Key Points

· The total market capitalization of cryptocurrencies is $3.89 trillion, up from $3.45 trillion last week, representing a 12.75% increase this week. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $52.36 billion, with a net inflow of $2.72 billion this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $5.31 billion, with a net inflow of $907 million this week.

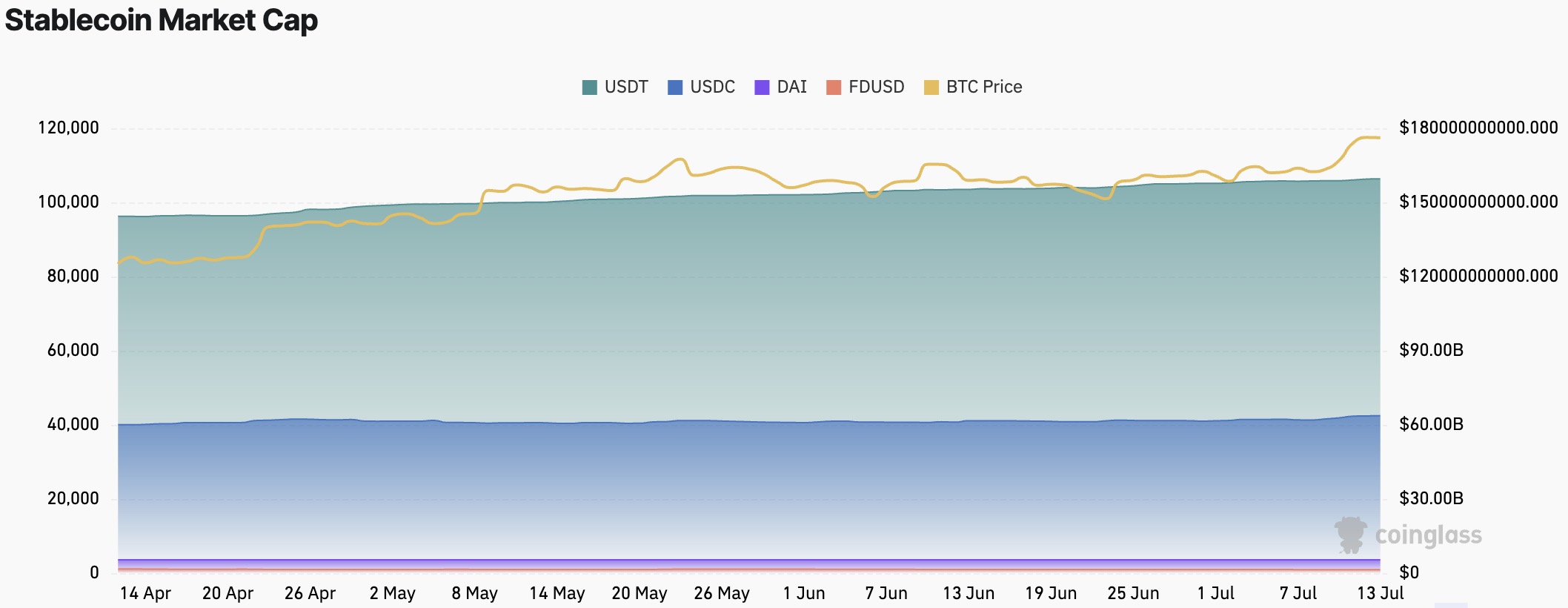

· The total market capitalization of stablecoins is $253.4 billion, with USDT's market cap at $159.5 billion, accounting for 62.94% of the total stablecoin market cap; followed by USDC with a market cap of $63.6 billion, accounting for 25.09%; and DAI with a market cap of $5.36 billion, accounting for 2.12%.

