Maple Finance is a multi-chain DeFi platform that specializes in providing on-chain lending and investment services for institutional clients.

Written by: Deep Tide TechFlow

Do you think the altcoin season will come? This question has become a trending topic on crypto Twitter.

The current mainstream view is that an overall altcoin season is still a long way off, as most altcoins lack liquidity, and investors are turning their attention to U.S. stocks, Bitcoin, and RWA (real-world assets).

While everyone believes that the altcoin season won't come, some altcoins are rising against the trend.

For example, the token SYRUP from Maple Finance has increased by 400% since the beginning of this year and has reached an all-time high (ATH) as of the time of writing.

Grayscale has also included Maple Finance in its list of the TOP 20 tokens to watch in Q2 2025, while there is still relatively little analysis of this project in the Chinese community.

Amidst the noise of more information, we seem to have forgotten a clear main line in this version that is not directly related to most people -- - Institutional Entry.

Products serving individuals, such as Launchpads and Memes, are emerging endlessly, but competition is gradually becoming more intense, and the lack of liquidity in the industry is lowering their fundamentals;

On the other hand, serving institutions is a different path. The products are not as intuitive and require higher thresholds, yet they represent opportunities that are more easily overlooked in the current version of institutional entry.

Maple Finance has clearly benefited from this version's dividends.

