The reign has no eternity.

Written by: Deep Tide TechFlow

On July 9, the well-established on-chain perpetual contract exchange GMX suffered a heavy blow.

Hackers exploited a reentrancy vulnerability in the GMX V1 smart contract to steal approximately $42 million in crypto assets from its GLP liquidity pool, including USDC, FRAX, WBTC, and WETH.

On-chain data shows that about $9.6 million of the assets have been transferred via cross-chain bridges. The GMX team has made an offer to the attackers: if 90% of the funds are returned within 48 hours, they will receive a 10% "white hat bounty" and be exempt from prosecution.

However, although $40 million is not a small amount, this incident has not sparked widespread discussion.

A heart-wrenching comment is:

"Who still puts money in GMX now?"

While everyone is discussing Bitcoin hitting new highs, Pumpfun about to issue tokens, and ETH standing tall again… the market may have already lost interest in GMX.

Once the "on-chain Perp DEX leader," it has now been marginalized.

In the short-memory, attention-scarce crypto market, being ignored is the greatest punishment. This theft took not only $42 million but also GMX's former glory.

Remembering Past Glory

The new entrants in this cycle may not have even heard of GMX.

Looking back at GMX's peak, this decentralized perpetual contract exchange (Perp DEX) was a shining star in the on-chain trading space, and it would not be an exaggeration to call it "the Hyperliquid of the last cycle."

In September 2021, GMX launched on the Arbitrum network and quickly emerged with its innovative multi-asset liquidity pool GLP. The GLP pool integrated various assets such as USDC, DAI, WBTC, and WETH, supporting up to 100x leverage trading, attracting a large number of users and funds.

From 2022 to 2023, GMX's cumulative trading volume soared to $277 billion, with an average daily trading volume of $923 million. DefiLlama data shows that its TVL peaked at nearly $700 million in May 2023, once accounting for about 15% of the total locked value on the Arbitrum network, firmly sitting at the top of on-chain Perp DEXs.

At that time, GMX excelled in both technological breakthroughs and economic incentives.

Its vAMM mechanism eliminated the complexities of traditional order books and expanded cross-chain to Avalanche (early 2022) and Solana (March 2025), accumulating over 700,000 users.

GMX token stakers could earn 30% of protocol fees (paid in ETH or AVAX), along with esGMX and Multiplier Points (MP) rewards, with peak APRs reaching as high as 100%. The amount of GMX staked in 2022 accounted for over 30% of the circulating supply, effectively alleviating selling pressure.

The once-popular on-chain contract products did not have the widespread participation and acceptance of today's on-chain memes; they attracted more professional DeFi players and those distrustful of CEXs, making GMX's rise quite remarkable.

So much so that later on-chain DEXs often used GMX as a comparison in their white papers and promotional materials, explaining how they optimized their offerings to outperform GMX in experience or returns, reminiscent of various competitors comparing themselves to Tesla and Apple at press conferences.

