Written by: FinTax

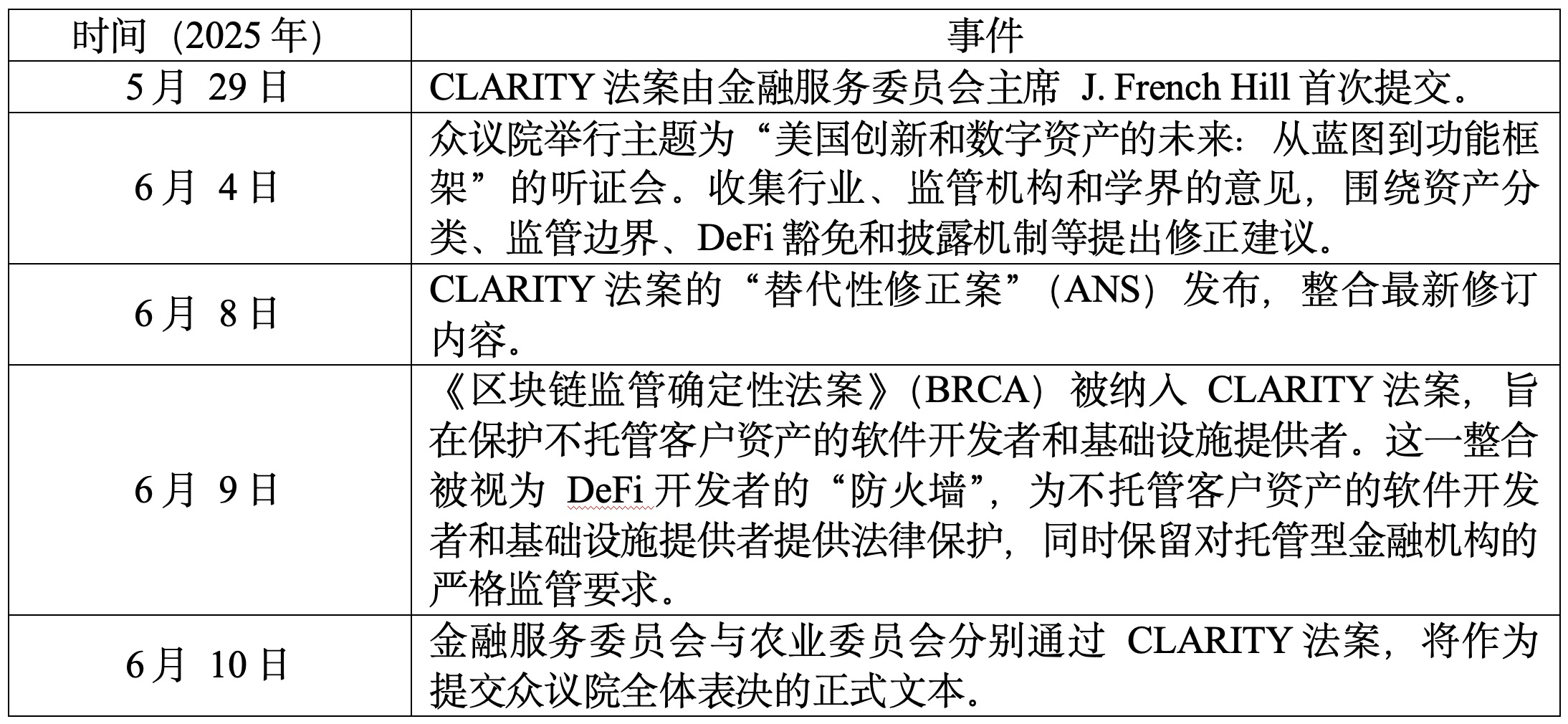

On the evening of June 8, 2025, the "Alternative Amendment" (ANS) to the CLARITY Act was released in the United States. The ANS serves as an updated version of the previously submitted bill, covering recent revisions and additions, and has become the foundational text for subsequent reviews by the House Financial Services Committee and the Agriculture Committee. On June 10, the two committees passed the CLARITY Act with votes of 47 in favor and 6 against, and 32 in favor and 19 against, respectively. The bill has now entered the full voting process in the House of Representatives.

