The mantis stalks the cicada; who is the yellow oriole?

Written by: AiYing Fund

In July 2025, the global financial market was shaken by a major news event. The top quantitative trading giant Jane Street, known for its mystery and elite status, was fined a record 48.43 billion rupees (approximately 580 million USD) by the Securities and Exchange Board of India (SEBI) for systematic index manipulation in the Indian market, and was temporarily banned from market access. The core document of this event is a 105-page SEBI interim investigation report, which reveals in detail how these technologically advanced "players" exploit the asymmetry of market structures for profit.

This is not only a case of an exorbitant fine but also a profound warning to all trading institutions worldwide that rely on complex algorithms and technological advantages—especially those in the regulatory "gray area" of virtual assets. When extreme quantitative strategies fundamentally conflict with market fairness and regulatory intentions, technological advantages will no longer be a "protective talisman" but may instead become evidence pointing back to oneself.

The Aiying research team spent a week deeply analyzing SEBI's investigation report, covering case reviews, regulatory logic, market impact, technical reflections, and mapping connections to the crypto field and future outlooks. They interpret the compliance "sword of Damocles" hanging over all participants in the virtual asset market and discuss how to navigate the tightrope of technological innovation and market fairness.

Part One: "Perfect Storm" Review—How Did Jane Street Weave Its Manipulation Web?

To understand the far-reaching impact of this case, it is essential to clearly restore the manipulation methods Jane Street is accused of. This is not an isolated technical error or an accidental strategy deviation, but a carefully designed, systematically executed, large-scale, and highly covert "conspiracy." SEBI's report reveals two core strategies in detail.

1. Core Strategy Analysis: The Mechanism of Two "Conspiracies"

According to SEBI's investigation, Jane Street primarily employed two interrelated strategies, repeatedly enacted on multiple BANKNIFTY and NIFTY index options expiration days, with the core being the exploitation of liquidity differences and price transmission mechanisms between different markets for profit.

Strategy One: "Intra-day Index Manipulation"

This strategy is divided into two clear phases, like a carefully choreographed drama, aimed at creating a false market appearance and ultimately harvesting profits.

First Phase (Morning / Patch I): Creating False Prosperity to Lure the Enemy In.

- Behavior: Through its locally registered entity in India (JSI Investments Private Limited), it invested billions of rupees in the relatively illiquid cash and stock futures markets, aggressively buying key component stocks of the BANKNIFTY index, such as HDFC Bank and ICICI Bank.

- Technique: Its trading behavior was highly aggressive. The report shows that Jane Street's buy orders were often above the market's latest transaction price (LTP), actively "pushing up" or strongly "supporting" the prices of component stocks, thereby directly lifting the BANKNIFTY index. At certain times, its trading volume accounted for 15% to 25% of the total trading volume of individual stocks, creating enough power to guide prices.

- Purpose: The sole purpose of this action was to create the illusion that the index was rebounding strongly or stabilizing. This would directly affect the highly liquid options market, artificially pushing up the prices of call options while correspondingly lowering the prices of put options.

- Coordinated Action: While creating "noise" in the cash market, Jane Street's overseas FPI entities (such as Jane Street Singapore Pte. Ltd.) quietly acted in the options market. They took advantage of the distorted option prices to buy large amounts of put options at very low costs and sell call options at inflated prices, thus building a massive short position. The SEBI report pointed out that the nominal value (cash-equivalent) of its options positions was several times the amount invested in the cash/futures market; for example, on January 17, this leverage ratio reached 7.3 times.

Second Phase (Afternoon / Patch II): Reverse Harvesting to Achieve Profit.

- Behavior: In the afternoon trading session, especially near the close, Jane Street's local entity would make a 180-degree turn, systematically and aggressively selling all the positions bought in the morning, sometimes even increasing the selling.

- Technique: In contrast to the morning, its sell orders were usually below the market LTP, actively "suppressing" the prices of component stocks, leading to a rapid decline in the BANKNIFTY index.

