The essence of blockchain is the trajectory of funds. As long as a product can utilize these trajectories to facilitate economic transactions in a disordered segmented market, value will be generated.

Written by: Joel John

Translated by: AididiaoJP, Foresight News

The crypto industry is gradually starting to avoid discussions about how grand the narratives are, and instead focuses on the sustainability of economic models. The reason is simple: when institutional funds begin to enter the crypto space, economic fundamentals will become incredibly important, and crypto entrepreneurs need to reposition themselves in a timely manner.

The crypto industry has moved past its infancy and is entering a new phase, where the revenue base determines the success or failure of projects.

Humans are shaped by emotions and composed of emotions, with nostalgia being particularly prominent. This attachment to past norms makes us resistant to technological change. Let’s call it "cognitive inertia": the inability to break free from old thinking patterns. When the foundational logic of the industry changes, early adopters tend to cling to past methods. When the electric light was invented, some lamented that oil lamps were better; in 1976, Bill Gates had to write an open letter in response to geeks unhappy with his development of paid software.

Today, the crypto space is experiencing its own moment of cognitive inertia.

In my spare time, I always ponder how the industry will evolve. The dream of "DeFi summer" has now emerged, and Robinhood has issued stocks on the blockchain.

When the industry crosses the chasm, how should founders and capital allocators act? As internet fringe users begin to use these tools, how will the core narrative of crypto evolve? This article attempts to explain how to generate monetary premiums by distilling economic activities into compelling narratives.

Let’s delve deeper.

Traditional Patterns in the Crypto Circle Have Failed

Venture capital can be traced back to the whaling era of the 19th century. Capitalists invested funds to purchase ships, hire crews, and equip them, with successful voyages often yielding tenfold returns. But this meant that most expeditions ended in failure, either due to bad weather, shipwrecks, or even crew mutinies; however, one successful venture could yield substantial rewards.

Today’s venture capital operates similarly. As long as there is one super project in the portfolio, it doesn’t matter if most startups fail.

The commonality connecting the whaling era and the explosion of applications in the late 2000s is market size. As long as the market is large enough, whaling is feasible; as long as the user base is sufficient to create network effects, developing applications can proceed. In both cases, the density of potential users creates a market size capable of supporting high returns.

In contrast, the current L2 ecosystem is dividing an already small and increasingly strained market. Without volatility or new wealth effects (like meme assets on Solana), users lack cross-chain motivation. It’s akin to traveling from North America to Australia to hunt whales. The lack of economic output is directly reflected in the prices of these tokens.

Understanding this phenomenon requires a perspective of "protocol socialism": protocols subsidize open-source applications through grants, even if they have no users or economic output. The benchmarks for these grants are often social affinity or technical fit, evolving into a "popularity contest" funded by token hype rather than an effective market.

In 2021, when liquidity was abundant, it didn’t matter whether tokens generated enough fees, whether users were mostly bots, or whether there were any applications. People were betting on the hypothetical probability of the protocol attracting massive users, much like investing before Android or Linux took off.

The problem is that in the history of open-source innovation, there have been few successes binding capital incentives to forkable code. Companies like Amazon, IBM, Lenovo, Google, and Microsoft directly incentivize developers to contribute to open source. In 2023, Oracle was surprisingly the main contributor to Linux kernel changes. Why would profit-driven organizations invest in these operating systems? The answer is clear:

They leverage these foundational builds to create profitable products. AWS partially relies on Linux server architecture to generate billions in revenue; Google’s open-source strategy for Android attracted manufacturers like Samsung and Huawei to jointly build its dominant mobile ecosystem.

These operating systems possess network effects that warrant continued investment. For thirty years, the scale of economic activity supported by their user base has formed a moat of influence.

In comparison to today’s L1 ecosystem: DeFillama data shows that among the existing 300+ L1 and L2, only 7 have daily on-chain fees exceeding $200,000, and only 10 ecosystems have a TVL over $1 billion. For developers, building on most L2s is like opening a store in a desert, with scarce liquidity and unstable foundations. Unless they throw money around, users have no reason to come. Ironically, under pressure from grants, incentives, and airdrops, most applications are doing just that. Developers are competing not for protocol fee sharing, but these fees are precisely a symbol of protocol activity.

