This is an extremely clever asymmetric strategy. The United States is leveraging its opponent's weakest link: the fear of losing control, to build its own moat.

I. The Ghost of History: The Digital Return of the East India Company

History does not simply repeat itself, but it does rhyme. As Trump happily signed his name on the "GENIUS Act" document, memories of history flooded my mind—specifically, the commercial giants of the 17th and 18th centuries, the Dutch and British East India Companies, which were granted sovereign powers by their respective nations.

This act appears to be merely a technical adjustment in financial regulation, but its deeper implication is that it is issuing a charter for the "new East India Company" of the 21st century, marking the beginning of a transformation that will reshape the global power structure.

1a. The Charter of New Power

Looking back four hundred years, the Dutch East India Company (VOC) and the British East India Company (EIC) were not ordinary trading firms. They were hybrids of merchants, soldiers, diplomats, and colonizers, empowered by state authorization. The Dutch government granted the VOC powers including: recruiting armies, issuing currency, signing treaties with other monarchs, and even waging war. Similarly, Queen Elizabeth I granted the EIC a royal charter that allowed it to monopolize trade in India and establish military and administrative functions. These companies were the earliest multinational corporations in history, controlling not just simple goods, but defining the lifeblood of globalization in that era—maritime trade routes.

Today, what the "GENIUS Act" does is, in legislative form, grant legitimacy to the new power brokers of the era—stablecoin issuers. On the surface, the act aims to regulate the market and prevent risks by setting reserve standards and requiring asset certification. However, its true effect is to create a "legitimate" oligopoly of stablecoin issuers recognized by the U.S. government through screening and certification. These "crowned" companies, such as Circle (USDC issuer), the future Tether (if it chooses compliance), and internet giants like Apple, Google, Meta, and others with billions of users, will no longer be the wild-growing crypto rebels but will be formally incorporated into the U.S. financial strategic landscape as "chartered companies." They will control the new era's global trade routes—24/7 uninterrupted, borderless digital financial tracks.

1b. From Trade Routes to Financial Tracks

The power of the East India Companies was rooted in their monopoly over physical trade routes. They ensured the exclusive rights to spice, tea, and opium trade through gunboats and fortresses, reaping enormous profits. The "digital East India Company" of the new era will exercise power by controlling the financial tracks of global value flows. When a dollar stablecoin regulated by the U.S. Treasury or specific agencies becomes the default settlement unit for global cross-border payments, DeFi (decentralized finance) lending, and RWA (real-world asset) transactions, its issuer will hold the power to define the rules of the new financial system. They can decide who can access this system, freeze assets of any address based on directives, and set compliance standards for transactions. This is a deeper, more intangible power than controlling physical routes.

1c. The Ambiguous Symbiosis and Confrontation with the State

The history of the East India Companies is an epic of evolving relationships with their mother countries. Initially, they were agents of state mercantilism, engaging in strategic games against competitors (like Portugal). However, the profit-seeking nature of the companies quickly inflated them into independent power centers. For profit, the EIC did not hesitate to wage wars (like the Battle of Plassey) and engage in unethical trades (like the opium trade), repeatedly dragging the British government into unwanted diplomatic and military quagmires. Ultimately, when the company neared bankruptcy due to mismanagement and overexpansion, it had to seek state assistance, leading the government to gradually strengthen regulation through a series of acts (like the Tea Act of 1773 and the Pitt's India Act of 1784), culminating in the complete revocation of its administrative powers after the Indian Rebellion of 1858, bringing its territories under direct royal rule.

This history foreshadows the potential dynamic relationship between future stablecoin issuers and the U.S. government. Currently, these companies are seen as strategic assets promoting dollar hegemony and countering China's digital yuan. However, once they grow into "too big to fail" global financial infrastructures, their institutional interests and shareholder demands will become crucial. They may make decisions that contradict U.S. foreign policy for commercial interests.

This suggests that when the dollar stablecoin system issued by private entities becomes too large, it will inevitably conflict with national sovereignty, and we are likely to see an upgrade of stablecoin legislation based on interest games.

