Written by: Matt Hougan, Chief Investment Officer of Bitwise

Translated by: Luffy, Foresight News

Want to know why Bitcoin hit an all-time high last week?

There are many reasons, including sustained demand from institutional investors and corporate treasuries. But one reason that hasn't been widely reported is that this week is "Crypto Week" in Washington, and you will see a lot of pro-cryptocurrency news in the coming days.

This is not made up. On July 3, the U.S. House of Representatives issued a little-reported but significant press release officially declaring the week of July 14 as "Crypto Week," promising to advance three key cryptocurrency bills:

- The GENIUS Act: A clear regulatory framework for stablecoins

- The CLARITY Act: A comprehensive framework for regulating crypto assets

- Anti-CBDC Surveillance National Act: A bill prohibiting the creation of a central bank digital currency in the U.S.

The GENIUS Act has already passed in the Senate, so if it passes smoothly in the House, it will be sent to the President for signing, potentially becoming the first major cryptocurrency legislation in U.S. history.

The CLARITY Act and the Anti-CBDC Act still need Senate approval, but the passage of either bill in the House would be a significant milestone.

Why This Is So Important for Cryptocurrency

I firmly believe that once the U.S. passes supportive cryptocurrency legislation, it will significantly drive growth in the crypto industry while reducing risks.

The logic for growth is clear and widely discussed. Clear cryptocurrency legislation will better incentivize large financial institutions to engage in the crypto space, bringing billions of dollars in investment to crypto assets and guiding trillions of dollars in traditional assets onto blockchain rails. If you've ever wondered what would happen if JPMorgan, BNY Mellon, and Nasdaq could freely operate in the cryptocurrency space, you are about to find out.

But I believe the greater development of this legislation is its impact on risk and how it will change the way crypto assets are traded in the future.

One of the biggest resistances facing cryptocurrency is its history of constant collapses: FTX, Luna, Three Arrows Capital, Genesis, Celsius, QuadrigaCX, BitConnect, Mt. Gox.

Each failure has had a massive impact on the cryptocurrency industry and diminished investor confidence. And each failure has largely occurred due to the lack of clear regulation in cryptocurrency.

If clear regulations allow for safer exchanges to operate domestically in the U.S., then offshore exchanges like FTX would never thrive, as they lack internal controls and have rough audits.

If large banks could custody crypto assets, investors would not shy away from cryptocurrency due to custody issues.

If we had legislation like the GENIUS Act, then Ponzi stablecoins like Luna would never exist.

Of course, examples from traditional finance prove that clear rules cannot eliminate all scandals: the Bernie Madoff fraud case and a series of violations by Credit Suisse were not prevented by rules. But rules can indeed play a significant role.

One challenge that deters investors is that we often witness significant drops in Bitcoin and other crypto assets. Bitcoin has been the best-performing asset globally over the past 15 years, but it has also experienced seven declines of over 70%.

For professional investors, buying an asset that could plummet 70% due to an unexpected scandal from an unregulated offshore platform is a tough sell. As Washington weighs these cryptocurrency bills, I believe the likelihood of such scandals occurring will sharply decline.

Strong cryptocurrency legislation will not eliminate market volatility, but I dare say that if the bills pass, we may never see a drop of over 70% in cryptocurrency again.

Why I’m Not Worried About the Future of Crypto Policy

One question people always ask about cryptocurrency legislation is: Aren't you worried that the next administration will reverse these gains?

My answer is: Not worried.

Contrary to media reports, cryptocurrency is one of the few policy issues that has bipartisan support. The GENIUS Act passed the U.S. Senate with a vote of 68 to 30, with 18 Democratic senators voting in favor. It is one of the most bipartisan consensus bills in the 2025 congressional session.

There are many reasons for bipartisan support, including the widespread popularity of cryptocurrency among young voters. But perhaps the most important reason is the support from the U.S. financial industry—traditionally, the financial sector is a major source of funding for the Democrats, and they are eager to seize growth opportunities in the crypto space.

This economic motivation leads me to believe that Washington's support for cryptocurrency is sustainable in the long term. As more investors and companies enter the space, it will become increasingly difficult for politicians to oppose cryptocurrency.

