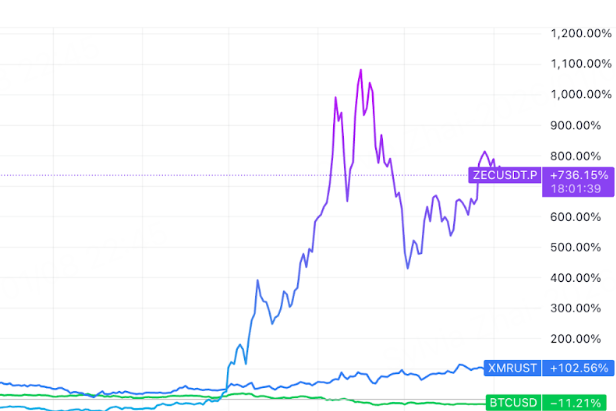

💠 DePinFi may be a more valuable form of DeFi

In the Web3 industry, everything can be Financed, and DePin is no exception.

Compared to other types of Finance, #DePinFi may be more practical, as most similar Finances are limited to financial ecological products, while the foundation of DePinFi consists of thousands of physical devices continuously performing various infrastructure tasks.

The logic of DePinFi is similar to POW. POS vs POW, POS is questioned, while POW is more supported.

The essence of DeFi is finance, and the essence of finance is to facilitate the flow of funds among various industries, institutions, and individuals in society. However, most DeFi in the Web3 industry is a circulation of funds within the Web3 industry itself.

As Aethir serves as an AI and cloud computing DePin, its main clients are enterprise-level customers, thus having relatively stable and continuous income from outside the Web3 ecosystem.

In contrast, Aethir's DePinFi has relatively stronger cost support and a higher quality of fund circulation.

💠 Aethir's DePinFi Evolution

🔹 First Generation DePinFi: Aethir Native Staking Pool

$ATH holders can participate in the native staking pool on the Aethir official website, which includes two pools: the Game Pool and the AI Pool. The total rewards for the native staking pool are fixed, with the Game Pool offering a total reward of 70 million $ATH, and the AI Pool offering approximately 434 million $ATH. The staking period for the native pool can be selected from 1 week to 4 years, with longer lock-up periods yielding higher reward multiples.

The native staking pool can earn veATH, which grants governance rights within the Aethir ecosystem and allows participation in ecological decision-making votes. However, veATH is non-transferable and non-tradable.

🔹 Second Generation DePinFi: Aethir + EigenLayer

Aethir's collaboration with EigenLayer represents the second generation of DePinFi.

Aethir's GPU computing network will be integrated as an AVS (Autonomous Verification Service) into the EigenLayer ecosystem.

EigenLayer users staking $ATH can earn returns from the AVS. The staking period is fixed until June 13, 2026, with uncertain yields. However, staking $ATH allows for a 1:1 exchange for e$ATH, which can be transferred and traded.

Currently, a total of 823 million $ATH is staked on EigenLayer, approximately equivalent to a TVL of $23 million.

