SEC Delays Polkadot ETF Decision Again, Final Verdict in November 2025

The U.S. Securities and Exchange Commission (SEC) delayed its ruling on the 21Shares Polkadot (DOT) Spot Exchange-Traded Fund (ETF). The ruling, due by June 24, 2025, has now been pushed back to November 8. This delay is part of a broader trend as the SEC still seems to be deliberating cautiously on several crypto-related ETFs.

SEC Still Hesitant About Crypto ETFs

The 21Shares Polkadot ETF plans to list on the Cboe BZX Exchange, while Coinbase will serve as the custodian of these tokens. The SEC, however, is taking longer to examine the risks associated with cryptocurrency investments before coming to a final decision.

This is not the first postponement. Last week, the SEC also postponed its ruling on Grayscale's Polkadot ETF proposal, originally submitted on June 11. Now, 21Shares and Grayscale both have to wait until November for a potential go-ahead.

The SEC has been taking the reviews of not only DOT but also other altcoins ETFs such as XRP , Litecoin (LTC), Solana (SOL), and Dogecoin (DOGE) on a case-by-case basis. The agency contends that it requires additional time for public comments and thorough analysis.

DOT Price Rises Despite Delays

Interestingly, Polkadot's price increased about 7% even after the delay news. Market analysts say this increase may be a result of the ease in Iran-Israel tensions that has left investors in a positive sentiment. Bitcoin also rallied above $106,000, propelling sentiment in the broader crypto market.

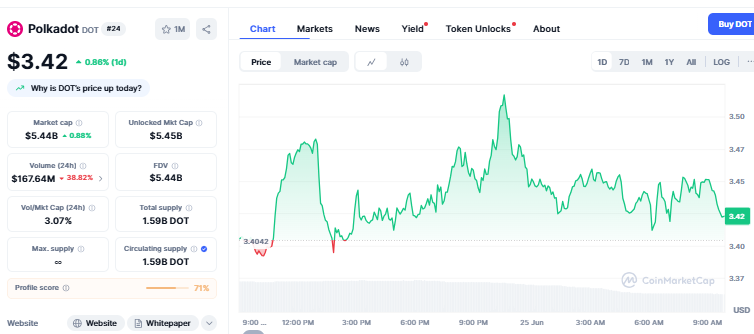

The price jump in DOT indicates that most investors continue to have faith in the long-term value of this cryptocurrency. Some even consider the ETFs delay a small speed bump on the path to eventual approval. Currently the price is $3.42 with an increase of 0.86% within the last 24 hours. It holds the market cap of $5.44 Billion as per the CoinMarketCap .

Source: CoinMarketCap

Analysts Believe High Odds of Approval

Leading Bloomberg analysts Eric Balchunas and James Seyffart are optimistic about the possibility of crypto ETFs approvals. They indicate that the SEC is taking very proactive and engaged approaches, which is positive.

Source: Eric Balchunas X Handle

Seyffart recently stated there's a 90% or better chance that a number of crypto ETFs, such as DOT, would be approved. He further stated that while final approval may not occur until late 2025, overall, the direction is positive.

21Shares Seeks U.S. Approval for DOT ETF

21Shares filed this Polkadot ETF on 31 January 2025 . They are no stranger to listing crypto investing products. Previously, in 2021, the firm launched the first Polkadot ETP on Switzerland's SIX exchange. Now, they are looking to introduce a similar product in the U.S. market.

If the ETF is approved, it may bring in additional institutional investors to this crypto. But if demand isn't good, the ETF might be withdrawn later on. It just depends on how well the product takes, as well as how easy it is to integrate into U.S. regulations.

What's Next?

With the SEC's ruling held off until November, investors and crypto observers will be watching closely. Although no one knows for sure, the analysts' optimism and the DOT price spike indicate that most believe this Exchange Traded Funds still has a good shot at becoming a reality.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。