Author: Deng Tong, Golden Finance

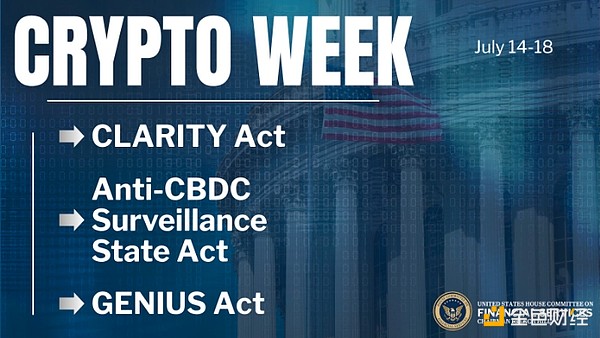

The U.S. House Financial Services Committee has announced that "Crypto Week" will begin on July 14 and end on July 18. Legislators will debate and possibly vote on three major crypto bills: the "CLARITY Act," which will define regulatory oversight of the crypto market; the "GENIUS Act," which establishes a framework for stablecoins and has been approved by the Senate; and the "Anti-CBDC Surveillance State Act," which will prohibit the creation of a U.S. central bank digital currency.

What do the three major bills say? How will they affect the cryptocurrency market? What are the views of industry insiders? What are the specific schedules for "Crypto Week"?

I. Review of the Three Major Bills

1. The CLARITY Act

The CLARITY Act is based on the "21st Century Financial Innovation and Technology Act" and is a market structure bill.

On May 29, 2025, House Financial Services Committee Chairman French Hill introduced the "Digital Asset Market Clarity Act," aimed at eliminating long-standing ambiguities in digital asset regulation by clarifying the roles of the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

On June 23, the House Financial Services and Agriculture Committees submitted the bill, which defines digital commodities as digital assets whose value is "intrinsically linked" to the use of blockchain.

The CLARITY Act requires that the value of digital commodities related to mature blockchains "primarily derives from the use and operation of the blockchain," and must not restrict or grant any user privileges, with specific holders limited to holding less than 20% of circulating units. Maturity (or expected maturity) will be a prerequisite for certain features of the bill's framework. The bill will provide exemptions from the registration requirements of the 1933 Securities Act for investment contracts involving digital commodities on mature blockchains that meet specific conditions.

The bill will allow traditional securities market participants registered with the SEC to participate in secondary market trading after notifying the CFTC (but without needing to register), provided that the regulatory oversight of both agencies is "consistent." The bill will grant the CFTC exclusive regulatory jurisdiction over any digital commodity transactions (including spot or cash markets) conducted by entities registered with or required to register with it.

More content can be found at: Focus on the CLARITY Act: Content, Significance, and Industry Evaluation

2. The GENIUS Act

On June 17, 2025, the U.S. Senate passed the landmark GENIUS Act, advancing the federal government's regulatory efforts on stablecoins.

The bill prohibits any non-"approved payment stablecoin issuer" from issuing payment stablecoins in the U.S.

The bill defines "payment stablecoins" as digital assets that maintain a fixed value through backing by fiat currency or other secure reserves.

The bill imposes federal standards on institutions approved to issue payment stablecoins, including full reserve backing requirements, reserve segregation, monthly certifications, and capital and liquidity requirements, as well as prohibiting re-hypothecation.

The bill allows state-regulated payment stablecoin issuers to issue stablecoins, provided that the applicable regulatory framework is fundamentally similar to the federal framework.

The bill grants federal banking agencies enforcement authority over approved payment stablecoin issuers, similar to the powers granted under Section 8 of the Federal Deposit Insurance Act to insured depository institutions and their holding companies and affiliates.

The bill establishes customer protection standards for those providing custodial services for approved payment stablecoins, including oversight and regulation, fund segregation, mixing prohibition standards, and monthly audit reports of statutory reserves.

The bill prohibits federal banking agencies, NCUA, and SEC from requiring custodial assets to be treated as liabilities. The bill also amends federal securities laws to clarify that payment stablecoins are not securities.

More content can be found at: GENIUS Act Passed by U.S. Senate: What Impact on the Crypto Industry

3. The Anti-CBDC Surveillance State Act

On March 25, 2025, the Senate introduced the Anti-CBDC Surveillance State Act.

It prohibits the Federal Reserve from providing certain products or services to individuals and prohibits the direct issuance of central bank digital currency.

It prohibits the Federal Reserve from indirectly issuing central bank digital currency.

Congress believes that the Federal Reserve Board does not have the authority to issue central bank digital currency or to issue substantively similar digital assets under any other name or label, and will not possess such authority unless granted by Congress under Article I, Section 8 of the U.S. Constitution.