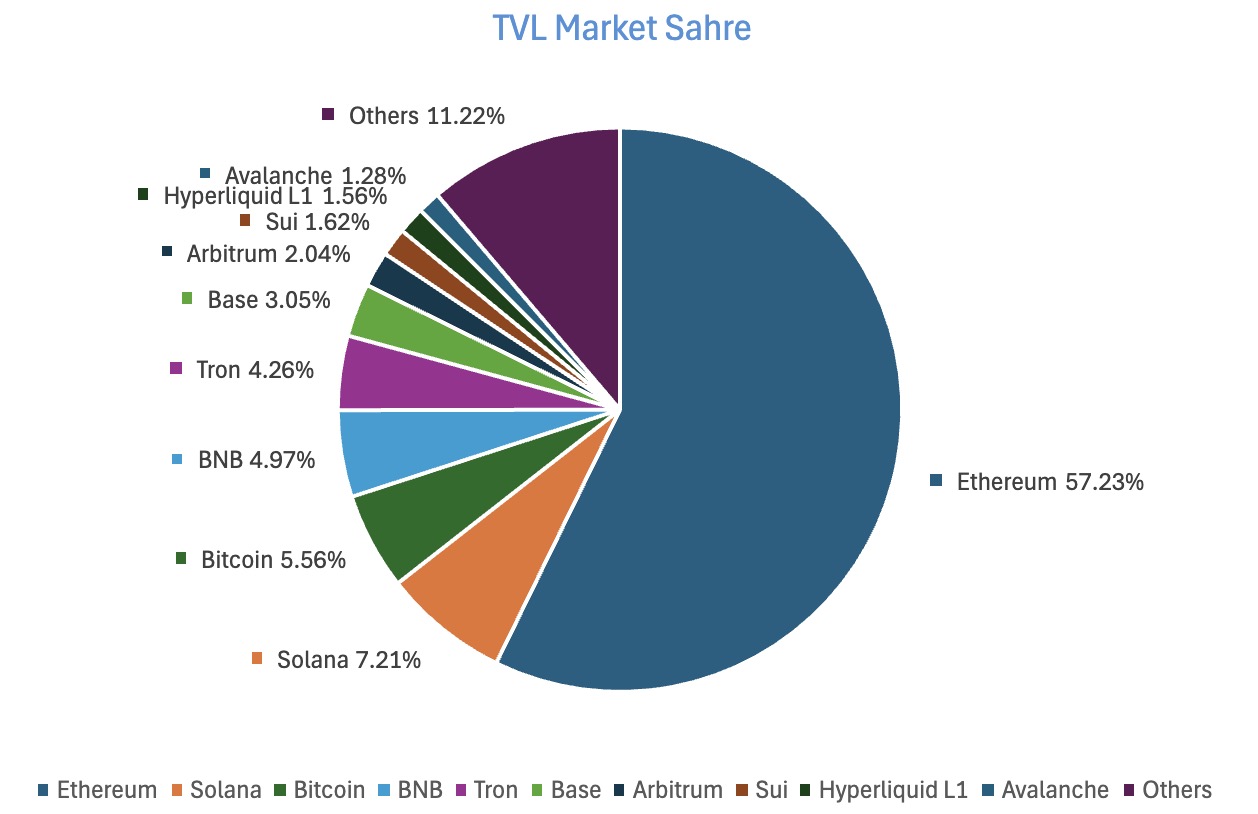

· According to DeFiLlama, the total TVL of DeFi this week is $127.2 billion, up from $116.4 billion last week, an increase of approximately 9.28%. By public chain, the top three chains by TVL are Ethereum, accounting for 57.23%; Solana, accounting for 7.21%; and Bitcoin, accounting for 5.56%.

· On-chain data shows that the overall activity of mainstream public chains has increased this week, with Ton chain's daily trading volume surging by 210%, the most notable performance; Ethereum, Solana, and Sui increased by 74.78%, 76.51%, and 80% respectively, while Aptos and BNB had relatively limited increases. In terms of transaction fees, Sui rose by 50%, Ethereum doubled, and other chains had little change. In terms of daily active addresses, Ethereum and Aptos grew by 9.61% and 11.47% respectively, while Sui fell by 31.14%; in terms of TVL, only Aptos saw a slight decline (-3.47%), while other chains saw slight increases, with Ethereum and Sui growing by 11.19% and 12.24% respectively.

· New project focus: KOR Protocol is an IP infrastructure protocol focused on entertainment content, aimed at helping creators manage, distribute, and monetize their intellectual property on-chain. BridgePort is a middleware infrastructure designed for institutional-level crypto trading, focusing on the on-chain and automation of credit allocation and settlement processes. NEXBRIDGE is a project based on El Salvador's compliance framework, issuing regulated digital assets on Bitcoin Layer 2 (Liquid Network), dedicated to connecting traditional finance with on-chain markets.