- Profit Loop: The sharp decline in the index caused the massive put options established in the morning to soar in value, while the call options' value dropped to zero. Ultimately, the enormous profits gained in the options market far outweighed the certain losses incurred in the cash/futures market due to "buying high and selling low." This model constituted a perfect profit loop.

Strategy Two: "Marking the Close"

This is another more direct manipulation method, primarily focused on the final stages of the trading day, especially during the settlement window of options contracts.

"Extended marking the close" refers to a manipulative trading behavior where entities, at the last moments of the trading session, aim to influence the closing price of securities or indices through large buy or sell orders, thereby profiting from their derivative positions.

On certain trading days, Jane Street did not adopt an all-day "buy-sell" model but instead, after 2:30 PM, when it held a large number of soon-to-expire options positions, suddenly engaged in large-scale one-way trading (buying or selling) in the cash and futures markets to push the index's final settlement price in a favorable direction.

Key Evidence and Data Support

SEBI's accusations are not baseless but are built on a vast amount of trading data and rigorous quantitative analysis.

- Scale and Concentration

The report presents detailed tables (such as Table 7, 8, 16, 17) showing Jane Street's astonishing trading volume share within specific time windows. For example, on January 17, 2024, its buying volume in the ICICIBANK cash market accounted for 23.33% of the total buying volume in the market. This market dominance is a prerequisite for its ability to influence prices.

- Price Impact Analysis (LTP Impact Analysis)

This is a major highlight of the SEBI report. The regulatory agency not only analyzed trading volumes but also assessed the "intent" of its trades through LTP impact analysis. The analysis showed that during the lifting phase, Jane Street's trades had a significant positive price impact on the index; conversely, during the suppression phase, they had a significant negative impact. This strongly refutes any potential defense of "normal trading" or "providing liquidity," proving that its actions had a clear intent to "push up" or "suppress" the market.

- Cross-Entity Coordination and Regulatory Evasion

SEBI explicitly pointed out that Jane Street cleverly circumvented the restriction that a single FPI cannot engage in intra-day trading by utilizing a combination of its local entity (JSI Investments) and overseas FPI entities. The local entity was responsible for high-frequency intra-day reversal trading (buying and then selling) in the cash market, while the FPI entities held and benefited from large options positions. This "left hand trading with the right hand" coordinated manipulation model demonstrates the premeditated and systematic nature of its actions.

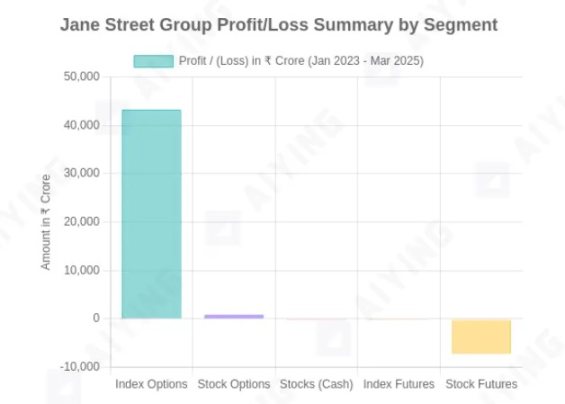

Data Source: SEBI Interim Investigation Report (Table 4). The chart clearly shows that Jane Street made huge profits in the options market while incurring significant losses in other markets (especially stock futures), confirming the manipulation logic of "exchanging losses for greater profits" in its strategy.

Part Two: The Regulatory "Heavenly Net"—SEBI's Penalty Logic and Core Warnings

In the face of Jane Street's complex and highly technical trading strategies, SEBI's penalty decision did not fall into an endless exploration of its algorithmic "black box," but rather struck at the heart of the matter, focusing on the essence of its behavior and the damage to market fairness. The regulatory logic behind this serves as a strong warning to all technology-driven trading institutions, especially participants in the virtual asset field.

The sign outside the headquarters of the Securities and Exchange Board of India (SEBI)

1. SEBI's Penalty Logic: Qualifying Based on "Behavior" Rather Than "Results"

SEBI's legal weapon is primarily its "Prohibition of Fraudulent and Unfair Trade Practices Regulations" (PFUTP Regulations). Its penalty logic is not based on "Jane Street made money," but rather on "the way Jane Street made money is wrong."

