Original Title: "Is Linea Finally Going to TGE? A Look at the Life and Death of the Layer 2 Unicorn Over 900 Days"

Original Author: White55, MarsBit

From a darling of tens of millions in traffic to a silent valley, a trust crisis and ecological redemption triggered by a token delay.

In July 2023, when Linea, a Layer 2 network under ConsenSys, made a strong debut with the traffic of MetaMask's 30 million monthly active users, the entire crypto world took notice. In the first week of the mainnet launch, cross-chain ETH transactions exceeded 11,000, with over 65,000 independent addresses, and ecological projects quickly surpassed a hundred. At that time, Linea was seen as the number one challenger to disrupt the dominance of Arbitrum and Optimism, thanks to its zkEVM full compatibility and ConsenSys's backing of $726 million in financing.

However, just a year later, this star project found itself deeply mired in a user trust crisis. In January 2024, during a large-scale account theft incident involving the Adspower fingerprint browser, hackers specifically targeted Linea addresses, resulting in losses of up to $5 million. The angry community pointed fingers at the project team: "PUA for so long without TGE, giving hackers an opportunity!" At that time, Linea's ecological TVL stagnated, developer activity sharply declined, and the once-glorious aura gradually dimmed amid the long-awaited token generation event (TGE).

I. A Shining Start: The Layer 2 Aristocrat Born with a Silver Spoon

The direct lineage of ConsenSys provided Linea with an unparalleled inherent advantage. Founded in 2014 by Ethereum co-founder Joseph Lubin, ConsenSys not only boasts MetaMask, the world's largest Ethereum gateway (with over 30 million monthly active users in 2022), but also has built a complete developer matrix including Infura, Truffle, and Codefi. This ecological synergy was evident during Linea's testing phase:

- The public testnet launched in March 2023, processing 46 million transactions within just a few weeks, attracting 5.5 million independent wallets.

- The seamless development migration experience allowed developers to deploy DApps without rewriting contracts, natively integrated with ConsenSys infrastructure.

- An enterprise-level security architecture created a "frictionless" user experience through designs like malicious website scanning and transaction double confirmation.

In terms of technical positioning, Linea chose to become a Type 2 zkEVM—achieving exponential improvements in transaction verification efficiency through zero-knowledge proofs while fully maintaining Ethereum Virtual Machine compatibility. Although this route sacrificed some performance, it significantly lowered the migration threshold for developers, becoming key to its early ecological explosion.

II. Trust Collapse: Ecological Collapse Triggered by Delayed Token Release

Despite impressive technical performance, Linea's token economic model remained unresolved for a long time, laying the groundwork for subsequent crises. At the end of 2023, when competitors like Arbitrum and Optimism distributed tens of millions of tokens through short-term incentive programs (Arbitrum distributed 50 million ARB in a single round) to stimulate their ecosystems, Linea only maintained user expectations with the "Voyage XP" points system, lacking substantial incentives.

The Adspower security incident in January 2024 became a turning point for trust. Hackers exploited a vulnerability in the fingerprint browser API to precisely loot high-quality wallets on the Linea chain. The community's anger was directed at the project team: "It's been two years and you're still making empty promises! Without TGE, where's the security budget?" The deeper contradictions included:

- Ecological projects fell into a liquidity crisis: The leading lending protocol LineaBank had a deposit APY of only 4%, far below mainstream Layer 2 counterparts.

- Developers continued to flee: The number of newly deployed contracts in Q1 2024 decreased by 37% month-on-month, with social and gaming applications nearly stagnant.

- "Vampire attacks" intensified: New Layer 2 projects like Blast siphoned off Linea's existing users with higher airdrop expectations.

At this point, Linea had become a typical cautionary tale of "a top student in technology, but a failing student in tokens."

III. Silent Evolution: Technical Self-Rescue and Ecological Reconstruction Amid Crisis

Faced with the collapse of community trust, the Linea team chose a path of technical deepening rather than hastily launching tokens for redemption:

Breakthrough in Modular Proof Systems

They promoted the implementation of a "Multi-Prover" architecture, allowing three independent Layer 2s to jointly verify transactions, ensuring network security even in the event of a single point of failure. This design directly addressed the verification vulnerabilities exposed by previous security incidents.

Challenging Performance Limits

The mainnet was upgraded to Beta v2, integrating "Limitless Prover" technology, aiming to become the "highest-performing EVM-compatible Layer 2." The testnet TPS exceeded 300, a 15-fold increase from the initial version.

Trial of Economic Incentives

In June 2024, they launched the "Surge" liquidity program:

Users depositing assets equivalent to ≥$24 could earn LXP-L points, clearly linked to future token distribution.