In this environment, economic output becomes secondary; hype and performance are more eye-catching. Projects don’t need to be genuinely profitable; they just need to appear to be building. As long as someone buys the tokens, this logic holds. While in Dubai, I often wonder why there are drone shows or taxi ads for tokens; do CMOs really expect users to emerge from this desert nook? Why are so many founders so eager for "KOL wheels"?

The answer lies in the bridge between attention and capital injection in Web3. Attract enough eyeballs and create enough FOMO (fear of missing out), and there’s a chance to achieve high valuations.

All economic behavior stems from attention. If you cannot continuously attract attention, you cannot persuade others to talk, date, collaborate, or trade. But when attention becomes the sole pursuit, the costs are evident. In an age of rampant AI-generated content, L2s are still using outdated scripts; endorsements from top VCs, large listings, random airdrops, and fake TVL games are becoming ineffective. If everyone repeats the same patterns, no one can stand out. This is the harsh reality that the crypto industry is gradually awakening to.

In 2017, even without users, developing on Ethereum was feasible because the underlying asset ETH could potentially skyrocket 200 times within a year. In 2023, Solana saw a similar wealth effect, with its underlying asset rebounding about 20 times from the bottom, sparking a series of meme asset booms.

When investors and founders are enthusiastic, new wealth effects can sustain crypto open-source innovation. However, in the past few quarters, this logic has reversed: personal angel investments have decreased, founders' own funds struggle to survive the financing winter, and large financing cases have sharply declined.