Key qualitative bases are as follows:

Creating False or Misleading Market Appearances (Regulation 4(2)(a)): SEBI believes that Jane Street artificially created the rise and fall of the index through its large-scale, high-intensity buying and selling behavior, which conveyed false price signals to the market and misled other participants (especially retail investors relying on price signals for decision-making). This behavior itself constitutes a distortion of the true supply and demand relationship in the market.

Manipulating Security Prices and Benchmark Prices (Regulation 4(2)(e)): The report clearly states that Jane Street's behavior was directly aimed at influencing the BANKNIFTY index—a significant market benchmark price. All its operations in the cash and futures markets were intended to move this benchmark price in a direction favorable to its derivative positions. This is viewed as typical price manipulation.

Lack of Independent Economic Rationality: This is the "winning hand" in SEBI's argument. The regulatory agency pointed out that Jane Street's intra-day high-buy low-sell reversal trading in its cash/futures market inevitably leads to losses from a single business perspective. Report data shows that on 15 trading days of "intra-day index manipulation," it incurred a cumulative loss of 1.997 billion rupees in the cash/futures market. This behavior of "intentional loss" precisely proves that these trades were not for investment or normal arbitrage, but served as a "cost" or "tool" for manipulating the options market to obtain greater profits.

2. Core Warning: Technology is Neutral, but Those Who Use Technology Have Positions

The most profound warning from this case is that it clearly delineates a red line:

In today's increasingly refined and principled regulation, pure technological and mathematical advantages, if lacking respect for market fairness and regulatory intentions, may at any time cross the legal red line.

- The Boundaries of Technological Advantage: Jane Street undoubtedly possesses world-class algorithms, low-latency execution systems, and excellent risk management capabilities. However, when this capability is used to systematically create information asymmetry and disrupt the market's price discovery function, it transforms from a "tool for enhancing efficiency" into a "weapon for manipulation." Technology itself is neutral, but its application methods and intentions determine the legality of its actions.

- The "Principle-Based" Regulatory New Paradigm: Global regulatory agencies, including SEBI and SEC, are increasingly evolving from a "rule-based" to a "principle-based" regulatory concept. This means that even if a complex trading strategy does not explicitly violate a specific rule, as long as its overall design and final effect contradict the fundamental principles of "fairness, justice, and transparency" in the market, it may be deemed manipulative. Regulators will ask a fundamental question: "What benefit does your behavior bring to the market, aside from harming others' interests to profit yourself?" If the answer is negative, then the risk is extremely high.

3. The "Arrogance" of Ignoring Warnings: A Catalyst for Severe Penalties

SEBI particularly emphasized an aggravating circumstance in the report: In February 2025, the National Stock Exchange of India (NSE) had issued a clear warning letter to Jane Street at SEBI's direction, demanding that it cease suspicious trading patterns. However, the investigation found that Jane Street continued to employ similar "marking the close" methods to manipulate the NIFTY index in the following May.

This behavior was viewed by SEBI as a blatant contempt for regulatory authority and "not a good faith actor." This was not only one of the reasons for its exorbitant fine but also an important catalyst for SEBI's severe temporary measure of "prohibiting market access." This serves as a lesson for all market participants: communication and commitments with regulatory agencies must be taken seriously; any form of luck-seeking mentality and arrogant attitude may lead to harsher consequences.

Part Three: Under the Avalanche, No Snowflake is Innocent—Market Impact and Victim Spectrum Analysis

The impact of the Jane Street case extends far beyond the fines and reputational damage of a single company. It is like a boulder thrown into a calm lake, creating ripples that affect the entire quantitative trading ecosystem and redefine our understanding of "victims." The breadth and depth of its impact warrant deep reflection from all market participants.

