In our era, everyone is driven to madness, without exception.

Written by: Zuo Ye

On one hand, CEXs are developing on-chain trading tools, wallets, and Perp DEXs; on the other hand, they are actually scrutinizing CEX users to achieve compliance, which is inherently contradictory.

In our era, everyone is driven to madness, without exception.

Man-Made Crisis, Roman Shih in the Crypto Circle

Compared to Roman Shih, who is struggling due to the 3C industry, facing production halts and wage cuts, OKX's problem lies in the lack of internal checks and balances, completely driven by the founder's whims.

Creating a public opinion crisis does not accelerate the compliance process.

OKX's Xu Mingxing's "commanding" statements, excluding "loan shark" users, shocked the entire crypto industry; this is not the Xu Mingxing that people are familiar with, who used to take responsibility.

In the public memory, early OK was a very responsible entity:

In 2020, when OK faced regulation, the term "private key manager" gave the public a profound understanding of crypto: Not your Keys, Not your Money;

In 2025, when OK faced regulation, the MiCA license required compliance, and they proactively suspended the DEX aggregator within the OKX wallet, leading to Binance stealing their market share.

Of course, there can be different interpretations of this. If one suspends their services for regulatory reasons, the money that OK does not earn can still be earned by other service providers. However, this time, OKX initiated a special regulatory action against users, which is incredibly confusing.

For the sake of going public, this does not hold water. From Didi's sudden rush to go public being urgently ordered to rectify, to Binance paying the price of CZ going to jail + fines + exiting Binance + Binance's rectification, even stopping the issuance of BUSD, all of these were only halted after being discovered.

But OK is different from everyone else; they directly inform everyone, "I am going to take action against you." The core issue is not compliance problems, but rather the loss of attitude towards users.

Image caption: OK admits to misjudging compliance, image source: @star_okx

Ultimately, it also fermented from the public opinion arena, and must be addressed from public opinion. OK's global compliance team of 600 must dynamically adjust according to market conditions. If OK ceases to exist, then no matter how well compliance is done, it will be meaningless.

At the end of the day, it is not a compliance issue, nor is it a question of whether to accept loan sharking and trading. The discussion on the latter actually falls into the trolley problem; the best response is to not respond.

This is an exceptionally distinctive public relations crisis, and the hardest part is that the founder initiated it himself.

Compared to Binance's dual-core drive, the true controller of OK is only Xu Mingxing himself. For many rumors circulating, once a company grows, it becomes hard to say who is cleaner; this is not the core factor affecting business competition.

Xu Mingxing's will is OKX's will; OKX has no will of its own. In the founder's strong corporate culture, no executive can raise objections, let alone dissenting opinions.

JD's Liu Qiangdong can have executives line up to report, directly dismantling the brand department and reallocating it to a more market-oriented marketing department;

After CZ's release from prison, he cannot manage Binance again, but he can "influence" Binance, which then accepts market influences, with lawyers ensuring compliance.

Which plan is more astute is self-evident. Now, OK's problem is that the founder is clearly unsuitable for being on the front lines of public relations, yet insists on interacting with the market, igniting repeated public opinion crises.

Here, a prediction can be made: if OK does not isolate the founder, the subsequent public opinion storm will reappear. It would be better to hand it over to professional managers.

Professional managers seek to avoid mistakes, while founders aiming for achievements can be even more terrifying.

Binance Continues to Win by Lying Down, Liu Xiu in the Crypto Circle

Liu Xiu is different from Liu Bang; he is lucky enough. Liu Xiu is different from Liu Bei; he is lucky enough.

If luck can be synonymous with a person, then it must be that the opponent contributed to their own misfortune.

Currently, exchanges are not doing well. Bybit is struggling to survive after being hacked, Bitget faces accusations from retail investors, Gate/Matcha is like a child’s table, Huobi belongs to Sun Ge, and Coinbase and Kraken are rooted in the U.S.

