In 2025, stock tokenization will drive cryptocurrency stock trading to operate around the clock, allowing investors to participate in the market at any time. The supply of stablecoins continues to rise, with a global market capitalization exceeding $250 billion, and the number of active on-chain addresses has increased by 53% year-on-year. The market size for Real World Assets (RWA) has grown by over 60% in a year, with DeFi innovations enhancing trading efficiency. Regulatory policies in places like the United States and Hong Kong are being improved to ensure compliance in cryptocurrency stock trading, promoting globalization. Decentralized platforms lower the barriers to entry, enabling more investors to enjoy a convenient and secure financial experience.

Key Points

• Stock tokenization utilizes blockchain technology to convert traditional stocks into digital assets, enabling 24/7 trading and lowering investment thresholds.

• Major trading platforms like Coinbase and Binance are driving the globalization of cryptocurrency stock trading, providing high liquidity and diverse trading options.

• Compliance regulations are becoming increasingly refined, and investors should choose licensed platforms, focusing on asset security and risk prevention.

• Technological innovations enhance trading efficiency and asset management, with smart contracts and AI risk control improving market transparency and security.

• The market size for stock tokenization is rapidly growing, presenting abundant investment opportunities in the future, with investors encouraged to pay attention to policy support and diversified asset portfolios.

Current State of Cryptocurrency Stock Trading

Foundation of Stock Tokenization

Stock tokenization leverages blockchain and smart contract technology to transform traditional stocks into on-chain digital assets. Only 0.003% of the total global asset value has been tokenized, indicating that this field is still in its early stages. Approximately 67,500 institutional entities hold non-stablecoin tokenized assets, reflecting that market participants are primarily large fintech companies and compliant exchanges.

The total asset value of tokenized government securities has reached $1.849 billion, mainly concentrated on blockchain platforms like Ethereum.

Blackstone Group's BUIDL fund launched in 2024, achieving a market capitalization of $500 million within four months, marking a significant milestone in the regulated tokenized market in the U.S.

Traditional financial giants like BlackRock and Franklin Templeton are actively participating, driving institutional capital into the cryptocurrency stock trading space.

Many Fortune 500 companies are considering launching tokenization projects, with 86% of executives recognizing the potential of asset tokenization.

Many Fortune 500 companies are considering launching tokenization projects, with 86% of executives recognizing the potential of asset tokenization.

Major Platform Landscape

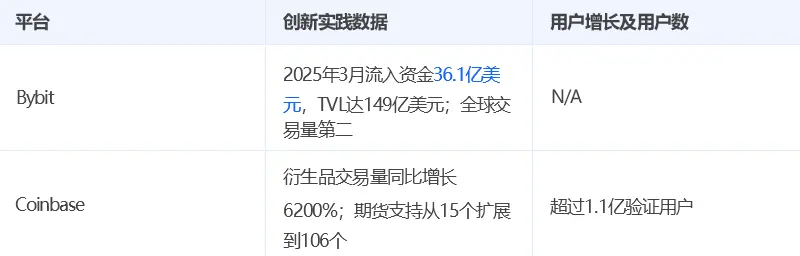

The landscape of cryptocurrency stock trading platforms is becoming increasingly diverse. Coinbase, Bybit, and Binance have emerged as major market players.

• Coinbase holds about 35% of the market share in the BTC-USD fiat trading market, supporting over 100 countries with high liquidity.

• Bybit's market share has decreased from 38% in October 2023 to the current 8%, but it remains one of the main platforms in the derivatives market.

• Binance has an average daily trading volume of approximately $19 billion, far exceeding Bybit's $4 billion, offering over 1,200 trading pairs.

• The market share of the USDC stablecoin is 24.4%, with a circulation of $61 billion, covering over 100 countries globally.

• USDT is the largest dollar stablecoin in the world, supporting cross-border payments and cryptocurrency trading.

These platforms enable cryptocurrency stock trading to operate 24/7, lowering investment thresholds and promoting globalization.

