Will the Soft RUG Scandal Affect the Enthusiasm for Stock Tokenization?

Written by: Bright, Foresight News

As Robinhood, Kraken, and Bybit successively announced their plans for stock tokenization in the U.S. market, major ecosystems like Chainlink and Jupiter also declared their support for trading tokenized stocks of companies like Apple, Tesla, and Nvidia. This "breaking the wall" concept became an overnight sensation in the crypto space. Among them, the crypto-native exchanges Kraken and Bybit chose to adopt the stock tokenization platform xStocks based on the Solana underlying architecture, while the digital brokerage Robinhood opted for Arbitrum as the token issuance chain.

Just as various ecosystems were filled with enthusiasm, a piece of "cold water" news emerged in the market. According to LinkedIn profiles, the three co-founders of the stock tokenization platform xStocks, namely Adam Levi Ph.D., Yehonatan Goldman, and Roberto Klein, have all been confirmed to have previously worked at the now-bankrupt DAOstack.

Among them, Adam Levi Ph.D. served as a co-founder of DAOstack to provide endorsement, Yehonatan Goldman was the Chief Operating Officer of DAOstack, and Roberto Klein was responsible for legal and regulatory matters at DAOstack.

Data from ICO Drops shows that DAOstack raised approximately $30 million through multiple rounds of financing from the fourth quarter of 2017 to May 2018, but closed at the end of 2022 due to a lack of funds. The DAOstack team has been accused of a "soft RUG PULL."

According to crypto KOL @cryptobraveHQ, DAOstack issued the token $Gen in 2019, which plummeted after the 2021 bull market. "The team couldn't even be bothered to set up a small office; they just let the token go to zero after issuing it."

xStocks Operating Mechanism

However, in terms of operational mechanism, at least for now, xStocks provides a workable path.

xStocks is operated by its parent company registered in Switzerland, with the issuer Backed Assets controlled from Jersey. Backed Assets purchases stocks in the U.S. market through the IBKR Prime channel under Interactive Brokers, and then transfers them to a segregated account at Clearstream, a subsidiary of the Frankfurt Stock Exchange.

Once the "buy - transfer - deposit" three-step operation is completed, the issuer Backed Assets will trigger a contract deployed on the Solana chain to issue corresponding stock tokens. For every 1,000 shares of Tesla stock purchased and stored, 1,000 TSLAx tokens will be minted on-chain at a 1:1 ratio. The control address of the token contract belongs to the issuer Backed. Subsequently, third-party exchanges like Kraken, Bybit, and Jupiter can directly list these tokens for spot and contract trading.

If investors or market makers actually buy one or more TSLAx tokens, they can apply to Backed to redeem them for actual Tesla stocks from the brokerage. Meanwhile, dividends will automatically airdrop more of the same tokens after a snapshot.

During market closure, the prices of stock tokens across the network will refer to Chainlink's oracle. If there is a significant deviation from the U.S. stock prices, arbitrageurs can profit by trading tokens on the xStocks platform or Kraken and Bybit, thus pushing the prices back to a reasonable range.