Not to mention that Deribit has already been sold to Coinbase, and a new round of consolidation among exchanges has begun. In a time when trading enthusiasm is already low, the competition is about making fewer mistakes and stabilizing customer sources, rather than embarking on new journeys.

The only hope to compete with Binance actually lies with centralized OKX and "decentralized" Hyperliquid, but it seems that only the latter will remain.

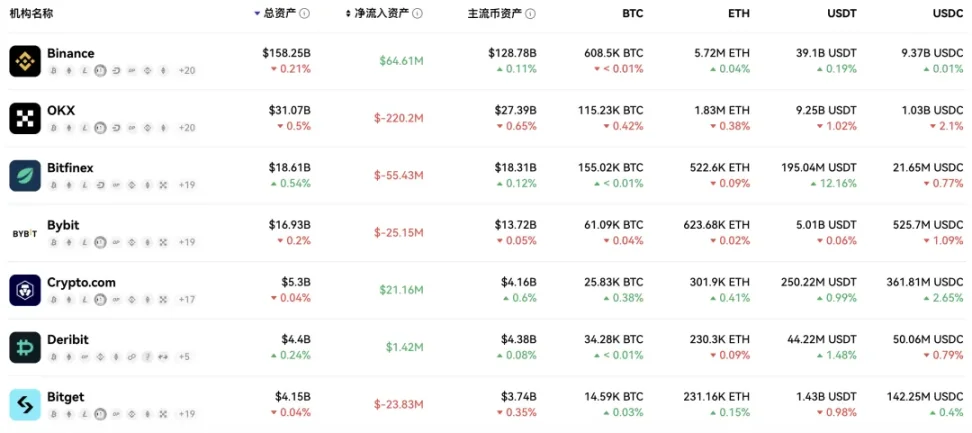

Image caption: 24H capital flow of exchanges, image source: @OKLink_CN

Not using DeFillama's data, OKLINK's own data also shows that OKX is experiencing asset outflows. Although the withdrawal movement has only taken down FTX, that was a notorious FTX.

The market has repeatedly criticized Binance, and other competitors are also working hard. For example, Bybit actively participates in the Solana ecosystem, and its own Perp DEX Byreal uses the Solana tech stack, initially supporting xStocks coin-stock trading.

Thus, all exchanges must consider one question: how to operate under compliance, which is not an easy task.

Compliance issues began in 2022, with the high leverage problems of BitMEX, FTX, and Binance being ethical issues, money laundering being a legal issue, and offshore operations being an operational issue.

As of now, only Binance retains the composure of an old artist, while FTX has vanished, and BitMEX is a shell of its former self. If you think compliance only requires lip service, you clearly underestimate the dangers involved.

Previously, Binance withdrew its application for a Hong Kong exchange license because it could not include mainland customers. Hong Kong takes compliance seriously, and many offshore exchanges chose to "protect the market and abandon the license." At that time, OKX HK also withdrew its license application.

In this era, exchanges are anxious. On one hand, they need to comply and obtain licenses; on the other hand, they must face the real impact of DEXs.

The pain of the latter is something the former regulatory bodies will not understand. It can even be predicted that licensed CEXs will soon launch attacks against unlicensed DEXs. Trust me, Coinbase, which can initiate Stand With Crypto, can target congressional members and also Hyperliquid.

Binance is working on Alpha, solidifying the wallet market it snatched from OK, and expanding BSC, occasionally launching surprise attacks on Hyperliquid to outpace everyone.

The tactical success of OK's wallet and products ultimately contributes to Binance's strategic win by lying down. In the midst of this, who can judge the merits and demerits?

Conclusion

In the crypto circle, as one navigates through, the difficulty of avoiding fate, metaphysics, and political topics decreases sequentially. Holding a scientific and rational attitude, we can explain the movement of the universe and the ebb and flow of tides, but it is hard to explain why a certain coin rises or why OKX clashes with users.

One can only sigh deeply; it is not that the opponent is too powerful, but that the peers are too foolish.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。