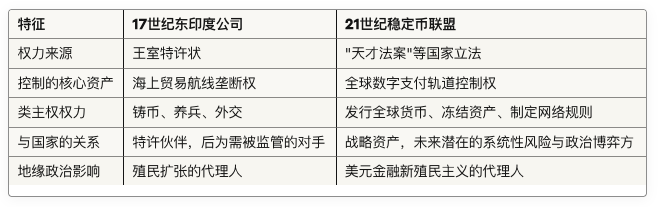

The following table clearly compares these two power entities across time and space, revealing the astonishing similarities in history:

The ghost of history has returned. Through the "GENIUS Act," the United States is unleashing a new East India Company. It is cloaked in the guise of technological innovation, wielding the scepter of blockchain, but its core is the ancient logic of commercial empires—a global private enterprise sovereignty authorized by the state, ultimately vying for power with the state.

II. The Global Currency Tsunami: Dollarization, Great Deflation, and the End of Non-Dollar Central Banks

What the "GENIUS Act" spawns is not only a new power entity but also a currency tsunami that will sweep across the globe. The energy of this tsunami originates from the collapse of the Bretton Woods system in 1971. That historic "liberation" paved the way for today's global conquest of dollar stablecoins. For countries with already fragile sovereign credit, the future will no longer be about whether the government chooses its own currency or traditional dollars, but rather about the public choosing between a collapsing local currency and an easily accessible, frictionless digital dollar. This will trigger an unprecedented wave of super dollarization, completely ending the monetary sovereignty of many countries and bringing them devastating deflationary shocks.

2a. The Ghost of the Bretton Woods System

To understand the power of stablecoins, one must return to the moment of the Bretton Woods system's dissolution. This system pegged the dollar to gold, with other currencies pegged to the dollar, forming a stable structure anchored by gold. However, this system contained a fatal contradiction known as the "Triffin Dilemma": as the global reserve currency, the dollar had to continuously flow into the world through U.S. trade deficits to meet the demands of global trade development; yet, persistent deficits would undermine confidence in the dollar's ability to be exchanged for gold, ultimately leading to the system's collapse. In 1971, President Nixon closed the gold window, declaring the system's death.

However, the death of the dollar marked the beginning of its rebirth. Under the subsequent "Jamaica System," the dollar was completely decoupled from gold, becoming a purely fiat currency. It was liberated from the "chains of gold," allowing the Federal Reserve to issue currency more freely to meet domestic fiscal needs (such as expenses from the Vietnam War) and global demand for dollar liquidity. This laid the foundation for the past half-century of dollar hegemony—a hegemonic system that relies on global network effects and the comprehensive national power of the United States. Stablecoins, especially those recognized by U.S. law, represent the ultimate technological form of this post-Bretton Woods system. They elevate the dollar's liquidity supply capability to a new dimension, enabling it to bypass the regulatory layers of various governments and the traditional, slow, and costly banking system, directly penetrating every capillary of the global economy and into the hands (or phones) of individuals.

2b. The Arrival of Hyper-dollarization

In countries like Argentina and Turkey, which have long suffered from high inflation and political turmoil, the public spontaneously exchanges their local currency for dollars to preserve their wealth, a phenomenon known as "dollarization." However, traditional dollarization faces many obstacles: you need a bank account, you must deal with capital controls, and you bear the risks of holding physical currency. Stablecoins completely dismantle these barriers. Anyone with a smartphone can, in seconds and at a very low cost, exchange their soon-to-devalue local currency for a dollar-pegged stablecoin.

In Vietnam, the Middle East, Hong Kong, Japan, and South Korea, U-stores are rapidly replacing traditional exchange shops, Dubai real estate offices are beginning to accept Bitcoin payments, and small shops in Yiwu can now use U to buy cigarettes.

These pervasive payment penetrations will transform the dollar stablecoinization from a gradual process into an instantaneous tsunami. When inflation expectations rise slightly in a country, capital will no longer "flow out," but rather "evaporate"—instantly disappearing from the local currency system and entering the global crypto network. We can define this attribute as "enhanced substitutability against sovereign currency."

For governments whose credit is already shaky, this will be a fatal blow. The status of the local currency will be completely undermined, as the public and businesses will have a more perfect and efficient alternative.

2c. Great Deflation and the Erosion of State Power

When an economy is swept by the wave of hyper-dollarization, its sovereign state will lose two of its most core powers: the power to print money to cover fiscal deficits (i.e., the seigniorage); and the power to regulate the economy through interest rates and money supply (i.e., monetary policy independence).

The consequences are catastrophic.