Table of Contents

1. Total Cryptocurrency Market Cap/Bitcoin Market Cap Proportion

3. ETF Inflow and Outflow Data

4. ETH/BTC and ETH/USD Exchange Rates

5. Decentralized Finance (DeFi)

7. Stablecoin Market Cap and Issuance Status

2. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Growth This Week

1. Major Industry Events This Week

2. Major Upcoming Events Next Week

3. Important Investments and Financing from Last Week

1. Market Overview

1. Total Cryptocurrency Market Cap/Bitcoin Market Cap Proportion

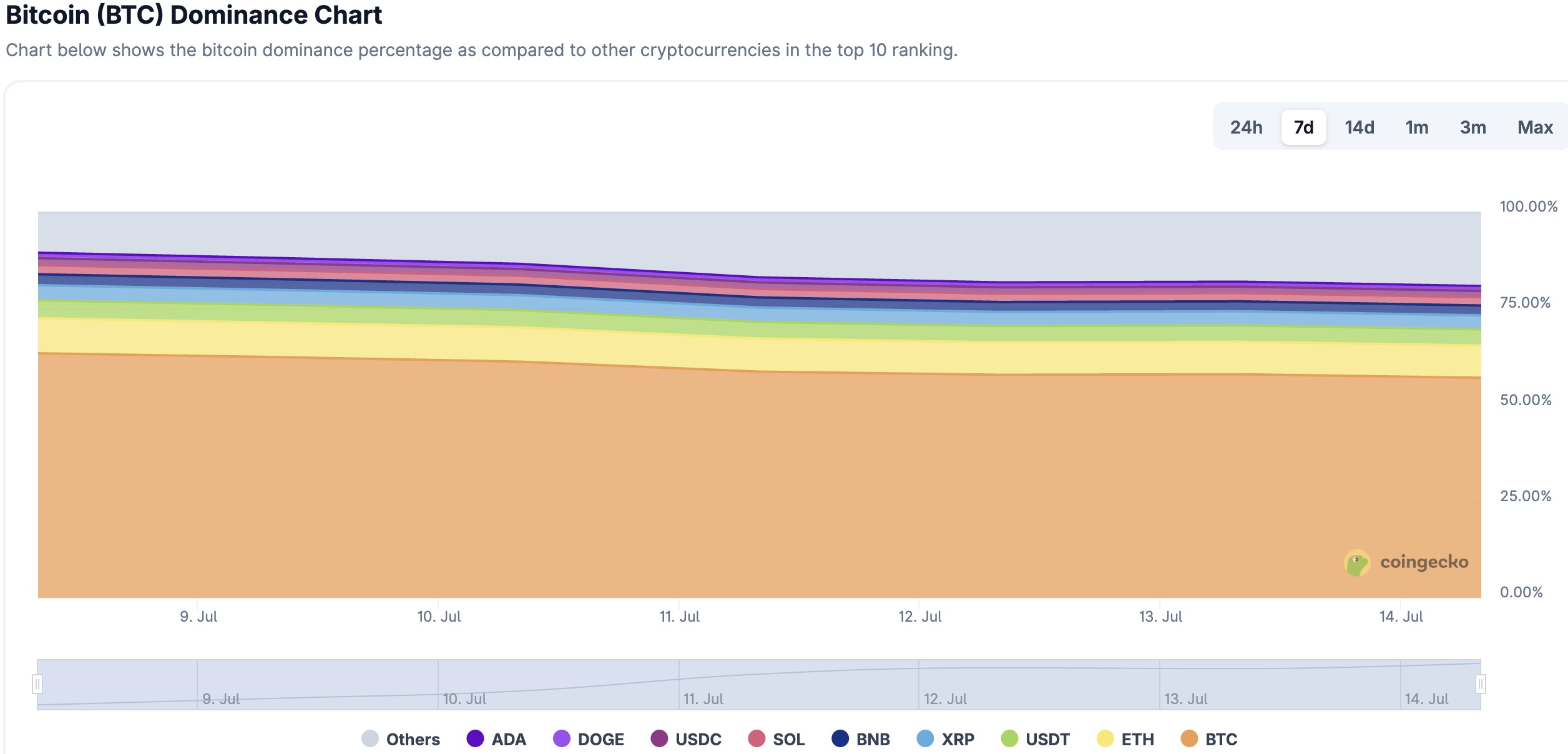

The total market capitalization of cryptocurrencies is $3.89 trillion, up from $3.45 trillion last week, representing a 12.75% increase this week.

Data Source: cryptorank

Data as of July 13, 2025

As of the time of writing, the market cap of Bitcoin is $2.36 trillion, accounting for 60.6% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $253.4 billion, accounting for 6.51% of the total cryptocurrency market cap.

Data Source: coingeck

Data as of July 13, 2025

2. Fear Index

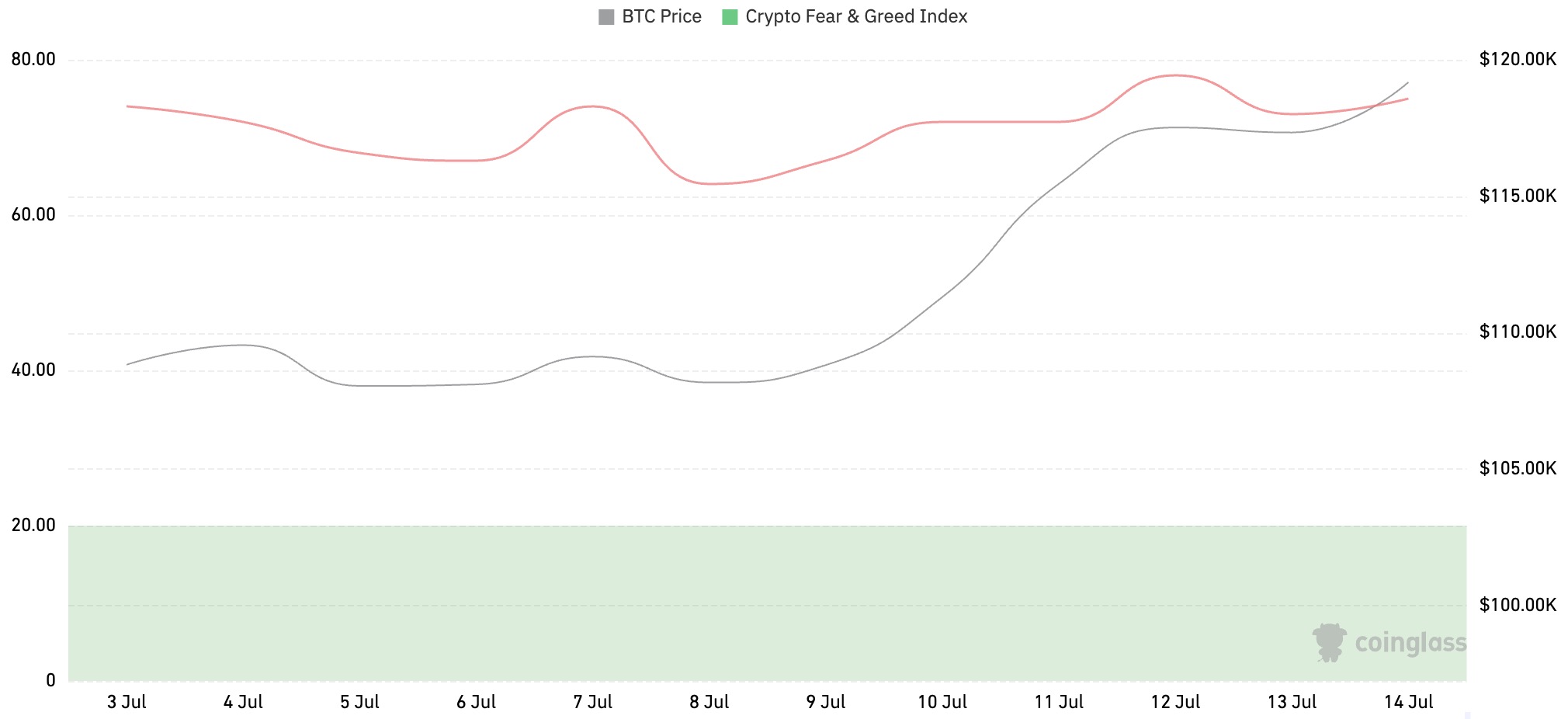

The cryptocurrency fear index is 75, indicating greed.

Data Source: coinglass

Data as of July 13, 2025

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $52.36 billion, with a net inflow of $2.72 billion this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $5.31 billion, with a net inflow of $907 million this week.