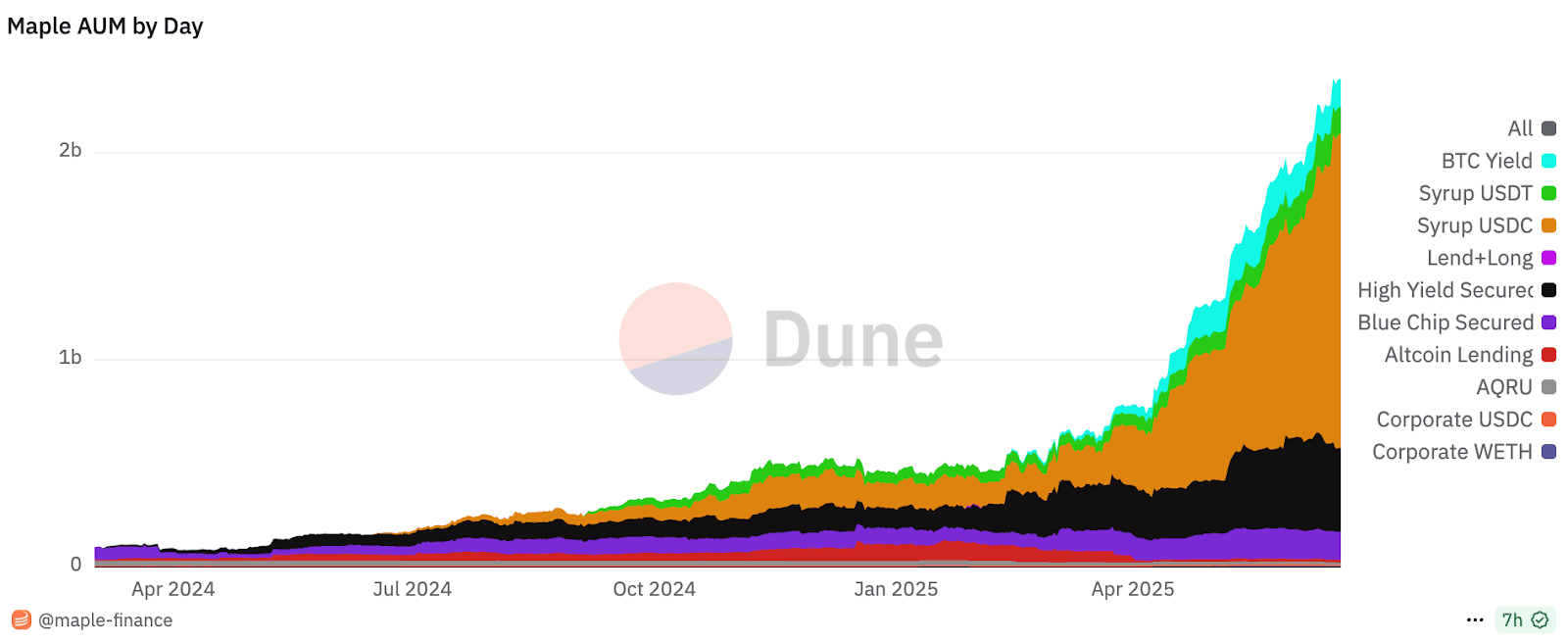

The project focuses on providing low-collateral loans and RWA investments for institutions, such as tokenized U.S. Treasury bonds and trade receivables pools. Its assets under management (AUM) surpassed $2 billion in June 2025, serving traditional hedge funds, DAOs, and crypto trading companies.

The counter-trend rise of SYRUP may already reflect the market's rediscovery of Maple's undervalued worth.

The current market capitalization of this token is around $700 million. Compared to some meme tokens in the previous version that were purely driven by sentiment and had market caps of over $1 billion, do you think SYRUP is overvalued or undervalued?

Of course, different varieties in different tracks cannot be compared solely based on market capitalization; we also need to understand more about Maple Finance's business.

Providing On-Chain Lending Services for Institutions

Maple Finance is a multi-chain DeFi platform (operating on Ethereum, Solana, and Base) that specializes in providing on-chain lending and investment services for institutional clients—such as hedge funds, DAOs (Decentralized Autonomous Organizations), and crypto trading companies.

In simple terms, you can think of it as an asset management tool that helps these large institutions borrow money, manage funds, or invest on-chain, avoiding the complex processes and low returns of traditional banks.

Since its establishment in 2019, Maple has grown into a mature platform, with its assets under management (AUM) reaching $2.4 billion and a total locked value (TVL) of $1.8 billion by June 2025.

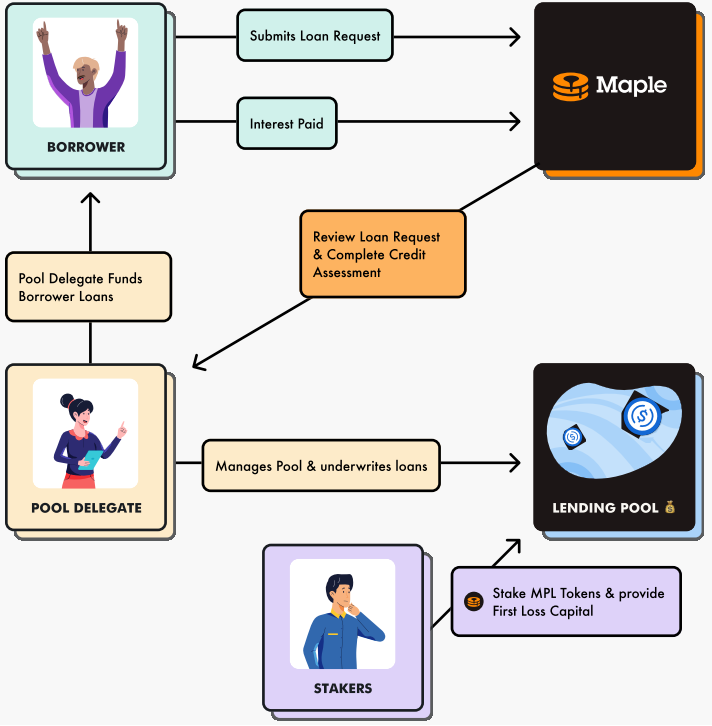

Although primarily aimed at institutional users, the roles involved in Maple Finance have distinct functions. You can choose to lend, stake, borrow, and/or become a delegate for a specific lending pool.

(Source: consensys)

Borrowers are institutions in need of funds, such as crypto trading companies, who use digital assets like Bitcoin (BTC) or Ethereum (ETH) as collateral to borrow stablecoins like USDC; these institutions often need to quickly obtain liquidity, but the approval processes of traditional financial systems are too lengthy to meet their needs.

Lenders provide liquidity, for example, by depositing USDC or ETH to earn interest; this is the common LP found in DeFi products. For LPs, Maple's appeal lies in its higher annual percentage yield (APY) and transparent fund management mechanisms.