The New King Hyperliquid, A Change of Power

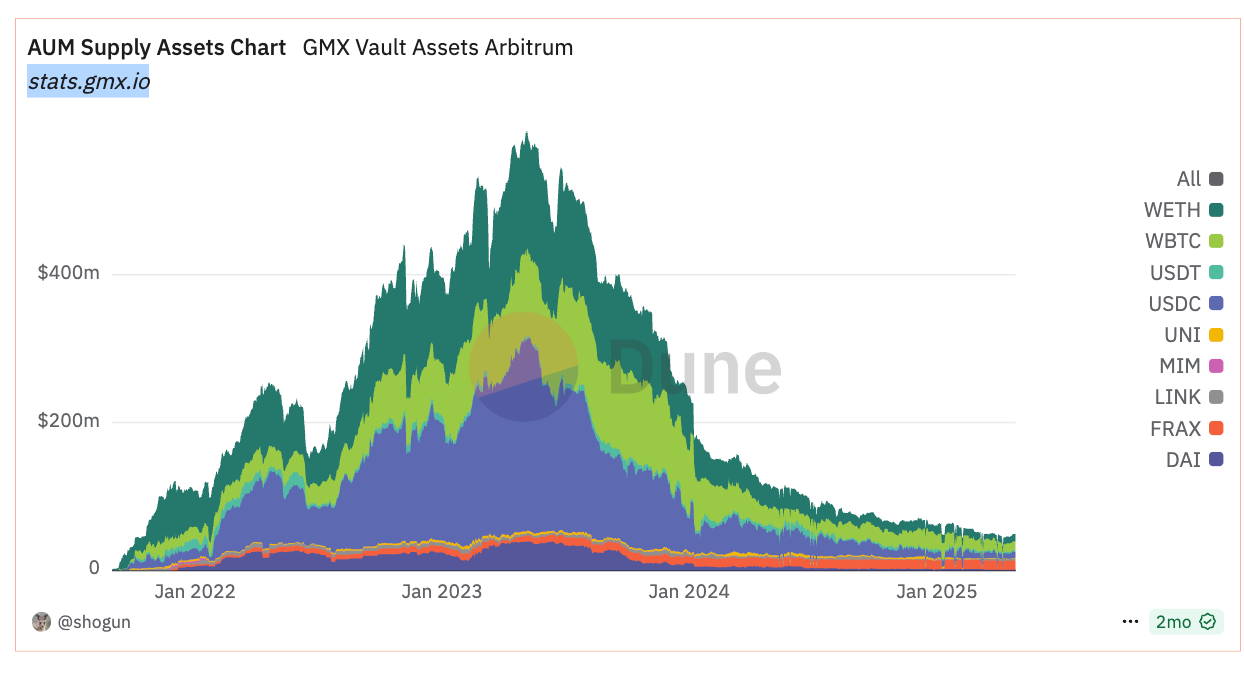

From the chart below, it is clear that GMX's asset management scale on Arbitrum began to decline rapidly from the end of 2023, with data around April showing about $30-40 million, far from its peak.

This decline coincided with the rise of Hyperliquid.

Hyperliquid represents the new king. The platform uses an order book mechanism, replacing the traditional vAMM, significantly reducing slippage and price manipulation risks. On-chain degens are most sensitive to experience and returns; even slight improvements in these areas can lead to gradual "voting with their feet."

