Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

Robinhood's stock tokenization plan is in full swing. Last night, it completed the token minting of 213 U.S. stocks on the Arbitrum chain, covering mainstream assets such as Nvidia, Microsoft, and Apple.

Among the most notable developments is Robinhood's extension of tokenization to unlisted private companies, including OpenAI and SpaceX. However, early this morning, OpenAI officially issued a strong statement to "cut ties": no collaboration, no participation, no endorsement, and no approval of any equity transfer.

This firm stance quickly sparked controversy: Can unlisted stocks be tokenized? Do the tokens correspond to real equity?

In response, we have sorted out the core disputes and practical dilemmas in the current market regarding "stock tokenization," hoping to provide a clearer perspective for everyone.

1. Token ≠ Equity

Most stock token products on the market are essentially price-pegged derivatives, with their underlying structure resembling that of a trust fund or ETF. They provide an on-chain "shadow asset" of a certain stock price, rather than a true equity registration.

In this model:

- Users do not possess any shareholder identity;

- No voting rights or participation in corporate governance;

- No legal ownership of the assets;

- Annual fees similar to fund management and custody fees must be borne.

Crypto KOL AB Kuai.Dong humorously remarked: "Control it yourself, issue it yourself. Once a brokerage, now a crypto circle central bank."

2. Tokenization of Unlisted Stocks May Trigger Governance Conflicts in Private Companies

Tokenizing the equity of unlisted companies on-chain seems like an innovation that breaks traditional financial restrictions, but it touches on complex and sensitive areas in terms of legal reality and corporate governance.

Private companies may impose restrictions on the "transfer" of equity through articles of association, shareholder agreements, or investment memoranda. Here, "transfer" does not merely refer to changes in ownership; it often encompasses a broad range of actions from pledging, derivative design to trading rights.