Pool Delegates are professional teams responsible for assessing borrower creditworthiness to ensure loan safety; to reduce LP risk, Maple allows pool delegates to conduct strict screening of borrowers and monitor loan performance in real-time.

Stakers hold SYRUP tokens, staking to share risks and rewards. If a loan defaults, their SYRUP can be used to cover losses, while they also receive additional rewards from the platform when no issues arise.

Thus, a simple process can be: the borrower submits a loan request, the pool delegate reviews the qualifications, the lender provides funds, the staker guarantees, and the smart contract automatically executes the loan and repayment, with profits distributed according to the roles mentioned above.

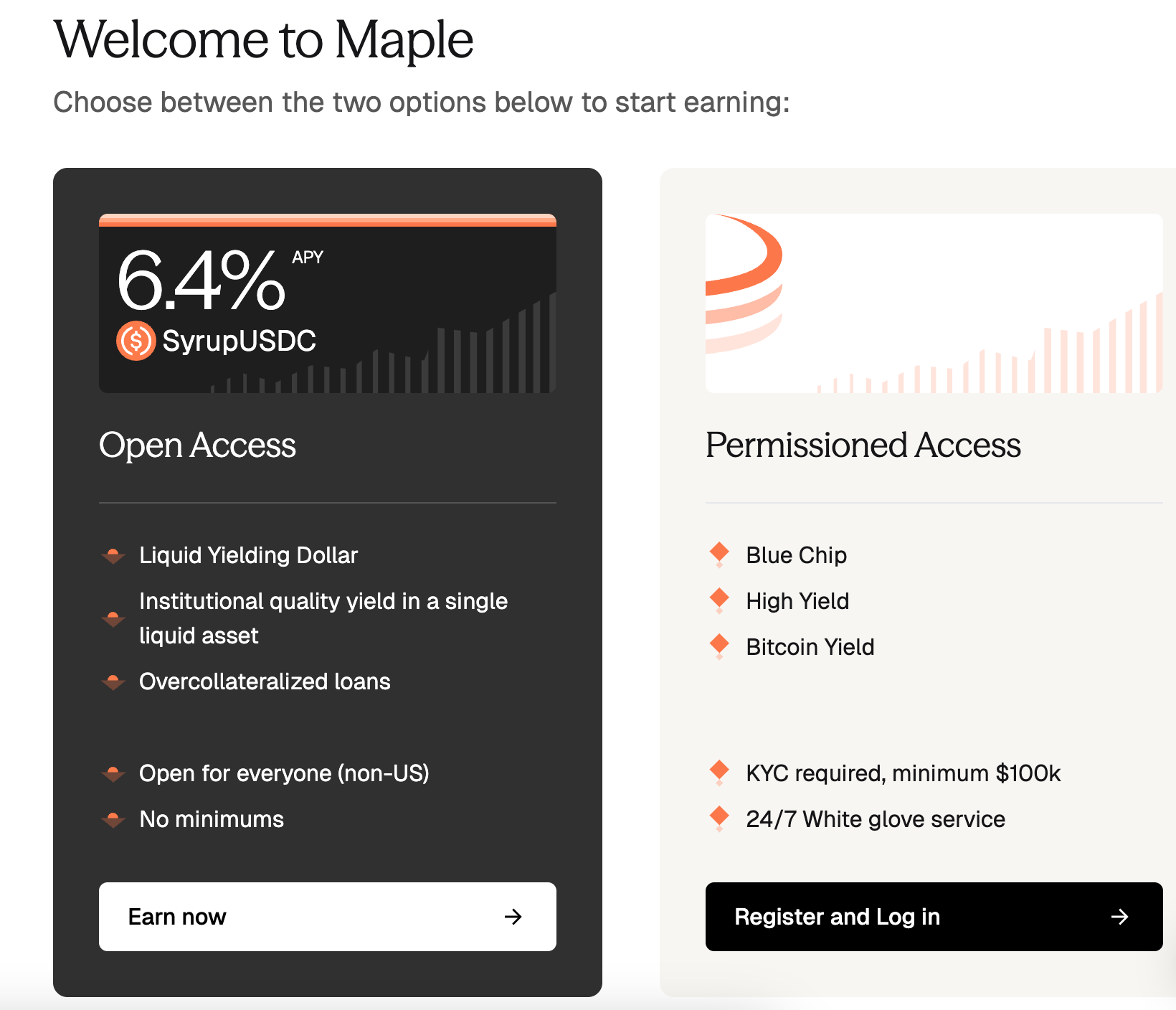

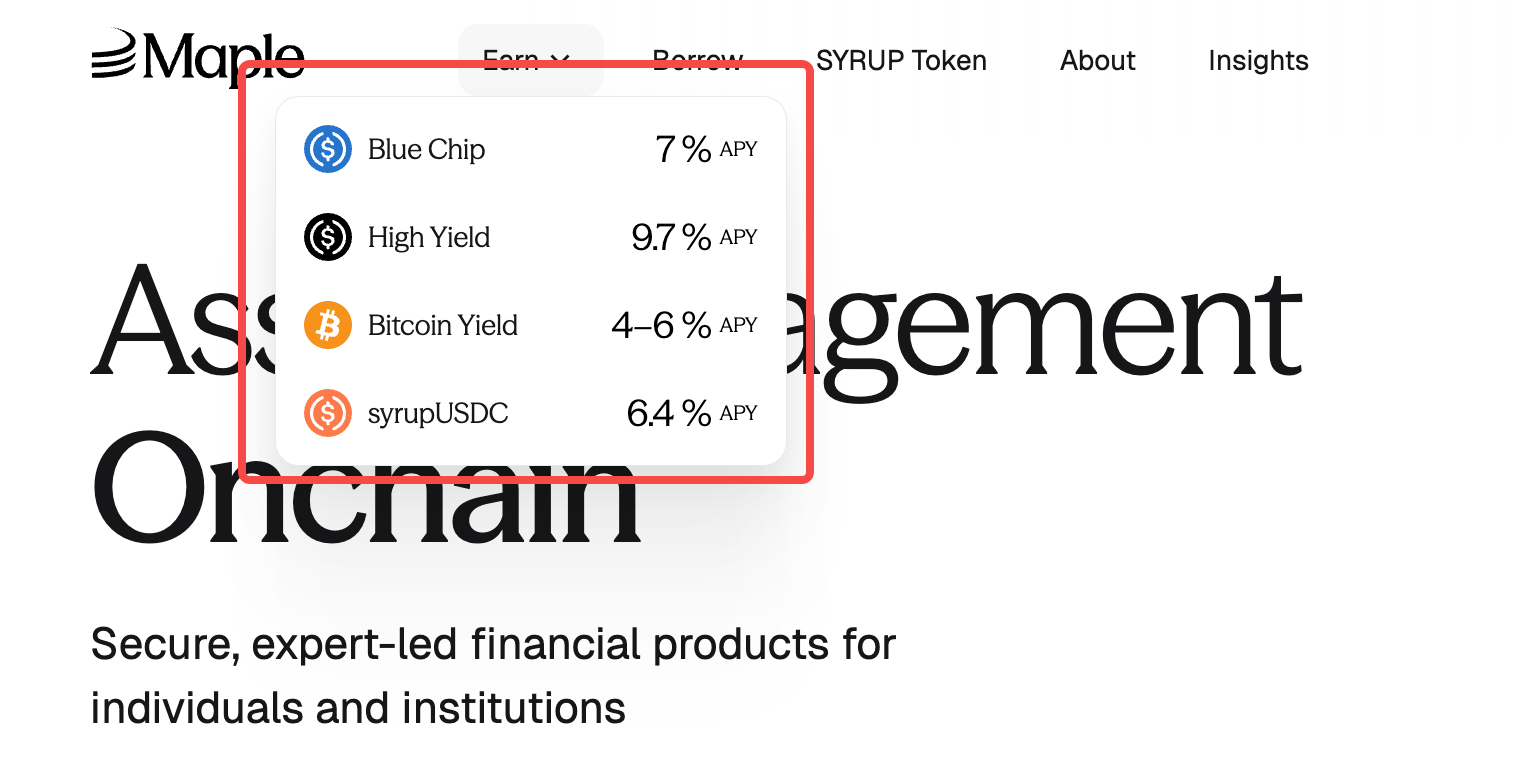

In terms of lending products, Maple is divided into "Open Access" and "Permissioned Access."

