Unified Liquidity Layer + GHO Liquidation Upgrade, two core functions help Aave maintain its position as the leader in DeFi.

Written by: Matt, Researcher at Castle Labs

Translated by: Tim, PANews

At the Ethereum Community Conference (ETHCC), Aave founder Stani announced the upcoming release of the new protocol Aave V4. As the largest lending protocol in the DeFi space, this iteration has garnered significant market attention.

Today, I will focus on the functional updates of the Aave V4 protocol, particularly how the new interest rate parameters and GHO stablecoin upgrades will reshape the protocol ecosystem. These innovative measures could profoundly change the capital efficiency model, with the liquidity pool adopting a dynamic spread mechanism, allowing borrowing rates to achieve market-driven pricing for the first time; while GHO's cross-chain enhancement module will not only improve the stablecoin's utility but also optimize on-chain liquidation of debt positions, establishing a new financial infrastructure for the entire protocol.

What is AAVE V4?

Aave's total locked value has surpassed $25 billion for the first time, making it the first lending protocol in the DeFi space to reach this milestone. Its development team is actively advancing new feature development, aiming to drive platform growth through risk parameter adjustments.

New features announced last year are about to go live:

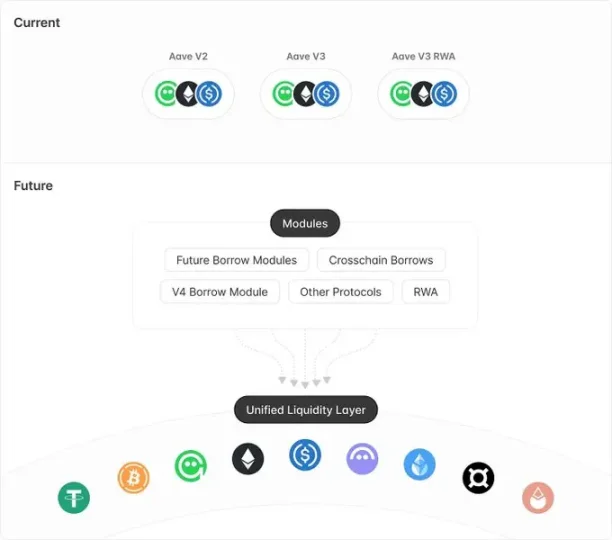

Unified Liquidity Layer: Introduces a series of modules that lift the original restrictions on liquidity migration while adding new functionalities such as cross-chain lending.

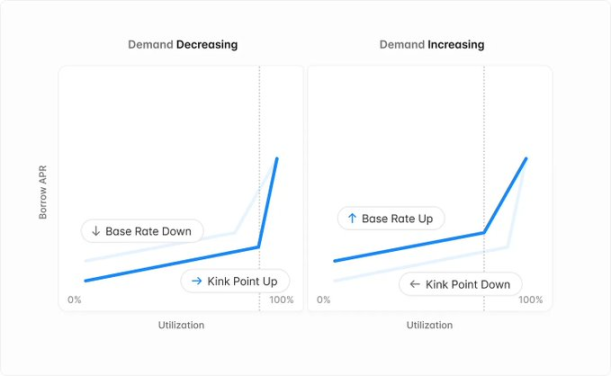

Blurred Control Interest Rates: This mechanism automatically adjusts the interest rate curve and inflection points based on market conditions, rather than relying on governance votes.

Liquidity Premium: Borrowing costs will increasingly depend on the liquidity status of each token. Assets like ETH will remain at no premium, serving as the benchmark currency, while other assets like WBTC and wstETH will adopt corresponding premium mechanisms based on their liquidity status.

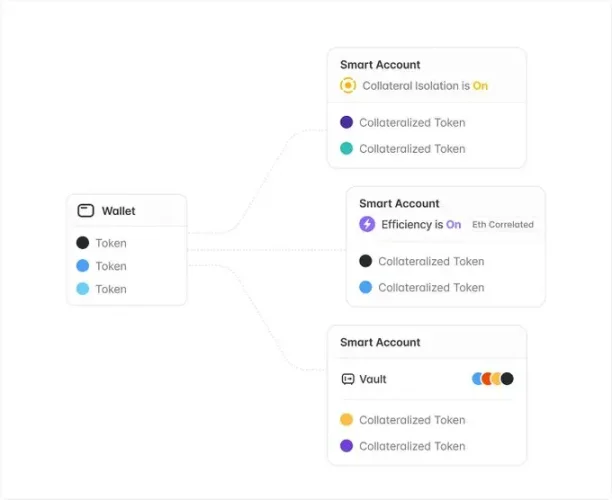

Aave V4 Lending Module: The team is exploring the use of smart accounts to support functionalities such as the Aave treasury, which can lock liquidity and disable collateral features.