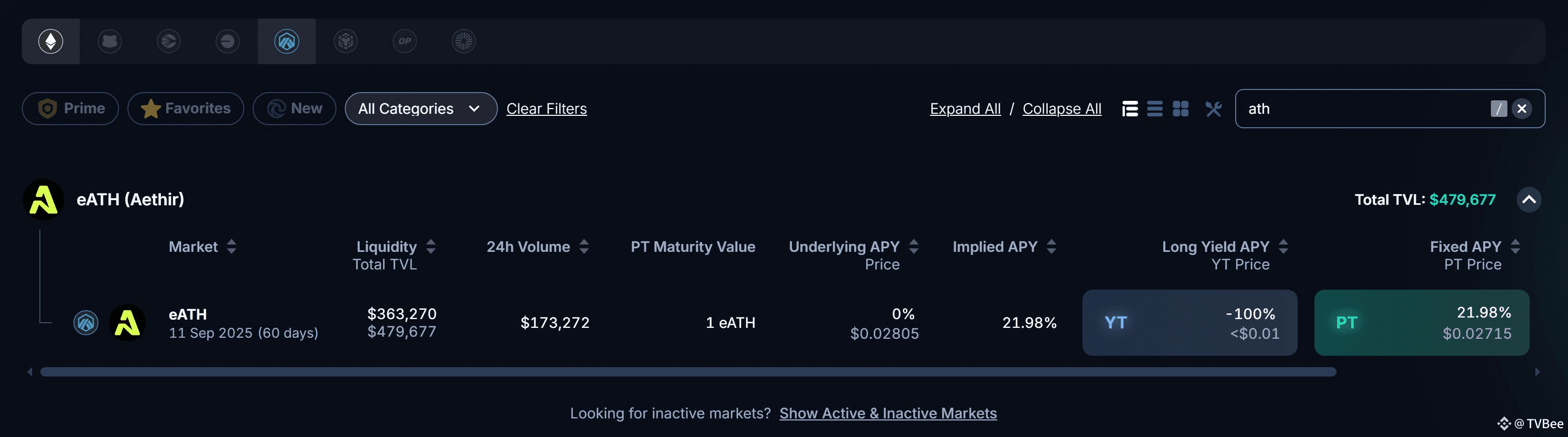

🔹 Third Generation DePinFi: Aethir + Pendle

Recently, Aethir partnered with Pendle to push DePinFi into the realm of third-generation financial derivatives.

The third generation of DePinFi is a further development based on the second generation.

Users staking $ATH on EigenLayer receive $eATH, which can be converted to $SY-eATH on the Pendle platform, and then split into $PT-eATH and $YT-eATH.

Among these, $PT-eATH is the principal token, and its price will be lower than the redemption value of $eATH at maturity, implying a stable yield.

$YT-eATH is a standardized yield token, with returns derived from market expectations of future earnings from $eATH, while also carrying certain risks and corresponding risk returns.

$PT-eATH is akin to the shovel itself, with a fixed annualized yield of 21.98%.

The value of $YT-eATH comes from the mining returns of the shovel, specifically from the AVS.

Aethir + Pendle creates many DePinFi gameplay options.

✦ Risk Play

Splitting $eATH into PT and YT, selling PT for $eATH, and splitting again into PT and YT… This allows for holding more $YT-eATH, thus having the opportunity to gain more risk returns.

✦ Conservative Play

The conservative play is the opposite of the risk play, splitting $eATH into PT and YT, selling YT for $eATH, and splitting again into PT and YT… This allows for holding more $PT-eATH, thus achieving stable returns with lower risk.

✦ Hedging Play

The hedging play is a method of adjusting the ratio of PT to YT holdings. When expecting a decline in yield, reduce the proportion of YT and increase the proportion of PT to mitigate losses from the yield decline. Conversely, when expecting an increase in yield, increase the proportion of YT and decrease the proportion of PT to better capture additional returns from the yield increase, maximizing portfolio returns.

✦ Liquidity Play

Using $eATH to add liquidity to earn trading fee income. $eATH's YT and PT cannot be traded directly, only with $eATH or $SY-eATH.

✦ Arbitrage Play

There may be arbitrage opportunities between the relative price fluctuations of PT/YT.

……

According to Pendle data, within just one month of launch, the TVL of $eATH is nearly $480,000, with a 24-hour trading volume of $173,000.

Currently, YT has no yield because Aethir's AVS on EigenLayer is still under construction. Once the AVS is launched, YT will have real-time yields.

💠 Final Thoughts

In Web3, two project logos combined on a poster can establish a partnership, yet most do not represent true collaboration.

Aethir is different; every collaboration is a substantial partnership in technology, products, or ecosystems.

Aethir + Layerzero technically transforms $ATH into a cross-chain asset, transitioning node rewards from Arbitrum to a multi-chain ecosystem, which is crucial for Aethir's nodes.

Aethir + Filecoin merges distributed GPU infrastructure with decentralized storage, creating new decentralized computing and storage solutions.

Token terminal + Token terminal connects data from the DePin ecosystem to a platform, providing a blueprint for acquiring and analyzing on-chain data.

Aethir + Avalanche/Solana/… brings AI computing resources to various public chains.

Aethir + Reality/Beamable/… provides cloud gaming infrastructure for various gaming ecosystems.

……

Aethir + EigenLayer jointly launches EigenLayer ATH staking in the ecosystem. Aethir's GPU computing verification infrastructure is integrated as AVS into EigenLayer, allowing users to stake $ATH on the EigenLayer platform and earn AVS rewards.

Aethir + Pendle further deepens DePinFi products, splitting ATH staking tokens into low-risk principal tokens and standardized yield tokens, providing ATH investors with more on-chain financial products to mitigate risks and increase returns without increasing financial leverage.

Aethir can be said to have opened a new chapter in the history of DePinFi, establishing a leading model for the development of DePinFi.

However, not all DePin products can be modeled after Aethir; truly valuable infrastructure has clients, demand, and sources of income, which are key to DePinFi.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。