Open Access includes SyrupUSDC, which offers a 6.4% annual percentage yield (APY) and is suitable for individual and small institutional investments. SyrupUSDC is a USDC-based yield product where funds enter a liquidity pool and invest in over-collateralized loans (borrowers must provide assets exceeding 50% of the loan value), with no minimum amount, emphasizing liquidity and stability.

Permissioned Access is aimed at institutional clients and includes Blue Chip (7% APY), High Yield (9.7% APY), and Bitcoin Yield (4-6% APY), requiring KYC certification and a minimum investment of $100,000, providing 24/7 white-glove service.

The white-glove service here is a high-end customized support, similar to a private banking exclusive advisor, where institutional clients can enjoy round-the-clock one-on-one assistance, including loan scheme design, fund management advice, and emergency issue resolution.

Blue Chip invests in high credit-rated loans, similar to traditional "blue-chip stocks," with low risk; High Yield focuses on high-risk, high-return loan portfolios; Bitcoin Yield utilizes BTC collateral to allow holders to earn passive income.

From DeFi Crisis to $2 Billion in AUM

The lending mechanism is the core highlight of Maple. However, the path for lending services did not start smoothly.

In 2022, the DeFi industry faced a "black storm": the collapse of Terra and the bankruptcy of Three Arrows Capital led many DeFi platforms into liquidity crises, and Maple was no exception.

Initially, Maple adopted a partial collateral model, meaning that when applying for a loan, full collateral was not required, and evaluation was based solely on the borrower's reputation, which was high-risk and made it more vulnerable in the face of black swan events. Its AUM once shrank to $200 million; at certain times, its partial collateral model led to a default rate soaring above 5%.

In the face of the crisis, Maple decisively transformed, introducing over-collateralization (150% collateral ratio) and tri-party agreements in 2023. Borrowers use BTC as collateral to borrow USDC, with a third-party institution monitoring the collateral value. Maple executes smart contracts, and if the BTC price drops below a threshold, the third party triggers liquidation to protect the interests of lenders.

The changes in product design not only restored trust but also provided a safer lending environment for institutional clients.

Starting this year, as the mainstream narrative in the crypto market shifts from individual speculation to institutional dominance, and more funds seek low-risk and risk-free returns, you can more clearly feel the strong recovery momentum exhibited by Maple Finance through the following data:

Maple's flagship product SyrupUSDC—a yield stablecoin based on USDC—has seen its total locked value grow from $166 million to $775 million within 11 months, reflecting a surge in market demand for Maple's products.

Additionally, since January 2025, assets under management (AUM) have skyrocketed nearly tenfold, with outstanding active loans within the protocol increasing to approximately $880 million, making Maple one of the largest crypto lenders.

