SharpLink Gaming (SBET), a publicly-listed gaming tech company with a crypto strategy focused on ether ETH, said Tuesday it increased its treasury holdings of the second-largest cryptocurrency to 188,478 ETH.

The Minneapolis-based firm bought 12,207 ETH for some $30.7 million between June 16 and June 20 at an average price of $2,513 per coin, according to a press release.

To fund the purchase, SharpLink raised $27.7 million in net proceeds through its at-the-market (ATM) offering, selling over 2.5 million shares.

SharpLink in one of the growing group of public companies that recently pivoted to add cryptocurrencies to their balance sheets, following the playbook of Michael Saylor's bitcoin-focused Strategy (MSTR).

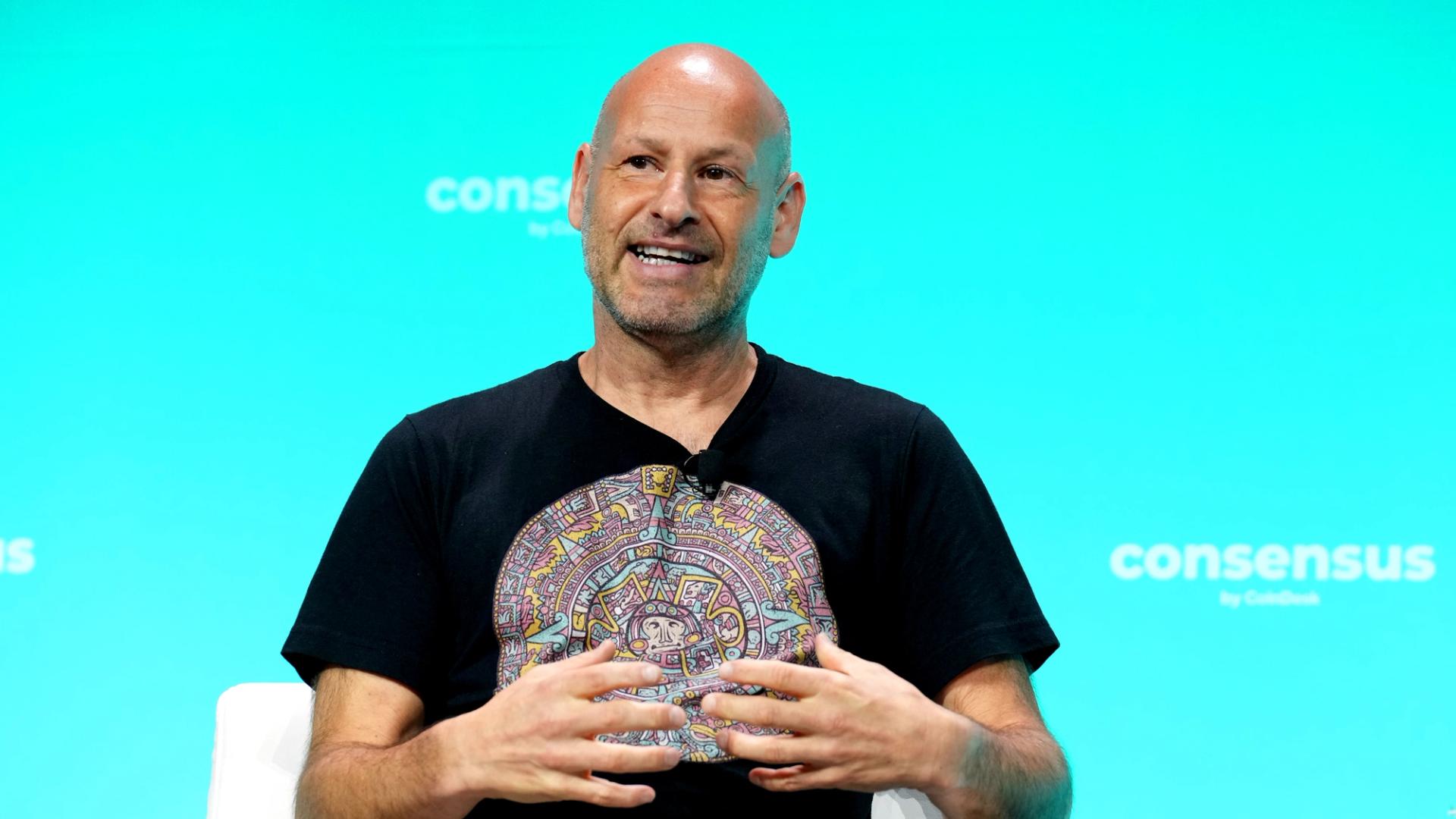

The latest move follows a $450 million fundraising round earlier this month through a private round from a wide range of investors, including ConsenSys, Galaxy and Pantera Capital, to buy ETH. Ethereum co-founder and ConsenSys CEO Joseph Lubin also joined the firm as board chairman. The firm now claims the bragging right of being the largest publicly traded holder of ether globally with some $470 million in ETH at current prices.

Since launching its ETH treasury strategy, the company said it has staked all its crypto stack earning 120 ETH in rewards. The company also reported a nearly 19% increase in ETH per share during that span.

"This move reflects our confidence in Ethereum’s utility and our commitment to exploring transformative technologies that can unlock new value for our business and stockholders, alike," Lubin said in a statement.

Read more: SharpLink Acquires $463M in Ether, Shares Remain 66% Lower

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。