Potential Concerns

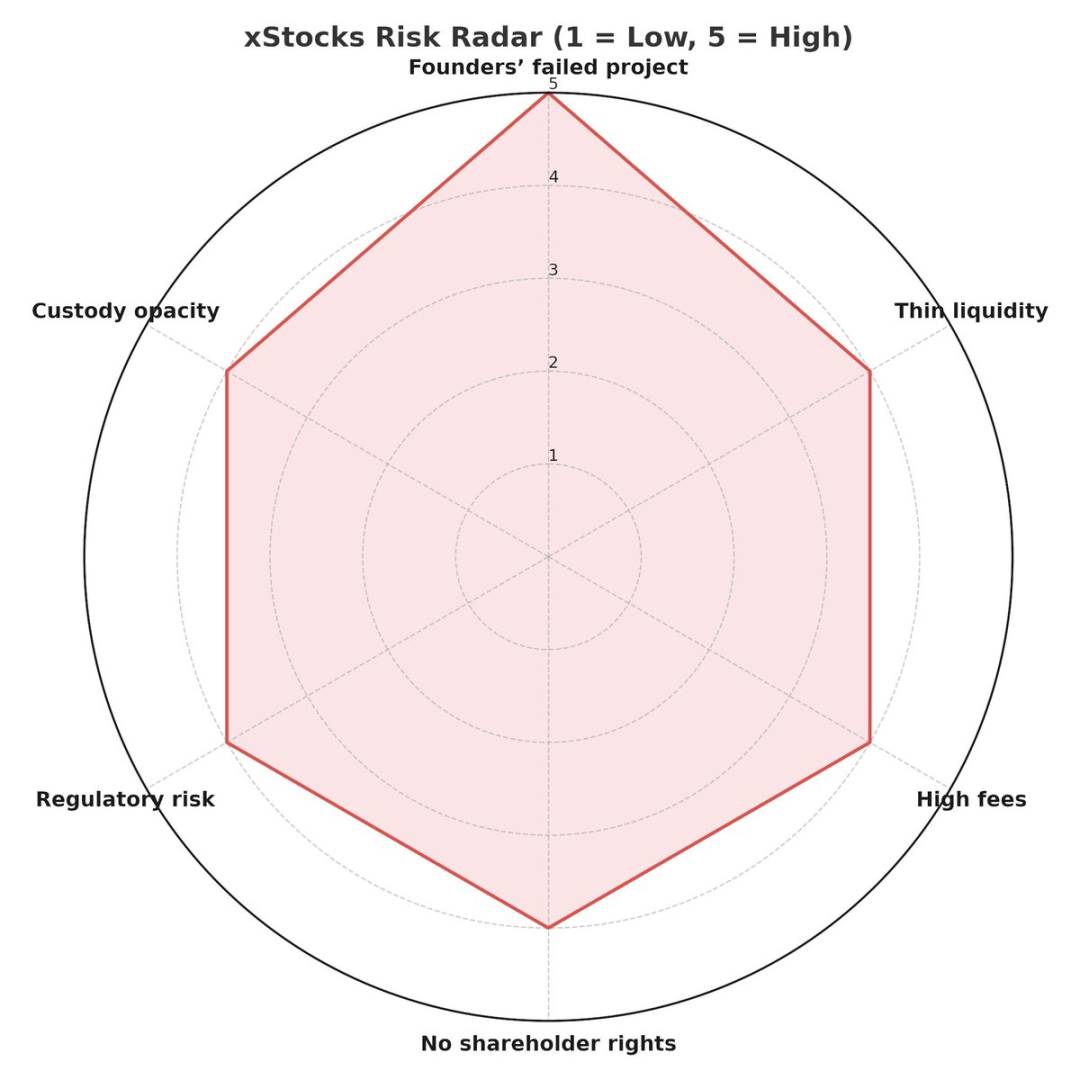

However, aside from the previously mentioned "soft RUG PULL" history of the founders, community users still report many shortcomings of xStocks, some of which are difficult to substantively improve. Some users bluntly state: "On-chain stock tokens are just a castrated version of stocks created to avoid taxes."

For instance, users generally believe that xStocks has very thin liquidity, with only 6,000 tokens available for each stock currently listed, leading to significant volatility that exceeds the actual situation of U.S. stocks on-chain.

Secondly, the fees are excessively high. On-chain tokenized stocks on xStocks have a destruction fee of up to 0.50% and an annual management fee of 0.25%, making it more expensive to hold U.S. stocks on-chain than to hold actual shares.

Additionally, some community members believe that the collateralized stocks are held by off-chain custodians, lacking public audits and posing a risk of collapse. The on-chain stocks do not grant shareholders voting rights, and what is actually held are unsecured notes, which raises concerns. The slow experience of buying and redeeming is also unbearable for users.

Using the KOL's comment that exposed the xStocks founders' scandal, "Israeli web3 projects have the 'Buddhist' temperament of European projects and the capital operation capabilities of American projects; in summary, they are completely irresponsible to users from start to finish."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。