The premium in bitcoin (BTC) futures listed on the global derivatives giant Chicago Mercantile Exchange (CME) has narrowed sharply, a sign of reduced institutional appetite.

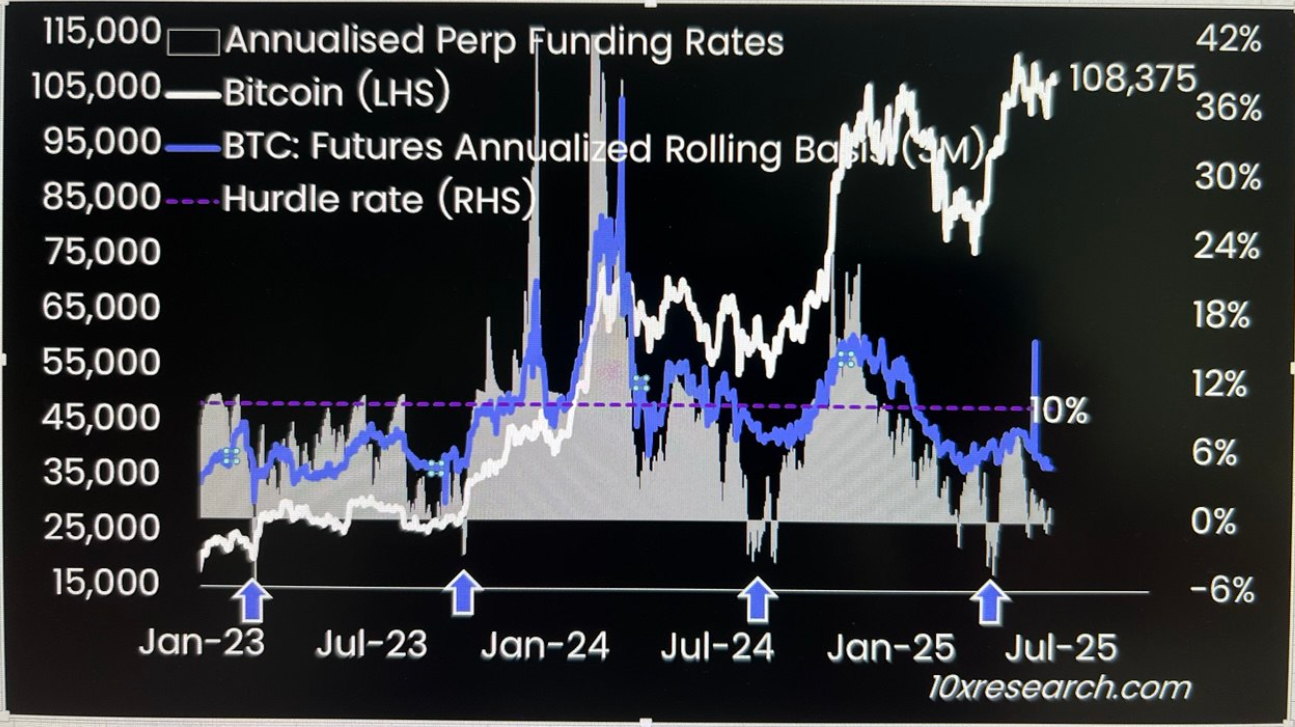

The annualized premium in rolling three-month futures has dropped to 4.3%, the lowest since October 2023, according to data tracked by 10x Research. That's down significantly from highs above 10% seen early this year.

The decline in the so-called basis, despite BTC's price holding steady above $100,000, indicates fading optimism or uncertainty about future price prospects.

The drop is consistent with the slide in the funding rates in perpetual futures listed on major offshore exchanges. According to 10x, funding rates recently flipped negative, suggesting a discount in perpetual futures relative to the spot price, which is also a sign of bias for bearish short positions.

The dwindling price differential is a setback for those seeking to pursue the non-directional cash-and-carry arbitrage, which involves simultaneously purchasing spot ETFs (or actually BTC) and shorting the CME futures.

"When yield spreads fall below a 10% hurdle rate, Bitcoin ETF inflows are typically driven by directional investors rather than arbitrage-focused hedge funds. This dynamic often coincides with price consolidation. Currently, these spreads are down to 1.0% (perpetual futures funding rate) and 4.3% (CME basis rate), indicating a significant decline in hedge fund arbitrage activity," Markus Thielen, founder of 10x Research, told CoinDesk.

Thielen added that the drop-off coincides with muted retail participation, as indicated by depressed perpetual funding rates and low spot market volumes.

Padalan Capital voiced a similar opinion in a weekly update, calling the decline in funding rates a sign of retrenchment in speculative interest.

"A more acute signal of risk-off positioning comes from regulated venues, where the CME-to-spot basis for both Bitcoin and Ethereum has inverted into deeply negative territory, indicating aggressive institutional hedging or a substantial unwind of cash-and-carry structures.," Padalan Capital noted.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。