Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

U.S. Bitcoin Spot ETF Net Inflow of $2.386 Billion

Last week, the U.S. Bitcoin spot ETF saw a net inflow for five consecutive days, totaling $2.386 billion, with a total net asset value of $152.4 billion.

Seven ETFs were in a net inflow state last week, with inflows mainly from IBIT, BTC, and HODL, which saw inflows of $2.569 billion, $41.9 million, and $30.9 million, respectively.

Data Source: Farside Investors

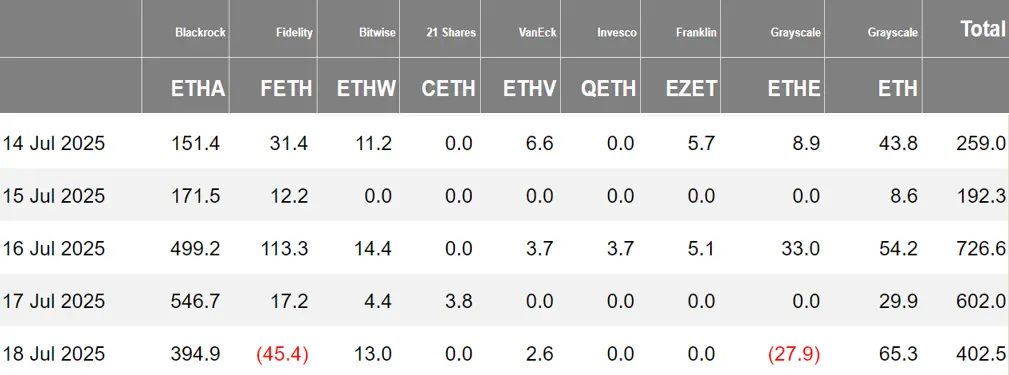

U.S. Ethereum Spot ETF Net Inflow of $2.182 Billion

Last week, the U.S. Ethereum spot ETF also experienced a net inflow for five consecutive days, totaling $2.182 billion, with a total net asset value of $18.37 billion.

The inflow last week was mainly from BlackRock's ETHA, which had a net inflow of $1.763 billion. All nine Ethereum spot ETFs were in a net inflow state.

Data Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Inflow of 72.73 Bitcoins

Last week, the Hong Kong Bitcoin spot ETF had a net inflow of 72.73 Bitcoins, with a net asset value of $50.5 million. The holdings of the issuer, Harvest Bitcoin, decreased to 293.2 Bitcoins, while Huaxia increased to 2,280 Bitcoins.

The Hong Kong Ethereum spot ETF saw a net inflow of 920 Ethers, with a net asset value of $8.117 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of July 18, the nominal total trading volume of U.S. Bitcoin spot ETF options was $1.33 billion, with a nominal total long-short ratio of 2.53.

As of July 17, the nominal total open interest of U.S. Bitcoin spot ETF options reached $27.41 billion, with a nominal total open interest long-short ratio of 1.82.

The market's short-term trading activity for Bitcoin spot ETF options has increased, with overall sentiment leaning bullish.

Additionally, the implied volatility was 43.54%.

Data Source: SoSoValue

Overview of Crypto ETF Developments Last Week

According to DL News, BlackRock's recent move to add staking options to its iShares Ethereum Trust has reignited discussions about the U.S. Securities and Exchange Commission's batch approval process. VanEck, 21Shares, and Canary Capital have urged the SEC to consider adopting a first-come, first-served approval process, rather than wanting to "batch approve" alongside BlackRock, which submitted its application later.

Bloomberg ETF analyst James Seyffart stated on platform X that the staking options for Ethereum ETFs submitted by multiple institutions "will take time to complete," with the final deadline for early applications being late October 2025. However, the response deadline for BlackRock's Ethereum ETH staking application is around April 2026, although it is believed that approval could come as early as the fourth quarter of 2025.

According to reports from Hong Kong media, after listing the Bitcoin ETF, Ren Junfei, founder and CEO of licensed virtual asset management company Pandora, announced plans to launch a staking spot Ethereum ETF product in Hong Kong in the second half of this year. This product will not only be a spot holding product but will also include additional income. Currently, discussions are ongoing with Hong Kong regulators regarding how to protect investor interests and operational matters such as subscription and redemption.

21Shares Applies to U.S. SEC for Two Crypto Index ETFs

21Shares has applied to the U.S. SEC for two cryptocurrency index ETFs: the 21Shares FTSE Crypto 10 Index ETF and the 21Shares FTSE Crypto 10 ex-BTC Index ETF. The two products track the top ten cryptocurrencies by market capitalization and the FTSE crypto index excluding Bitcoin, respectively.

U.S. SEC Delays Decision on Bitwise BTC and ETH ETF Physical Redemption

According to Decrypt, the U.S. Securities and Exchange Commission (SEC) has extended the timeline for its decision on the physical redemption of the Bitwise Bitcoin ETF Trust and Bitwise Ethereum ETF.

Physical redemption allows investors to exchange their ETF shares for the underlying tokens. The SEC's new deadline is September 8.

Bitwise Launches Third-Party Asset Reserve Proof Service for Its Bitcoin and Ethereum Spot ETFs

According to official news, Bitwise announced the launch of a third-party asset reserve proof transparency service for its Bitcoin spot ETF (BITB) and Ethereum spot ETF (ETHW), provided by the U.S. registered accounting firm The Network Firm.

NYSE Approves ProShares Ultra XRP ETF

According to Cointelegraph, the NYSE has approved the ProShares Ultra XRP ETF (code: UXRP).

BlackRock Applies to Introduce Staking Feature in Ethereum ETF

Canary Submits S-1 Form for STAKED INJ ETF

Market News: ProShares Launches ETF Aimed at Achieving 2x Daily Returns for SOL and XRP

Views and Analysis on Crypto ETFs

Bloomberg ETF Analyst: BlackRock's IBIT Size May Reach $100 Billion This Summer

Bloomberg senior ETF analyst Eric Balchunas stated on social media that the size of BlackRock's Bitcoin spot ETF IBIT may reach $100 billion this summer, possibly even this month.

Thanks to recent inflows and overnight market increases, its size has already reached $88 billion. Established only a year and a half ago, it has now become the 20th largest ETF in the U.S. and BlackRock's 7th largest ETF (also its most profitable ETF). It's truly incredible.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。