can have such bizarre operations, even though Binance has repeatedly adjusted the frequency and rates of funding, it still cannot "dissuade" the enthusiasm of retail traders.

Interesting "conscientious behavior" of exchanges:

It is said that some "slightly conscientious" exchanges, in order to smooth prices, will "print" a little coin themselves, sell it in the spot market, and simultaneously go long in the contract for hedging.

Why is it called conscientious? Because they could have directly printed coins to dump and arbitrage, but they chose to stabilize the market — in capitalism, this is already quite zen. However, after a bug occurred, they were attacked by the community.

Smart readers should have realized several key facts by now:

Mark Price determines the profit and loss status of your account

The funding rate mechanism is the bridge for price transmission between contracts and spot

The algorithm design of different exchanges affects liquidation rhythms, capital flow, and even trading strategies

Sometimes, the reason the contract price does not return is not that arbitrageurs do not see opportunities, but because they lack money, lack coins, or cannot borrow

3. Above algorithms, beneath human nature — Different trading methods and offensive strategies

The differences in algorithms give rise to two distinct "trading methods" and coin listing strategies (with the premise of controlling the spot).

Trading on OKX:

Easier to spike: Due to OKX's mark price algorithm only referencing Buy 1/Sell 1, and the price precision being coarser, a slightly larger Taker order can cause significant price fluctuations, making "spike liquidations" very convenient.

Higher volatility, lower cost for pushing prices: You can influence market trends with less capital while triggering counterparty liquidations more quickly.

Suitable for manipulation and quick trades: More suitable for short-term wash trading, quickly triggering user stop-loss points and then rapidly retracing.

More aggressive arbitrage: Because the price returns to equilibrium quickly, you can frequently construct spot-futures arbitrage and hedging operations.

Trading on Binance:

Harder to push price volatility: Due to referencing the depth of the entire order book, to "spike" you need to consume more orders, resulting in higher trading costs. Also, because of this order book thickness, we can peek into whether there is a "whale" presence through the order book depth.

Suitable for slow layout and stable position control: Steady large players may prefer this "hen-like market" — not easily liquidated, but can steadily push prices up or down.

Arbitrage opportunities are harder to trigger: But once an arbitrage opportunity arises, it tends to be more persistent. For example, in funding rate events that squeeze shorts, this has led Binance to frequently adjust the funding rate settlement frequency.

If this were "Honor of Kings":

OKX is more suitable for an assassin like Han Xin, playing liquidation games and oscillating wash trading; high mobility + jungle infiltration + extreme escape;

It is suitable for traders who like to frequently strike in market fluctuations and fight volatility.

Binance is more suited for a strategist like Zhuge Liang, adept at trend control, capital management, and institutional arbitrage; calmly calculating, employing kite tactics, and passively triggering harvests.

Binance's algorithm emphasizes order book depth, impact pricing, and the balance of capital costs, much like Zhuge Liang uses wisdom and institutional strategy to maneuver, exhausting opponents with kite tactics (funding rates) — stabilizing control and prioritizing the big picture (this is also why most funding rate consumption battles occur on Binance).

4. Does the algorithm affect the exchange's decision to list new perpetual contracts?

The answer is yes, and the impact is significant, especially in the context of overall market liquidity being severely insufficient, where new coins must be "doused" right from the start. How exchanges manage price volatility and control liquidation risks has almost become a "life-and-death line" for whether they can list perpetual contracts.

From a mechanism design perspective, Binance is more suitable for launching new coin perpetual contracts. First, its relatively smooth pricing mechanism constructs the mark price by taking the median of the spot index, order book depth, and transaction price, making it less likely for new coins to experience severe "spikes and crashes" even in the early stages of listing, thus avoiding the risk of liquidation that could lead to losses for the exchange.

Second, its depth-driven funding rate algorithm no longer solely relies on the buy and sell prices at the order book but simulates large Taker order behaviors to calculate "impact bid/ask prices," constructing a more realistic basis. This mechanism effectively reduces the extreme profits/losses caused by liquidations, allowing market makers and project parties to stabilize prices.

In contrast, OKX faces significantly higher risks when launching new coin perpetual contracts. Its algorithm results in coarser price granularity and more severe volatility, and with the funding rate only considering the order book price and lacking borrowing rate constraints, it is akin to throwing a new coin directly into a sensitive, high-pressure liquidation trigger.