First, as the local currency is massively abandoned, its exchange rate will spiral downwards, plunging into hyperinflation. However, in terms of economic activities priced in dollars, there will be severe great deflation. Asset prices, wages, and the value of goods measured in dollars will plummet.

Second, the government's tax base will evaporate. Taxes denominated in rapidly depreciating local currency will become worthless, leading to a collapse of national finances. This death spiral of fiscal collapse will completely destroy the state's governance capacity.

This process, starting from Trump's signing of the GENIUS Act, will accelerate through RWA (real-world assets on-chain).

2d. White House vs. Federal Reserve: The Power Struggle Within the U.S.

This currency revolution is not only aimed at striking America's adversaries; it will even trigger a crisis within the United States.

Currently, the Federal Reserve, as an independent central bank, controls U.S. monetary policy. However, a privately issued digital dollar system regulated by a new agency under the Treasury or the White House will create a parallel monetary track. The executive branch can indirectly or even directly intervene in the money supply and flow by influencing the regulatory rules for stablecoin issuers, thereby bypassing the Federal Reserve. This could become a powerful tool for the U.S. executive branch to achieve its political or strategic goals (for example, stimulating the economy in an election year or precisely sanctioning adversaries), potentially leading to a profound trust crisis regarding the independence of U.S. monetary policy in the future.

III. The Financial Battlefield of the 21st Century: The U.S. Against China’s "Free Financial System"

If the stablecoin legislation represents a power restructuring domestically, then externally, it is a crucial piece in the chess game of great power competition between the U.S. and China: legislating to support a private, public blockchain-based "free financial system" centered on the dollar.

3a. The Financial Iron Curtain of the New Era

After World War II, the United States led the establishment of the Bretton Woods system, aimed not only at rebuilding the post-war economic order but also at creating a Western economic bloc that excluded the Soviet Union and its allies in the context of the Cold War. Institutions like the International Monetary Fund (IMF) and the World Bank became tools for promoting Western values and consolidating the alliance system. Today, what the "GENIUS Act" aims to construct is a new version of the Bretton Woods system for the digital age. It seeks to establish a global financial network based on dollar stablecoins, which is open, efficient, and ideologically opposed to the state-led model of China. This is somewhat akin to the arrangements the U.S. made to counter the Soviet Union's free trade system, but with a more aggressive approach.

3b. Open Siege Against Closed Systems: Permissioned vs. Permissionless

The strategic paths of China and the U.S. regarding digital currencies reveal fundamental differences; this is an ideological war of "openness" versus "closure."

China's digital yuan (e-CNY) is a typical "permissioned" system. It operates on a private ledger controlled by the central bank, with every transaction and account under strict state surveillance. This is a digital "walled garden," whose advantages lie in efficient centralized management and strong social governance capabilities, but its closed nature makes it difficult to gain the genuine trust of global users, especially those wary of its surveillance capabilities.

In contrast, the stablecoins supported by the U.S. through the "GENIUS Act" are built on "permissionless" public blockchains like Ethereum and Solana. This means that anyone, regardless of their location, can innovate on this network—developing new financial applications (DeFi), creating new markets, and conducting transactions—without needing approval from any centralized authority. The role of the U.S. government is not to operate this network but to act as the "credit guarantor" of its most core asset (the dollar).

This is an extremely clever asymmetric strategy. The U.S. is leveraging its opponent's weakest link—the fear of losing control—to build its own moat. It attracts global innovators, developers, and ordinary users seeking financial freedom into an open ecosystem centered around the dollar. China is invited to participate in a game it structurally cannot win: how can a state-controlled local area network compete with a vibrant financial internet that is open to the world?

3c. Bypassing SWIFT: A Dimensional Strike at the Root

In recent years, countries like China and Russia have adopted a core strategy to counter dollar hegemony by establishing financial infrastructures that bypass U.S. control, such as alternative cross-border payment systems to SWIFT (Society for Worldwide Interbank Financial Telecommunication). However, the emergence of stablecoins makes this strategy appear clumsy and outdated. Stablecoin transactions based on public blockchains fundamentally do not require intermediaries like SWIFT or any traditional banks. The transfer of value is accomplished cryptographically through a globally distributed network of nodes, creating a new parallel track to the old system.

This means that the U.S. no longer needs to laboriously defend the old financial fortress (SWIFT) but has directly opened up a brand new battlefield. In this new arena, the rules are defined by code and protocols, not by treaties between nations. As a significant portion of global digital value begins to operate on this new track, attempting to establish a "SWIFT alternative" becomes as meaningless as trying to build a more luxurious carriage road in the age of highways.