Data Source: sosovalue

Data as of July 13, 2025

4. ETH/BTC and ETH/USD Exchange Rates

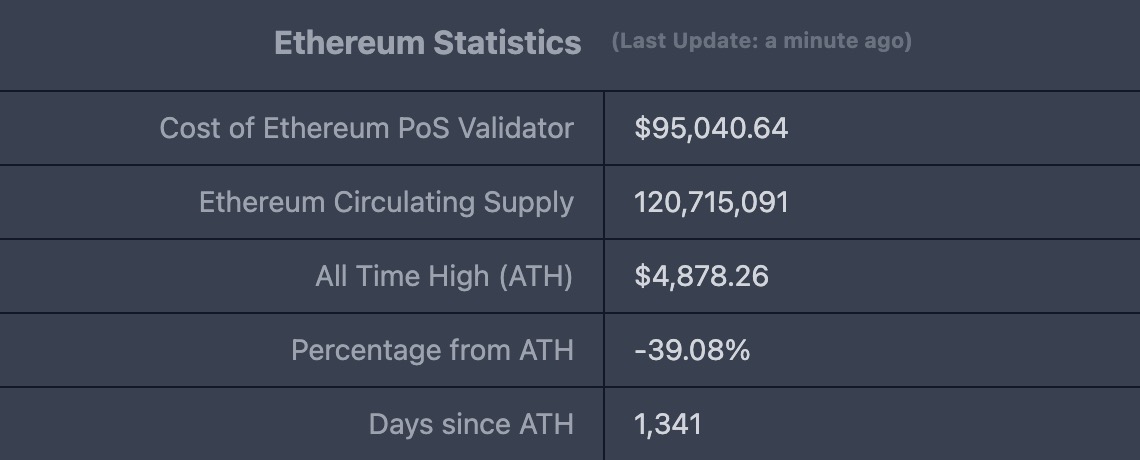

ETHUSD: Current price $2,969.58, historical highest price $4,878.26, down approximately 39.08% from the highest price.

ETHBTC: Currently at 0.024950, historical highest at 0.1238.

Data Source: ratiogang

Data as of July 13, 2025

5. Decentralized Finance (DeFi)

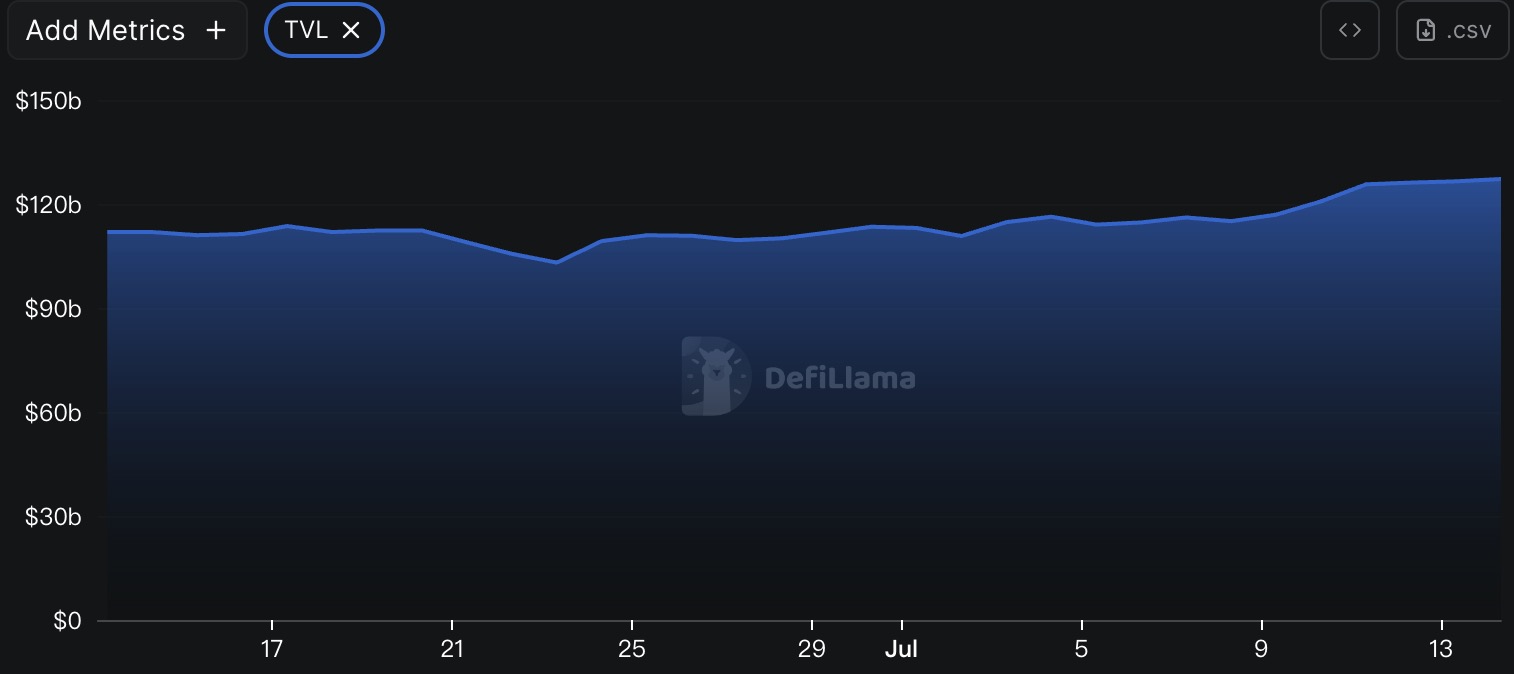

According to DeFiLlama, the total TVL of DeFi this week is $127.2 billion, up from $116.4 billion last week, an increase of approximately 9.28%.

Data Source: defillama

Data as of July 13, 2025

By public chain, the top three chains by TVL are Ethereum, accounting for 57.23%; Solana, accounting for 7.21%; and Bitcoin, accounting for 5.56%.