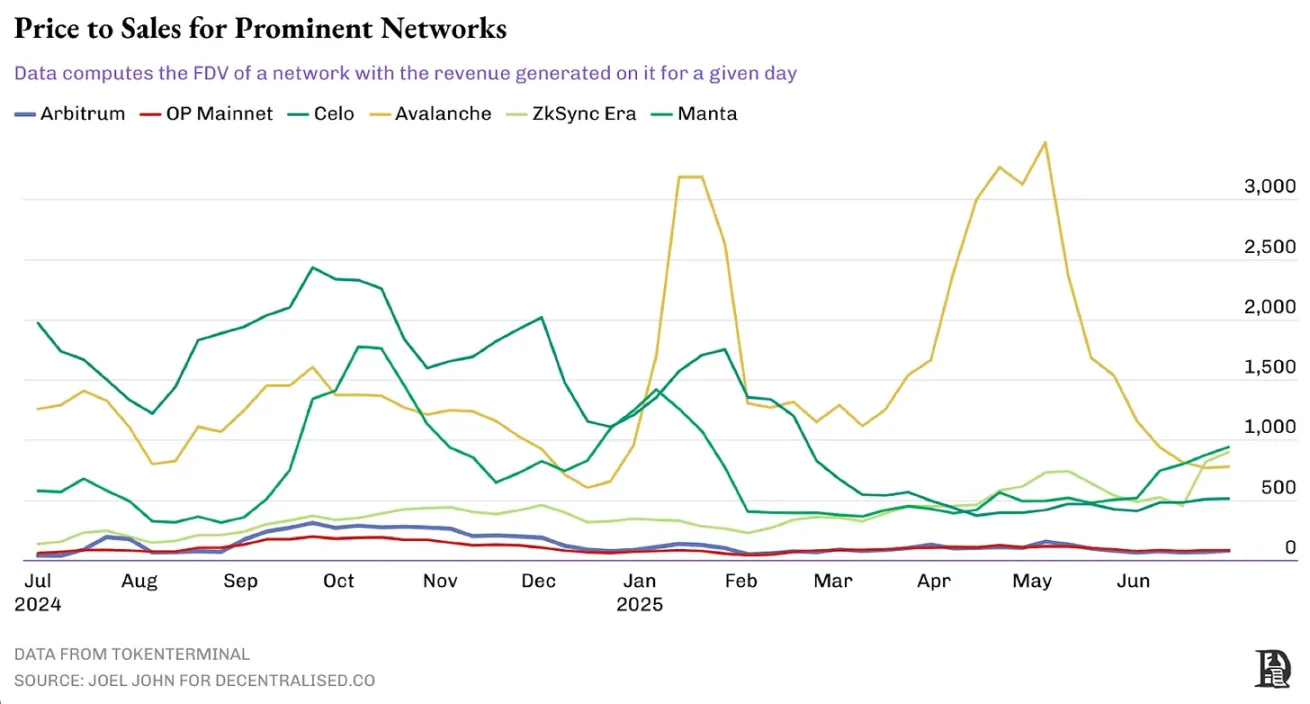

The consequences of application lag are intuitively reflected in the price-to-sales (P/S) ratios of mainstream networks. The lower this value, the healthier it typically is. As shown in the Aethir case later, the P/S ratio declines as revenue grows. But most networks are not like this; new token issuances maintain valuations while revenues stagnate or decline.

The table below selects samples of networks built in recent years, with data reflecting economic realities. Optimism and Arbitrum maintain P/S ratios at a more sustainable 40-60 times, while some networks have ratios as high as 1000 times.

So, where do we go from here?

Revenue Replaces Cognitive Narratives

