Author: Nancy, PANews

Since the stablecoin issuer Circle successfully went public in early June, its stock price has continued to soar, attracting global investors' attention and even becoming the fourth largest overseas stock purchased in South Korea this year. As the stock price skyrocketed, Circle's investors and key shareholders reaped substantial returns, and their holdings have become a market focus.

This article by PANews summarizes the reduction and holding scale of 11 major Circle shareholders before and after the IPO. In terms of shareholding ratio, IDG Capital, rooted in China, has become one of Circle's known largest non-founder shareholders through multiple rounds of early investment. Early investors such as Accel, General Catalyst, Breyer Capital, and Oak locked in profits by reducing their holdings before the IPO, but missed out on significant profits due to exiting early, with losses potentially reaching hundreds of millions of dollars, while most still maintain considerable holdings and will continue to benefit from the rising stock price. Of course, players like ARK Invest, who joined later, chose to make bold bets in the early stages of Circle's IPO and subsequently cashed out at high levels for substantial returns.

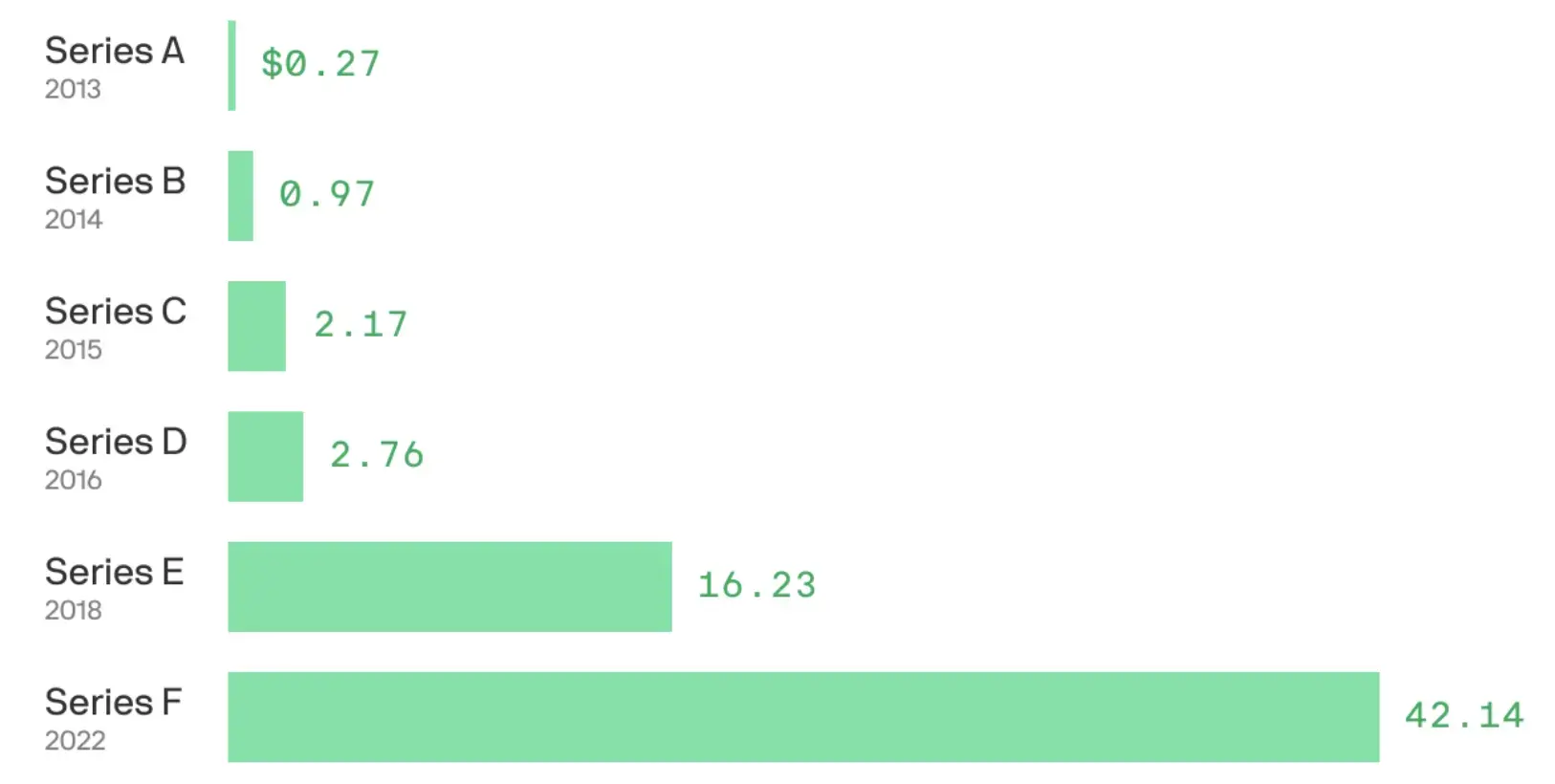

Circle's investment prices for each round of financing, image source: Axios Visuals

IDG Capital: Cashed out over $68 million before the IPO, still one of the largest external shareholders

IDG Capital is one of the earliest venture capital firms in China to engage in early-stage investments, having invested in Tencent, Baidu, JD.com, ByteDance, and Coinbase, among others. As an important early investor in Circle, IDG participated in the early A, B, and C rounds of financing, holding a significant amount of equity in the company.

The prospectus shows that IDG's shares are held by its affiliated entities Chuang Xi Capital Limited (controlled by IDG Capital II GP) and Wide Palace Limited (controlled by IDG Capital III GP), totaling 23,275,040 shares, with a shareholding ratio of 12.8%.

Among them, Chuang Xi Capital reduced its holdings by approximately 2.328 million shares at a price of $29.3 on June 6, cashing out about $68.29 million. If calculated at the current market price of $213.6, it missed out on nearly $430 million in potential profits. After the reduction, IDG-affiliated capital still holds about 20.947 million shares of Circle stock, with a shareholding ratio of 10.4%. Based on the current stock price, the remaining holding's market value exceeds $4.473 billion, making it one of the largest external institutional investors in the company.