1. Bill Content

The full name of the CLARITY Act is the Digital Asset Market Clarity Act of 2025. It was first submitted by J. French Hill, the Republican Congressman from Arkansas and Chairman of the House Financial Services Committee, on May 29, 2025, and has evolved into its latest version after multiple rounds of hearings and reviews. The current version is divided into five chapters, covering:

Chapter One, Definitions and Rulemaking. This chapter amends the Securities Act of 1933, the Securities Exchange Act of 1934, and the Commodity Exchange Act, supplementing definitions of core concepts such as "blockchain," "decentralized governance system," "digital assets," and "digital commodities." It clarifies that USDT, USDC, securitized tokens, and other non-speculative assets do not fall under "digital commodities," requiring the SEC and CFTC to issue supporting rules within a specified timeframe and establishing a temporary registration mechanism for digital commodity exchanges, dealers, and brokers.

Chapter Two, Issuance and Sale of Digital Commodities. This chapter sets forth the criteria for identifying "investment contract assets," the exemption conditions for primary issuance and secondary market resale, and the requirements for "mature blockchain systems." If digital commodities are raised in the form of investment contracts compliant with securities laws, they are considered investment contract assets and are subject to securities law; if resold in the secondary market by non-issuers, they are no longer considered investment contracts and are not subject to securities trading regulations.

Chapter Three, SEC Intermediary Registration. This chapter includes licensed payment stablecoins and digital commodities within the SEC's anti-fraud enforcement scope and sets exemption clauses for DeFi activities to avoid excessive regulation of non-custodial developers and infrastructure providers. The following direct or indirect blockchain or DeFi-related activities are not subject to Section 15H of the Securities Exchange Act and its derivative rules, including: (1) compiling, forwarding, retrieving, sorting, and verifying network transactions; (2) providing computing power, running nodes/oracles, bandwidth, or other similar ancillary services; (3) providing a front-end interface for user access; (4) developing, publishing, managing, maintaining, or distributing blockchain systems, DeFi trading protocols, or DeFi messaging systems; (5) operating or participating in liquidity pools to execute spot trades of digital commodities; (6) providing non-custodial wallet and key management services.

Chapter Four, CFTC Intermediary Registration. This chapter clarifies the CFTC's regulatory authority over the digital commodity spot market, requiring futures traders to use qualified digital asset custodians and establish a registration mechanism for trading certification and intermediaries, while extending the obligations of commodity pool operators (CPO) and commodity trading advisors (CTA) to the digital commodity sector, with strict provisions that prohibit unregistered practice.

Chapter Five, Innovation and Technical Support. This chapter reaffirms Congress's support for the innovative development of digital assets, requiring the establishment of a FinTech and Innovation Strategy Center and the CFTC Lab (LabCFTC) within 180 days of the bill's enactment, and mandates the SEC and CFTC to jointly conduct specialized research and submit activity reports on areas such as DeFi, NFTs, blockchain payments, market infrastructure, and financial literacy.

2. Background of Revisions

The CLARITY Act is a bipartisan bill aimed at establishing a clear and unified regulatory framework for the U.S. digital asset market. Its core objectives can be summarized in three points: first, to establish clear classification standards for digital assets (including tokens, stablecoins, DeFi tools, etc.) to resolve the long-standing disputes over the identification of "securities" versus "commodities"; second, to clarify the regulatory division of responsibilities between the SEC and CFTC, with the CFTC responsible for the digital commodity spot market and the SEC responsible for securities issuance and anti-fraud enforcement; and finally, to establish a temporary registration mechanism and market research requirements to balance investor protection with technological innovation.

