We are experiencing the "Suez moment" of stablecoins.

Written by: Niu Xiaojing

How much is a channel worth?

Let's start with an ancient yet groundbreaking story.

In 1859, the Suez Canal began construction, taking a full ten years to dig out an artificial waterway connecting the Mediterranean Sea and the Red Sea. At that time, it cost 416 million francs, equivalent to 1.5% of France's GDP. Today, this is an investment comparable to national-level infrastructure.

Why was such a high price paid to dig a "man-made river"?

Look at this set of data and you'll understand:

Each ship passing through the Suez pays about $250,000;

18,000 to 21,000 ships pass through each year;

Annual revenue exceeds $6 billion;

Average daily revenue exceeds $15 million.

Because it is not an ordinary river, but a "golden channel" that connects Europe and Asia.

Without this canal, all ships would have to navigate around the Cape of Good Hope at the southern tip of Africa, adding 4 to 5 days to the journey and costing 2 to 3.7 times more than now. Each detour could incur additional costs of hundreds of thousands to millions of dollars.

So, this is not a water issue, but a "channel" issue. An efficient, safe, and legal channel brings not just savings in time and cost, but the key to mastering global trade.

The value of stablecoin channels is being rediscovered

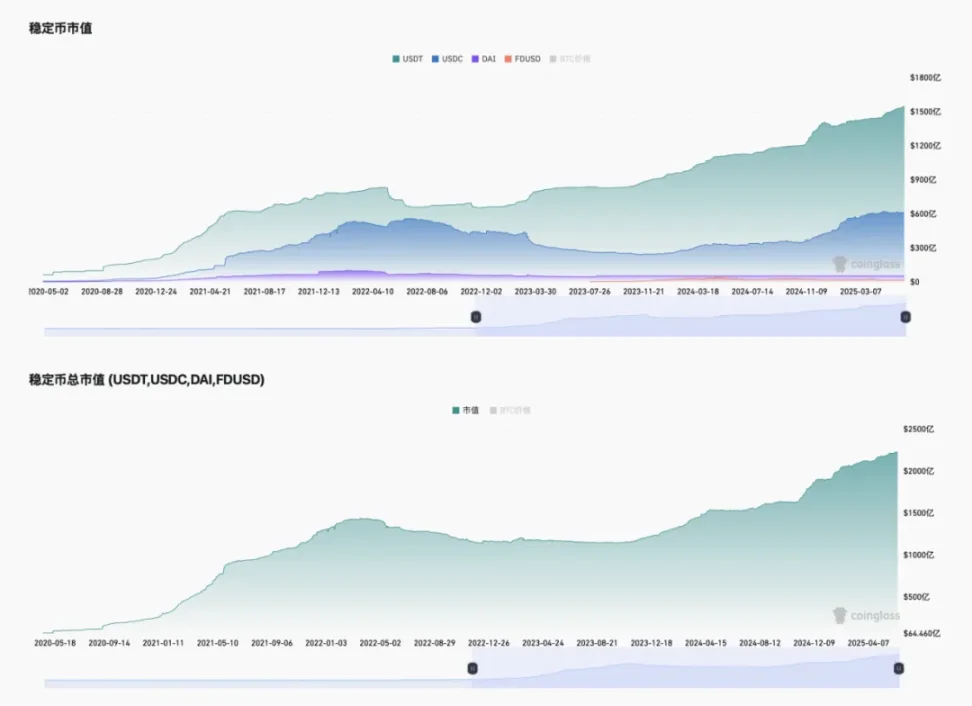

Today, we are also standing at a new starting point of a "channel revolution." Many countries around the world are promoting stablecoin legislation, opening up the main artery to the real financial system for the on-chain world. In other words, it has opened a fast track for traditional commerce to on-chain finance. It is predicted that by 2025, the global market value of stablecoins will reach $250 billion; Standard Chartered Bank is even more optimistic, expecting its potential to expand to $2 trillion, thereby leveraging $10 trillion in capital flow.

More importantly: regulators are beginning to recognize the legitimacy of stablecoins.

Just as the Suez Canal is not just about "water transport," but also about "trade"; the moment stablecoin legislation is passed means that capital can finally enter the on-chain world legally and directly. No longer relying on intermediary companies or navigating gray channels, costs are reduced, and efficiency is increased.

This is a landmark moment: the compliant channel is officially opened.