I have been fortunate to participate early in several crypto data products. Two of the most influential are:

Nansen: The first platform to use AI to label wallets and display fund flows.

Kaito: The first tool to use AI to track the volume of crypto Twitter and the influence of protocol creators.

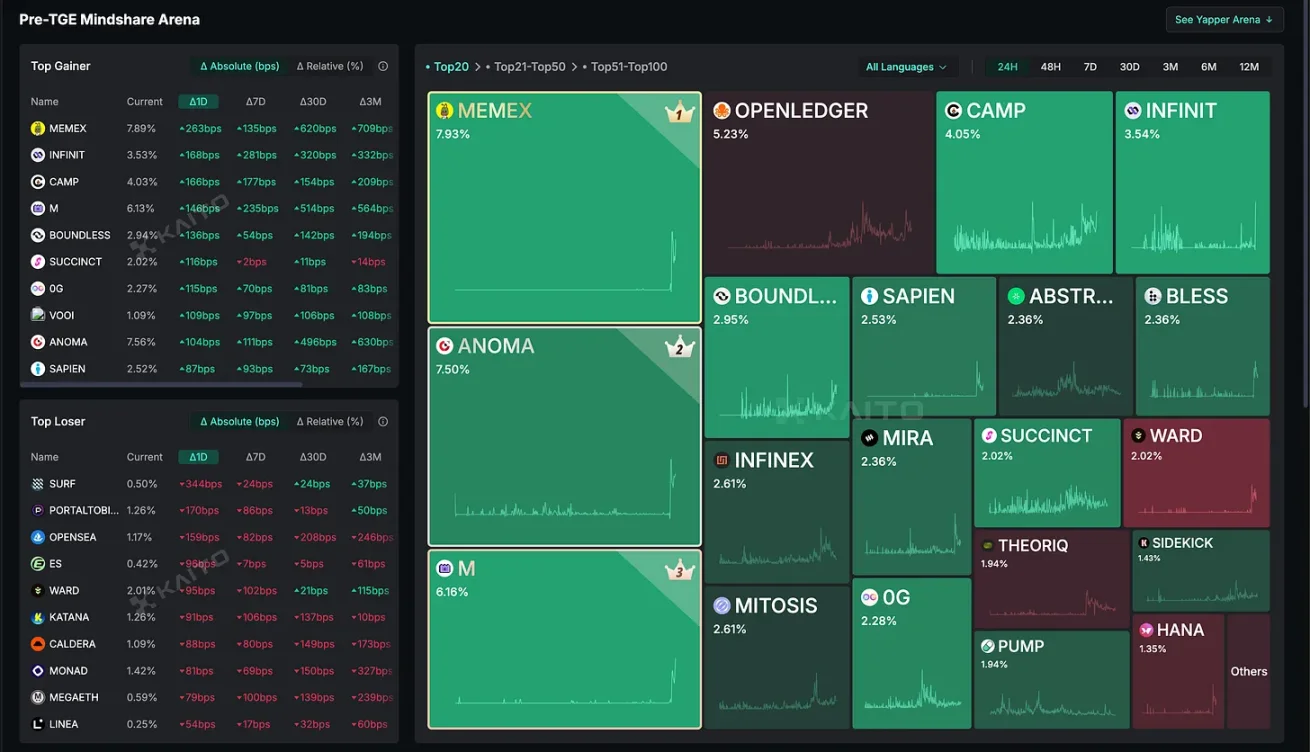

The timing of their releases is intriguing. Nansen was born in the midst of the NFT and DeFi craze, when people were eager to track whale movements. To this day, I still use its stablecoin index to measure Web3 risk appetite. Kaito, on the other hand, was released after the Bitcoin ETF craze in Q2 2024, when fund flows were no longer key, and public opinion manipulation became central; it quantified attention distribution during a period of shrinking on-chain transactions.

