Yesterday I drank too much, and today I've had quite a bit as well. Over the two days, I've consumed about 400 grams. Fortunately, I became clear-headed as soon as I started typing, but it still took a bit of time. When I drink too much, I tend to be chatty, so please bear with me.

Today's focus is not on the macro level, but rather on what RobinHood and xStocks have provided. Although their impact on prices isn't very deep, they have opened the door for on-chain brokerages in the long run. This is a sector that I personally have very high hopes for.

Of course, xStocks is not compliant in the U.S. and cannot allow U.S. users to trade. While it may not seem like a big issue, and they are trading U.S. stocks, they still lack the capital effects that compliance brings. However, this model allows many friends holding stablecoins to conveniently purchase U.S. stocks.

Additionally, some friends asked why $MSTR rose over 5.3% today, wondering if there was some news. In fact, I searched for a long time and couldn't find any information. I saw some overseas media saying it was because MSTR bought $BTC, but that shouldn't be related. After all, Michael announced it at 8:30 PM, and although there was a slight increase before the market opened, it actually dropped at the opening, only starting to rise six minutes after the market opened.

So, it should have little to do with buying BTC. I personally speculate that investors who bought $CRCL and $Coin have returned to MSTR, as MSTR represents Bitcoin in U.S. stocks. The phase of $CRCL and Coin, especially $CRCL, may have ended. Of course, this is just my speculation and may not be accurate.

While writing this, I suddenly saw that Circle applied for a national trust bank license in the U.S. This would be a significant positive for $CRCL, but it only counts if it's approved; if not, it doesn't mean anything. I wrote two separate tweets about it, so those interested can take a look.

Link: https://x.com/Phyrex_Ni/status/1939782272183652500

Looking back at Bitcoin's data, there hasn't been much change in price on Monday, and the turnover hasn't changed much either. It's just that market makers have started to become active now that the workweek has begun. In reality, the actual trading volume isn't very high, and the market is still waiting for a directional change.

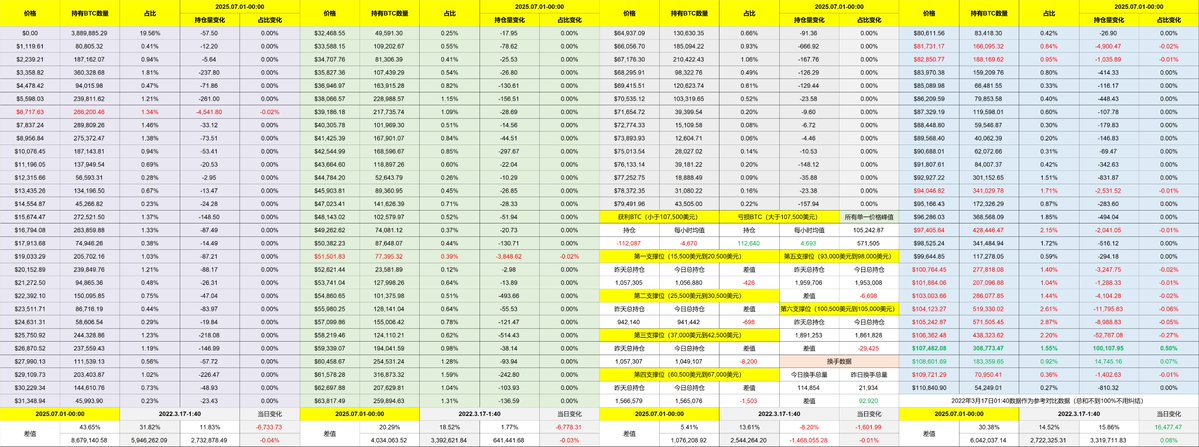

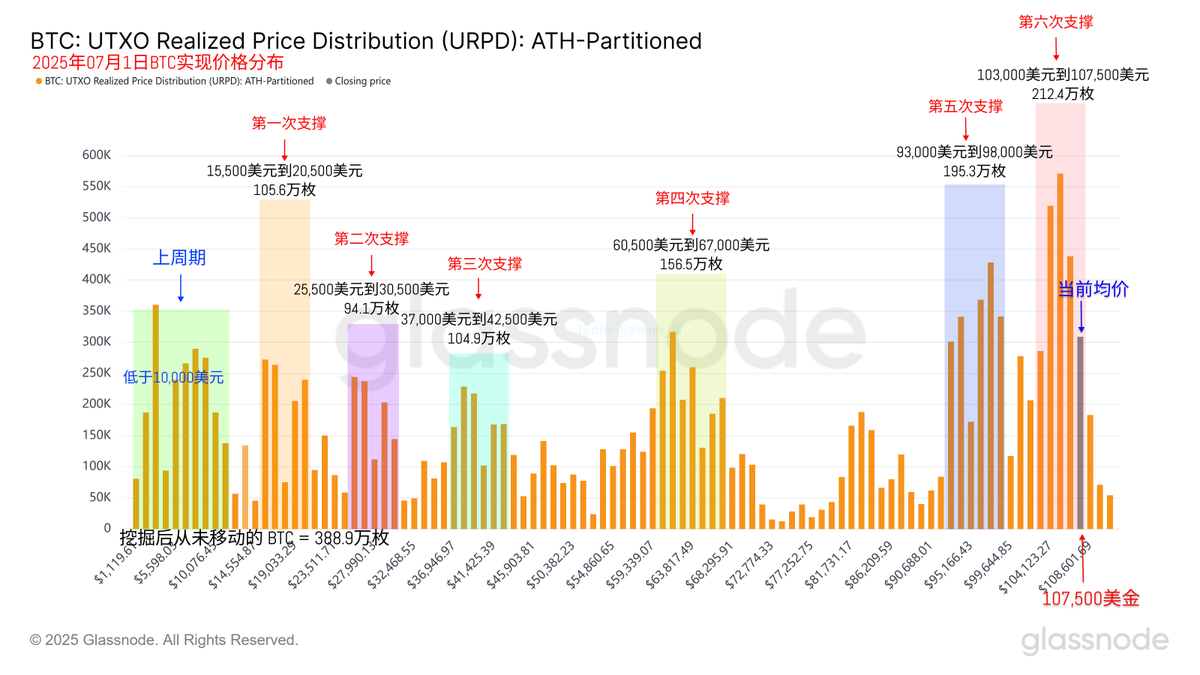

I made a slight adjustment to the support data. The primary support range of $93,000 to $98,000 remains the most reliable support, followed by a new support level of $103,000 to $107,500. Currently, both ranges seem to have decent stability, but the latter still has a higher proportion of short-term investors.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。