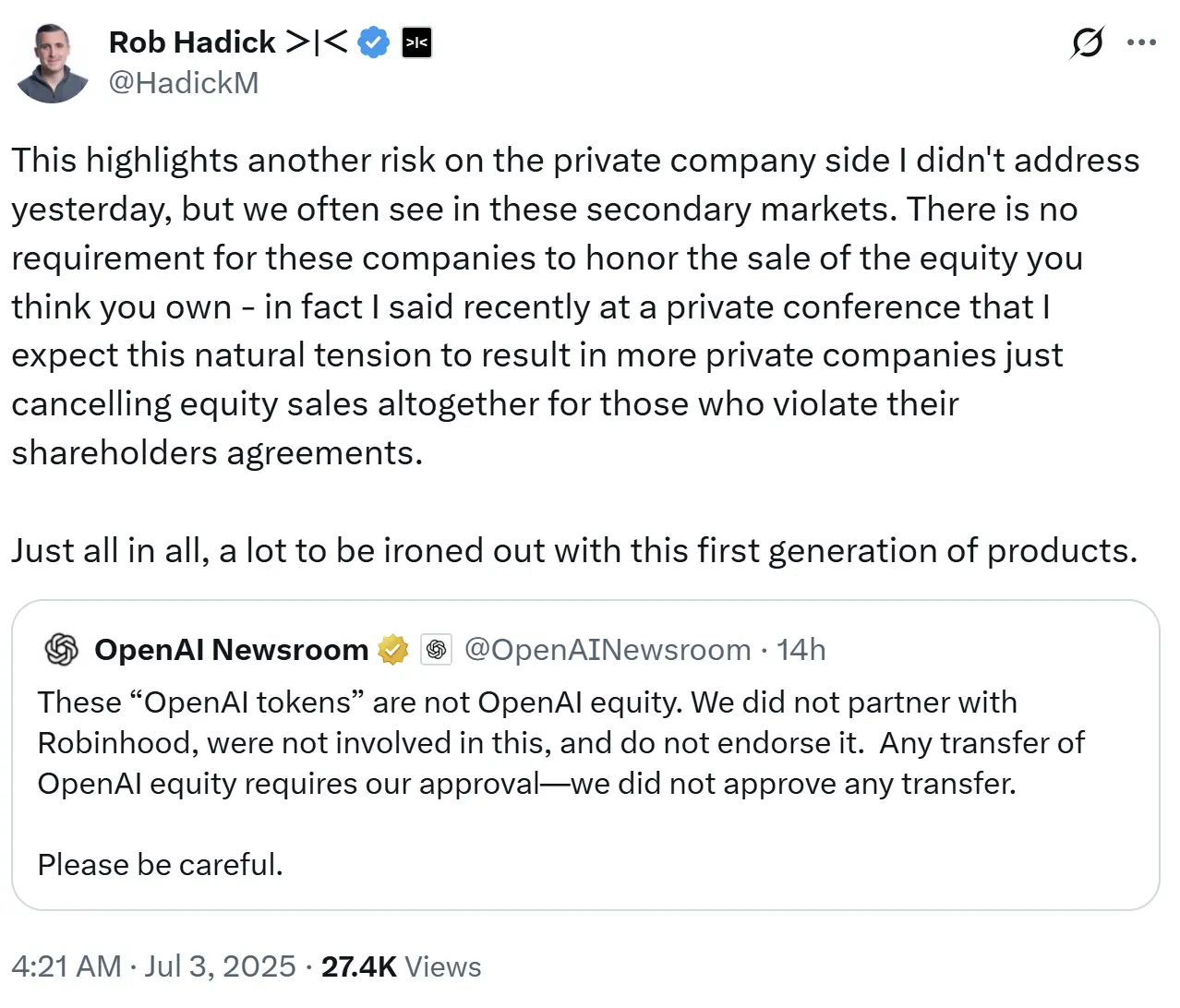

In the case of Robinhood and OpenAI, Dragonfly partner Rob Hadick pointed out that these companies are under no obligation to recognize "the equity sales you think you own." He anticipates that this inherent contradiction will lead more private companies to directly cancel equity sales that violate shareholder agreements. This phenomenon is not uncommon in the secondary market.

Crypto KOL qinbafrank proposed another scenario: in the secondary market for private equity, the circulating shares of unlisted companies often do not represent direct equity but correspond to LP shares of the investment funds behind the unlisted companies (usually held through SPV structures, with GP exercising rights). The transfer of these LP shares does not require official consent from the company, and the unlisted company may not even be aware of changes in the investment institution's LP shares. However, despite the flexibility of LP share trading, it also carries a high risk of information asymmetry.

Additionally, companies like OpenAI may resist stock tokenization to maintain their pricing power in the secondary market, posing challenges for enterprises pushing for tokenization.

3. Incremental Benefits Are Doubtful, Limited Appeal to Large Funds

Although stock tokenization has advantages in narrative terms such as "24/7 trading" and "global no-threshold access," its incremental benefits to the overall market structure still appear limited, especially in attracting institutional-level funds.

Crypto KOL Phyrex pointed out that most stock tokens circulating on-chain are not issued by brokerages, with the core issue being the inability to achieve substantial delivery. The inability to deliver means that price distortions may not be corrected in a short time, making positive arbitrage difficult. Moreover, since they have not received legal approval from regulatory bodies like the SEC, they cannot attract institutional funds with scalable trading capabilities.

More critically, the traditional stock market does not operate 24 hours, while the 24/7 trading mechanism of on-chain stock tokens creates a "time misalignment." In the absence of delivery, if price anchoring relies entirely on oracles, price disconnection between tokens and stocks will become the norm, and deep sharing between stock tokens will be impossible, leading to systemic disadvantages in price depth and volatility.

4. Triple Risks of Audit, Compliance, and Security

In the previous round of attempts at stock tokenization, the lack of compliance was almost a common issue leading to the failure of all projects. Although the overall regulatory environment for the crypto industry has slightly improved in recent years, the regulatory framework for stock tokenization remains highly uncertain, even blank.

Currently, Coinbase is actively seeking approval from the U.S. SEC, attempting to provide stock tokenization trading services for users within a compliant framework, but there has been no clear outcome so far.

At the same time, issues related to smart contracts and asset custody pose another systemic risk for this sector. Stock tokenization projects typically rely on smart contracts to perform key functions such as asset mapping, position recording, and rights settlement. However, if they encounter external attacks, on-chain assets may suffer irreversible losses. In the absence of regulation, users will find it even more difficult to seek legal remedies or recover corresponding off-chain assets.

If the platform (such as xStocks) encounters operational or systemic issues, its connected exchanges and other partners may be quickly affected, leading to a "domino effect."

"Stock tokenization" has once again become a focal point in the industry, undoubtedly opening up vast imaginative space for on-chain finance, but the market risks behind it cannot be ignored. This journey of transformation remains full of unknowns and challenges.

Recommended Reading:

Entering the stock token battlefield, Robinhood aims to be the Nasdaq of the crypto world

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。