The financial freedom promised by Bitcoin ultimately becomes entangled with the very system it sought to replace.

Written by: THEJASWINI M A

Translated by: Saoirse, Foresight News

Roger Ver is broke.

But this is not the bankruptcy that the world understands. The Bitcoin he holds is still enough to buy a small country. However, when he finds himself in a Spanish prison, facing a potential 109-year sentence in the U.S. and burdened with ever-increasing legal fees, this kind of "bankruptcy" becomes fatal.

On July 4, 2025, someone transferred 80,000 Bitcoins, worth $8.72 billion, from eight wallets that had been dormant since 2011. The transfers were orderly and methodical, as if someone was executing a checklist. Within hours, Twitter users in the crypto community concluded that Roger Ver was liquidating his long-held Bitcoins in exchange for freedom.

This inference is logical: Roger Ver has the motive, the means, and the technical knowledge to manipulate early Bitcoin wallets. His legal troubles were escalating, an extradition hearing was imminent, and his public plea for presidential clemency painted the picture of a desperate man.

But no one could confirm the connection between these wallets and him; these wallets had never been linked to any known addresses of Roger Ver. The funds could belong to any early Bitcoin holder who might have finally decided to cash out as Bitcoin prices reached six figures.

Roger Ver's legal predicament is undeniable. The man once known as "Bitcoin Jesus" has long fallen from the pedestal of a preacher. Overnight, he transformed from a fervent advocate of cryptocurrency into a cautionary tale of tax evasion and hubris. His arrest in Spain made the crypto community acutely aware that their digital revolution could be so easily dismantled by traditional legal systems.

As a Silicon Valley entrepreneur, cryptocurrency evangelist, and federal fugitive, his experience reveals a contradiction: the financial freedom promised by Bitcoin ultimately becomes entangled with the very system it sought to replace.

Silicon Valley Origins

Looking back, one might say Roger Ver was born at the right time and place.

He was born on January 27, 1979, in San Jose. His father made a living repairing computers, which meant Roger Ver grew up surrounded by the machines that would connect the world, and he learned the principles of how the internet operates.

Roger Ver deviated from the traditional life path early on. From 1997 to 1999, he attended De Anza College, majoring in economics, mathematics, and astronomy, while also taking physics courses at Stanford University. During this time, he founded MemoryDealers.com, reselling Cisco networking equipment, memory, and accessories during the internet bubble, when demand for such hardware was extremely high.

During the internet bubble, everyone was scrambling to buy servers, routers, memory chips, and any device that could accelerate data transmission. Roger Ver not only obtained wholesale prices but also had a clientele willing to pay retail prices for immediate delivery. Two years later, he chose to drop out of school and fully commit to running the company. During his ten years as CEO, he witnessed the customer base expand from Bay Area startups to Fortune 500 companies.

In 2004, he founded Agilestar.com, focusing on fiber optic transceivers. These components are key to achieving high-speed internet. The company's business spanned nearly every country in the world, making Roger Ver a figure with both technical insight and a global business perspective.

Throughout this process, Roger Ver gradually formed his worldview. He embraced libertarian philosophy, believing that "individuals should control their own wealth, data, and lives." In 2000, he ran for the California State Assembly as a Libertarian candidate; although he did not receive many votes, he established a firm stance that "technology will make government obsolete."

Explosives Incident

In 2002, federal agents arrested Roger Ver for selling explosives on eBay.

Between January 1999 and August 2000, Roger Ver purchased 49 pounds of an explosive device called "Pest Control Report 2000" from a supplier in South Carolina and sold at least 14 pounds to online bidders. However, he did not have the necessary permits to handle or sell such materials. Multiple violations followed: Roger Ver stored explosives in an apartment building, transported them via the U.S. Postal Service, and did so without obtaining the required permits.

On May 2, 2002, Roger Ver was sentenced to 10 months of federal imprisonment, a $2,000 fine, and three years of supervised release. This experience profoundly changed him; he felt the weight of federal law enforcement and developed a different view of government authority. Sitting in his cell, he realized for the first time the power of federal authority.

Bitcoin Revelation

In 2011, Roger Ver discovered Bitcoin.

After studying the white paper, he saw a currency system that did not require central banks or government regulation. For someone who had served 10 months in federal prison, this allure was undeniable.