Under conditions of insufficient liquidity, any sharp buying or selling can cause price spikes, triggering widespread liquidations; if there are large slippages and insufficient counterparties after liquidations, it can easily lead to liquidation beyond the margin, ultimately resulting in losses for the exchange itself. The launch of $OM is a typical example — high volatility, spikes, and liquidations, ultimately leading the exchange to "harm others without benefiting itself."

Therefore, in terms of algorithmic philosophy, Binance's robust mechanism makes it more suitable for following a "large market cap trend + institutional arbitrage" route, and it is easier to engage in commercial connections with project parties/market makers; while OKX's high volatility mechanism, although more attractive to aggressive traders, may backfire if liquidity preparations are not made when new coins are launched.

This is not merely a difference in business strategy but an inevitable result determined by underlying design philosophy.

5. Different underlying algorithms reflect different financial philosophies

You can view this algorithmic competition as a clash of two worldviews: one world advocates for systematic, smooth, and stable — that is Binance; the other believes in the invisible hand, volatility, and the extreme games of human nature — that is OKX. The platform you choose not only determines your trading strategy but also implies your belief in this financial world.

OKX: Behavioral Finance School + Market Structuralism

OKX embodies a trading perspective that is more aligned with a "volatility philosophy." Its core logic is: the market is not rational; it is a stage driven by human nature and trading games.

From an algorithmic perspective, OKX uses the buy and sell prices as the core calculation source for the mark price, combined with coarser price precision and more direct responses to the order book, making prices more prone to "jumping" and quickly triggering liquidations or large profits. This mechanism is almost a laboratory model of behavioral finance: prices are driven by emotions, and irrational decisions and herd behavior lead to exaggerated market reactions.

On OKX, strategy formulation is not based on long-term equilibrium assumptions but on "temporary imbalances in market structure." It encourages, and even tacitly allows, traders to exploit market microstructures (such as slippage, low liquidity, order book placements, etc.) for harvesting — this is the essence of "structuralist trading philosophy," which creates volatility through designed structural instability to capture excess returns.

It attracts traders who excel in rhythm battles and are willing to take risks — they do not need market stability; what they need is "extreme volatility."

Binance: Efficient Market Hypothesis + Quantitative Finance School

In stark contrast is the financial philosophy represented by Binance: while the market may be irrational in the short term, it will ultimately return to equilibrium in the long term; the mission of mechanism design is to push the market toward stability and rationality.

In Binance's system, the mark price is constructed from the median of the spot index, order book price, and transaction price, and the funding rate also considers borrowing costs and impact prices. This design essentially builds a systematic arbitrage equilibrium mechanism, allowing each price deviation to be gradually pulled back through rational arbitrage paths — this aligns perfectly with the belief in the "Efficient Market Hypothesis (EMH)": prices reflect all information, and excess returns can only come from taking on greater risks or systematic arbitrage.

Binance's logic is "market control." They rely on a low-volatility, high-trust, and cost-transparent trading environment. This philosophy extends to the quantitative finance school and systematic trading theory: using mathematical models to navigate the market, employing portfolio strategies to hedge risks, and seeking probabilistic advantages within certainty.

It does not require you to engage in knife fights amid volatility but rather allows you to gradually bring the market into your logic using arbitrage formulas.

OKX is human-centric; it believes the market is irrational, and "emotion, volatility, and trading" are the eternal protagonists; Binance is structure-centric; it believes the market can be modeled, anticipated, and managed, with volatility being a deviation rather than a destiny. This is not only a confrontation of two product logics but also an eternal debate between behavioral finance and quantitative finance, chaotic markets and rational markets.

In conclusion

Behind this seemingly cold algorithmic competition lies a fundamental understanding of the "market" as a fictional entity: is it viewed as a battlefield full of human emotions, desires, and games running rampant; or as an order that can be tamed by rationality, models, and institutions?

OKX and Binance are like two philosophers, interpreting Heraclitus's "everything flows" and Plato's "rational order"; one fights in chaos, while the other strategizes within a framework. Traders immersed in this not only bet on prices but also choose systems. Perhaps true trading is not just about understanding algorithms but also about insight and mastery over the tension between human nature and order.

The market never sleeps, and the philosophy of the market never stops.

May we always maintain a sense of reverence for the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。