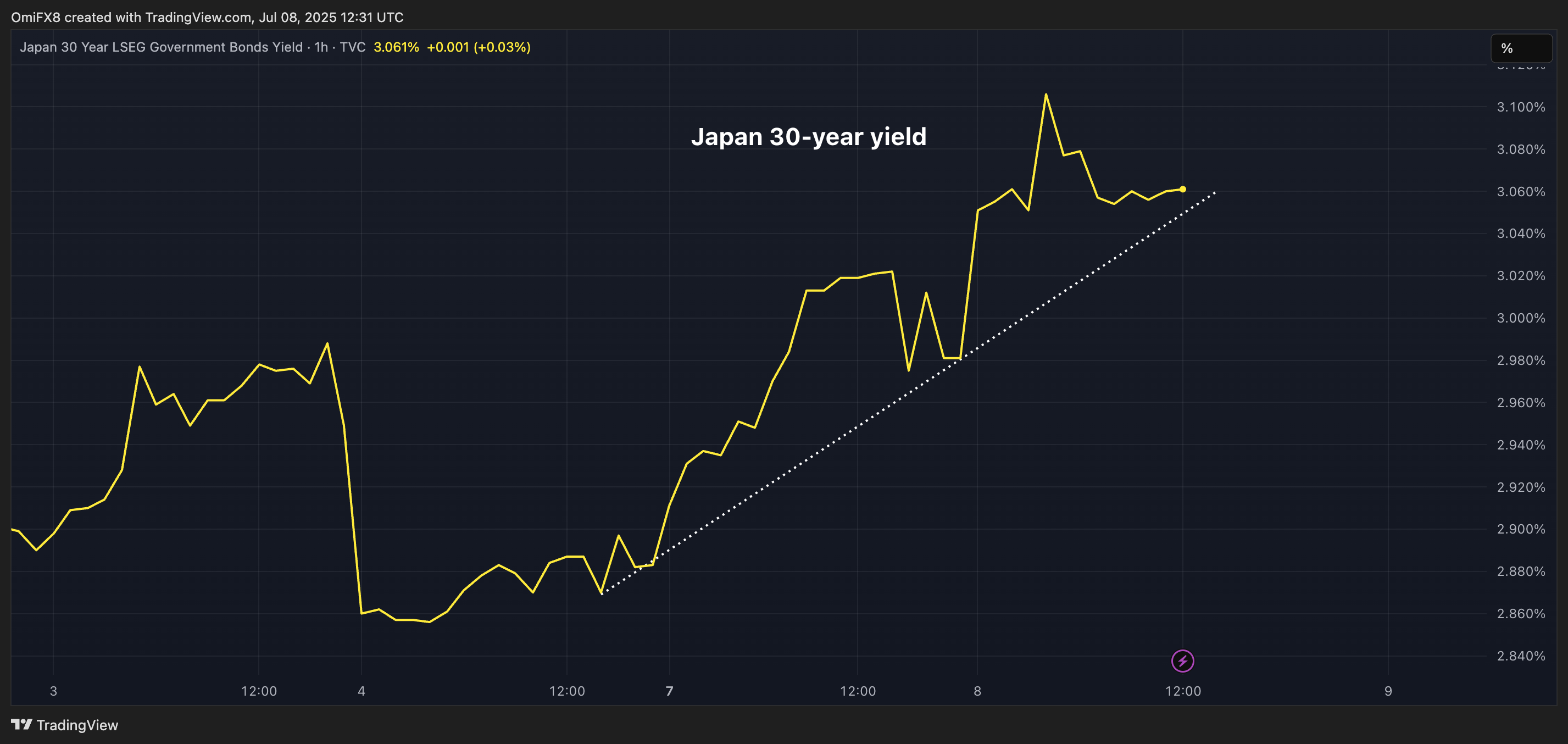

The yield on the superlong Japanese debt has surged significantly since Friday, warning of volatility in bond markets across advanced nations. This situation typically leads to financial tightening and zaps investors' risk appetite.

The yield on the Japanese 30-year government bond (JGB) has surged over 30 basis points (bps), topping the 3% mark for the first time since May 23, when it hit a high of 3.20%, according to data source TradingView. The 40-year yield has risen nearly 15 basis points to 3.36%.

The uptick likely represents markets' concerns about fiscal profligacy ahead of the impending Upper House election in Japan later this month. Last week, Japan's Prime Minister Shigeru Ishiba defended his plans to distribute cash handouts as the opposition called for tax cuts.

Further, President Donald Trump's decision to impose a 25% tariff on Japan may be causing stress in the market.

Watch out for rates volatility

The latest uptick in the Japanese ultra-long bond yields could add to the momentum in yields in the U.S. and other countries, whose governments are spending beyond their means.

That, in turn, may lift rates volatility, potentially causing financial tightening and weighing over risk assets, including bitcoin. Crypto bulls, therefore, may want to keep track of the MOVE index, which measures the options-based 30-day implied volatility in the U.S. Treasury notes.

Historically, majors tops in BTC have corresponded to bottoms in the MOVE index and vice versa.

Focus on Thursday's auction

The volatility in JGB and other bond markets may increase later this week if the Japanese Ministry of Finance’s sale of 20-year bonds on Thursday disappoints expectations.

According to Bloomberg, the 20-year bond auction has a history of disappointing outcomes, leading to volatility in longer-duration bond yields.

Japan is no longer a source of low rates

For years, Japan maintained ultra-low bond yields through a cocktail of unconventional monetary policy measures. That effectively exerted downward pressure on yields across the advanced world, while underpinning the Japanese yen's role as funding currency for the risk-on carry trades.

However, since 2023, Japan has slowly normalized its monetary policy, greasing the rally in yields worldwide.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。