When the price of Bitcoin was below $1, Roger Ver began allowing MemoryDealers to accept Bitcoin payments, making the company one of the first to treat Bitcoin as real currency (rather than a novelty).

Bitcoin is a sophisticated technology, but for its development to extend beyond the realm of cryptography enthusiasts, it needed the support of exchanges, wallets, payment processing tools, and educational resources.

Roger Ver began investing in Bitcoin startups. He provided early funding for BitInstant, one of the first Bitcoin exchanges, invested in what would later become the Kraken trading platform, and funded companies like Blockchain.com, Ripple, BitPay, and Purse.io, which were responsible for the practical operations of Bitcoin circulation.

In 2012, Roger Ver launched Bitcoinstore.com to sell electronics for Bitcoin and founded Bitcoin.com, which later became a well-known cryptocurrency education platform.

Roger Ver understood that controlling the infrastructure meant controlling the adoption process. He positioned himself at the core of the Bitcoin ecosystem, not just as an investor but as a key figure that other entrepreneurs needed to collaborate with.

Roger Ver systematically accumulated Bitcoin. By 2014, he and his companies held approximately 131,000 Bitcoins (with 58,000 personally held and 73,000 held by MemoryDealers and Agilestar), with total holdings estimated to exceed 400,000 Bitcoins. When the price of Bitcoin was around $871 in 2014, his assets were valued at over $100 million.

In addition to collecting Bitcoin, Roger Ver tirelessly promoted it: speaking at conferences, giving media interviews, funding educational projects, and using his expanding platform to advocate for Bitcoin adoption, leading the community to refer to him as "Bitcoin Jesus."

This nickname was quite fitting. His fervor for promoting Bitcoin seemed to stem from a belief that he was providing financial salvation to a world controlled by government monetary systems. In his eyes, Bitcoin had transcended its technical nature to become a manifestation of ideology.

Fatal Decision

On February 4, 2014, Roger Ver purchased citizenship in Saint Kitts and Nevis for $150,000 and renounced his U.S. citizenship. This move was financially strategic: as a Caribbean citizen, he could avoid U.S. taxes on global income while gaining visa-free access to over 130 countries. For someone who viewed the government as a "predator," this decision aligned perfectly with his beliefs.

However, renouncing U.S. citizenship triggered an exit tax obligation. U.S. citizens must report capital gains on their global assets when renouncing citizenship. Roger Ver was required to report the Bitcoin he held and pay taxes on its appreciated value, but he failed to fulfill this obligation, which nearly altered the trajectory of his life.

Factional Split

In 2017, Bitcoin faced a tricky issue: a surge in users led to a limited number of transactions processed per block, causing congestion and skyrocketing fees.

The community was divided over solutions. One side wanted to increase block size to handle more transactions, while the other favored off-chain solutions like the Lightning Network. The technical trade-offs were crucial: larger blocks could increase transaction throughput but would also raise hardware requirements for miners, potentially driving small miners out of business due to high costs, thus reducing Bitcoin's decentralization; while off-chain solutions could maintain decentralization, they would increase system complexity and require additional infrastructure support.

Roger Ver supported increasing block size, insisting it aligned with Satoshi Nakamoto's original intent of Bitcoin as "digital cash."

In August 2017, this scaling debate culminated in a fork, resulting in a new cryptocurrency called Bitcoin Cash with larger blocks. Roger Ver became a major advocate, pouring resources into its promotion. He also adjusted the content focus of Bitcoin.com to support Bitcoin Cash while neglecting Bitcoin, leading critics to accuse him of misleading newcomers into buying the "wrong cryptocurrency."

This decision proved costly, as Bitcoin's market value and adoption continued to rise, while Bitcoin Cash gradually lost market position. In a critical area of cryptocurrency development, Roger Ver chose the wrong side.

Fateful Reckoning

On February 15, 2024, a federal grand jury indicted Roger Ver on eight counts: three counts of mail fraud, two counts of tax evasion, and three counts of submitting false tax returns.

The core of the charges revolved around his renunciation of U.S. citizenship in 2014. According to the Department of Justice, Roger Ver provided false information to law firms and asset appraisers, concealing the true number of Bitcoins held by him and his companies, leading to a severe undervaluation of his tax returns and failing to report his personally held Bitcoin assets.