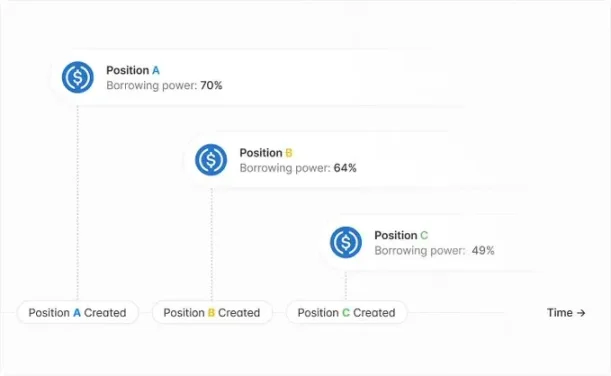

Dynamic Risk Allocation: The collateral ratio is linked to the market state at the time of position establishment, rather than subsequent market fluctuations, providing greater stability for user positions.

Automated Asset Delisting

Automated Fund Management

Liquidation Engine V4: Aave's liquidation mechanism is undergoing significant upgrades, including variable liquidation parameters and reward mechanisms, while also supporting batch liquidation functionality.

Deeper GHO Integration: GHO will achieve deeper native integration in Aave V4, including upgrades to the soft liquidation mechanism, paying stablecoin interest in GHO, and adding emergency redemption mechanisms.

Additional upgrades include gas fee optimization and the deprecation of tokenized positions and stable interest rates.

Now, let's delve into the two major transformations: Unified Liquidity Layer and GHO Upgrade.

Unified Liquidity Layer

The Unified Liquidity Layer introduces a brand new chain-agnostic, independent, and abstracted liquidity infrastructure.

A significant improvement of this modular system is that new lending modules can be deployed or old lending modules can be taken offline without migrating liquidity.

This architecture supports the addition or optimization of lending functionalities (such as isolated liquidity pools, physical asset modules, and collateral debt positions) without altering the overall system and liquidation module, effectively addressing the liquidity fragmentation issues present in earlier versions of the protocol.

The liquidity layer supports both user-provided assets and natively minted assets, thereby improving integration with GHO and other cryptocurrencies collateralized by Aave protocol native assets.

Cross-chain lending may be one of the most impactful functional modules, allowing users to deposit on one chain and borrow on another. This not only significantly enhances the platform's cross-chain liquidity potential but also creates new opportunities for market growth.

GHO Upgrade

GHO is an over-collateralized stablecoin launched by Aave, currently valued at over $220 million, with a 53% increase since early 2025.

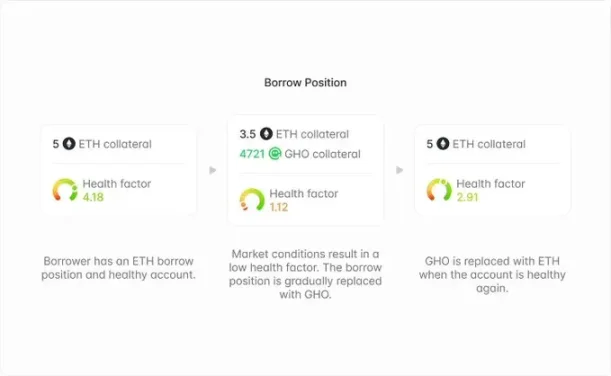

In addition to subtle improvements such as enhancing native minting efficiency, the most notable upgrade is the introduction of a flexible liquidation mechanism. This mechanism draws on the innovative model of crvUSD, streamlining the liquidation process through automated market makers (LLAMM).

Liquidation operations occur within customizable ranges, guiding the system to convert assets into GHO during market downturns and repurchase collateral during upswings. Compared to crvUSD, Aave V4 has three major advantages: users can independently select collateral from an asset basket for liquidating positions; they can freely choose collateral for repurchase from all available assets on the Aave platform (including assets not initially provided); and they can benefit from the interest income generated automatically by GHO.

Another noteworthy change is that stablecoin market users can receive interest payments in the form of GHO, a mechanism that can expand the supply of GHO by directly converting interest into tokens.

Aave V4 introduces an emergency redemption mechanism to address extreme situations of severe and persistent GHO de-pegging. Once triggered, the platform will gradually exchange the assets of the collateral positions with the lowest health factor for GHO tokens to repay user debts based on the innovative LLAMM design.

Conclusion

For a protocol as large and significant as Aave, minimizing risk is crucial, especially when launching major features like cross-chain lending.

Automating processes such as asset delisting and interest rate model adjustments helps reduce reliance on slow DAO processes, particularly when responding to market-driven changes.

Aave is confident in the growth of its stablecoin GHO, which has seen significant improvements and achieved deeper integration within the protocol.

In the foreseeable future, Aave is expected to continue maintaining its cornerstone position in the DeFi space. The success of the broader ecosystem heavily relies on its sustained leadership. After all, no other project has been able to accumulate a total locked value at this level while maintaining the same level of security.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。