Kaito has become the benchmark for measuring the flow of attention, fundamentally changing the logic of crypto marketing. The era of creating value through bot traffic or fake metrics is over.

Looking back, cognition drove value discovery but could not sustain growth. Most of the "hot" projects in 2024 have plummeted by 90%, while those applications that have steadily progressed over the years can be divided into two categories: vertical niche applications with native tokens and centralized applications without native tokens. Both follow the traditional path of gradually achieving product-market fit (PMF).

Take the evolution of TVL for Aave and Maple Finance as an example. TokenTerminal data shows that Aave has cumulatively spent $230 million to build its current $16 billion lending scale; Maple, on the other hand, has built a $1.2 billion lending scale with $30 million. Although both currently have similar revenues (P/S ratios of about 40 times), the volatility of their revenues differs significantly. Aave invested heavily early on to establish a capital moat, while Maple focused on the niche market of institutional lending. This does not determine which is superior or inferior, but clearly illustrates the major differentiation in the crypto space: on one end are protocols that built capital barriers with early heavy investments, and on the other end are products that delve into vertical markets.

Maple's Dune Dashboard

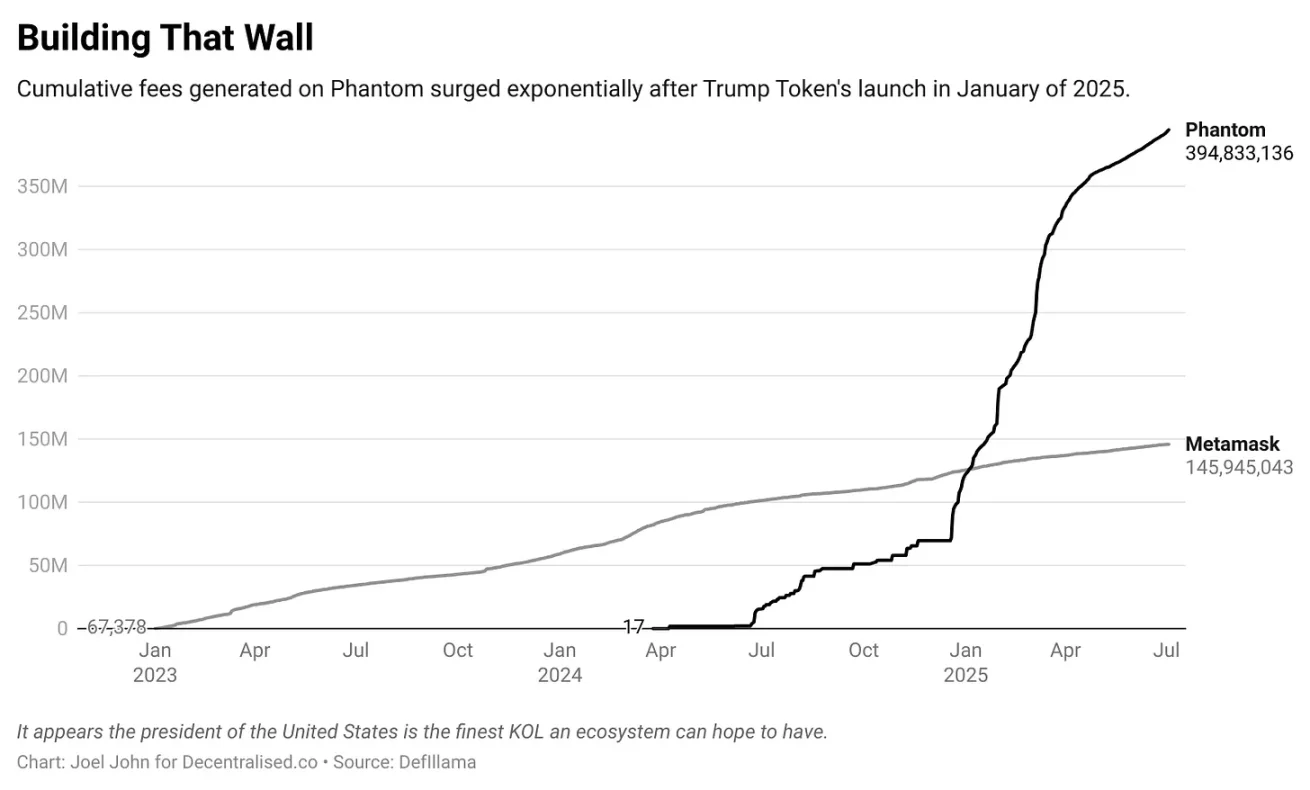

Similar differentiation is also seen between Phantom and Metamask wallets. DeFiLLama data shows that Metamask has generated $135 million in fees since April 2023, while Phantom has generated $422 million since April 2024. Although the meme coin ecosystem on Solana is larger, this points to a broader trend in Web3. Metamask, as a well-established product launched in 2018, has unmatched brand recognition; while Phantom, as a newcomer, has achieved substantial returns due to its precise positioning in the Solana ecosystem and excellent product quality.

Axiom has pushed this phenomenon to the extreme. Since February of this year, the product has generated a total of $140 million in fees, with $1.8 million just yesterday. Last year, application layer revenue mostly came from trading interface products. They do not indulge in "decentralized" performances but directly address the essential needs of users. Whether this can be sustained remains to be seen, but when a product generates about $200 million in revenue over six months, the question becomes "whether it needs to be sustained."