The indictment also noted that in November 2017, Roger Ver sold tens of thousands of Bitcoins, cashing out approximately $240 million, but deliberately concealed the transaction from his accountant and did not report capital gains. The government claimed his actions resulted in at least $48 million in losses to the IRS. In April 2024, Roger Ver was arrested in Spain, and after posting a $160,000 bail, he is still awaiting a decision from Spanish authorities on whether to extradite him to the U.S. If convicted on all charges, he faces a maximum sentence of 109 years.

Roger Ver, trapped in prison, publicly appealed to President Trump for clemency: "Mr. President, I am an American, and I need your help. Only by standing for justice can you save me."

Even the entire industry is supporting him:

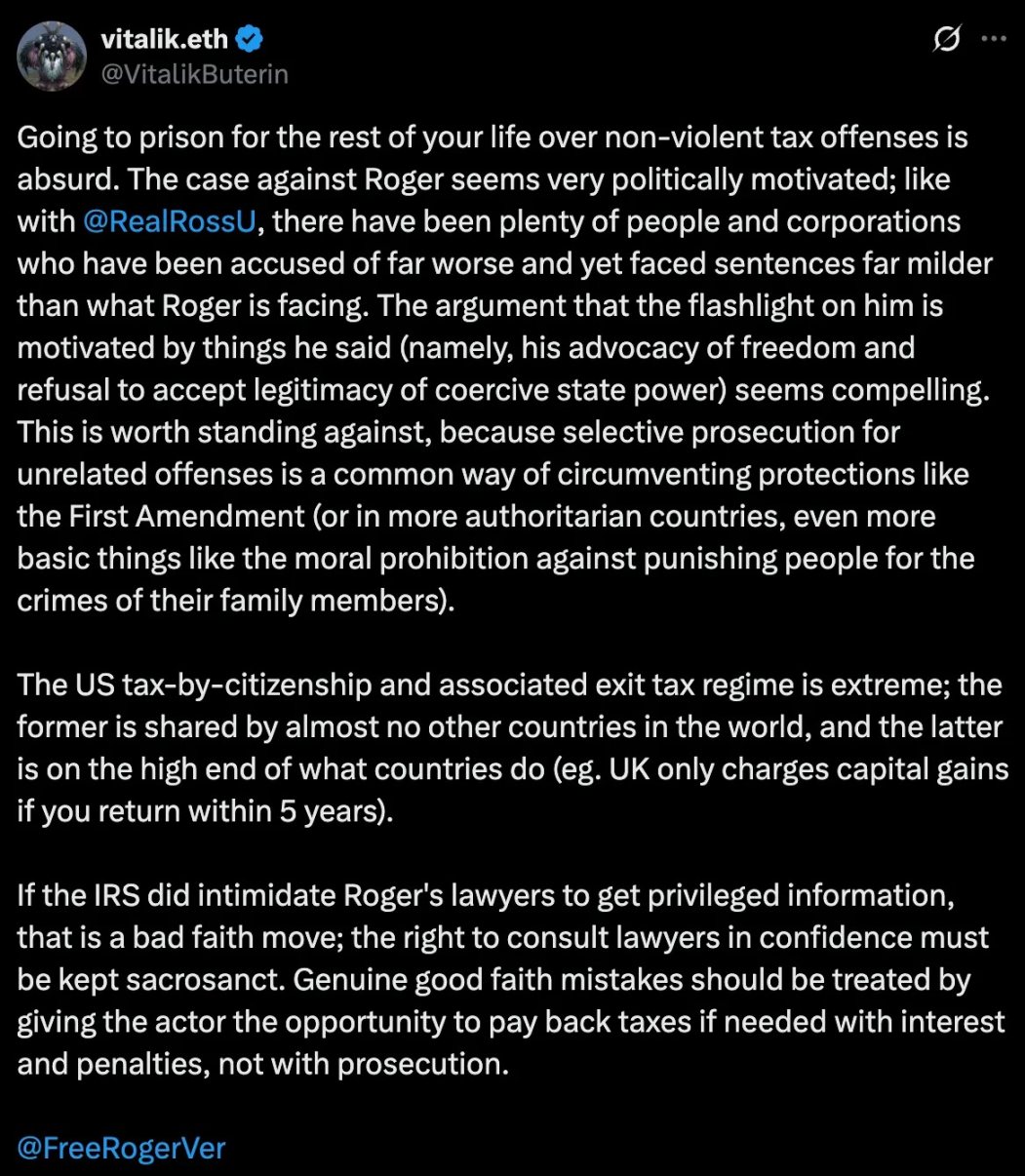

Vitalik:

It is utterly absurd to be sentenced to life imprisonment for non-violent tax violations. The case against Roger Ver is clearly politically motivated—much like Ross Ulbricht's case, where too many individuals and businesses have been accused of far more serious crimes yet face much lighter sentences than Roger Ver. There is a compelling argument that the reason he is being targeted is due to his statements (i.e., his advocacy for freedom and refusal to acknowledge the legitimacy of coercive state power). This matter deserves our opposition because using selective prosecution of irrelevant charges to circumvent protections afforded by the First Amendment (in more authoritarian countries, even bypassing the most basic moral principle of "not punishing individuals for the crimes of their family") is a common tactic.

The U.S. system of "citizenship-based taxation" and its related refund policies are extremely harsh: the former is almost unheard of in other countries, and the latter's tax rates are among the highest globally (for example, the UK only taxes capital gains on funds repatriated within five years).

If the IRS indeed obtained confidential information by intimidating Roger Ver's lawyers, that would be a complete betrayal. The right to confidential consultations with lawyers must be absolutely respected. In cases of genuine oversight, the appropriate course of action should be to allow the individual the opportunity to pay back taxes (if necessary) along with interest and penalties, rather than filing a lawsuit.

However, Roger Ver's decision to renounce his U.S. citizenship in 2014 sowed the seeds of trouble. When asked if he supported clemency for Roger Ver, Elon Musk responded on social media: "Roger Ver voluntarily renounced his U.S. citizenship and should not be granted clemency; citizenship itself comes with rights."

This person, who abandoned his nationality to escape government control, now finds that only U.S. citizenship can provide him with government protection, falling into a classic "Catch-22" paradox. (Note: Catch-22 originates from the 1961 novel of the same name by American author Joseph Heller, describing a "paradoxical dilemma." Its core meaning is that when you are trapped in a contradictory system of rules, no matter how you choose, you cannot escape the predicament because the rules themselves create a deadlock.)

This brings us back to the moment on July 4, 2025, when eight mysterious wallets suddenly transferred $8.72 billion worth of Bitcoin. Cryptocurrency analysts immediately linked this transaction to Roger Ver's legal troubles, with some Twitter users speculating that he might be liquidating assets to pay hefty legal fees or reaching a settlement with the IRS.

For the desperate Roger Ver, selling off early-held Bitcoins to support his defense costs, or even negotiating a plea deal with the prosecution, seemed like the only rational choice. However, the speculation within the crypto community remained based on circumstantial evidence and timing coincidences, with the truth still shrouded in mystery.

The Fallen Prophet

Today, Roger Ver's net worth is approximately $700 million, primarily from early Bitcoin investments and stakes in crypto companies. But wealth cannot resolve his current predicament: as a stateless person, he faces extradition to the country from which he voluntarily renounced his citizenship for trial.

His story is both a microcosm of the early glory of cryptocurrency—building the digital asset ecosystem through keen insights into Bitcoin's potential and strategic investments in infrastructure; promoting and educating millions of newcomers about cryptocurrency—and a revelation of the dangers of the collision between idealism and the rules of reality.

This visionary of Bitcoin's future failed to foresee the cost of his choices: unlicensed sale of explosives, renouncing citizenship to evade taxes, supporting Bitcoin Cash while diverging from the mainstream… ultimately destroying his own fate.

Whether the Bitcoin fluctuations on July 4 were orchestrated by him remains an unresolved mystery, but what is certain is that those transactions mirrored Roger Ver's former self, wielding the power of billions of dollars at the touch of a button, existing outside the traditional financial system, and promising the ultimate liberation that cryptocurrency offered to its early believers.

For Roger Ver, this freedom has long since transformed into a cage of his own making.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。