II. Impact on Cryptocurrency Markets

1. Short-term Impact: Boosting Cryptocurrency Prices

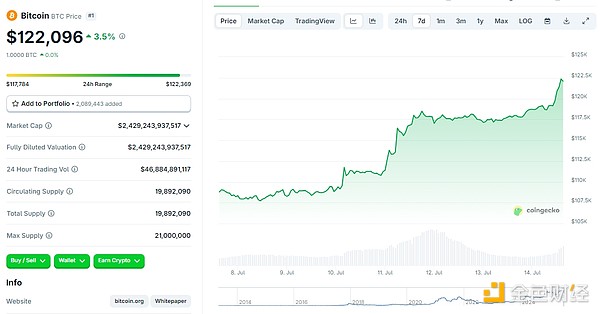

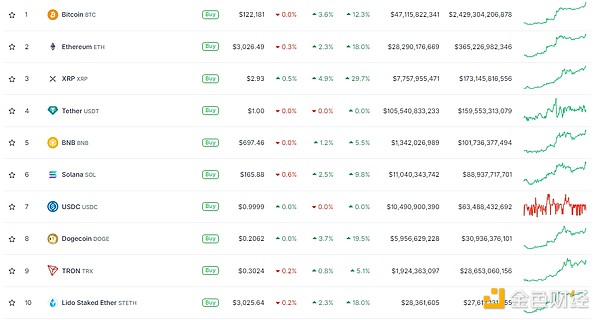

With the arrival of "Crypto Week," the crypto market has shown strong anticipation. BTC has today surpassed a new high of $122,000, currently trading at $122,096, with a daily increase of 3.5%. Other cryptocurrencies are also experiencing a broad rally.

"Crypto Week" not only brings short-term positive news to the crypto market, but in the long term, the increase in regulatory certainty will attract more institutional funds, pushing mainstream coins like Bitcoin into a "slow bull" phase. Meanwhile, segments like DeFi and NFTs may experience a wave of innovation due to the exemption clauses in the CLARITY Act.

2. Long-term Impact: Attracting Institutional Investors

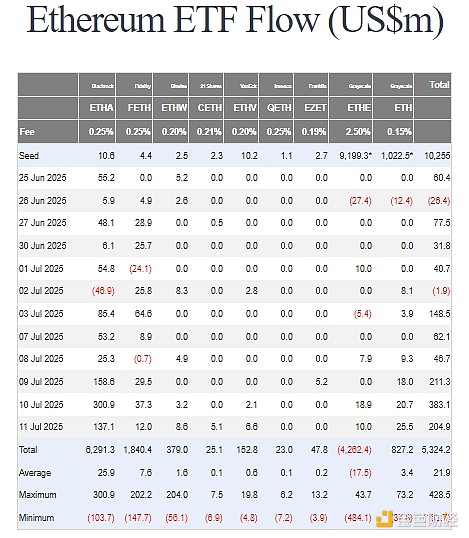

Spot Bitcoin ETFs and spot Ethereum ETFs have seen several days of consecutive net inflows:

From July 7 to July 11, Eastern Time, the Bitcoin spot ETF saw a net inflow of $2.72 billion in one week. The Bitcoin spot ETF with the highest net inflow last week was BlackRock's Bitcoin ETF IBIT, with a weekly net inflow of $1.76 billion, bringing IBIT's total historical net inflow to $54.4 billion. The second was Fidelity's ETF FBTC, with a weekly net inflow of $400 million, bringing FBTC's total historical net inflow to $12.61 billion.

The Ethereum spot ETF saw a weekly net inflow of $908 million, with all nine ETFs showing no net outflows. BlackRock's ETHA had a net inflow of $675 million, with a historical total of $6.29 billion; Fidelity's FETH had a net inflow of $87.04 million, with a cumulative total of $1.83 billion. The total net asset value of Ethereum spot ETFs is $13.53 billion, accounting for 3.77% of Ethereum's market cap. The historical cumulative net inflow has reached $5.31 billion.

The above data indicates that institutional investors are "voting with their feet," and they are optimistic about the crypto market, which will continue to drive the prices of cryptocurrencies like BTC upward in the long term.

III. Views from Industry Insiders

Chairman of the House Financial Services Committee French Hill: "We are taking historic steps to ensure that America remains the world leader in innovation, and I look forward to the House's 'Crypto Week.' After years of focused work in Congress on digital assets, we are advancing landmark legislation to establish a clear regulatory framework for digital assets to protect consumers and investors, set rules for the issuance and operation of dollar-backed payment stablecoins, and permanently prevent the creation of central bank digital currency (CBDC) to safeguard the financial privacy of Americans. I appreciate the collaboration and leadership of my congressional colleagues and the Trump administration, and I am ready to work with the Senate to advance independent market structure legislation by the end of September."

House Speaker Mike Johnson: "House Republicans are taking decisive action to fully implement President Trump's agenda on digital assets and cryptocurrencies. During 'Crypto Week,' the House looks forward to timely consideration of three landmark pieces of legislation. I appreciate the close cooperation between the Financial Services Committee and the Agriculture Committee, as well as the leadership of Chairman French Hill and GT Thompson, and I look forward to President Trump signing these bills."