1. Direct Impact on Market Ecology

- Liquidity Paradox and Decline in Market Quality

In the short term, the prohibition of top market makers like Jane Street will undoubtedly impact the liquidity of its active derivatives market (such as BANKNIFTY options). Bid-ask spreads may widen, leading to increased trading costs. As noted by Nithin Kamath, CEO of the well-known Indian brokerage Zerodha, top proprietary trading firms contribute nearly 50% of the options trading volume, and their retreat could significantly affect market depth.

- Trust Crisis and Industry Chill Effect

This case severely undermines market trust in quantitative trading, especially high-frequency trading (HFT). The negative perception from the public and regulatory agencies may lead to the "stigmatization" of the entire industry. Other quantitative funds, especially foreign institutions, may become more cautious due to this case, reassessing regulatory risks in emerging markets like India or actively shrinking their business scale, creating a "chill effect."

- The Prelude to Comprehensive Regulatory Tightening

The SEBI chairman has clearly stated that monitoring of the derivatives market will be strengthened. This indicates that all quantitative institutions will face stricter algorithm reviews, more transparent position reporting requirements, and more frequent compliance checks in the future. A stricter regulatory era has arrived.

2. Victim Spectrum Analysis: Chain Reactions from Retail to Institutional

Traditional analysis often focuses on victims who are directly "harvested" retail investors. However, in an interconnected market, the harm of manipulative behavior is systemic.

- Direct Victims: Retail Investors Who Were "Harvested"

This is the most obvious group of victims. The SEBI report repeatedly mentions that as many as 93% of retail investors in India incur losses in F&O (futures and options) trading. Jane Street's strategy exploited the retail group's reliance on price signals and their inadequate information processing capabilities. When the index was artificially lifted, retail investors were lured into a long trap; when the index was artificially suppressed, their stop-loss orders exacerbated the market decline. They became the direct "counterparties" to Jane Street's massive profits, with almost no ability to fight back under the dual disadvantages of information and capital.

- Indirect Victims: Other Quantitative Institutions Misled by "Polluted" Signals

This is a commonly overlooked but crucial group of victims. The market game does not only involve Jane Street and retail investors. Hundreds of other small and medium-sized quantitative institutions also rely on publicly available market data—prices, trading volumes, order book depth, etc.—to make decisions. Their survival depends on finding small arbitrage opportunities in a fair and efficient market through superior models or faster execution.

However, when "whales" like Jane Street use their overwhelming capital advantage to systematically "pollute" the price signals that are the foundation of the market, the rules of the entire game change. Other quantitative institutions receive distorted data, experiencing a market situation that has been artificially "directed."

This can lead to a series of chain reactions:

- Strategy Failure

Models based on trend following, mean reversion, or statistical arbitrage may completely fail in the face of such artificially created sharp reversals, leading to erroneous trades and losses.

- Risk Model Misjudgment

Risk management models (such as VaR) are calculated based on historical volatility. When market volatility is artificially amplified, these models may underestimate real risks or trigger risk control instructions at the wrong time.

- Missing Real Opportunities

When the main driving force of the market comes from manipulation rather than fundamentals or genuine sentiment, strategies aimed at discovering real value will have no way to proceed.

Thus, Jane Street's actions not only harvested retail investors but also dealt a "dimensional blow" to other professional institutions in the same field. They thought they were competing with the "market," but in reality, they were competing with a "falsified market" that had a god's-eye view. This breaks the simple understanding of "quantitative competition, the strong remain strong," revealing how fragile the market's price discovery function is in the face of absolute power. From this perspective, all participants relying on fair signals, regardless of their technical level, become potential victims of this manipulation drama.

Part Four: Reflections from the Crypto Field—Cross-Market Mapping of Jane Street's Strategies

For virtual asset institutions, the Jane Street case is far from a distant concern. Its core manipulation logic is highly analogous to the "technical original sin" commonly seen in the crypto market. Using this case as a mirror, we can clearly see the significant compliance risks lurking in the crypto field.

1. Jane Street's Layout and Behavior in the Crypto Field

Jane Street is one of the earliest and most influential institutional players in the crypto world. Its behavioral patterns are consistent with those in traditional financial markets: low-key, mysterious, but with significant influence.