These platforms enable cryptocurrency stock trading to operate 24/7, lowering investment thresholds and promoting globalization.

Technology and Compliance

Stock tokenization relies on blockchain and smart contracts to achieve asset digitization and automated trading. Compliance has become a core focus of the industry.

The U.S., EU, Hong Kong, and other regions have introduced relevant policies to promote the compliant development of cryptocurrency stock trading. Technological innovation and regulatory compliance together enhance market security and investor confidence. Stock tokenization not only improves liquidity but also brings more participation opportunities for global investors.

New Trends

Technological Innovation

In 2025, blockchain technology will continue to upgrade, promoting the widespread application of smart contracts and on-chain asset management in the financial sector. Smart contracts have become a core tool in the blockchain 2.0 phase, helping automate and enhance transparency in financial services and supply chain management. AI agents are gradually becoming a hot topic in corporate digital transformation, optimizing business processes and facilitating intelligent collaboration. The data asset management system is also continuously improving, with government-led data asset registration agencies being established nationwide, significantly enhancing corporate awareness of data asset management. It is expected that by 2025, the scale of data assets entering the balance sheet will grow rapidly, potentially doubling throughout the year. At the national level, efforts are being accelerated to improve the policy framework for the data factor market, promoting the formation of technical standards for data asset packaging, registration, and tracking.

Blockchain technology, centered on credit mechanisms, ensures asset security through decentralization and cryptographic algorithms. Nevertheless, the industry still faces challenges such as technological maturity, standardization, and talent shortages, which affect its development speed and scale.

• The combination of platform and supply chain finance models with blockchain technology promotes innovation in pledge financing.

• On-chain transaction evidence, electronic warehouse receipts, and accounts receivable information assist in customizing supply chain financial products.

• The efficiency of fund circulation and credit management among upstream and downstream enterprises in the industrial chain has significantly improved.

Regulatory Dynamics

Major global economies are continuously refining regulatory policies for digital assets and tokenized stocks to ensure healthy market development. The U.S., France, Hong Kong, and other regions are actively exploring tokenization projects for government bonds and green bonds, promoting the compliance and internationalization of cryptocurrency stock trading. The table below shows the latest regulatory progress in some countries and regions:

Countries are increasingly detailing their regulatory policies, emphasizing investor protection and financial stability. The U.S. has introduced the GENIUS Act, establishing a federal regulatory framework for stablecoins, requiring issuers to obtain licenses and disclose reserve assets. Hong Kong has implemented the Stablecoin Regulation Draft, achieving full-chain regulation, requiring real-time risk monitoring and independent custody of reserve assets. European countries like France are actively promoting tokenization projects for government bonds to foster market innovation.

• Institutional access management requires virtual asset service providers to register or obtain licenses.

• Customer identity verification and transaction monitoring have become regulatory priorities to prevent financial risks.

• The classification of cryptocurrencies is gradually becoming clearer, with regulatory standards for main chain coins and security tokens being progressively refined.

Market Participants

The structure of global market participants is undergoing profound changes. The total market capitalization of U.S. stocks is approximately $52 trillion, accounting for over 45% of the global stock market size, indicating a substantial market foundation. Major financial institutions like Blackstone, Goldman Sachs, and Fidelity are actively entering the tokenization market, enhancing the credibility and influence of the market. The Boston Consulting Group predicts that by 2030, the global market size for tokenized assets is expected to reach $16 trillion, showcasing tremendous growth potential.

Trading platforms like Bybit support USDT trading of high-quality global stock assets, covering multiple industries such as technology, consumer goods, and energy, reflecting the diversity and scale of investor participation. The active involvement of major global financial institutions is continuously expanding the cryptocurrency stock trading ecosystem, attracting more investors to focus on and participate in this emerging market.

The tokenization market is continuously expanding in financial centers like the U.S., Europe, and Asia, accelerating the globalization process and diversifying the industry landscape.

The tokenization market is continuously expanding in financial centers like the U.S., Europe, and Asia, accelerating the globalization process and diversifying the industry landscape.