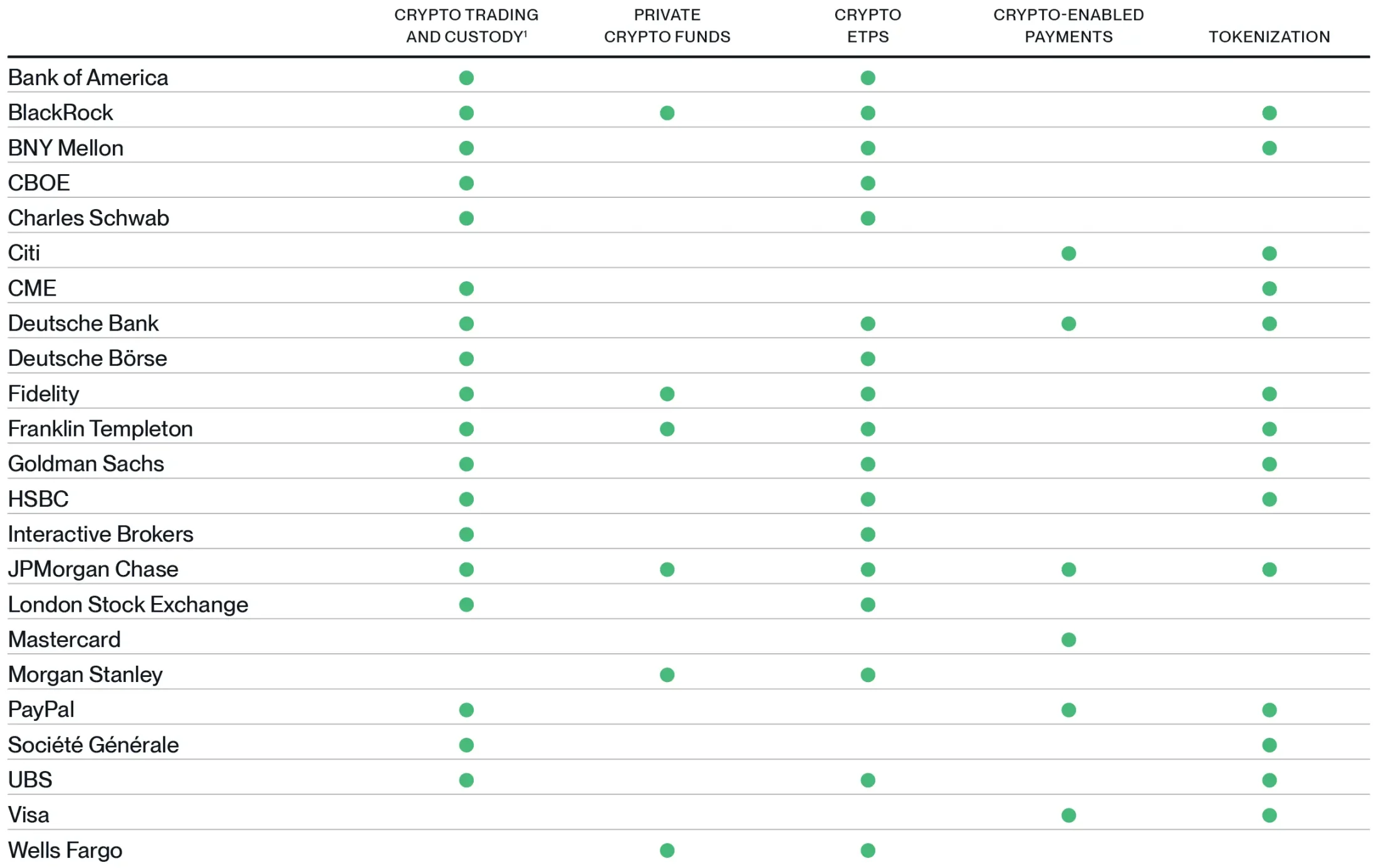

Think about it: today, almost all major financial institutions in the U.S. are involved in cryptocurrency to some extent. If BlackRock, JPMorgan, and Morgan Stanley, along with thousands of American companies and millions of Americans, have made significant investments in cryptocurrency, it will be hard for politicians to change course.

Institutional Adoption of Cryptocurrency

Source: Bitwise Asset Management, data as of June 30, 2025. "Cryptocurrency trading and custody" includes trading of cryptocurrency spot, futures, and derivatives.

In other words: once the genie is out of the bottle, it cannot be put back. If these bills pass Congress during "Crypto Week" and are ultimately signed into law, we will enter a new era.

Cryptocurrency is moving into the mainstream, risks are continuously decreasing, and Wall Street is making a big push into the space.

No wonder Bitcoin has hit an all-time high.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。