According to Aiying, Jane Street is not only a major cryptocurrency market maker globally but has also been an important liquidity provider for top exchanges like FTX and Binance. Recently, it has become an authorized participant (AP) for several Bitcoin spot ETFs from firms like BlackRock and Fidelity, playing a key role in bridging traditional finance and crypto assets. Notably, after the tightening of the regulatory environment in the U.S. in 2023, Jane Street reduced its cryptocurrency trading business in the U.S. but remained active in other regions globally. This indicates its high sensitivity to regulatory risks and its ability to flexibly adjust strategies worldwide. It can be concluded that Jane Street's well-honed quantitative models, technical architecture, and risk management philosophy in traditional financial markets are also applied to its crypto asset trading. Therefore, its manipulation methods in the Indian market hold significant reference value for understanding its potential behavioral patterns in the crypto world.

Compared to traditional financial markets, manipulation methods in the crypto asset market are characterized by their close integration with technical protocols, market structures, and community ecosystems. The following cases cover multiple dimensions from DeFi to CEX, from algorithms to social media, revealing the diversity and complexity of its manipulative behaviors.

Case One: Mango Markets Oracle Manipulation Case (DeFi)

Manipulation Method: In October 2022, manipulator Avraham Eisenberg exploited structural vulnerabilities in the Mango Markets protocol by artificially inflating the price of its governance token MNGO across multiple platforms, significantly increasing the value of his collateral. He then borrowed and drained approximately $110 million worth of various mainstream crypto assets from the protocol's treasury using this highly inflated collateral.

Market Impact and Legal Consequences: This incident led to the instant bankruptcy of the Mango Markets protocol, freezing user assets. Eisenberg later claimed that his actions were a "highly profitable legitimate trading strategy," challenging the boundaries of "code is law." However, the U.S. Department of Justice ultimately arrested and convicted him on charges of commodity fraud and manipulation. This case became the first landmark case successfully prosecuting manipulation in the DeFi market, establishing the applicability of traditional market manipulation regulations in the DeFi space.

Case Two: FTX / Alameda Research Internal Related Party Manipulation Case (CEX)

Case Two: FTX/Alameda Research Internal Related Party Manipulation Case (CEX)

Manipulation Method: The U.S. Commodity Futures Trading Commission (CFTC) and the Financial Crimes Enforcement Network (FinCEN) accused FTX and its affiliated trading company Alameda Research of systematic profit transfer and market manipulation. Alameda exploited its special privileges on FTX (such as immunity from automatic liquidation) to misappropriate customer deposits for high-risk investments. At the same time, both parties collaborated to manipulate the price of FTX's platform token FTT, using it as false collateral to cover Alameda's massive losses.

Market Impact and Legal Consequences: This manipulation ultimately led to the collapse of the FTX empire, triggering a liquidity crisis that affected the entire industry, with investor losses amounting to billions of dollars. Founder Sam Bankman-Fried was convicted on multiple charges, including securities fraud and wire fraud. This case revealed the extreme systemic risks that can arise from centralized platforms lacking external regulation and internal risk control.

Case Three: BitMEX Derivatives Market Manipulation Case (Derivatives)

Manipulation Method: The CFTC and FinCEN accused BitMEX of operating illegally for an extended period and failing to implement necessary anti-money laundering (AML) and know your customer (KYC) procedures. This created conditions for market manipulators (including internal employees) to influence derivatives prices through methods such as "spoofing" and "wash trading." Its unique "liquidation engine" was also criticized for exacerbating user losses during extreme volatility.

Market Impact and Legal Consequences: BitMEX's actions undermined the fairness of the derivatives market and harmed traders' interests. Ultimately, BitMEX reached a settlement with regulators, paying a hefty fine of $100 million, and several of its founders admitted to violating the Bank Secrecy Act. This case marked the beginning of tighter regulation of crypto derivatives platforms by regulatory agencies.