Majority Leader Steve Scalise: "To fulfill President Trump's commitment to make America a global leader in the digital asset space, House Republicans will introduce three major bills during 'Crypto Week.' These pieces of legislation will further advance the President's pro-growth and pro-business agenda and provide a clear regulatory framework for digital assets. I want to thank Financial Services Committee Chairman French Hill and Agriculture Committee Chairman GT Thompson for their leadership on this issue and look forward to submitting these bills to the President."

Majority Whip Tom Emmer: "This is a historic opportunity for America. After years of effort, American innovators are one step closer to building the clear framework needed domestically while ensuring that the future of the digital economy reflects our values of privacy, personal sovereignty, and free market competitiveness. By submitting these three pieces of legislation to President Trump, we will protect the financial privacy rights of Americans and fulfill our promise to make America the capital of cryptocurrency. A new era of American excellence has finally arrived, and now is the time to get this done."

Chairman of the House Agriculture Committee GT Thompson: "I am pleased that the House will consider the CLARITY Act and other digital asset-related bills this month. As I have said before, the legislation on digital asset market structure should have been introduced long ago. In numerous hearings, roundtables, and other events, we have heard the voices of countless innovators, creators, professors, lawyers, and constituents. We have repeatedly heard calls for regulatory transparency and certainty in this ecosystem. The House Agriculture Committee and the Financial Services Committee have worked together to facilitate the passage of the CLARITY Act, and the House will soon deliver on its promise to the American people by submitting the CLARITY Act to the Senate for consideration. I appreciate the House leadership recognizing that the CLARITY Act is crucial for solidifying America's leadership in the digital asset space."

House Speaker Tim Scott: "The actions of the House mark a historic milestone in our efforts to build a clear, innovation-friendly framework for digital assets. I commend my House colleagues for advancing stablecoin legislation and look forward to seeing the GENIUS Act enacted into law. Under President Trump's leadership, we have a real opportunity to solidify America's dominant position in digital asset innovation while protecting consumer rights and maintaining financial freedom. I look forward to working with the House to push market structure legislation through the Senate and ensure that America leads the future of digital assets."

Republican Senator Cynthia Lummis of Wyoming: "For the first time in American history, we have a President who sees the value of embracing digital assets, and we are already working to leverage that. In Wyoming, we have been working for nearly a decade to embrace digital assets, and I am pleased to see the federal government beginning to follow in the footsteps of the 'Cowboy State.' On the occasion of Crypto Week, I am excited to work with Chairman Hill and Chairman Thompson to establish clear market structure rules through comprehensive stablecoin legislation and ensure that any central bank digital currency respects the privacy and financial freedom of Americans. Together, we will maintain America's competitive edge and ensure that the U.S. remains a global leader in fintech while upholding the principles that make our economy the strongest in the world."

Congressman Brian Steil: "The golden age of digital assets has arrived, and America will lead the way. Through stablecoin and market structure legislation, and by prohibiting CBDCs, we will ensure that America wins the Web3 race. This plan encourages innovation and development in American Web3 businesses, protects consumers from fraud, and allows us to outpace our competitors, ensuring that America dominates the future of blockchain technology."

Mason Lynaugh, Community Director of Stand With Crypto: "The cryptocurrency industry sees this moment as urgent and decisive. We have witnessed incredible momentum, attention, and bipartisan support for the topic of cryptocurrency."

Matthew Sigel, Head of Digital Asset Research at VanEck: "The GENIUS Act is most likely to pass, as fintech companies, banks, and internet companies are already working to launch dollar-backed tokens."

Eugene Cheung, Chief Business Officer of crypto platform OSL: "BTC could reach $130,000 to $150,000 by the end of the year."

Rachael Lucas, Analyst at Australian cryptocurrency exchange BTC Markets: "Bitcoin breaking through $120,000 is not just a milestone; it also signifies how deeply digital assets have embedded themselves in institutional portfolios. We expect altcoins to continue following Bitcoin's trend as traders diversify their portfolios and take on more risk."

In addition to "Crypto Week," other factors influencing cryptocurrency markets this month include:

President Trump's digital asset task force will release a cryptocurrency policy report on July 22, which may include a strategic Bitcoin reserve proposal.

The Federal Reserve will hold a meeting on July 30, where a rate cut is expected.

IV. Appendix: What are the specific schedules for "Crypto Week"?

Eastern Time July 14, Monday at 4:00 PM: The House Rules Committee will meet to discuss the CLARITY Act, the GENIUS Act, and the Anti-CBDC Surveillance Act.

Eastern Time July 15, Tuesday at 3:00 PM: The Senate Agriculture Committee will hold a hearing on market structure legislation.

Eastern Time July 15, Tuesday (exact time TBD): The House may hold a meeting and begin voting on the three aforementioned bills.

Eastern Time July 16, Wednesday at 9:00 AM: The House Ways and Means Committee will hold a hearing on cryptocurrency taxation.

Eastern Time July 17, Thursday: No schedule has been set yet.

Eastern Time July 18, Friday: If the House votes to advance the GENIUS Act on Tuesday, a bill may be signed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。