One of the most controversial issues during the advancement of the bill has been the anti-money laundering provisions. Critics question whether the CLARITY Act provides sufficient safeguards for decentralized systems to prevent illegal financing, as traditional anti-money laundering regulations rely on intermediaries to monitor and report suspicious transactions, while DeFi protocols do not depend on centralized intermediaries, potentially creating regulatory blind spots. Supporters argue that sanctions and compliance screening requirements still apply to all U.S. companies, and that the transparency and traceability of blockchain actually provide better regulatory visibility than traditional finance.

Some critics are also concerned that the bill may weaken financial safeguards and open regulatory loopholes, with some companies potentially claiming to be decentralized finance projects to evade regulation. Additionally, some critics express concern over Trump's involvement in the crypto industry, questioning potential conflicts of interest that could interfere with the legislative process of the bill. In response, supporters emphasize that whether a platform is regulated will depend on its actual operational methods, rather than its label.

3. Potential Impact on the Crypto Industry

Currently, the CLARITY Act has been submitted to the House for a full vote, and based on the voting results from the two committees, the bill is likely to pass in the House. Overall, it is considered favorable for the crypto industry:

- Defining the Responsibilities of the SEC and CFTC

One of the main innovations of the CLARITY Act is the shift from focusing on "whether cryptocurrencies are securities" to discussing the "degree of decentralization" of projects. The level of centralization will ultimately determine whether tokens are classified as "investment contract assets" or "digital commodities," and thus governed by the SEC or CFTC, while hybrid assets with characteristics of both securities and commodities will be coordinated by both agencies. Moreover, as digital assets become more decentralized, the regulatory authority will shift from the SEC to the CFTC. Therefore, the bill clearly delineates the regulatory scope of the SEC and CFTC based on the nature of digital assets, filling a regulatory gap in existing laws to some extent.

- Clarifying Compliance Requirements and Providing Regulatory Certainty

According to the bill, digital asset companies must adhere to information disclosure and conflict of interest avoidance requirements, subject to a comprehensive registration system; digital asset developers have clear financing pathways under the jurisdiction of the SEC and are required to provide accurate and relevant disclosure information; trading entities will conduct digital transactions through intermediaries and exchanges regulated by the CFTC, ensuring legal and reliable pathways. Through these measures, the bill provides a clearer compliance and development path for participants in the crypto market.

- Encouraging Traditional Financial Institutions to Enter the Crypto Market

The bill provides institutional support for banks and traditional exchanges to enter the crypto market. For example, under the proposed CLARITY Act, banks are recognized as qualified custodians of digital assets, prohibiting federal regulatory agencies from forcing the inclusion of customer-custodied crypto assets on banks' balance sheets or requiring corresponding capital adequacy ratios, unless necessary to address operational risks. This means banks can custody cryptocurrencies and trade more complex crypto financial instruments without balance sheet liabilities. Additionally, the bill allows existing registered securities exchanges or alternative trading systems (ATS) to apply for temporary registration and operate as "digital commodity exchanges," enabling traditional exchanges to simultaneously offer securities and digital commodity trading under a unified framework.

- Supporting Decentralized Innovation and Market Integration

The CLARITY Act explicitly recognizes and protects decentralized finance protocols, acknowledging that the operational methods of truly decentralized protocols differ from traditional financial entities, while still retaining enforcement authority against fraud and manipulation to ensure a balance between innovation and user protection, which is conducive to promoting the maturity of the DeFi ecosystem and its integration with the traditional financial system. Furthermore, the bill requires the establishment of a FinTech and Innovation Strategy Center and the CFTC Lab, which will help guide the construction and improvement of the U.S. Web3 infrastructure, promoting the crypto industry towards a more compliant direction.

The ongoing regulatory ambiguity has forced innovative companies in the U.S. to migrate to overseas jurisdictions, and this bill is beneficial for stabilizing industry expectations and restoring confidence in the U.S. crypto market. The CLARITY Act aims not only to provide regulatory certainty but also to lay the foundation for the integration of cryptocurrencies into a broader financial system. For crypto institutions planning to operate in the U.S., this presents both a challenge and a significant opportunity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。