Data Source: CoinW Research Institute, defillama

Data as of July 13, 2025

6. On-Chain Data

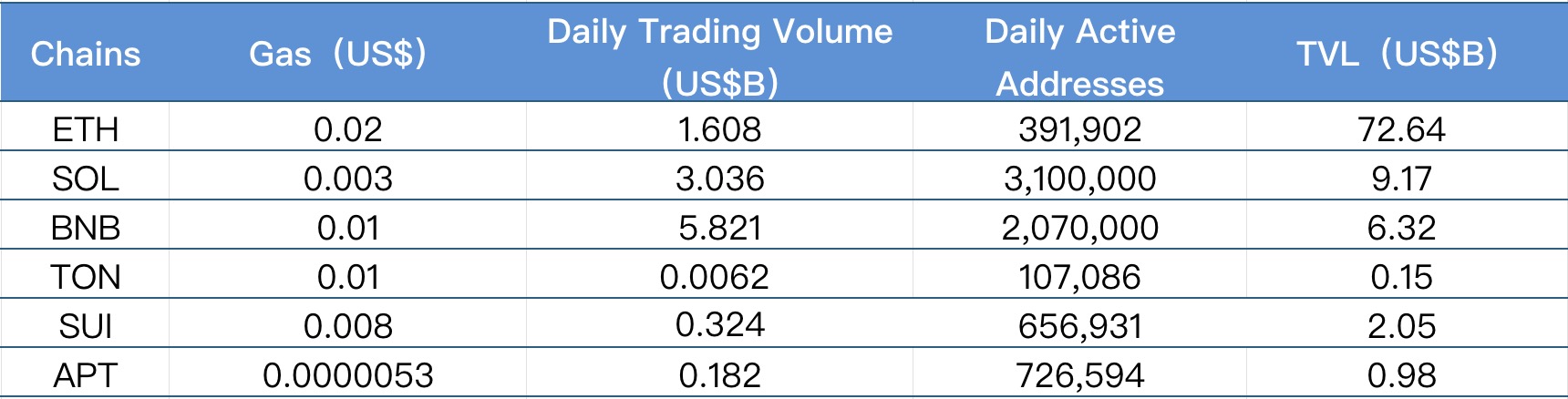

Layer 1 Related Data

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT based on daily trading volume, daily active addresses, and transaction fees.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of July 13, 2025

· Daily trading volume and transaction fees: Daily trading volume and transaction fees are core indicators for measuring the activity and user experience of public chains. This week, the daily trading volume of all public chains has increased, with Ton chain showing the most remarkable performance, increasing by 210%. Ethereum, Solana, and Sui increased by 74.78%, 76.51%, and 80% respectively, while Aptos (+7.06%) and BNB chain (+18.55%) had relatively limited increases. In terms of transaction fees, BNB and TON remained basically flat compared to last week, Aptos (+2.81%) and Solana (+6.04%) saw slight increases, Sui's increase was significant at 50%, while Ethereum's transaction fees doubled, increasing by 100%.

· Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects users' trust in the platform. This week, daily active addresses for Ethereum and Aptos increased by 9.61% and 11.47% respectively; Ton remained basically flat; Sui saw a significant decline, dropping by 31.14%; Solana and BNB experienced slight decreases of 6.63% and 3.27% respectively. In terms of TVL, only Aptos saw a slight decline (-3.47%), while other public chains achieved increases. Among them, Ethereum and Sui grew by 11.19% and 12.24% respectively, while Solana, BNB, and Ton had smaller increases of 4.98%, 3.84%, and 5.71%.

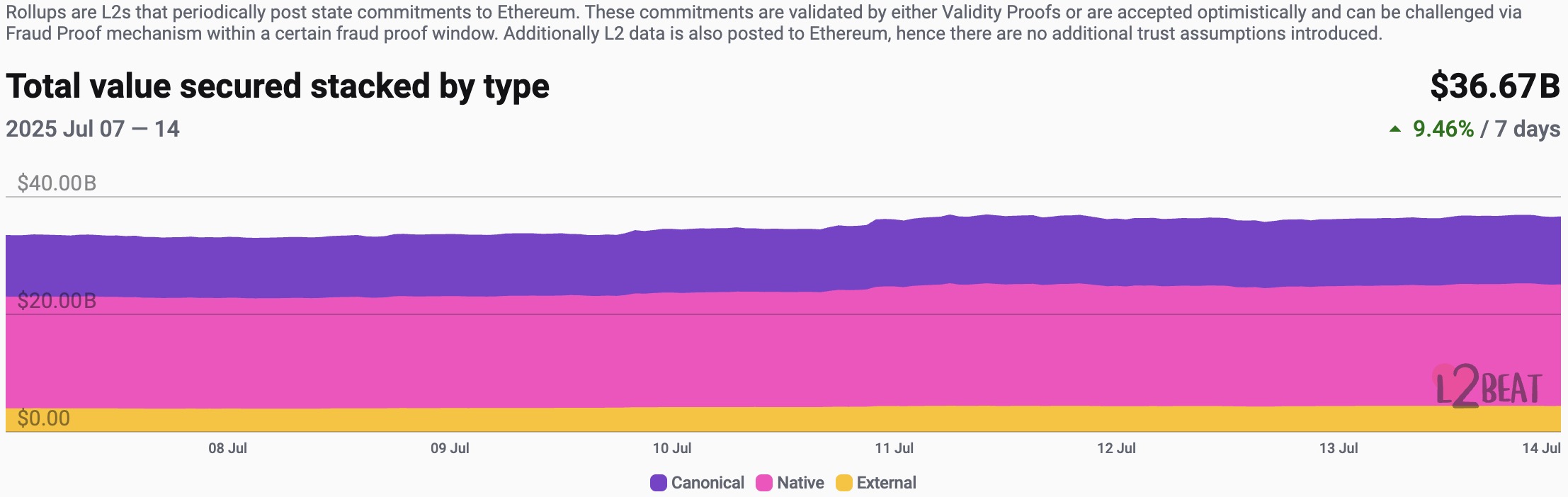

Layer 2 Related Data

According to L2Beat, the total TVL of Ethereum Layer 2 is $36.67 billion, representing a 9.46% increase from last week ($33.5 billion).