They introduced a points decay mechanism (reducing by 10% each period) to stimulate early participation.

In the first week, the locked amount surged to $420 million, releasing long-suppressed airdrop expectations.

IV. Countdown to Rebirth: The Final Chapter of Token Economics and Ecological Ambitions

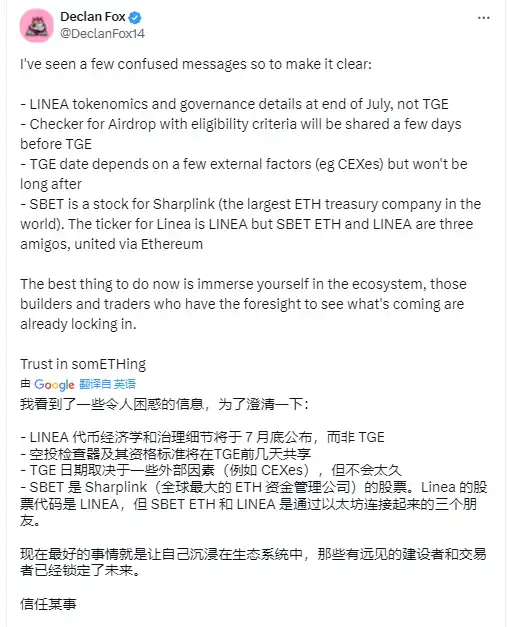

On July 14, 2025, a statement from project leader Declan Fox finally brought a conclusion to the long wait:

The token economic model would be released at the end of July: clarifying the distribution mechanism of 1 trillion LINEA tokens, with 33% released at TGE (including 18% private placement and 15% public sale).

Airdrop eligibility would be made transparent: a query tool would be launched a few days before TGE to verify the rights of early contributors.

CEX would dominate the issuance rhythm: the listing schedule of exchanges like Binance would become a core variable in the final timeline for TGE.

Even more intriguing is the proposed concept of the "Ethereum Three Musketeers":

LINEA will form a strategic triangle with ETH and Sharplink stock (SBET). SBET, as the largest ETH reserve publicly listed company (recently acquiring 10,000 ETH from the Ethereum Foundation), will serve as a bridge connecting traditional capital with the crypto ecosystem.

This layout suggests that Linea is transitioning from a purely technical scaling solution to a pillar of Ethereum's financial infrastructure. If SBET injects its ETH reserves into the Linea ecosystem, it could instantly activate billions of dollars in liquidity.

V. The Unfinished Battle: The Three Life-and-Death Trials of Layer 2's Final Game

Although dawn is breaking, Linea's path to revival is still fraught with thorns:

The Trust Cost of Airdrop Games

While the LXP-L points from the "Surge" plan stimulated TVL growth, an ecosystem overly reliant on airdrop expectations is like a liquidity dam—once the token release falls short of expectations, it could trigger a stampede of capital fleeing. Previously, Arbitrum's STIP plan saw APY plummet due to concentrated token sell pressure, and Linea needs to design a more refined release curve.

Dimensional Strikes in the Modular War

OP Stack and Arbitrum Orbit have already built a Layer 3 ecological matrix:

- OP Stack attracts institutional chains like Coinbase Base and opBNB, forming a "super chain" network effect.

- Arbitrum Orbit supports development in non-Solidity languages like Rust, breaking through the EVM developer ceiling.

- Linea's Multi-Prover needs to prove its substantial competitiveness in cross-chain interoperability.

Regulatory Gray Rhino

With SBET, a Nasdaq-listed company, participating in the "Three Musketeers" alliance, Linea faces the infiltration of traditional financial regulation. If the U.S. SEC includes Ethereum staking services under securities regulation, Linea's institutional liquidity strategy may encounter compliance challenges.

Epilogue: The Second Curve of Trust

The 900-day rise and fall of Linea reflects a collective shift in the Layer 2 track from technological idealism to economic realism. When Declan Fox wrote "Trust in somETHing" at the end of his tweet, this pun hinted at a call for faith in Ethereum, as well as a metaphor for ecological reconstruction.

In the Layer 2 battlefield post-Cancun upgrade, performance barriers have been leveled, and token economics and ecological synergy have become the true moats.

With the unveiling of the token economics at the end of July, Linea will face its last chance for redemption—this time, it needs to prove that it is not only a technical masterpiece of ConsenSys but also an economic organism capable of supporting billions of dollars in liquidity. If successful, the competition in Layer 2 will shift from a TPS number game to a multi-dimensional war of institutional liquidity, developer culture, and community governance. The second half of the epic of Ethereum's scaling is just beginning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。