Case Four: Hydrogen Technology Algorithmic Manipulation Case (Algorithmic)

Manipulation Method: The U.S. Securities and Exchange Commission (SEC) accused Hydrogen Technology and its market makers of conducting large-scale "wash trading" and "spoofing" operations on its token HYDRO through specially designed trading bots between 2018 and 2019. These algorithmic trades created over $300 million in false trading volume, accounting for the vast majority of the token's global trading volume, aimed at creating a false appearance of market activity to attract investors.

Market Impact and Legal Consequences: This manipulation misled the market, artificially inflated the token's price, and caused ordinary investors to suffer losses after the price collapse. The SEC ultimately ruled that it violated federal securities laws regarding anti-fraud and market manipulation provisions. This case is a typical example of regulators successfully identifying and combating algorithm-driven manipulation using data analysis techniques.

Case Five: Social Media Influence Manipulation Case (Social Media)

Manipulation Method: This type of manipulation does not rely on complex technology but instead utilizes the influence of social media (such as X, Telegram, Discord). A typical pattern is "pump and dump," where manipulation groups preemptively buy a low-liquidity token at a low price, then use influencers (KOLs) or community announcements to spread false positive news, attracting a large number of retail investors to buy at inflated prices, ultimately selling at a profit.

Market Impact and Legal Consequences: This behavior leads to the target token's price skyrocketing and plummeting within a short period, with the vast majority of following retail investors becoming "bag holders." The SEC has filed lawsuits in multiple such cases, accusing relevant influencers and project parties of promoting security tokens without disclosing compensation, constituting fraud. This indicates that the regulatory scope has extended to market marketing and community opinion guidance.