Data Source: L2Beat

Data as of July 13, 2025

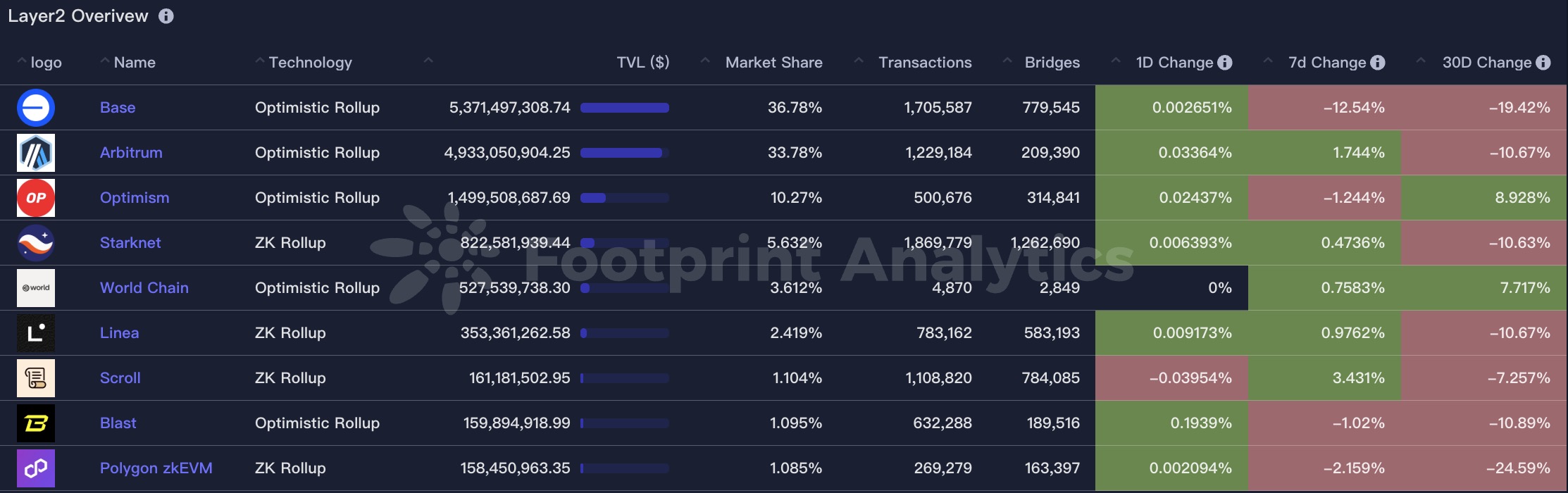

Base and Arbitrum occupy the top positions with market shares of 36.78% and 33.78% respectively, with an overall increase in their shares.

Data Source: footprint

Data as of July 13, 2025

7. Stablecoin Market Cap and Issuance Status

According to Coinglass, the total market cap of stablecoins is $253.4 billion, with USDT's market cap at $159.5 billion, accounting for 62.94% of the total stablecoin market cap; followed by USDC with a market cap of $63.6 billion, accounting for 25.09%; and DAI with a market cap of $5.36 billion, accounting for 2.12%.