It is worth mentioning that Everbright Holdings also invested in Circle after co-founding the "Guangji Capital Industry Fund" with IDG Capital in 2016, and this investment may be included in the aforementioned IDG affiliate's investments.

General Catalyst: Shareholding ratio reaches 10%, CRCL position nearly $4.3 billion

General Catalyst is an investor in Circle's A and C rounds. According to Form 4 documents disclosed by the U.S. SEC, General Catalyst is a significant shareholder of Circle, with a shareholding ratio that once exceeded 10%. As a continuous investor from Circle's A round to E round, General Catalyst sold approximately 3.55 million shares at a price of $29.3 on June 6, cashing out about $104 million. Based on the stock price of $213.6, it missed out on approximately $650 million in paper profits. After the reduction, the institution still holds about 20.12 million CRCL shares, valued at over $4.29 billion.

ARK Invest: Cashed out over $350 million, CRCL remains a core holding

According to its official website, as of June 27, ARK Invest held CRCL worth nearly $580 million, with approximately 2.818 million shares. Among them, the ARK Innovation ETF holds CRCL worth $368 million, the ARK Next Generation Internet ETF holds $133 million, and the ARK Fintech Innovation ETF holds $78.85 million.

On the day of Circle's IPO, ARK Invest purchased approximately 4.486 million CRCL shares for the first time, with a holding value of about $373 million at that time. However, starting from June 16, the institution began to significantly reduce its CRCL stock, cumulatively reducing about 1.667 million shares, cashing out approximately $352 million. Despite the large-scale reduction, Circle remains one of the important holdings in ARK Invest's three main ETFs.

CEO Jeremy Allaire: Large-scale conversion of equity before the IPO, cashed out over $46 million

Jeremy Allaire is the Chairman and CEO of Circle. His large-scale stock conversion and trading operations before the company's IPO resulted in a stock ratio of 23.7% post-IPO. According to disclosures, Allaire converted all of his 18.59 million Class A common shares into Class B common shares on June 6, with a 1:1 automatic conversion ratio. These shares enjoy the same economic benefits as Class A common shares but have stronger control in voting rights. Additionally, Allaire converted over 330,000 Class A common shares into Class B shares through his personally established trust, Allaire 2025 Qualified Annuity Trust, and continues to hold them indirectly. On June 6, Allaire also sold over 15,800 Class B common shares after automatic conversion at an average price of $29.3, cashing out approximately $46.4 million. Furthermore, Allaire converted over 18 million Class A stock options into Class B options, with an exercise period extending to 2033.