3d. Winning the Battle of Network Effects

The core war of the digital age is a battle of network effects. Once a platform attracts enough users and developers, it creates a powerful gravitational pull that makes it difficult for competitors to catch up. Through the "GENIUS Act," the U.S. is merging the dollar—this world's most robust currency network—with the crypto world—this world's most innovative financial network. The resulting network effects will be exponential.

Global developers will prioritize creating applications for dollar stablecoins, which have the largest liquidity and the broadest user base. Global users will flock to this ecosystem due to its rich application scenarios and asset choices. In contrast, while the e-CNY may be promoted within specific scopes like the "Belt and Road Initiative," its closed, renminbi-centered nature makes it difficult to compete globally with this open dollar ecosystem.

In summary, the "GENIUS Act" is far from a simple domestic bill. It is a core strategic deployment of the U.S. in the geopolitical chessboard of the 21st century. It uses the concepts of "decentralization" and "openness" in a "four ounces can deflect a thousand pounds" manner to consolidate its most core power—dollar hegemony. It is not engaging in a symmetrical arms race with China but is changing the terrain of the financial battlefield, bringing competition into a new dimension where the U.S. holds absolute advantages, delivering a dimensional strike against its opponent's financial system.

IV. The "De-nationalization" of Everything: How RWA and DeFi Undermine State Control

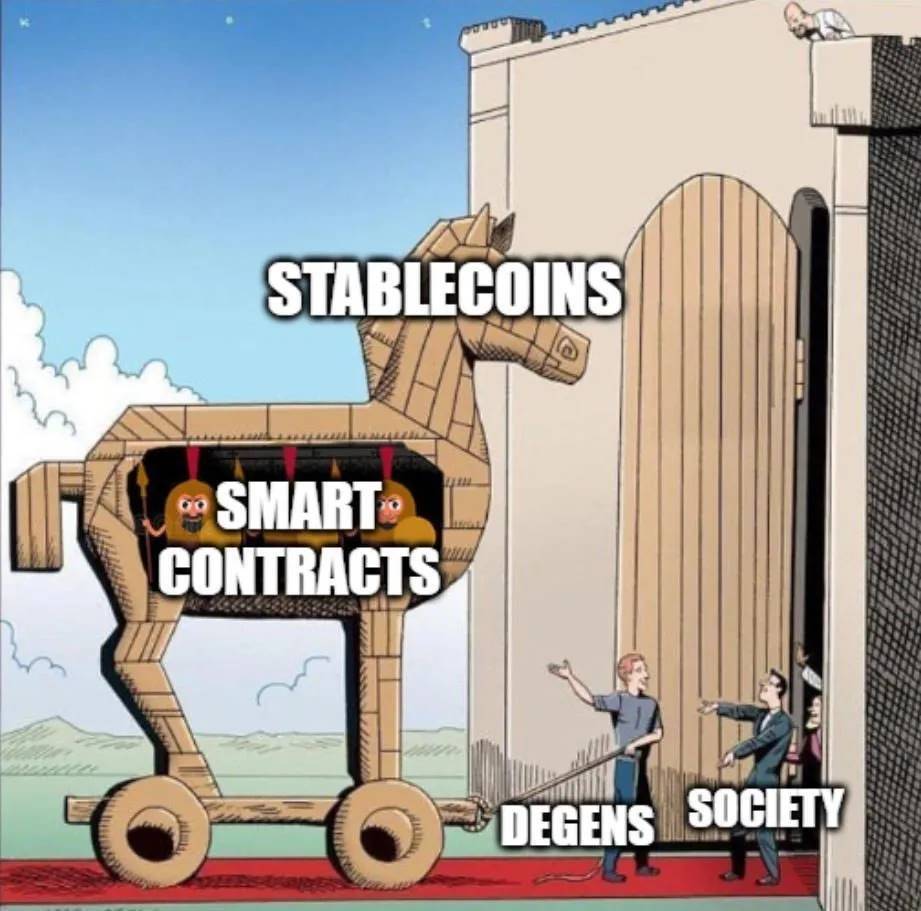

Stablecoins themselves are not the endpoint of the revolution; they are more like a Trojan horse breaching the city. Once global users become accustomed to holding and transferring value through them, a larger and deeper revolution will follow. The core of this revolution is to transform all valuable assets—stocks, bonds, real estate, artworks—into digital tokens that can flow freely on a global public ledger. This process, known as "Real World Assets on-chain" (RWA), will fundamentally sever the connection between assets and specific national jurisdictions, achieving the "de-nationalization" of assets and ultimately subverting the traditional financial system centered around banks.