Data Source: CoinW Research Institute, Coinglass

Data as of July 13, 2025

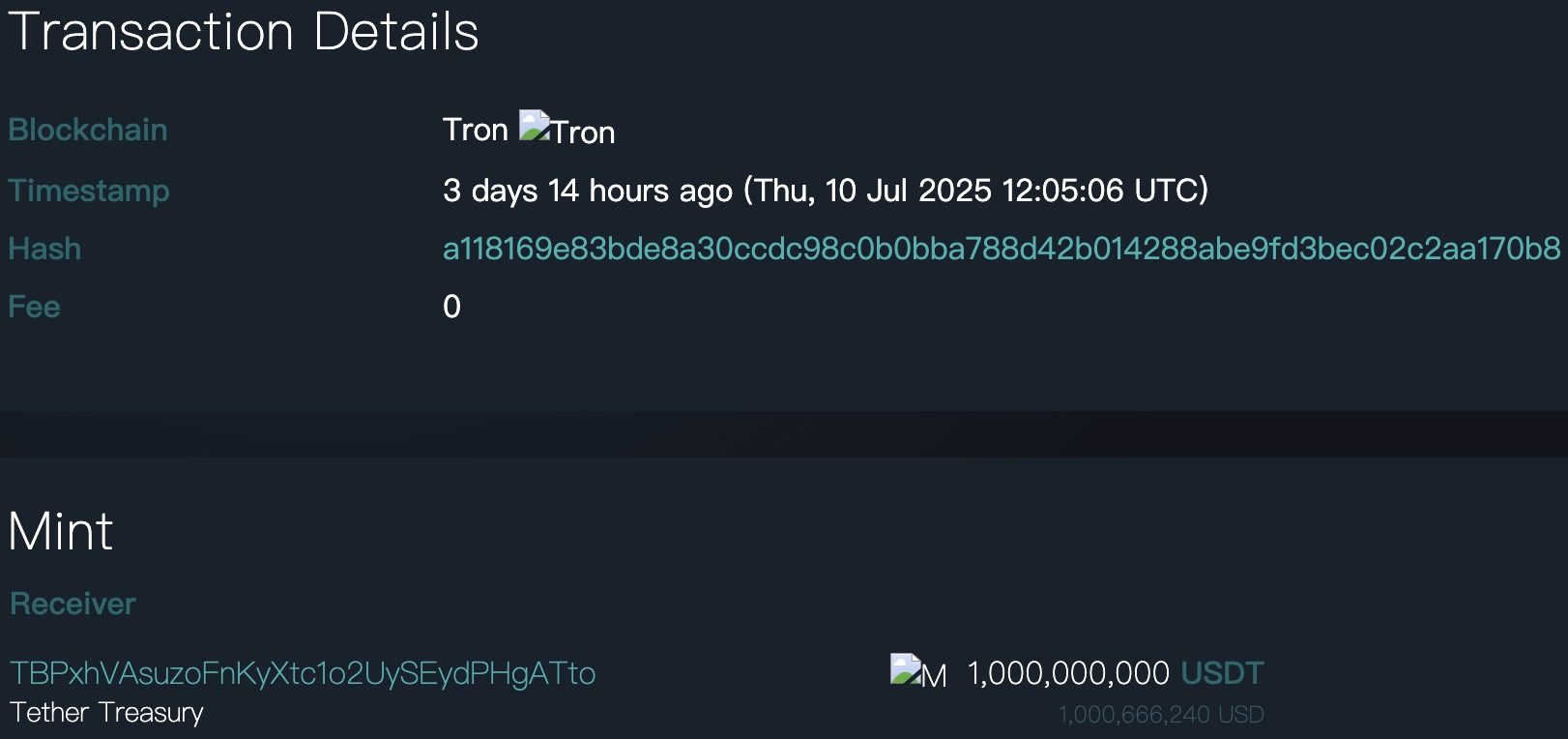

According to Whale Alert, this week the USDC Treasury issued a total of 1.373 billion USDC, while the Tether Treasury issued a total of 1 billion USDT. The total issuance of stablecoins this week was 2.373 billion, an increase of 16.32% compared to last week's total issuance of 2.04 billion.

Data Source: Whale Alert

Data as of July 13, 2025

II. This Week's Hot Money Trends

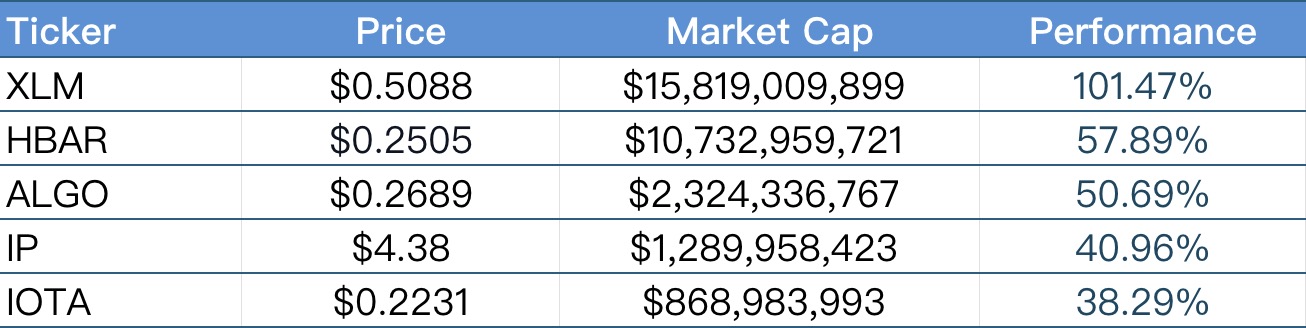

1. Top Five VC Coins and Meme Coins by Growth This Week

The top five VC coins by growth over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of July 13, 2025

The top five Meme coins by growth over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of July 13, 2025

2. New Project Insights

· KOR Protocol is an IP infrastructure protocol focused on entertainment content, aimed at helping creators manage, distribute, and monetize their intellectual property on-chain. By combining AI tools with decentralized applications, KOR Protocol creates a comprehensive on-chain entertainment ecosystem, promoting the deep integration of IP and Web3, and is committed to building the world's largest on-chain IP economic system.

· BridgePort is a middleware infrastructure designed for institutional-level crypto trading, focusing on the on-chain and automation of credit allocation and settlement processes. By connecting custodial institutions with exchanges, BridgePort has created an efficient interoperable trading network that supports the secure, real-time flow of assets within the ecosystem, achieving seamless integration and liquidity for institutional trading.

· NEXBRIDGE is a project based on El Salvador's compliance framework, issuing regulated digital assets on Bitcoin Layer 2 (Liquid Network), dedicated to connecting traditional finance with on-chain markets. Its first product is the USTBL stable asset backed by U.S. Treasury bonds, featuring custody, auditing, and redeemable mechanisms. NEXBRIDGE aims to create a secure and transparent Bitcoin-native financial market, facilitating compliant entry of institutional capital.

III. Industry News

1. Major Industry Events This Week

· BOOM launched its TGE and airdrop event on July 8 from 16:00 to 18:00 (UTC+8), with the eligibility snapshot completed on July 6. Eligible users can participate during this period. The planned total airdrop amount is 5% of the total supply (i.e., 50 million BOOM), with 40% distributed on the day of TGE and the remaining 60% released 30 days later.

· Space Nation (OIK) officially launched its TGE and airdrop event on July 8, allowing eligible users to claim 750 OIK tokens each. Additionally, the official team will launch a trading competition, giving participants a chance to share a reward pool of 5 million OIK. Space Nation is a AAA-level space exploration MMORPG, and the OIK token serves as the governance token within the game, used for various activities and transactions.