Applications and Cases

Platform Innovation

Many innovative platforms are driving the practical implementation of stock tokenization in cryptocurrency stock trading.

Kraken has partnered with Backed Finance to launch the xStocks product, fully compliant with EU MiFID II regulations, with underlying stocks fully collateralized 1:1, meeting institutional-grade standards. The future market size is expected to expand to $250 billion.

The Dubai Allo tokenized securities exchange has completed the tokenization of $2.2 billion in real-world assets, covering approximately 11,000 U.S. stocks and ETFs. Users can directly purchase on-chain stocks of companies like Tesla and Google.

The Allo platform has also achieved the tokenization of over a thousand companies planning IPOs, including SpaceX, OpenAI, and Anthropic. The platform lowers investment thresholds, accelerates settlement speeds, and enhances liquidity.

Stock fragmentation allows more investors to participate with lower capital, reducing international investment bank settlement times to seconds or minutes, significantly improving capital utilization efficiency.

Cross-Border Investment

Stock tokenization brings a new experience for global investors. Investors can participate in mainstream markets like U.S. and Hong Kong stocks around the clock, without being limited by traditional trading time zones. Platforms support multi-currency settlement and real-time clearing, greatly enhancing capital flow efficiency. Many investors achieve cross-border asset allocation through cryptocurrency stock trading platforms, reducing foreign exchange and settlement costs. Stock fragmentation lowers investment thresholds, attracting more small and medium-sized investors to participate in the global market.

DeFi Scenarios

Stock tokenization demonstrates strong vitality in the DeFi field.

The tokenization process includes stages such as asset selection, evaluation, legal framework establishment, token creation and trading, asset management, and redemption.

Tokens represent partial shares of assets, supporting secondary market trading and enhancing liquidity.

Blockchain technology enables instant settlement and 24/7 trading, reducing operational costs.

Low liquidity assets attract more investors through fragmentation, bringing additional liquidity.

Token holders receive returns based on their shares, with automated asset management reducing manual and intermediary costs.

Representative projects like Securitize help traditional equity assets go on-chain, enabling secondary market trading and promoting the diversification and stable development of the DeFi ecosystem.

As an important component of RWA, stock tokenization connects traditional finance with the DeFi ecosystem, promoting asset digitization and liquidity enhancement, injecting new vitality into the cryptocurrency stock trading market.

Challenges and Impact

Compliance Risks

Compliance risks have become a core challenge in the development of stock tokenization. The global cryptocurrency market has extremely high liquidity, with a market capitalization of approximately $2.8 trillion as of the end of February 2025, and daily trading volumes in the hundreds of billions of dollars. The market is highly volatile, with Dogecoin's maximum yield reaching 1,516, theoretically achievable.

150% daily returns. Regulatory uncertainty exacerbates market risks. Taking the Mt. Gox incident as an example, the violations of centralized exchanges exposed regulatory loopholes. The anonymity of cryptocurrencies and the 24-hour trading mechanism increase the difficulty of regulation. During the pandemic, Bitcoin's volatility spillover to the S&P 500 index increased by approximately 16 percentage points, with insufficient regulatory capacity leading to intensified risk transmission.

Impact on Investors

Stock tokenization enables 24/7 trading, enhancing global capital liquidity and lowering investment thresholds.

Market volatility has increased, with extended trading hours and more participants leading to more frequent price fluctuations.

Tokenized financing reduces reliance on traditional investment banks, resulting in a more diversified market structure.

Investor rights face risks due to imperfect asset mapping mechanisms and lack of custody arrangements, potentially leading to asset decoupling and price manipulation.

Investors need to assess platform credibility and asset mapping mechanisms, prioritizing transactions with licensed institutions to protect their rights.

Coinbase is discussing with the U.S. SEC how to ensure that tokenized shareholders enjoy the same rights as traditional shareholders, with regulators gradually adapting to market changes, which helps protect investor rights. It is expected that in the next 24 to 36 months, regulatory agencies may approve multiple token ETFs, facilitating capital entry into the market through passive investment methods, further promoting market size growth.

