Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

U.S. Bitcoin Spot ETF Net Inflow of $2.714 Billion

Last week, the U.S. Bitcoin spot ETFs saw a net inflow over three days, totaling $2.714 billion, with total assets under management reaching $150.6 billion.

Eight ETFs experienced net inflows last week, primarily from IBIT, FBTC, and ARKB, which saw inflows of $1.759 billion, $399 million, and $339 million, respectively.

Data Source: Farside Investors

U.S. Ethereum Spot ETF Net Inflow of $908 Million

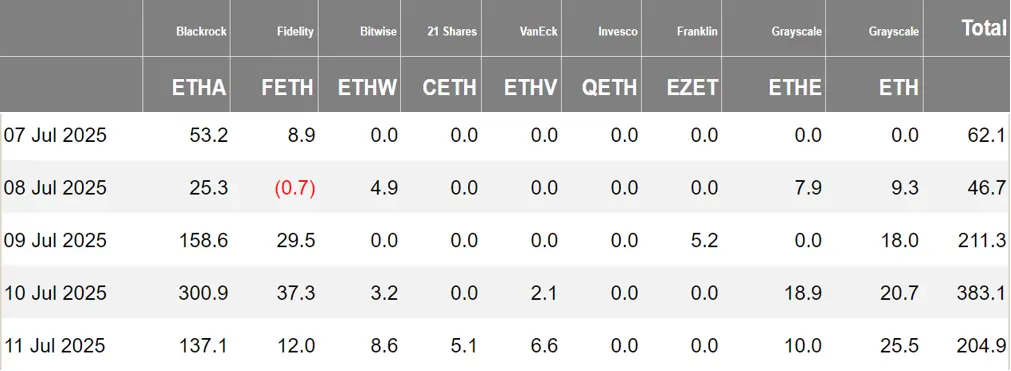

Last week, the U.S. Ethereum spot ETFs had a net inflow over four days, totaling $908 million, with total assets under management reaching $13.53 billion.

The inflow last week mainly came from BlackRock's ETHA, with a net inflow of $675 million. Only one Ethereum spot ETF had no fund movement.

Data Source: Farside Investors

No Fund Inflow for Hong Kong Bitcoin Spot ETF

Last week, the Hong Kong Bitcoin spot ETFs had no fund inflow, with total assets under management reaching $48.8 million. The holdings of the issuer, Harvest Bitcoin, decreased to 293.31 BTC, while Huaxia maintained 2,220 BTC.

The Hong Kong Ethereum spot ETF also had no fund inflow, with total assets under management at $6.402 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of July 11, the nominal total trading volume of U.S. Bitcoin spot ETF options was $6.2 billion, with a nominal total long-short ratio of 2.79.

As of July 10, the nominal total open interest of U.S. Bitcoin spot ETF options reached $22.95 billion, with a nominal total long-short ratio of 2.07.

The market's short-term trading activity for Bitcoin spot ETF options has increased, with overall sentiment leaning bullish.

Additionally, the implied volatility stands at 43.80%.

Data Source: SoSoValue

Overview of Crypto ETF Developments Last Week

Grayscale Submits Letter of Protest to U.S. SEC Against GDLC ETF Conversion "Stay" Order

Bloomberg analyst James Seyffart tweeted that Grayscale and its lawyers submitted a letter in response to the U.S. SEC's "stay" order on the GDLC ETF conversion, arguing that the SEC has no authority to do so.

Leveraged ETF Tracking TRON Submits Application to U.S. SEC

The U.S. ETF Opportunities Trust has submitted an application to the SEC for the "T-REX 2X Long TRON Daily Target ETF," which plans to amplify TRON's performance by 2 times daily, joining the queue of crypto funds pending review by the U.S. SEC.

This fund is initiated by REX Shares and will track TRON's price through derivatives such as swaps. The SEC is currently evaluating multiple crypto ETF proposals, including those for SOL and DOGE, with an increase in regulatory friendliness. Additionally, the SEC is exploring a set of standards that could expedite the ETF approval process, covering metrics such as market capitalization, degree of decentralization, and wallet distribution.