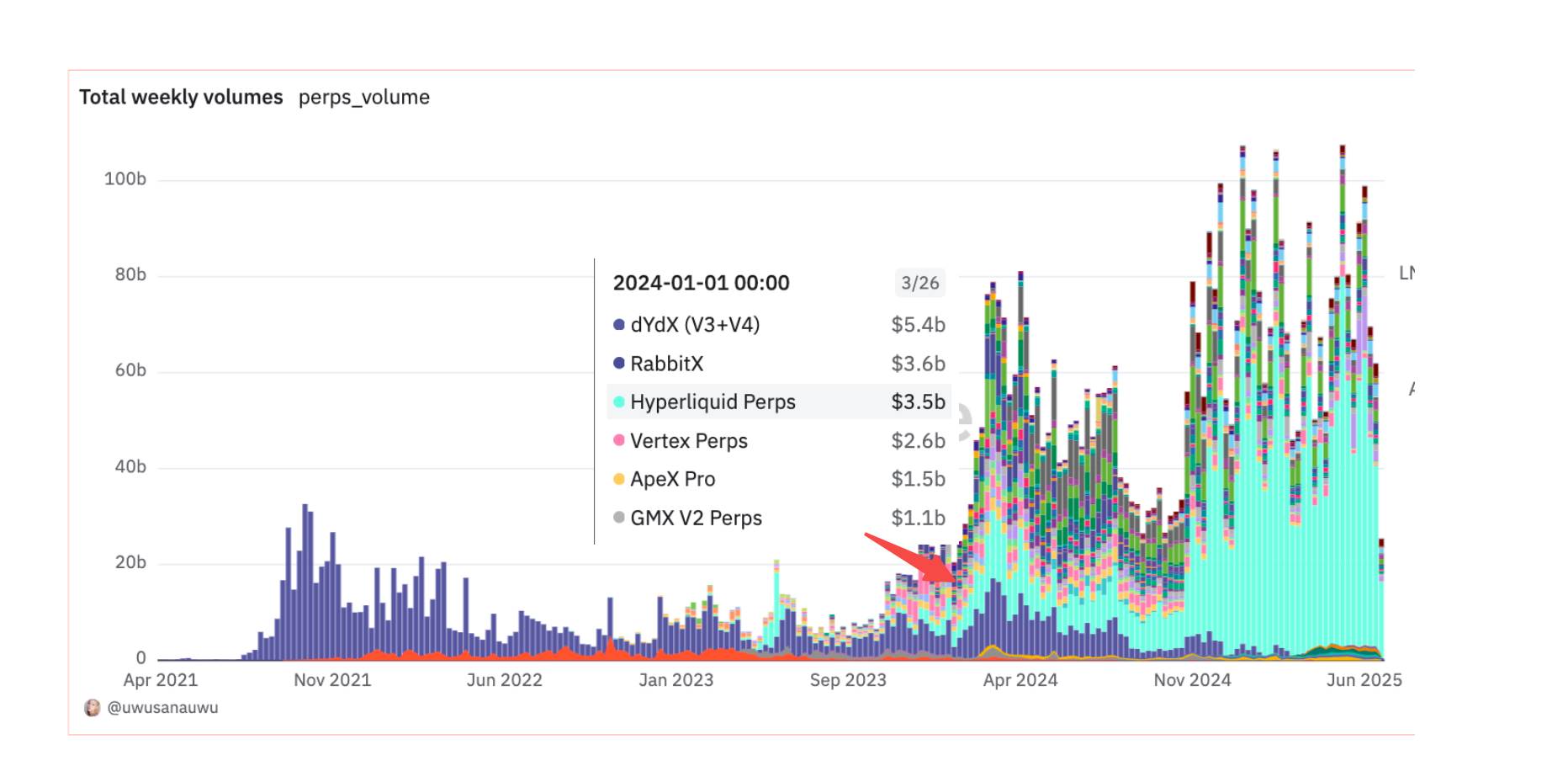

For example, in the last week of 2023, Hyperliquid's trading volume quietly reached $3.5 billion in comparison to all on-chain DEXs, while GMX only had $1.1 billion.

In other words, not only GMX but all similar DEXs have been impacted by Hyperliquid. The data clearly supports this: after the end of 2024, Hyperliquid almost captured the on-chain Perp DEX market with an absolute market share advantage.

Looking at the bigger picture, the DeFi boom of 2021-2022 propelled GMX's rapid growth, but during the same period, a large number of VCs began investing in on-chain infrastructure, leading to the emergence of products with lower transaction fees and higher performance, intensifying competition among on-chain DEXs.

Moreover, with the rise of various chains, there were representative DEXs on different chains, such as Jupiter on Solana. Although GMX can operate cross-chain, it also means it has to compete with native DEXs on different chains, naturally leading to market share erosion.

As the new king rises and power changes hands, GMX's decline may have been a trend all along; it was just this recent hacker attack that brought it back into the spotlight.

The Reign Has No Eternity

GMX's decline is not an isolated case but another footnote in the rapid turnover of projects in the crypto market.

Where are the various chain games you saw in the last cycle, like the once-popular StepN? If this example still has some suspicion of the project party actively dumping, many other projects that have not issued tokens and focused on product development sometimes have not done much wrong yet are still abandoned by the times.

For instance, two years ago, there were projects focusing on on-chain wallets, emphasizing MPC and full-chain experiences and features, but after OKX Wallet and Binance Alpha bound their own entrances, these similar competitors have long since disappeared.

Uniswap was once the benchmark for DEXs, but as SushiSwap and Curve rose, its market dominance began to waver; Aave and Compound, while gradually iterating, also face challenges from emerging lending protocols.

In the crypto industry, product experience is not the only moat; speculation drives liquidity, which can easily breach the moat.

Once a narrative ignites a sector, you can see projects springing up like feudal lords, all vying for the supreme position on the throne; yet the cycle of rise and fall continues, and looking back, the only constant is BTC.

The reign in the crypto market is not eternal; attention is power, and GMX's silence may be the best proof.

Sources of data used in the article:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。