SharpLink Ethereum News: Strategy Reaches Key Milestone

The SharpLink Ethereum news strategy continued to accelerate as the company confirmed the purchase of an additional 7,689 ETH between June 28 to July 4, 2025. Acquired at an average price of $2,501 per token, which also includes the transaction fees, this type of acquisition raises SharpLink’s total count of holdings to a significant 205,634 ETH.

Source: Twitter

With this more, the Minneapolis-based firm has further solidified its position as the largest publicly traded company to adopt its primary treasury reserved asset. This purchase marks another step in broader commitment to align with the future of digital capital.

SharpLink's Strategic Shift: Web3 and DeFi Integration

For the expansion, SharpLink Ethereum news raised a fund of $64 million in net proceeds via its At-The-Market (ATM) equity facility, selling its common stock over 5.49 million shares. Of the amount, 37.2 million was raised on July 3, though it had not yet been used to acquire as of the end of that business day. A substantial portion of this capital is expected to be deployed in the coming week.

SharpLink committed 100% of holdings to staking and staking protocols. Between June 28 to July 4, the SharpLink Ethereum news earned an estimated 100 ETH in the forms of rewards, contributing to a total number of 322 ETH. The rewards were given since the program began on June 2, 2025.

Race for Ethereum Treasury

With SharpLink Ethereum news leading one of the cryptocurrencies for Treasuries, now we have a three-way, very heated contest. Bit Digital, listed on Nasdaq, having completely converted its Bitcoin holdings, accounts for having a huge 100,603 ETH to form an exclusive Ethereum Treasury. Bitmine of Tom Lee meanwhile has raised $250 million to build its own ETH reserves. The battle for the largest Treasury has just begun, with more companies shifting attention.

Impact on Price and Market Sentiment

It shows his confidence, and market sentiments seen positive. Some analysts have expressed concerns regarding the company’s overall financial health, including ongoing losses and revenue tools recently rated the stock as “ Underperform.”

Still, supporters of the SharpLink Ethereum news strategy believe the company’s focus on crypto and Web3 technologies may give it a competitive edge. Its bold strategy is for buying continuously.

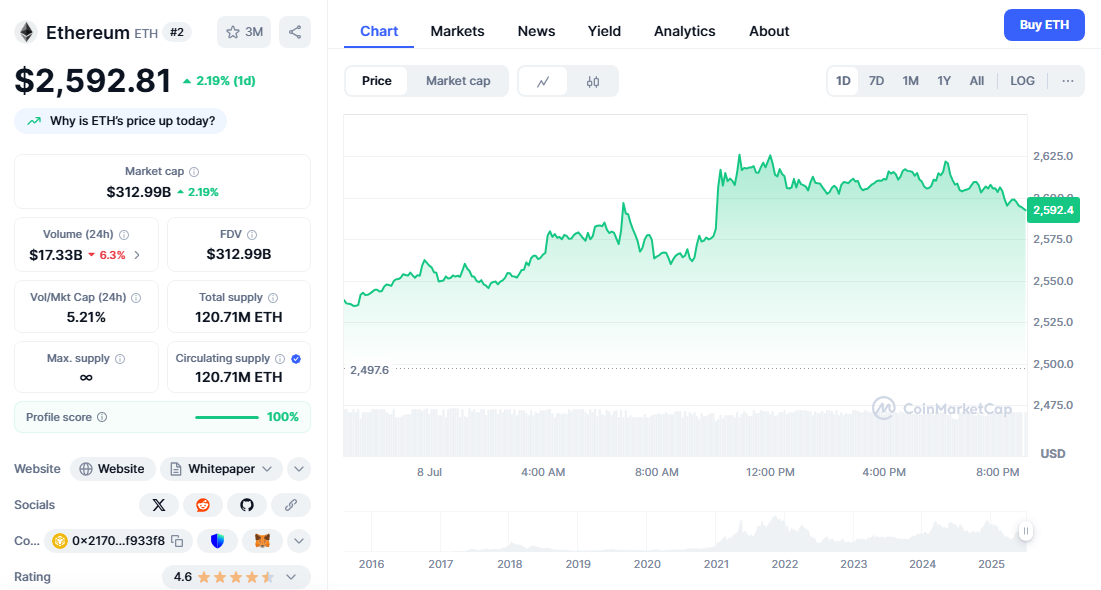

After this news, the price of ($ETH) experienced moderate upward movement, currently trading at $2,592.81, marking a 2.19% increase in the last 24 hours. The price surged from a low of around $2,497 earlier in the day, touching highs near $2,625 before setting slightly lower.

Source: CoinMarketCap

BlackRock, led by Larry Fink, has shifted focus to accumulating over 1.5 million ETH, as revealed by ETF fillings and on-chain data. The move has boasted market confidence. Analysts see this as a strong signal of growing institutional trust in future.

Corporate Crypto Treasury Management: Risks vs. Rewards

Managing a crypto treasury is not without risks. Its volatility, regulatory grey areas, and market liquidity can challenge even the most experienced finance terms. However, transparency-first approach–higlighted by the introduction of its Concentration metric – sets a new standard.

This tool gives shareholders a real-time understanding of shareholding of ETH exposure per 1,000 diluted shares, offering clarity rarely seen in corporate crypto reporting. It’s one of the standout elements in SharpLink Ethereum news this quarter.

Comparison With Other ETH-Holding Corporations

Compared to companies like Tesla or MicroStrategy that favor Bitcoin, stands out as a pro leader. Unlike firms holding passively, SharpLink Ethereum news is actively engaging with ecosystem on the network.

This positions the company uniquely among holding corporates, making it a case study for functional adoption rather than speculative holding.

Regulatory Considerations for Holding on the Balance Sheet

Holding on the books invites regulatory scrutiny, US GAAP accounting requires to be marked to market each quarter leading to earnings volatility.

In addition, evolving regulations around staking income and token classification must stay ahead of legal developments.

Still, the company’s commitment to compliance and financial transparency gives it an edge in navigating this complex environment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。