4a. Stablecoins: The "Trojan Horse" to a New World

In ancient legend, the Greeks captured the impregnable city of Troy by presenting a giant wooden horse. Today, stablecoins play a similar role. In the eyes of governments and regulatory agencies, regulated, asset-backed stablecoins seem to be the "Trojan horse" to tame the wild horse of the crypto world—a relatively safe and controllable entry point.

However, the irony of history is that while the GENIUS Act aims to consolidate state power by promoting "safe" stablecoins, it inadvertently builds the largest user acquisition channel for "dangerous," truly decentralized non-state currencies in history.

The core function of stablecoins is to serve as a gateway connecting the world of traditional fiat currencies with the world of crypto assets. They are the "on-ramp" to the crypto world, a "bridge" across two realms. An ordinary user may initially seek stablecoins for their low cost and high efficiency in cross-border remittances or daily payments, or for the subsidies offered by merchants. But once they download a digital wallet and become accustomed to on-chain transaction models, the distance between them and truly decentralized assets like Bitcoin and Ethereum is reduced to just one click.

Platforms that provide stablecoin trading services, such as Coinbase or Kraken, are themselves comprehensive crypto asset supermarkets. Users come for stablecoins but are quickly attracted by the high yields offered by DeFi protocols or the narrative of Bitcoin as a store of value. Transitioning from holding USDC to staking ETH for liquidity mining becomes a natural extension for a user who has already entered the space.

This creates a profound paradox for the state. The short-term goal of the state is to reinforce dollar hegemony by promoting dollar-pegged stablecoins. To achieve this goal, the state must encourage and support the development and popularization of user-friendly wallets, exchanges, and various applications. However, these infrastructures are technically neutral and protocol-agnostic. The same wallet can hold regulated USDC as well as anonymous Monero; the same exchange can trade compliant stablecoins as well as completely decentralized Bitcoin.

As users deepen their understanding of the crypto world, their demand for higher yields, stronger privacy protection, or true censorship resistance will also grow. At that point, they will naturally shift from stablecoins that offer value stability but no appreciation potential to assets that can meet these higher-level needs.

4b. The RWA Revolution: Breaking the Chains of National Borders on Assets

If DeFi is the superstructure of this revolution, then RWA is its solid economic foundation. The core of RWA is to transform assets existing in the physical world or traditional financial systems into tokens on the blockchain through legal and technical processes.

We can envision a scenario like this:

An app developed by a Chinese team in the Apple App Store has millions of global users, and its ownership is tokenized through legal and technical means, becoming a digital certificate circulating on the blockchain.

This token is traded in a permissionless decentralized finance (DeFi) protocol on a blockchain.

A user in Argentina initiates a transaction and receives this token in their digital wallet within seconds.

The entire process—tokenization of assets, collateralization, minting and transferring stablecoins—occurs entirely on-chain, bypassing the traditional banking systems of China, the U.S. (due to its dollar peg), and Argentina. This is not just a superior payment track; it is a parallel financial universe that almost ignores the political and legal boundaries defined by the Westphalian system.

This is precisely how the "de-nationalization of currency" drives the "de-nationalization of finance," ultimately achieving the "de-nationalization of capital."

When capital can be de-nationalized, capitalists will naturally also become de-nationalized.

4c. The End of the Traditional Financial System

This new financial ecosystem driven by stablecoins and based on RWA represents a comprehensive shock to the traditional financial system. The core function of traditional finance is essentially to act as an intermediary of information and trust. Banks, brokerages, exchanges, payment companies, and other institutions solve the trust issues between transacting parties through their vast capital, complex systems, and government licenses, charging high fees in the process.

Blockchain technology, with its immutable and transparent characteristics, along with rules enforced by code (smart contracts), provides a new trust mechanism—"code is law." In this new paradigm, most functions of traditional intermediaries appear redundant and inefficient:

The deposit and loan business of banks can be replaced by decentralized lending protocols.

The matching of trades by exchanges can be replaced by automated market maker (AMM) algorithms.