Although Jeremy Allaire recently sold part of his shares and adjusted the equity structure, his control over Circle remains substantially unaffected due to the high voting power of Class B shares, the large option pool, and the family trust holding structure.

Accel: Holding valued at over $230 million, shareholding ratio reaches 5.3%

Accel is one of the important shareholders participating in multiple rounds of financing for Circle, and its partner Jim Breyer is also IDG's investment partner in the U.S. According to publicly disclosed information, Accel originally held 12.816 million CRCL shares, with a shareholding ratio of 6.9%. During Circle's IPO process, Accel reduced its holdings to 10.925 million shares, with a shareholding ratio of 5.3%, valued at over $230 million based on the most recent closing price.

Breyer Capital: Reduced holdings by 335,000 shares, remaining holding valued at over $280 million

Breyer Capital participated in Circle's financing from A round to D round. Although Breyer Capital chose to reduce over 335,000 shares during Circle's IPO, the specific reduction price was not disclosed. However, based on the current market price of $213.6, the value of this portion of shares has reached $71.6 million. Currently, Breyer Capital still holds 1.336 million shares, with a shareholding ratio of 6.5%, and its holding value exceeds $285 million.

Oak Investment Partners: After reduction, still holds 5.9%, position valued at $250 million

Oak Investment Partners began supporting Circle as early as 2014, participating in its B and C rounds of financing. According to public data, before Circle's IPO, Oak reduced approximately 209,000 CRCL shares, with the value of the reduced portion estimated at about $44 million based on the current market price. Currently, Oak holds over 1.188 million shares, with a shareholding ratio of 5.9%, and a holding value of approximately $250 million.

It is worth mentioning that at that time, Oak's trading head, Iftikar Ahmed, faced charges a year later for insider trading related to other mergers and misappropriation of company funds, which directly led Oak to decide not to raise new funds.

FMR: Maintains unchanged shares, holding value exceeds $280 million

FMR is the parent company of Fidelity Investments, which participated in Circle's $50 million C round financing. It did not make any reductions during Circle's IPO process, maintaining its shareholding at 1.341 million shares, with a voting power ratio of 4.6%, and the current holding value exceeds $280 million.

CFO Jeremy Fox-Geen: Cashed out over $5.8 million, option holdings exceed 1.2 million

Jeremy Fox-Geen is Circle's Chief Financial Officer (CFO). On June 5, he reduced his direct holdings of approximately 44,600 common shares through a non-sale transfer (F-type operation), and then increased his holdings by purchasing 160,000 common shares and corresponding stock options at a price of $10.11; on June 6, he sold 200,000 shares at a price of about $29.3, cashing out a total of approximately $5.854 million. If calculated at the current market price of $213.6, the potential paper profit from this portion of sold shares exceeds $37 million.

Currently, Jeremy Fox-Geen directly holds about 320,000 CRCL common shares and has approximately 1.27 million stock options with an exercise price of $10.11, with a term of up to 6 years.

Date Rajeev V.: Profited about $1.46 million, indirect holding valued at nearly $200 million

Date Rajeev V. is the managing partner of the investment and consulting firm Fenway Summer LLC. According to Form 4 documents disclosed by the U.S. SEC, on June 6, 2025, he increased his indirect holdings of approximately 600,000 CRCL common shares through a non-sale transfer (J-type operation), while personally selling 50,000 common shares at a price of about $29.3, cashing out approximately $1.465 million. If calculated at the current market price of $213.6, the potential paper profit from this portion of sold shares exceeds $9.5 million.

Currently, Rajeev V. indirectly holds about 900,000 CRCL common shares through affiliated entities Fenway Summer Ventures LP, FS Venture Capital L.L.C., and other trust institutions, estimated to be worth about $192 million based on the current CRCL stock price.

CPO Nikhil Chandhok: Cashed out over $22 million, still holds over 600,000 shares

Nikhil Chandhok is Circle's Chief Product Officer (CPO). According to Form 4 documents disclosed by the U.S. SEC, he reduced approximately 758,000 CRCL common shares between June 5 and June 6, with a reduction price range between $29.3 and $31, cashing out approximately $22.7 million. If calculated at the current market price of $213.6, the potential paper profit from this portion of reduced shares exceeds $160 million.

Currently, Nikhil Chandhok still holds about 606,000 CRCL common shares, estimated to be worth about $130 million based on the current stock price.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。