Outlook and Recommendations

Investment Opportunities

In the next five years, the stock tokenization market will present multiple investment opportunities. Authoritative reports indicate that the industry development trend from 2025 to 2030 is clear, with technological innovation driving continuous expansion of supply and demand. Investors can focus on emerging fields supported by national policies, seizing the growth dividends of automated platforms and digital asset management. Market forecast data suggests that low-volatility strategies and diversified asset portfolios are likely to yield stable returns.

Industry reports recommend that investors seize national investment opportunities, focusing on strategic alliances and key client management.

Data shows that from 2001 to 2024, diversified asset portfolios performed excellently, with stable returns.

Future market size forecasts are based on authoritative databases, ensuring the scientific nature of investment decisions.

Related Concept Tokens

Cryptocurrency Stock Concepts and Micro Strategies

U.S. Stock Companies

Cryptocurrency

Strategy (MSTR)

BTC Micro Strategy

SharpLink Gaming (SBET)

ETH Micro Strategy

Upexi (UPXI)

SOL Micro Strategy

DeFi Development (DFDV)

SOL Micro Strategy

SRM Entertainment (SRM)

TRX Micro Strategy

Nano Labs (NA)

BNB Micro Strategy

ATIF Holdings (ZBAI)

DOGE Micro Strategy

Interactive Strength (TRNR)

FET Micro Strategy

Industry Outlook

Institutions like a16z predict that after 2025, tokenized assets will achieve cross-sector applications, with the on-chain trading market for government bonds rapidly expanding. The blockchain software market is expected to reach $50.03 billion by 2031, with a compound annual growth rate of 15.5%. The opening of security token exchanges, the rise of alternative asset classes, and innovations in decentralized platforms will drive continuous industry growth. The technological integration of Backed Finance and Chainlink enhances asset liquidity and risk management capabilities, reflecting technological advancements and market potential in the industry.

The industry outlook is broad, balancing innovation and compliance, benefiting both investors and platforms.

The industry outlook is broad, balancing innovation and compliance, benefiting both investors and platforms.

In 2025, stock tokenization will continue to expand the cryptocurrency stock trading market, bringing increased liquidity and global investment opportunities.

• Bitwise data shows that the market size for tokenized real-world assets has grown from less than $2 billion to approximately $13.7 billion within three years, and is expected to reach $50 billion by 2025.

• DTCC collaborates with digital asset companies to implement a pilot for tokenizing U.S. Treasury bonds on the Canton network, enhancing settlement efficiency.

• Guangdong Province promotes innovation and compliance through market-oriented reforms in data factors, ensuring data registration and market vitality.

These cases demonstrate that innovative technology and regulatory compliance jointly drive industry development. In the future, institutional and individual investors will encounter more opportunities, with cryptocurrency stock trading expected to become an important component of modern finance.

FAQ

What is the difference between stock tokenization and traditional stocks?

Stock tokenization converts stocks into digital assets on the blockchain. Investors can trade 24/7 with lower thresholds. Traditional stocks can only be traded at specific times and markets.

Is investing in stock tokens safe?

Mainstream platforms employ multiple security measures, such as smart contract audits and asset custody. Investors should choose licensed platforms and pay attention to platform compliance and technical safeguards.

How does stock tokenization affect investor rights?

Some platforms have explored granting token holders the same rights as traditional shareholders. Investors need to pay attention to asset mapping mechanisms and platform rules to protect their rights.

Can tokenized stocks be used for cross-border investment?

Investors can participate in global stock markets through compliant platforms. These platforms support multi-currency settlement, reducing foreign exchange and settlement costs, and enhancing capital flow efficiency.

How do regulatory agencies manage stock tokenization?

Regulatory agencies in various countries have established specific policies requiring platforms to operate with licenses, conduct customer identity verification, and monitor risks. Regulation is continuously improving to ensure healthy market development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。