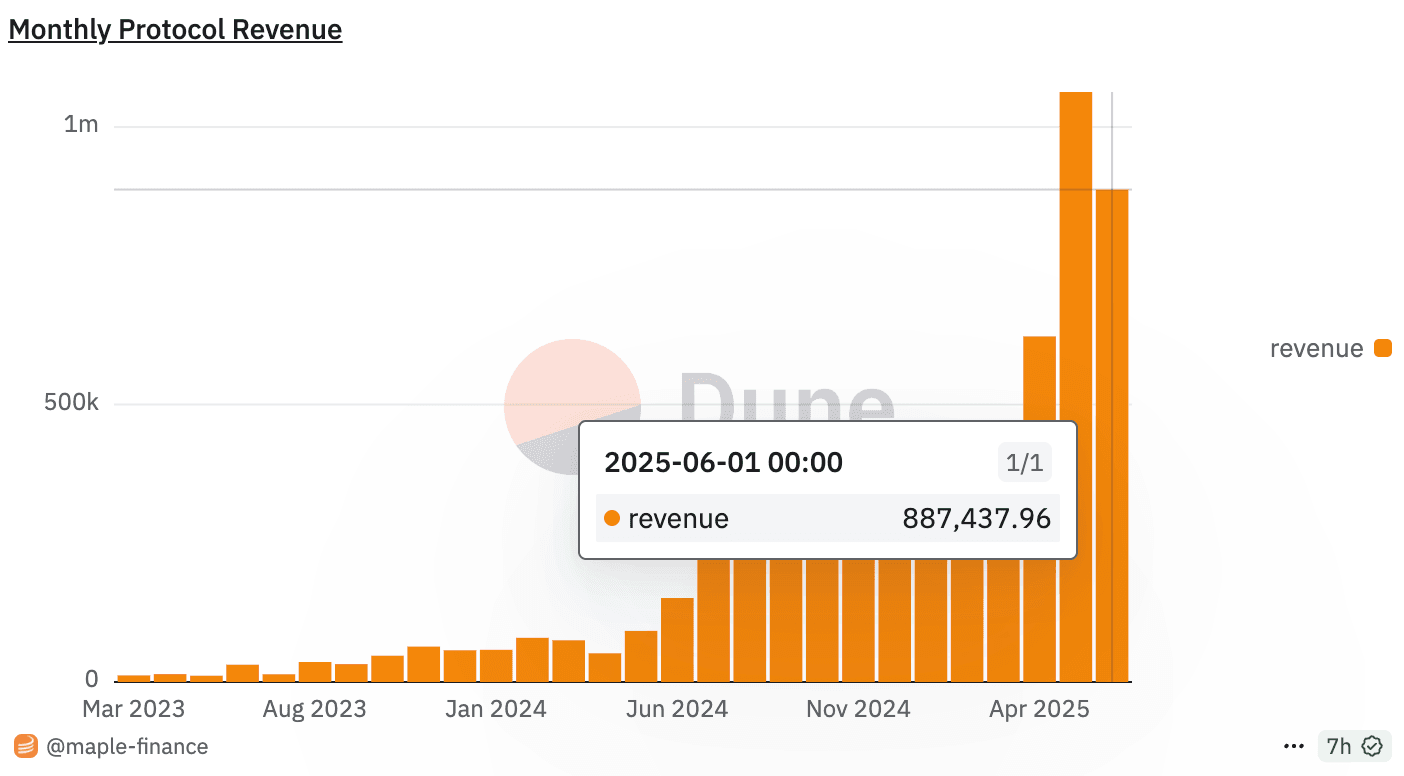

At the same time, the increase in lending demand has also made it profitable. Since Maple charges a 0.5-2% fee on each loan, its monthly revenue exceeded $1 million in May 2025, setting a record for revenue growth for three consecutive months.

In these meaningful cash flows, 20% of the fees will be used to repurchase SYRUP tokens for stakers, which may also partially reveal the reason for the counter-trend rise of the SYRUP token since the beginning of this year.

In May of this year, the globally renowned financial services company Cantor Fitzgerald announced a $2 billion Bitcoin (BTC) lending plan and chose Maple as its preferred partner.

As a long-established financial institution founded in 1945, Cantor's business covers bond trading, real estate, and fintech, representing traditional finance. Its entry also marks the recognition of on-chain credit by traditional giants.

Institutions often require flexible short-term financing, and the inefficiency of traditional bank loans makes Maple's customized services and more lenient access mechanisms an alternative for institutional borrowing.

Why Can SYRUP Rise During a General Downtrend?

Why can SYRUP rise against the trend?

The demand for institutional borrowing partially answers the question, but on a more micro level, the near-total circulation of the SYRUP token currently also reduces the potential for selling pressure.

If we analyze the reasons in a more structured way, the "version dividend" is the simplest answer to this question. Specifically, this dividend can be broken down into:

- Safe-Haven Asset Characteristics:

In a declining crypto market, investors tend to choose low-risk, high-yield assets. Maple's RWA products (such as treasury bond pools) and over-collateralized loans provide stable returns (5-20% APY), making them ideal choices for safe-haven assets.