· Bedrock has confirmed that on July 9, there was a severe liquidity imbalance in the BR/USDT trading pair, causing some traders to experience significant slippage between 10:30 and 12:00 UTC. To compensate affected users, the official announcement on July 10 stated that a special one-time airdrop compensation would be provided to users who traded during this period and experienced slippage, with each wallet eligible for a maximum compensation of 200 USDT equivalent. Users who meet the criteria can claim this compensation through the Bedrock airdrop page.

· On July 9, Hyperion, the largest DEX in the Aptos ecosystem, officially launched its Genesis airdrop plan, distributing 5% of the total supply in the form of RION tokens to users who made genuine contributions in the early stages of the ecosystem, including swap traders, liquidity providers, community task participants, and early Aptos airdrop users. This distribution will be conducted in multiple phases to ensure long-term alignment of incentives and contributions.

· RCADE launched its TGE on July 9, 2025, simultaneously starting an airdrop plan to reward early interactive users and points participants. This airdrop will be distributed in phases, supporting claims across multiple platforms, and will be based on user interaction data to further promote the activity and growth of the ecological community. The project completed its token presale in early July, with a total issuance of 40 billion tokens, and a presale price of approximately 0.00075 USDT.

· On July 12, 2025, Pump.fun officially launched its native token $PUMP's TGE (Token Generation Event), publicly offering 150 billion tokens, accounting for 15% of the total supply, with an issuance price of $0.004, aiming to raise $600 million, with a valuation of up to $4 billion. All public and private sale shares will be 100% unlocked on the day of TGE, making it one of the most closely watched meme token issuance events recently.

2. Major Upcoming Events Next Week

· Sonic announced that the first season airdrop will open at random times between July 15 and 22, allowing eligible users to claim airdrop tokens on the official platform. This airdrop will be distributed in two phases, with 25% of the tokens available for immediate trading, and the remaining 75% gradually released over 270 days through locking and NFT forms, aimed at rewarding early community supporters and promoting ecological development.

· Catex (CATX) will hold its TGE event on July 16 at 15:00 UTC, with a total token supply of 100 million tokens, 25% of which will be unlocked on the day of TGE, while the remaining portion will be released in installments in the form of veCATX over 6, 12, and 24 months. The project is currently conducting IDOs through Spores Network (July 11-13) and Fount Launchpad (July 14-16), with an issuance price of $0.10. The project also plans to reserve a large proportion of tokens for community airdrops and incentive programs, focusing on governance participation and user incentives to strengthen community-oriented ecological construction.

· t3rn (TRN) will launch its IDO from July 14 to 16, 2025, with an issuance price of $0.50 and a total fundraising target of approximately $1.35 million. The sold tokens will be 100% unlocked on the day of TGE. The TGE will take place shortly after the IDO ends, with specific timing to be announced later. Previously, t3rn launched the "BRN Airdrop Plan," encouraging users to obtain BRN tokens through cross-chain transactions and community tasks on the testnet and mainnet, which can be proportionally exchanged for TRN during TGE, with an exchange cap of 5% of the total token supply. Users can verify their airdrop eligibility and check for Sybil risks using the official Airdrop Checker tool.

· Declan Fox, the project lead of Linea, stated on social media on July 12 that the team is ready to fulfill the Linea plan announced in Bangkok earlier and will release a detailed announcement later this month. When community members inquired whether this plan is related to the token generation event (TGE), Declan confirmed with a "Yes," indicating that the TGE is imminent, marking Linea's transition from the technical infrastructure phase to the token economy and ecological incentive phase, with specific details expected to be announced soon.

3. Important Investments and Financing from Last Week

· Kuru Labs announced the completion of a $11.5 million Series A funding round, led by Paradigm, with participation from angel investors including 0xDesigner, Viktor Bunin, Zagabond, Tristan Yver, Kevin Pang, Will Price, Alex Watts, Jordan Hagan, 3nes, Shreyas Hariharan, Auri, and Joe Takayama. Kuru Labs is a decentralized trading platform deployed on the high-performance Layer 1 blockchain Monad, dedicated to building a comprehensive trading infrastructure that integrates order books with automated market-making (AMM) mechanisms. (July 7, 2025)

· Swedish health longevity company H100 Group announced the completion of a total of $10.5 million (approximately 101 million Swedish Krona) in funding to expand its Bitcoin reserve strategy. This round of financing was participated in by Blockstream CEO Adam Back, UTXO Management, and several family offices, with a funding structure that includes 69.65 million Krona in equity financing and 31.35 million Krona in interest-free convertible bonds, which can be converted into shares at 1.75 Krona per share. Since first purchasing Bitcoin on May 22, H100's stock price has increased by nearly 400%. (July 9, 2025)

· Stablecoin startup Agora completed a $50 million Series A funding round, led by Paradigm, with participation from Dragonfly. Agora is launching the AUSD stablecoin, backed by cash, government bonds, and overnight repurchase agreements, and is offering white-label services that allow other institutions to issue their own branded versions of AUSD while sharing its liquidity and interoperability to promote the standardization and expansion of the stablecoin ecosystem. (July 10, 2025)

· U.S. publicly listed company Upexi Inc. (NASDAQ: UPXI) announced the completion of $200 million in financing, including $50 million in common stock and $150 million in convertible notes, led by Big Brain Holdings, with A.G.P. serving as the exclusive private placement agent. Part of this financing will be used to expand existing operations, while more funds will be invested in its Web3 strategic layout, focusing on increasing its Solana assets. The notes are supported by investors staking SOL, and after the financing is completed, Upexi's Solana holdings will increase from 736,000 to approximately 1.65 million, with plans to continue increasing its holdings in the future. (July 11, 2025)

IV. Reference Links

KOR Protocol: http://korprotocol.io

BridgePort: https://www.bridgeportmq.com/

Agora: https://www.agora.finance/

H100: https://www.h100.group/

NEXBRIDGE: https://nexbridge.io/

Upexi: https://www.upexi.com/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。