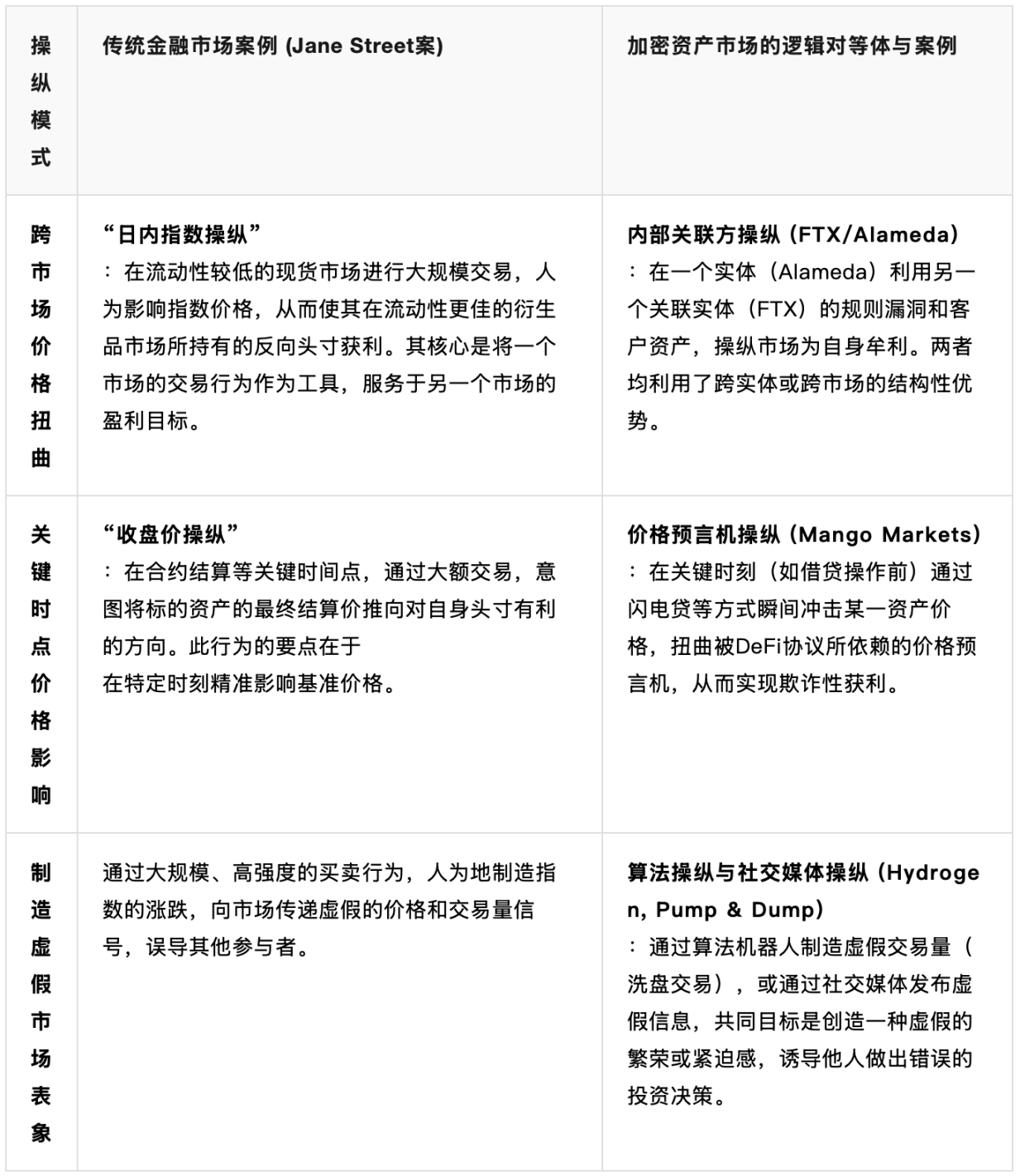

Cross-Market Comparative Analysis of Manipulation Logic

After analyzing the specific cases above, we can conduct a deeper comparison of the manipulation logic between the Jane Street case and the crypto world. Although the market vehicles and technical tools differ, the underlying manipulation philosophy—using information, capital, or regulatory advantages to create unfairness—is common.

Aiying Conclusion: The Mantis Catches the Cicada, Who is the Yellow Bird?

The Jane Street case and a series of precedents in the crypto world together depict a vivid picture of the financial market where "the mantis catches the cicada, and the yellow bird is behind." However, in this game, who is the mantis, and who is the yellow bird?

For many retail investors and small to medium-sized institutions immersed in candlestick chart fluctuations and chasing short-term trends, they resemble the mantis focused on its immediate prey (market alpha). They often fail to realize that every small pattern in their trading behavior, every emotional chase of rising and falling prices, may be observed and exploited by more powerful predators—top quantitative institutions like Jane Street. These "yellow birds," leveraging their capital, technology, and information advantages, are not competing with the "market," but are systematically "hunting" those predictable behavioral patterns.

This reveals the first cruel truth of market competition: your opponent may not be the "market" or other retail investors as you imagine, but a highly rational professional hunter with a god's-eye view. Losses often do not stem from bad luck but from a position in the food chain that has already been determined. However, the story does not end here. When the "yellow bird" mistakenly believes it is at the top of the food chain, reveling in the success of its hunting, it also exposes itself to the true "hunter"—the regulatory agencies. The fines in the Jane Street case illustrate that even the most powerful "yellow birds," once their actions cross the red line of market fairness and undermine the foundation of the entire ecosystem, can also become prey.

Therefore, for all market participants, the true wisdom of survival lies in two aspects: first, to recognize the true opponent, restrain the "mantis" instinct driven by short-term profits, and understand one's position in a jungle surrounded by "yellow birds." Second, to hold a genuine respect for market rules. Rational and strategic thinking should not only be used to design more sophisticated hunting strategies but also to understand the boundaries and bottom lines of the entire ecosystem. Any attempt to gain excess returns by harming the system's fairness may lay the groundwork for future upheaval.

In this never-ending game, the ultimate winner is not the fiercest "yellow bird," nor the most diligent "mantis," but those wise participants who can perceive the entire food chain, understand how to dance with the rules, and remain alert to risks.

Report link: chrome-extension://blegnhaaimfcklgddeegngmanbnfopog/https://images.assettype.com/barandbench/2025-07-04/aiwwj4zh/SEBIJaneStreet_order.pdf

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。