The Bitcoin yield product (BTC Yield) offers BTC holders a way to earn returns without selling their assets, attracting a significant amount of institutional capital.

- Direct Beneficiary of RWA Narrative:

The increasing interest of traditional financial institutions in blockchain (such as BlackRock's BUIDL and JPMorgan's digital bonds) has driven the growth of the RWA market. Maple, as the "institutional-grade lending engine" of DeFi, directly benefits from this trend. The large and stable capital of institutional investors offsets the emotional fluctuations of the retail market.

- Differentiated Competition:

Compared to retail-oriented protocols like Aave and Compound, Maple's institutional focus and emphasis on RWA give it an advantage in the niche market. While its competitors (such as BlackRock's BUIDL and Ethena) are strong, Maple's on-chain transparency and flexibility are better suited for crypto-native institutions.

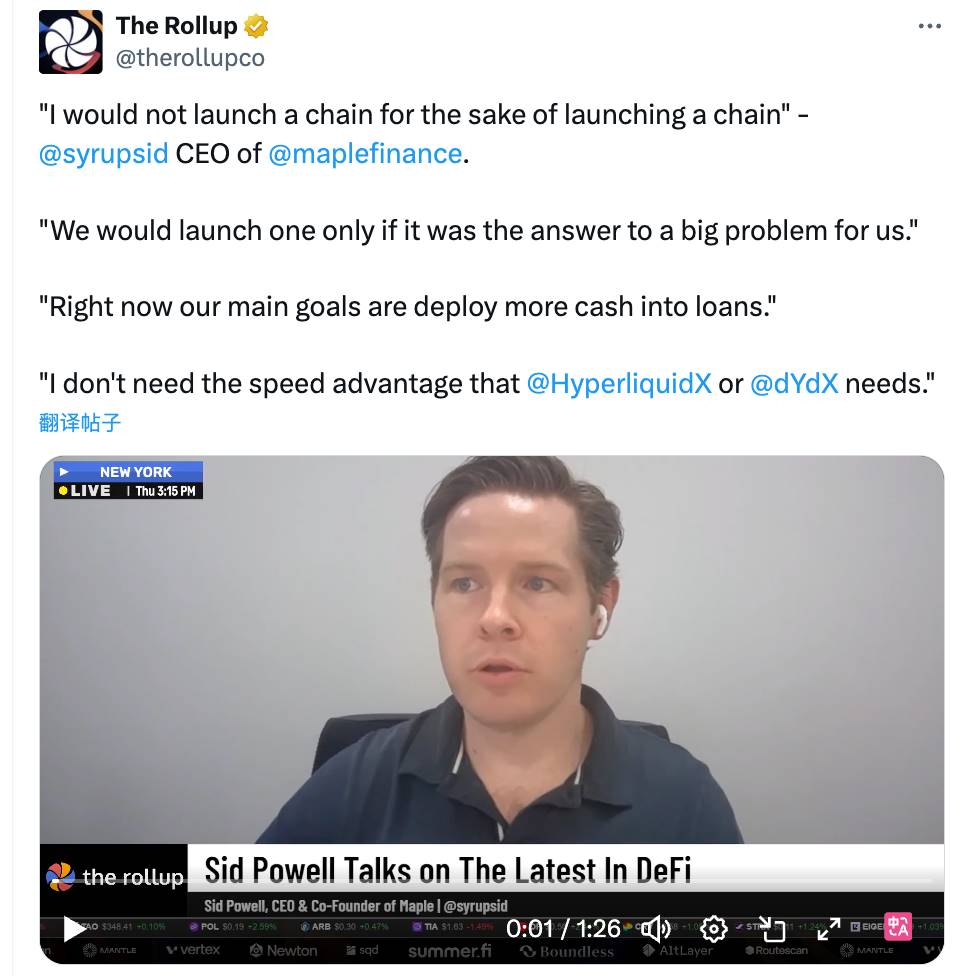

- Team's Demand Positioning for Products:

While some DeFi projects are focusing on L1, infrastructure, and performance, Maple's founder Sid Powell expressed a viewpoint during a podcast interview that infrastructure should not be built just for the sake of building:

"We will only launch it when it can solve our big problems… Our main goal right now is to put more cash into loans; I don't need the speed advantages of Hyperliquid and dydx."