The story of USDT: It's not just about issuing a coin, but seizing a structural position

Before discussing JD.com, we need to take a look at "Big Brother" Tether—the issuer of USDT.

What opportunity did Tether seize? When Bitcoin was first created, it was meant for peer-to-peer payments, but due to its high volatility, it was difficult to use for everyday settlements. USDT perfectly filled this gap. It did not "appear out of thin air"; it was born from real market demand: providing an anchor asset for on-chain transactions, a liquidity hub, and a hedging tool. As someone aptly put it: after every round of bull market bubbles burst, stablecoins are the "embers" left in the market, allowing funds to stay and wait for the next wave of market trends. Tether's returns are also astonishing:

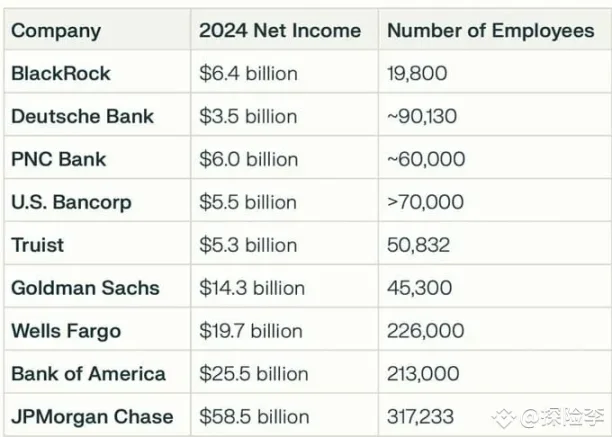

In 2024, net profit reached $13.7 billion, with a team of only 100 people, resulting in an average output of over $68 million per person, far exceeding JPMorgan, American Express, and Berkshire Hathaway.

Is this based on technology? No. It relies on structural positioning—it stands at the essential channel of on-chain capital flow. Even though it has faced investigations and regulatory fines, it did not evade compliance but instead improved and perfected itself along the way, ultimately gaining the trust of hundreds of millions of users worldwide. This is the structural dividend. And now, a new dividend window has opened.

Why is JD.com entering the stablecoin space?

Many people say that JD.com has entered Web3. But I see it differently.

JD.com is not creating a stablecoin just to "issue a coin," but to solve the old problems of cross-border e-commerce:

Long settlement cycles

High costs

Severe capital occupation

Complicated banking processes

The value of stablecoins lies in being the shortest path between reality and the chain. They can:

Arrive in real-time

Enable cross-border payments without intermediaries

Significantly reduce transaction fees

Allow for automated orchestration and auditing of systems

Therefore, stablecoins are not necessarily exclusive to Web3; they are a new tool for Web2 companies to build financial infrastructure.

This is not just an opportunity for JD.com, but for all Chinese companies looking to expand globally and connect with the world.

Stablecoin 2.0 Era: System-level Solutions

Past stablecoins served the purpose of speculation. Today's stablecoins serve enterprises. They are no longer just a "coin," but a system module, a part of the financial settlement system, and a component of user incentives, supply chain loops, and cross-border settlement processes. The next phase of stablecoins is systematic, compliant, and structured development. The opportunity behind this is to provide "stablecoin infrastructure" services for enterprises.

The role transformation of Web3 practitioners: from "speculators" to "structuralists"

The real opportunity lies not in whether you can issue a coin, but in whether you can:

Design payment systems for stablecoin integration

Build cross-chain settlement bridges

Implement automated revenue sharing and risk control strategies

Help enterprises achieve compliance

If you understand both the chain and the structure, and also understand enterprises, then you are precisely at this intersection.

If you only wander in Web3, that’s not enough; you also need to become a service provider, structuralist, and channel builder for more Web2 companies.

We are experiencing the "Suez moment" of stablecoins

Returning to the initial question: How much is a channel worth?

No one complains about the toll for the Suez Canal because everyone knows: taking the long way is expensive, slow, and dangerous.

The channel of stablecoins is the same. You can take gray paths, engage in arbitrage, or use intermediaries, but those risks are "temporary dividends," not a long-term moat.

What is truly valuable is the structure, the channel. The next explosion point in this industry is not the bustling coin issuance trend, but the steady construction of structures. Those who can earn long-term value are the ones who "build channels" for enterprises.

"I will open this river, and ships can sail directly to Persia, fulfilling my wishes." The oath of Persian King Darius still applies today. Now is the time for our generation of Web3 people to carve out a new channel.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。