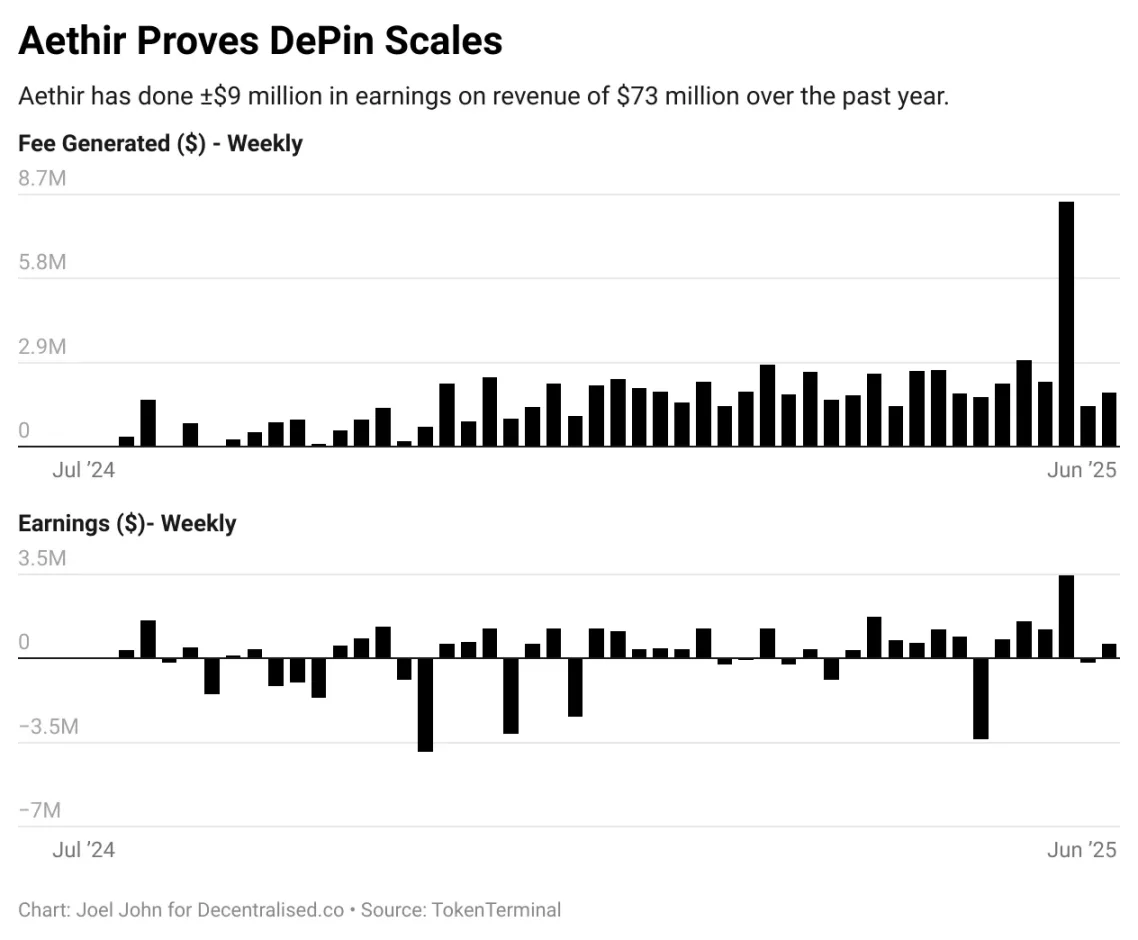

To believe that crypto will be limited to gambling, or that tokens will have no necessity in the future, is akin to asserting that the GDP of the United States will be concentrated in Las Vegas, or that the internet is solely for pornography. The essence of blockchain is the trajectory of funds; as long as a product can utilize these trajectories to facilitate economic transactions in a segmented disordered market, value will be generated. The Aethir protocol perfectly illustrates this point.

When the AI boom erupted last year, there was a shortage of high-end GPU rentals. Aethir built a GPU computing power market, with clients including the gaming industry. For data center operators, Aethir provides a stable source of income. To date, Aethir has generated approximately $78 million in revenue since the end of last year, with profits exceeding $9 million. Is it "hot" on crypto Twitter? Not necessarily. But its economic model is sustainable, even as token prices decline. This divergence between price and economic fundamentals defines the "vibecession" in the crypto space: on one end are protocols with few users, and on the other are a handful of products with soaring revenues that are not reflected in token prices.

The Imitation Game

The movie "The Imitation Game" tells the story of Alan Turing cracking the Enigma machine. There is a memorable scene: after the Allies decipher the code, they must resist the urge to act immediately, as premature reactions could expose the fact that they have broken the code. Market operations are similar.

Startups are essentially cognitive games. You are always selling the probability that the future value of the company will exceed the current fundamentals. When the probability of improvement in the company's fundamentals increases, the equity value rises accordingly. This is why signs of war can drive up Palantir's stock price, or why Tesla's stock surged when Trump was elected.

However, cognitive games can also have a reverse effect. Failing to effectively communicate progress will be reflected in the price. This "communication gap" is nurturing new investment opportunities.

This is the era of great differentiation in crypto: assets with revenue and PMF will crush those without a foundation; founders can develop applications based on mature protocols without issuing tokens; hedge funds will rigorously examine the economic models of underlying protocols, as exchange listings no longer support high valuations.

The gradual maturation of the market will pave the way for the next wave of capital influx, as traditional equity markets begin to favor crypto-native assets. Current assets exhibit a barbell structure, with one end being meme assets like fartcoin, and the other end being strong projects like Morpho and Maple. Ironically, both attract institutional attention.

Protocols like Aave that build moats will continue to survive, but what path lies ahead for new project founders? The writing on the wall has indicated the direction:

Issuing tokens may no longer be ideal. An increasing number of trading interface projects without VC support have achieved millions in revenue.

Existing tokens will be scrutinized by traditional capital, leading to a reduction in investable assets and creating crowded trades.

Mergers and acquisitions of public companies will become more frequent, introducing new capital from token holders and beyond venture capital into the crypto space.

These trends are not entirely new. Arthur from DeFiance and Noah from Theia Capital have long shifted to revenue-oriented investments. The new change is that more traditional funds are beginning to enter the crypto space. For founders, this means that focusing on niche markets to extract value from small user bases could yield substantial profits, as there are pools of capital waiting to acquire them. This expansion of capital sources may be the most optimistic development in the industry in recent years.

The unresolved question is: can we break free from cognitive inertia and respond to this shift with clarity? Like many key questions in life, only time will reveal the answer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。