SEC Weighing Faster Approval Framework, Potentially Opening "Gates" for Altcoin ETFs

According to The Block, as the number of applications for cryptocurrency exchange-traded funds (ETFs) surges, the U.S. Securities and Exchange Commission (SEC) is considering implementing a faster approval framework.

This change could open the gates for the approval of cryptocurrency ETFs, allowing more such financial products to enter the market. The SEC is weighing this new framework to address the growing demand for cryptocurrency ETFs.

Truth Social Submits S-1 Filing for Cryptocurrency Blue-Chip ETF

According to the U.S. SEC's official website, Truth Social has submitted an S-1 filing for a cryptocurrency blue-chip ETF.

The trust's assets primarily consist of Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Ripple (XRP), and Cronos (CRO) held by the custodian for the trust.

U.S. SEC Urges Issuers to Revise and Resubmit Spot Solana ETF Application by End of July

The U.S. Securities and Exchange Commission (SEC) is urging issuers to revise and resubmit their applications for the spot Solana ETF by the end of July, suggesting that the approval speed may be faster than expected. Previously, the REX-Osprey SOL and Staking ETFs received automatic approval and began trading last week under different regulatory rules, indicating that the spot Solana ETF will join Bitcoin and Ethereum as the only approved spot cryptocurrency fund in the U.S., while applications for XRP, Dogecoin, and Litecoin are still pending.

U.S. SEC Delays Approval of BlackRock's Spot Ethereum ETF Physical Redemption Method

U.S. SEC Confirms Bitwise's Spot Bitcoin and Ethereum ETF Amendment on Physical Redemption

U.S. SEC Delays Approval of Fidelity's Spot Solana ETF

U.S. SEC Confirms Receipt of Truth Social's Spot Bitcoin and Ethereum ETF Applications

Views and Analysis on Crypto ETFs

Xu Zhengyu, Secretary for Financial Services and the Treasury of Hong Kong, stated in an interview with Cable News' "Finance and Business" that only a limited number of stablecoin licenses will be issued in the first phase. Regarding the issuance of a renminbi stablecoin, he mentioned that there are no legal restrictions on the pegged currency, but if it involves other regional currencies, discussions with relevant institutions may be necessary.

Xu emphasized that the government will take the lead in promoting the application of stablecoins, particularly focusing on cross-border payment scenarios to help developing countries cope with currency devaluation and financial system risks. He also revealed that Hong Kong will promote the tokenization of financial assets in the future, expecting to extend to exchange-traded funds (ETFs) after green bonds, and believes that trading in commodities such as metals could also be explored for token payments.

Bloomberg ETF Analyst: BlackRock's IBIT Becomes the Fastest ETF to Surpass $80 Billion in Market Cap

Bloomberg ETF analyst Eric Balchunas tweeted that BlackRock's IBIT has surpassed the $80 billion mark, becoming the fastest ETF to reach this milestone in history, taking 374 days, which is about five times faster than the previous record held by VOO (1,814 days). Additionally, IBIT's market cap has reached $83 billion, currently ranking as the 21st largest ETF globally.

According to CoinDesk, Markus Thielen, founder of 10x Research, noted in a client report on Thursday that since late April 2025, inflows into Bitcoin ETFs have surged, primarily due to pressure from figures like Trump on the Federal Reserve. Trump publicly called for Chairman Powell to lower interest rates to 1% and resign, while Federal Housing Finance Agency Director Bill Pulte and Senator Cynthia Lummis also urged Powell to step down. Meanwhile, the minutes from the Fed's July meeting indicated increasing policy divergence among officials. The continuous inflow of ETF funds and growing pressure for rate cuts have forced previously hesitant traders back into the market, reviving bullish momentum in cryptocurrencies.

Thielen stated that since mid-April, Bitcoin ETFs have purchased $15 billion worth of Bitcoin, and the buying has not stopped, with stable demand forcing traders back into the market. Coupled with seasonal performance in July and macro catalysts, the market still supports further upward movement.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。