The cross-border settlements of payment companies can be replaced by the instant global transfers of stablecoins.

The asset securitization on Wall Street can be replaced by the more transparent and efficient tokenization of RWA.

V. The Rise of Sovereign Individuals and the Twilight of the State

When capital can flow across borders, when assets can escape judicial jurisdiction, and when power shifts from nation-states to private giants and network communities, we reach the endpoint of this transformation—a new era dominated by "sovereign individuals," marked by the end of the Westphalian system. This revolution, driven by stablecoins and artificial intelligence (AI), will have far-reaching impacts that surpass those of the French Revolution, as it not only brings about a change in regime but fundamentally alters the very form of power itself.

(The book "The Sovereign Individual" is indeed a prophecy of our time)

5a. The Prophecy of "The Sovereign Individual" Comes True

In 1997, James Dale Davidson and Lord William Rees-Mogg predicted in their groundbreaking work "The Sovereign Individual" that the arrival of the information age would fundamentally change the logic of violence and power. They argued that the reason nation-states rose during the industrial age was their ability to effectively protect large-scale, fixed industrial assets and tax them. However, in the information age, the most important capital—knowledge, skills, and financial assets—would become highly mobile, even existing in intangible cyberspace. At that point, the state would resemble a rancher trying to fence in "cattle with wings," significantly diminishing its ability to tax and control.

The emergence of stablecoins, DeFi, and RWA represents the real-world versions of "cybermoney" and "cybereconomy" described in the book. Together, they construct a global, low-friction value network that allows capital to truly take flight. An elite individual can easily allocate their wealth to RWA tokens around the world and instantaneously transfer it across different jurisdictions using stablecoins, all recorded on a public ledger that is difficult for state machinery to reach. The prophecies of the book—that "individuals will free themselves from government oppression" and "wealth holders will be able to bypass the state's monopoly on currency"—are becoming a reality.

5b. The End of the Westphalian System

Since the signing of the Treaty of Westphalia in 1648, the basic unit of world politics has been the sovereign state. The core principles of this system include: the state possesses supreme sovereignty within its territory, the equality of sovereign states, and the principle of non-interference in internal affairs. The cornerstone of this system is the absolute control of the state over the population and property within its territory.

The rise of sovereign individuals is fundamentally eroding this cornerstone. When the most creative and productive individuals conduct their economic activities and accumulate wealth in "cyberspace," the boundaries of territory lose their significance. The state finds itself unable to effectively tax these globally mobile elites, and its financial base will inevitably be weakened. In a desperate attempt to prevent wealth from flowing out, governments may resort to more radical and authoritarian measures, such as the "hostage-taking" taxation and the destruction of technologies that facilitate individual autonomy predicted in the book. But this will only accelerate the exodus of elites, creating a vicious cycle. Ultimately, the nation-state may devolve into a shell, its functions limited to providing welfare and security for those who cannot access the global digital economy—essentially a "nanny state" serving the poor. Clearly, such a state has no relation to wealth creation.

5c. The Final Frontier: The Ultimate Battle Between Privacy and State Taxation

The next step in this revolution will be privacy. Current public blockchains, while pseudonymous, still allow transactions to be traced. However, with the maturation of privacy technologies such as zero-knowledge proofs (as used by Zcash and Monero), future financial transactions may achieve complete anonymity and untraceability.

When a global, stablecoin-based financial system combines with powerful privacy technologies, it poses the ultimate challenge to the state's ability to tax. Tax authorities will face an impenetrable "black box," unable to effectively identify transaction parties and taxable income. This will represent the final form of "de-regulation," as when the state loses its ability to tax, it also loses its capacity for effective regulation and public service provision.

The French Revolution replaced "monarchical sovereignty" with "national sovereignty," shifting the locus of power from kings to nation-states, but the territorial nature of power remained unchanged. In contrast, the revolution initiated by stablecoins seeks to dissolve "the territorial sovereignty of nation-states" with "network sovereignty" and "individual sovereignty." It is not a transfer of power but a "decentralization" and "de-nationalization" of power. This represents a more fundamental and thorough paradigm shift, with implications that are indeed as profound, if not more so, than those of the French Revolution. We stand at the dawn of a disintegration of the old world and the emergence of a new order. This new world will grant individuals unprecedented freedom and power, but it will also bring about chaos and challenges that are difficult for us to imagine today.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。