Avoiding FOMO

With solid fundamentals and rising token prices, will you feel FOMO?

Don't rush; the crypto market has too many good products that do not equate to sustained good performance of tokens. Some movements of on-chain funds in SYRUP also seem to indicate the exit of early profit-takers.

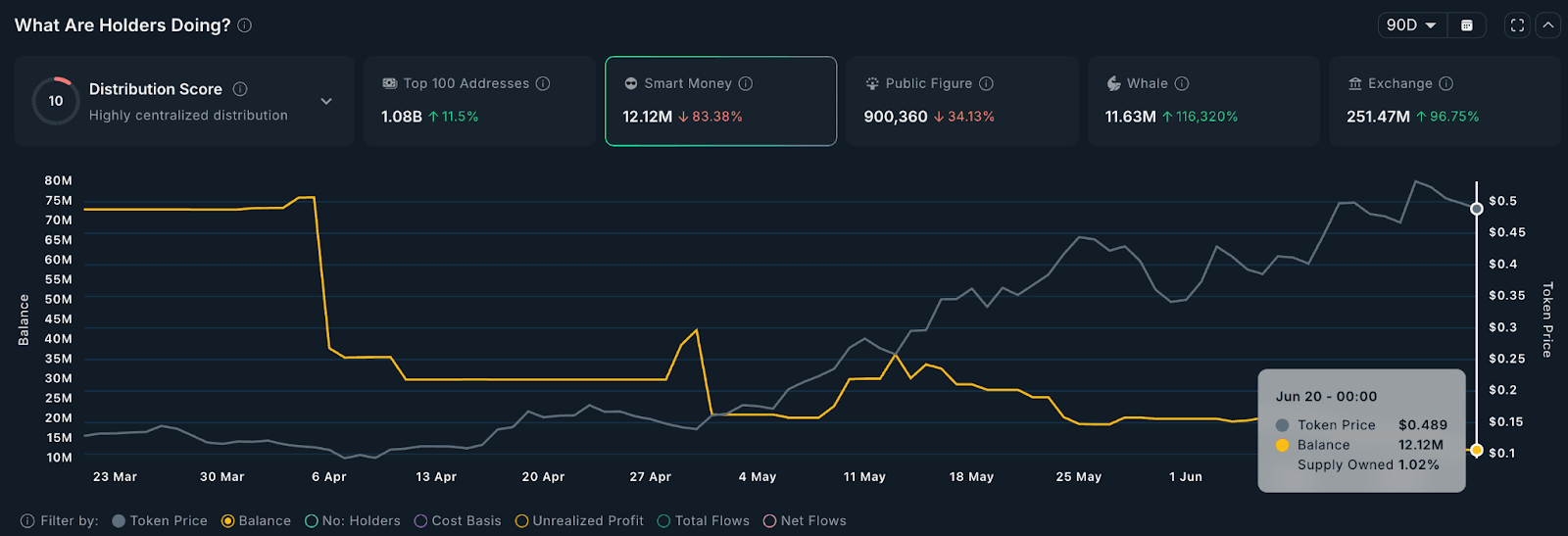

Nansen's analysis shows that smart money and funds have shown significant signs of capital outflow.

For example, Blocktower has deposited over 10.5 million SYRUP into Binance exchange wallets in the past 34 days, while Dragonfly sent over $1.75 million of SYRUP to a known FalconX wallet in recent days. Similarly, Maven11 sent SYRUP to an intermediary wallet before sending it to Binance.

Over the past 90 days, the number of smart money holders of SYRUP has decreased by over 83%, while the exchange balance of SYRUP has increased by 96%, which is clearly a sign of early capital withdrawal.

At the same time, some whales have begun to accumulate SYRUP, with whale holdings increasing by 116,000% over the past 90 days.

Putting all this data together, the market may have reached a point of turnover and divergence, and following either side carries investment risks.

Overall, the business model that aligns more with the version grants Maple greater growth potential; however, at any given moment, observing more and acting less is a safer choice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。